ES Thursday 11-21-13

here's what i have

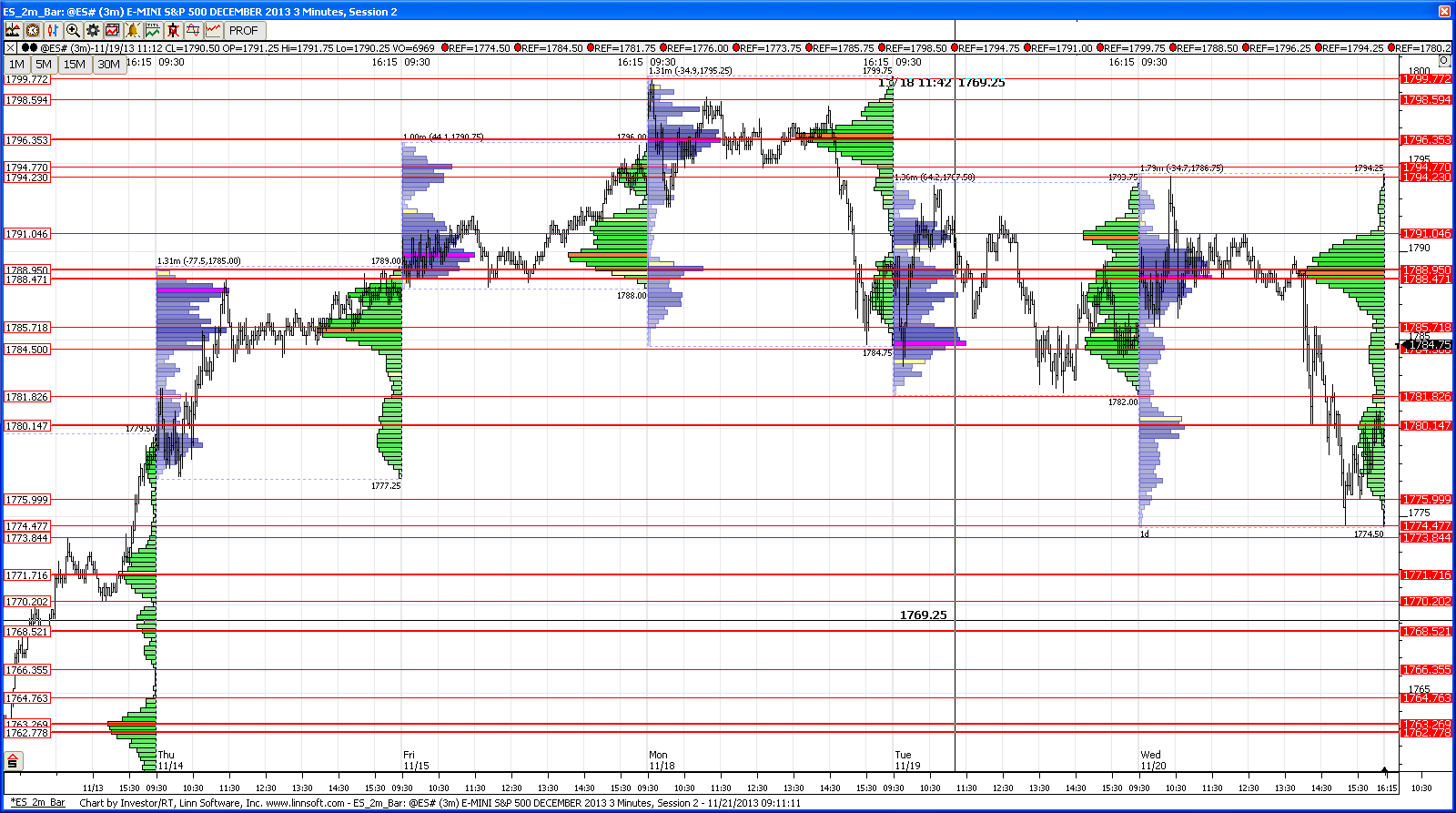

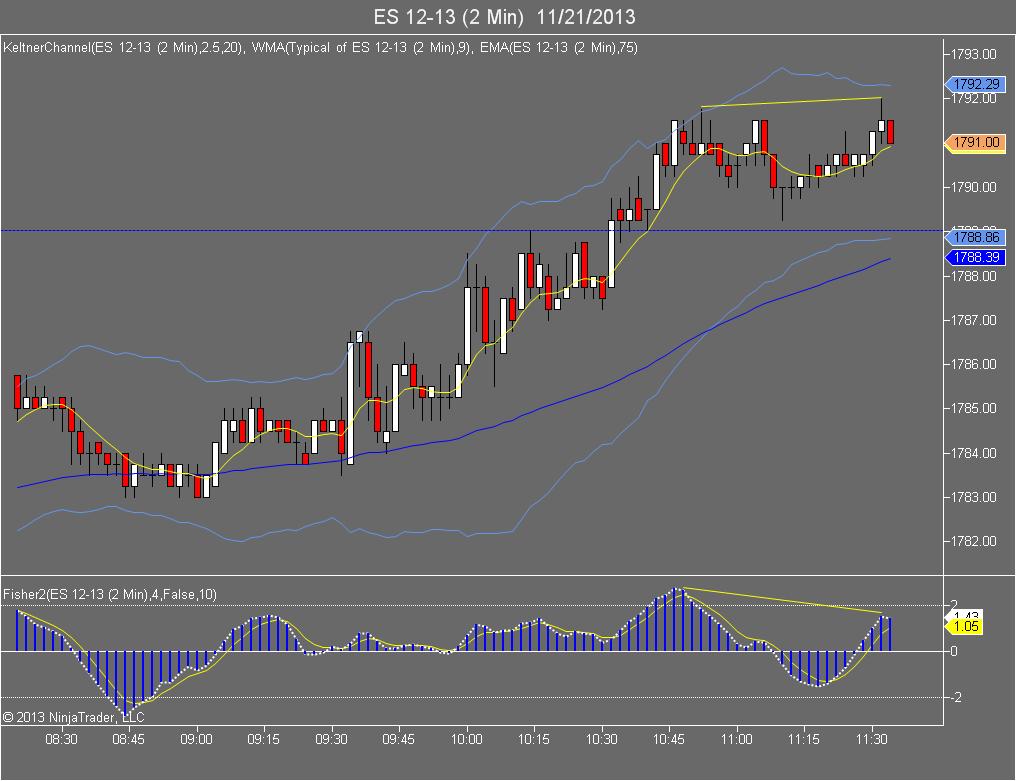

staying above 80-82 is a big step for bulls to resume the uptrend...the 84.5-86 area is being tested as i type so i think after the open i will wait for either 80-82 or 88.5-89.5...the latter is the composite vpoc of the whole balance area from 74.5 to 99.75 so will watch the reaction off that zone carefully...if the reaction is not strong, i will look for a buy off the 84.5-86 to look for yest highs and more importantly 96.5 nvpoc

beow 80-82 we still can have a reaction in the 74-76 area with strong support below that zone in the 67.5-70 and 64-65

good luck

staying above 80-82 is a big step for bulls to resume the uptrend...the 84.5-86 area is being tested as i type so i think after the open i will wait for either 80-82 or 88.5-89.5...the latter is the composite vpoc of the whole balance area from 74.5 to 99.75 so will watch the reaction off that zone carefully...if the reaction is not strong, i will look for a buy off the 84.5-86 to look for yest highs and more importantly 96.5 nvpoc

beow 80-82 we still can have a reaction in the 74-76 area with strong support below that zone in the 67.5-70 and 64-65

good luck

congrats bkay...

yep that why i liked the back part of that 87-89 for the longs...it seems so far though that they have tested the top part of that range and bought that -400 tick almost immediatly..taht's what i wanted to see but into the 87s...oh well, going for an early lunch here

good luck

yep that why i liked the back part of that 87-89 for the longs...it seems so far though that they have tested the top part of that range and bought that -400 tick almost immediatly..taht's what i wanted to see but into the 87s...oh well, going for an early lunch here

good luck

Originally posted by NickP

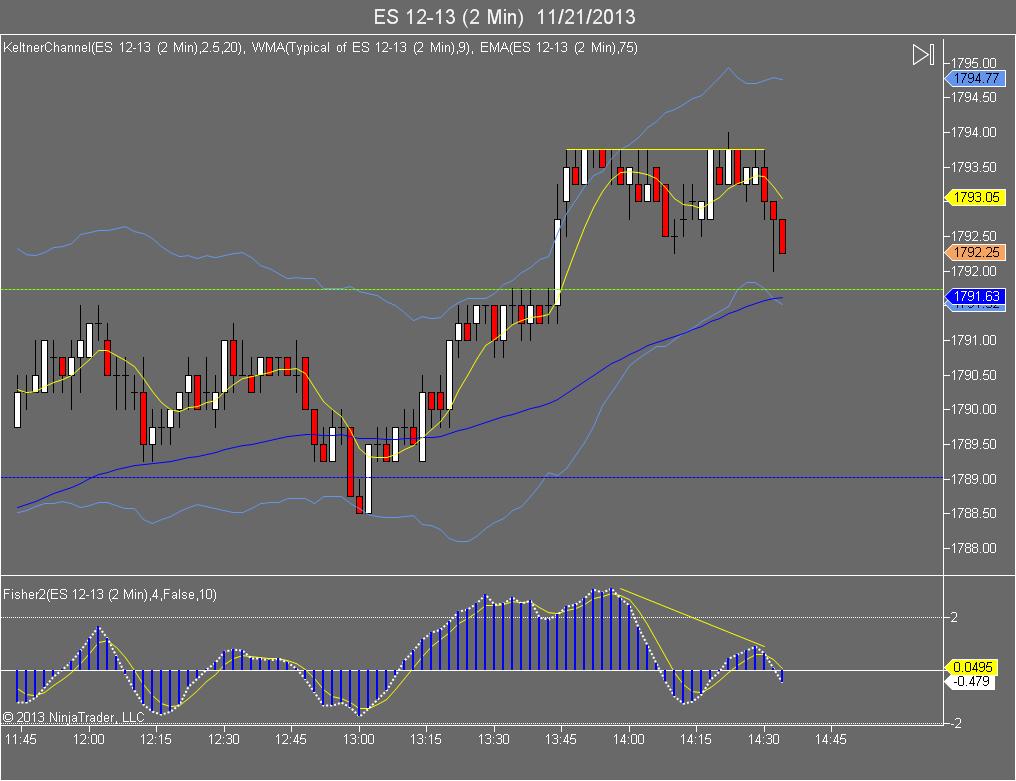

if u caught that long off 84.5-86 then 91.5-92.5 is definetely a scale zone

good call on the 91.50 resistance zone, i caught a few ticks off the level on the short side. 89.00 held for support as expected.

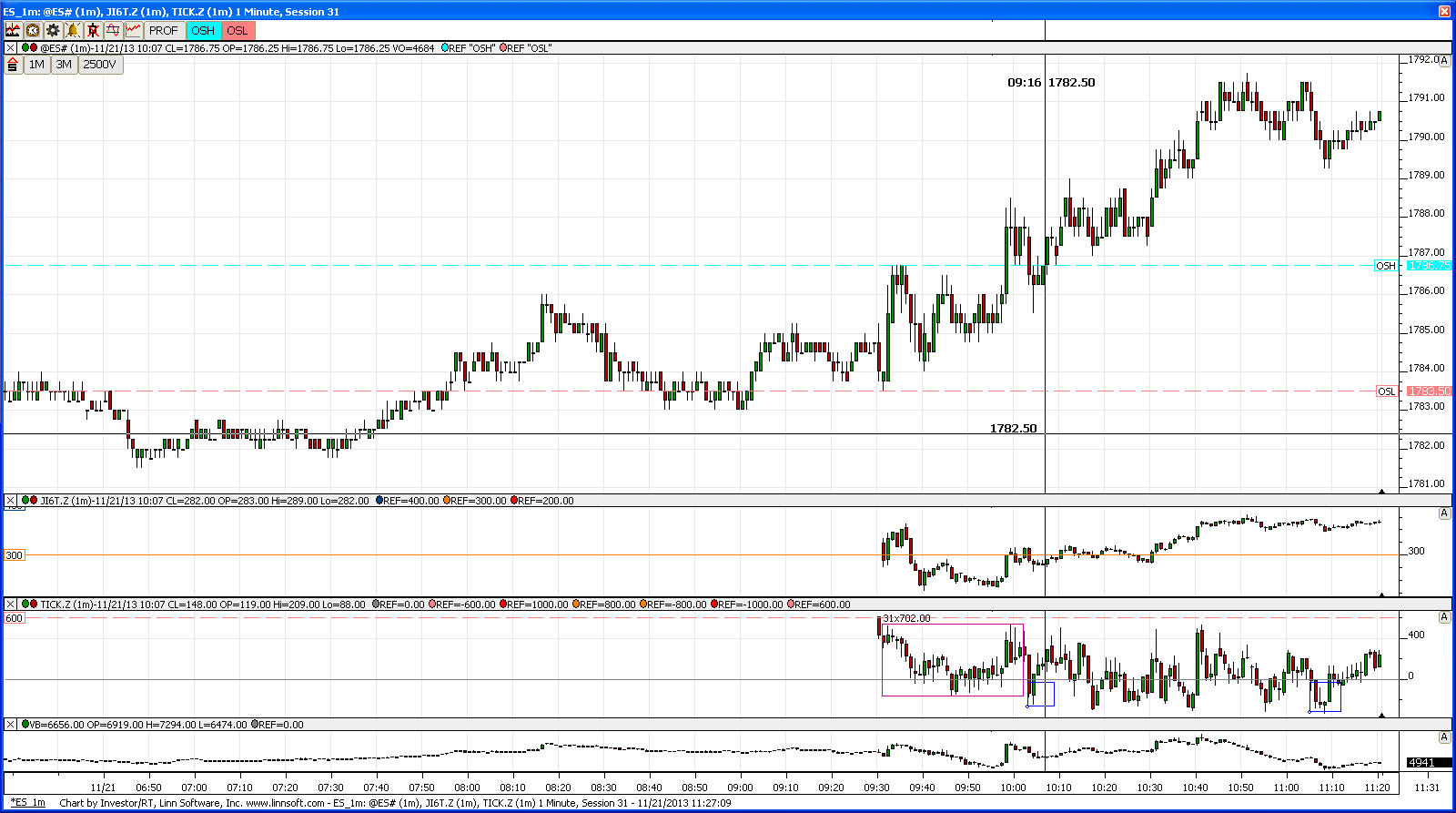

just a quick note on my tick/internals talk

going into 88.5-89.5 i mentioned the tick was completely above zero, which can be seen in the purple box on the third pane....once we got a pb, that negative tick was not strong at all and was bought pretty quickly (first little blue box), so that to me was not a strong reaction off the 88.5-89.5 zone and longs were a decent odds play from there...after getting into that 91.5-92.5 scale area, we pulled back into the 87-89 zone and that neg tick was pretty tame again (close to -400 in this case) and was bought quickly again (second little blue box)..i would have like to see this price action into the lower part of taht 87-89 area but getting it from 89 was not completely unexpected...iw as just trying to be more conservative going into lunch time, so i missed that long setup...oh well...

hope it helps, and now off to lunch for good !

going into 88.5-89.5 i mentioned the tick was completely above zero, which can be seen in the purple box on the third pane....once we got a pb, that negative tick was not strong at all and was bought pretty quickly (first little blue box), so that to me was not a strong reaction off the 88.5-89.5 zone and longs were a decent odds play from there...after getting into that 91.5-92.5 scale area, we pulled back into the 87-89 zone and that neg tick was pretty tame again (close to -400 in this case) and was bought quickly again (second little blue box)..i would have like to see this price action into the lower part of taht 87-89 area but getting it from 89 was not completely unexpected...iw as just trying to be more conservative going into lunch time, so i missed that long setup...oh well...

hope it helps, and now off to lunch for good !

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.