ES Thurs 11-14-13

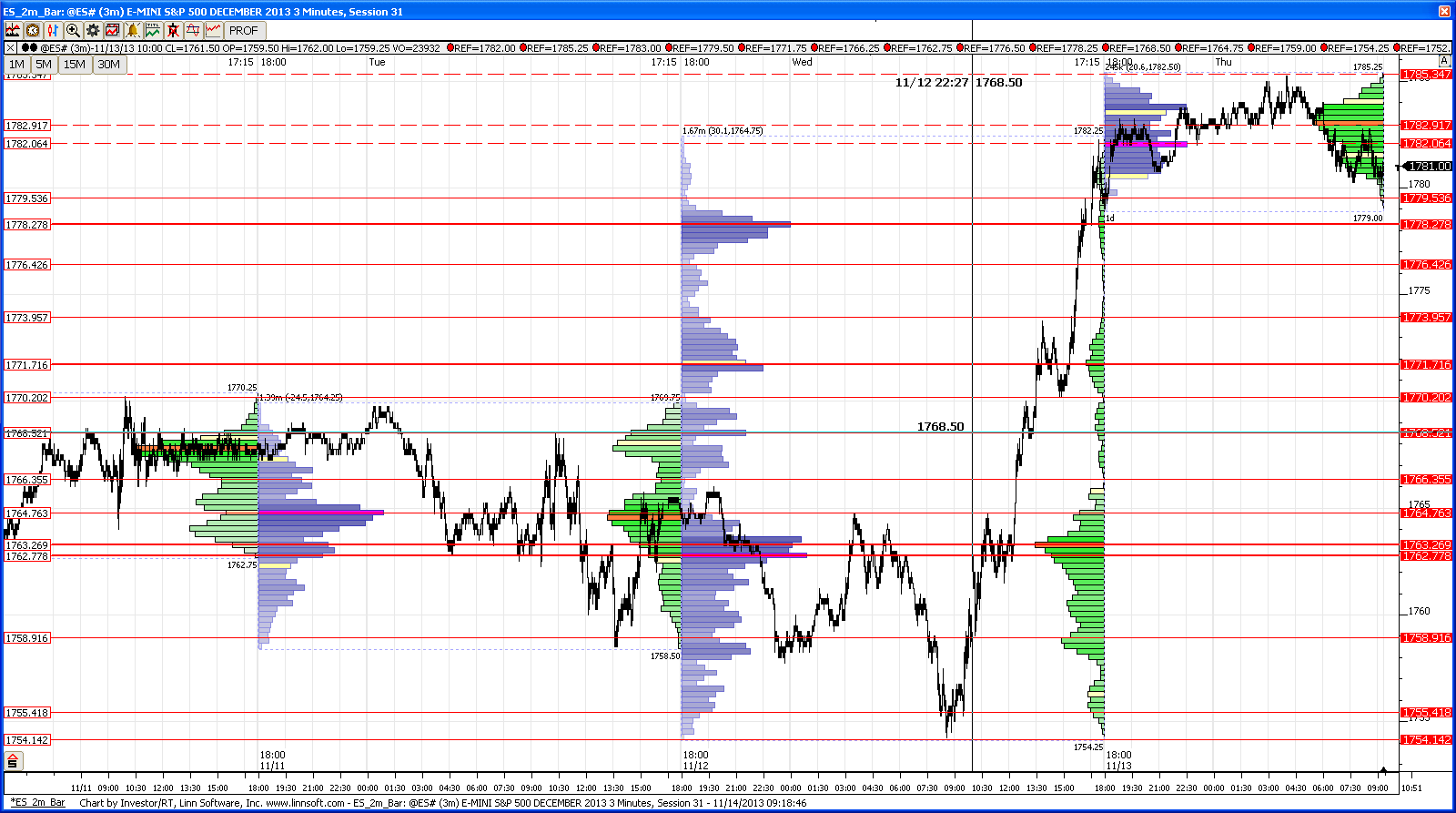

Here's what i have...only one chart with all session data (dotted lines are based on o/n action)...

pretty clear curves and zones to work from below

i have daily and weekly pivots in the 87-89 areaa and then up at 95 and 99-00...but remember there is no hard resist above current highs

good luck

pretty clear curves and zones to work from below

i have daily and weekly pivots in the 87-89 areaa and then up at 95 and 99-00...but remember there is no hard resist above current highs

good luck

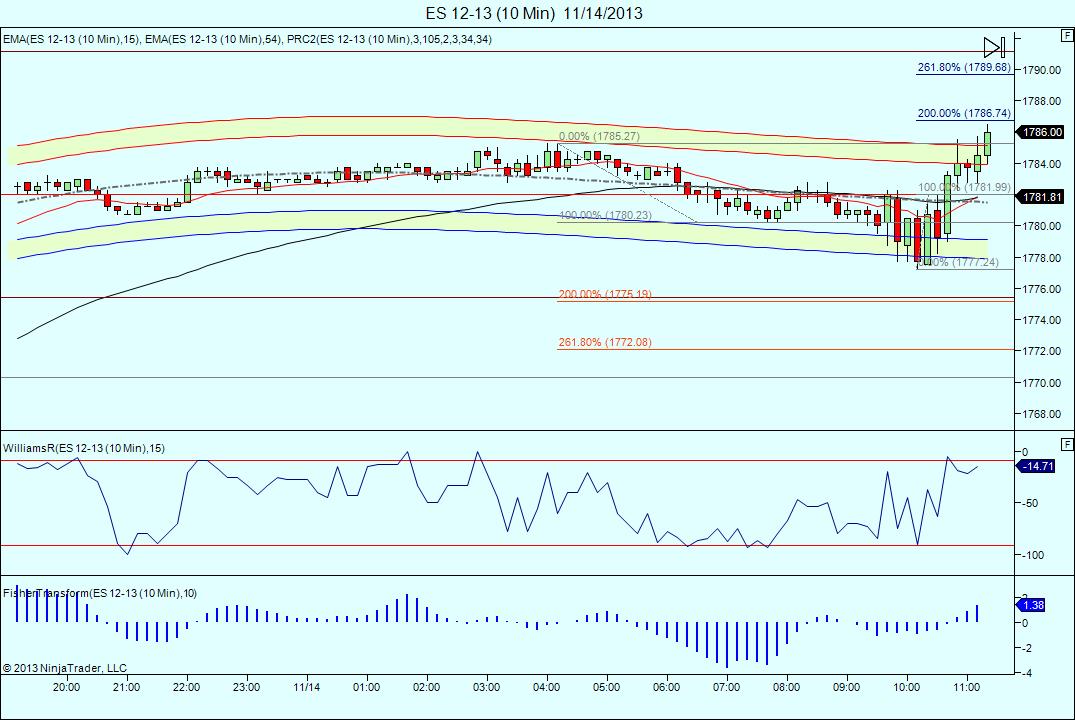

10 min, 5 min and below are now positive.. took a quick long a few min ago from 1783.25 to 1785.25 expecting 86.75 and higher later.

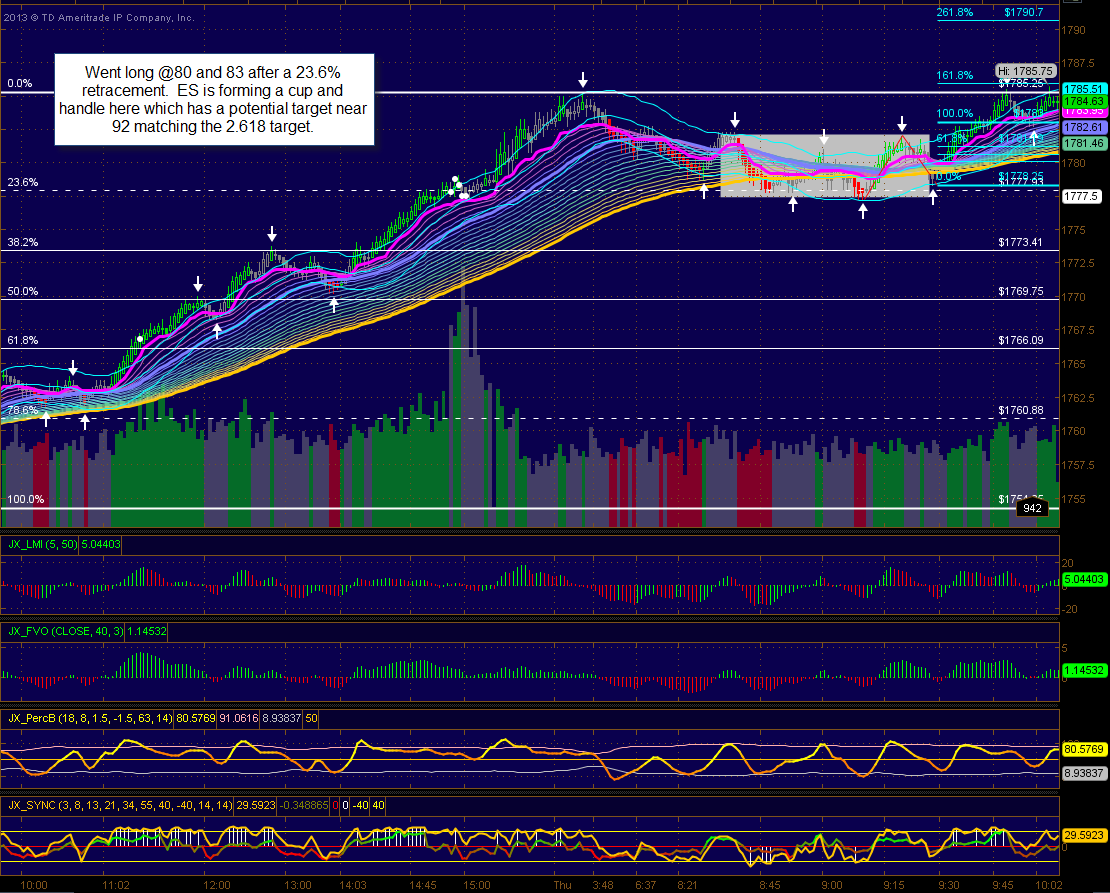

great chart!.. im mindful of the fact that a 20 handle day(which is 2 less than yesterday could portend a move to around 98!...

yesterday's 1788 target met~

if an assault on 98- 1800 is in the cards you would expect the market to creep higher never delining more than about 3 handles(like yesterday)

so the 82-83 area served initially for a short down to 78-79 area where a long could have been tried aiming for o/n high...once there u could have tried another short aiming down to the 82-83 area and depending on your bullishness that was an area to use as launching point to new all time highs....and we even stopped at the 87-89 pivot area i mentioned for a nice reversal back fdown to the o/n high as i speak

the first two trades were decent odds, especially the second one (in case u did not want to short early in the morning)...the short from the o/n high was tricky since we were above the peak of the o/n bell curve and that is by the definition a lower odds short...the short from the 87-89 was also hard but it also had some confluence with the ab=cd measured move from 36.5 to 70.25 & 54.25 to 88

in any case, hope the day is going fine

the first two trades were decent odds, especially the second one (in case u did not want to short early in the morning)...the short from the o/n high was tricky since we were above the peak of the o/n bell curve and that is by the definition a lower odds short...the short from the 87-89 was also hard but it also had some confluence with the ab=cd measured move from 36.5 to 70.25 & 54.25 to 88

in any case, hope the day is going fine

Originally posted by NickP

Here's what i have...only one chart with all session data (dotted lines are based on o/n action)...

pretty clear curves and zones to work from below

i have daily and weekly pivots in the 87-89 areaa and then up at 95 and 99-00...but remember there is no hard resist above current highs

good luck

im currently working a small long from 84.25, im going to grab some eats.. targeting 89-90 zone ,but will probably exit just in front ... i hope! i dont want to see this go below 83, and my stop is currently 82

well, that makes 3 chances to grab a 2 handle trade and didnt...hope im doing the right thing!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.