ES Wednesday 10-9-13

I really enjoyed making this one today....I hope it gives some ideas of how the daily bar charts can help us...

key zone above is 57.50 - 59.50

below is 50.50 - 51.25

those are upper and lower bell extremes

watch the video if/when you have time....

key zone above is 57.50 - 59.50

below is 50.50 - 51.25

those are upper and lower bell extremes

watch the video if/when you have time....

based on the overlap of the daily bars we should have a main downside zone that goes from 44.50 - 47.50......to me critical downside support zone below the 51 zone..

so if they have the power to push out the overnight low at 46 then we have a good spot to try the long sides against

so if they have the power to push out the overnight low at 46 then we have a good spot to try the long sides against

54.75 will be the magnet price today I think...that splits up the 57 area and the 51 area by half too

buying under 50 now....cautious but this is lower edge of the bell ...just because they push beyond a zone doesn't mean it isn't still valid

took loss at 48.50...trying again from 47.25 but will be more aggressive if they can push out the O/N lows.........long target will be 50.50

this 50 - 51.25 is one of our lines....!! gotta take something off just in case they sell it again

will try to hold runners for 53.50...magnet price is up there....see my second post today and why that 47.50 became a long for me

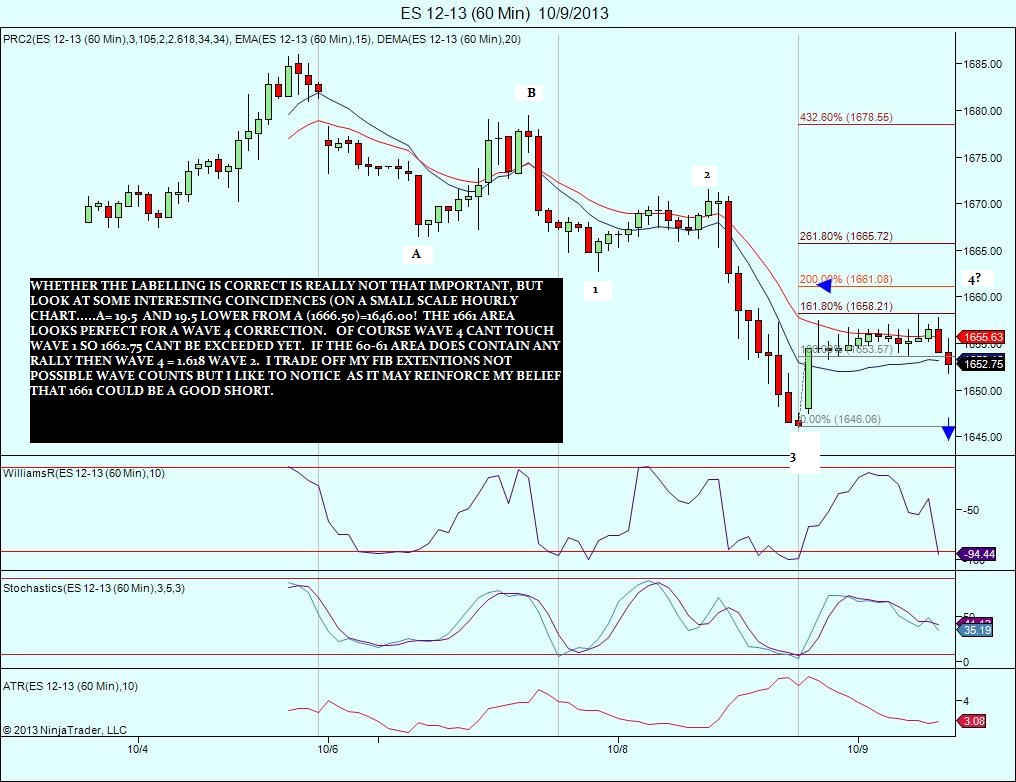

Bought 47.50 right alongside you pal, but chickened out at 49.50. im looking for 1661 area if 1644-46 holds today..

If that all important 1646 area holds this morning, the average daily range is about 15 handles and 1646plus 15=1661.......

trying to still hold runners but with all this time being spent under that 50 - 51 I am losing confidence...IIB coming to a close too.....so not looking great for runners as usual

oh man...just luck...hoping that coiling action lets it run up a bit from here......still don't trust that 50 - 51.25 and would like to see that turn into support...

whats always interesting is that so many of us have read that a failed auction on one side of a range ( a bell curve) can often go push to the other side....what the books etc never tell us is that there is no time limit on these failures and often we will see a bell curve get entered back into at some later date.....these failures happen on so many different time frames but for me it's watching those edges from different days to see if we are going re-take them and hold or reject them...

the point is that so far today is a good lesson that we can reverse roles quite often at the bell curve edges...also usually know as LVN's on different time frames

now all this babble would really have made me feel better if I had bought one of those retest into the lower edge I mentioned on the video after they rejected that prominient POC/vpoc at 54.75.....ok, so ends todays after the fact ramble

the point is that so far today is a good lesson that we can reverse roles quite often at the bell curve edges...also usually know as LVN's on different time frames

now all this babble would really have made me feel better if I had bought one of those retest into the lower edge I mentioned on the video after they rejected that prominient POC/vpoc at 54.75.....ok, so ends todays after the fact ramble

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.