ES 4-1-13

Basic idea is to use the 1560-50 - 1561.25 as a magnet price today. So we need to see a rally above that or a decline below that to initiate any trades IMHO...Much harder to buy or sell at those prices. I prefer to see an open and drive outside last weeks highs to look for sells or an open and drive under 58.50 to look for buys.

The 1554 - 1555.50 is an additional support point below created by high volume . It is ok to buy there on a drop down into it from above but I will go lighter due to the magnetic nature of high volume and potential to chop.

1549 - 1551 has a low volume area on the weekly but a high volume area from last months trade along with the s2 area today.

As usual I made a mistake on video and mentioned Fridays trade...well, the market wasn't open so that is Thursday.

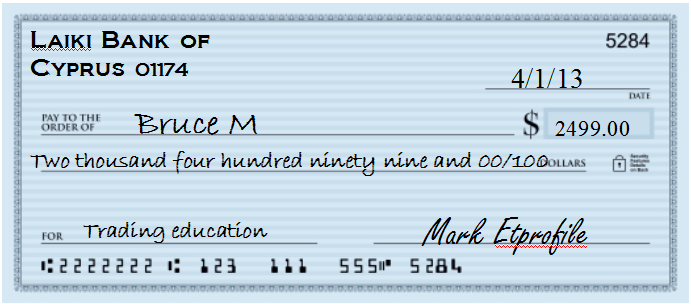

If you want to support these videos then please vote them up but more important is to send me a check for $2499 so I can pay for my internet connection and pay my production team salaries. The high quality of the videos is becoming more expensive to produce. As a bonus I will include my latest day trading course with all of the secrets to trading.

APRIL FOOLS !!!

The 1554 - 1555.50 is an additional support point below created by high volume . It is ok to buy there on a drop down into it from above but I will go lighter due to the magnetic nature of high volume and potential to chop.

1549 - 1551 has a low volume area on the weekly but a high volume area from last months trade along with the s2 area today.

As usual I made a mistake on video and mentioned Fridays trade...well, the market wasn't open so that is Thursday.

If you want to support these videos then please vote them up but more important is to send me a check for $2499 so I can pay for my internet connection and pay my production team salaries. The high quality of the videos is becoming more expensive to produce. As a bonus I will include my latest day trading course with all of the secrets to trading.

APRIL FOOLS !!!

all right thanks....that's hysterical !!

It might cost you $250.00 to cash it.

not much going on - now we just need to see what happens outside the IB.. we shouldn't be initiating at a magnet prices most days...it's just too hard..and we REALLY don't know which side of the IB they want to run out....while my idea about the 55.50 area is fun and interesting, it is worthless unless you have a low risk area to trade from....

I like the extremes and if I can't get trades on at extremes then I have no business trading most days

I like the extremes and if I can't get trades on at extremes then I have no business trading most days

something to think about...us Value traders want to put trades on in low volumne areas...now when we open inside a Value Area ( based on time or Volume but time is better)like we did today then when we poke our head outside and above the VA highs we are AUTOMATICALLY trading in a low volume area..

just something to think about from a conceptual point of view ...

just think about the classic examples : do u want to buy your house when the market is low and then sell when it seems above Value----yes...

just something to think about from a conceptual point of view ...

just think about the classic examples : do u want to buy your house when the market is low and then sell when it seems above Value----yes...

probabilities favor a retest of the IB low on some other TPO time frame then this one....so I am going to try and hunt for longs in the 54 - 55.50 zone

it is safer to wait until the 11 am bracket finishes but we shouldn't avoid the long side if we get a good bar/signal....just because two tpo's should print on the IB breakout, it is possible that the 11 am bar could close above the IB low and then another tpo tests that IB low from above...

whew - does that make sense ?? and naturally we always need to remember that it is only a probability and they can be horribly wrong..so the point is we don't want to get over focused on something that is supposed to happen as it may not come true..

man - can I babble today

whew - does that make sense ?? and naturally we always need to remember that it is only a probability and they can be horribly wrong..so the point is we don't want to get over focused on something that is supposed to happen as it may not come true..

man - can I babble today

with this push down off the 11 am bar it creates the third set of single prints today....thats excessive for so early in the day..so if we are to see the reversion back upp off the key zone then this is the place to do it

my plan is to take multiple small tries down here...this is the bigger bell curve peak time/volume price and we just never know if it will keep attracting price back over and over again before going for our IB/ single print test above

make sure that you think about the 2.5 - 4 points off swing lows or highs concept....ok to be greedy on runners but lets not get crazy and expect too much all the time...we are in this range and single print now...tricky holds in here

I assume most know where 1.5 the Ib came in at...nice confluence....so far !!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.