ES Friday 11-9-12

This is just a quicky that might inspire other shorter-term observations.

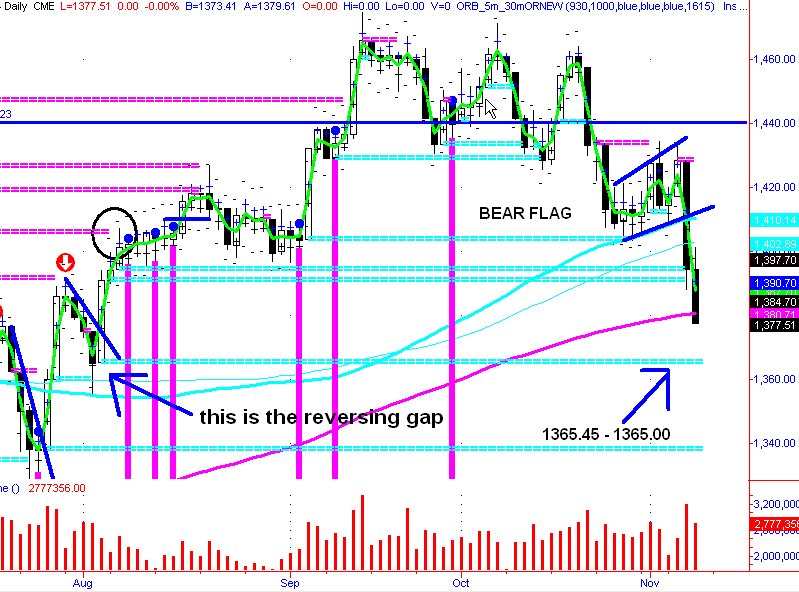

back in August I showed a chart that included an indicator I have that carries a line across the chart at gaps that have been left open.

the line will not be extinguished unless the gap gets filled from the direction in which it was initiated. In other words, if there is a gap UP, won't be considered filled until price drops from above and fills. vice versa for Gap down, in order to stop the gap line from carrying across the chart, the price would have to have moved UP from below to fill.

Magenta Lines on the chart are created by GAPS DOWN

Cyan lines on the chart are created by GAPS UP.

I have been studying gaps for years. There is more to it than breakaway and exhaustion. I think the most important gaps are the initiating gaps, meaning the gap that forms as a reversal of trend kind of move.

The possibility of additional down is real. These observations are a larger time frame than the rapid fire scalping/trading that Bruce and NickP excel at.

I just wanted to show the chart because there is a possibility that an initiating (a gap that is created at the beginning of a reversal) could get filled today. and since it is a Friday, if this gap is even touched, it is often a bell-ringer for profit-taking intraday.

Ask yourself this...Who has made all the profits the last two days? The Bears. How do Bears Take Profits? They BUY TO COVER.

Here's the chart. I like using the CASH because even though the open of a gap day is not as large as the ES it is real usually big money(Cash Open on gap days does not mimic Future's gaps because S&P has to get an index price on the board as soon as bell rings in NYC...So CASH open is artificial, BUT REAL...this has to do with the fact that in order to get values of the S&P 500 up on the board in a violent gap day, the opening Index price is generated as soon as one single stock in the index starts trading, and they use the closing prices of the previous day for all the other components until they start trading, then the new price for the individual stocks is incorporated into the index value and it is posted.

Here is the initiating/reversing gap on the CA$H SPX, it technically runs from 1365.45 down to 1365.00. Just getting close to this area is going to make (IMHO) bears with short-side profits start licking their chops to make the cash register ring (Buy to Cover). Does it have to get touched? NO. Can the market reverse intraday anyway, YES. This is just a heads up...Look to your shorter-term measures if you see prices come close to the gap.

GAP UP was created on the morning of August 3, 2012.

For some perspective (and satisfaction of gap in ES filling), the corresponding ES gap on a continuous contract ala Trade Station is 1371.75 down to 1355, but I have noticed that just hitting the High of the day preceding the Gap can be all that is needed. That High is 1362.50 ES. and that would be much better to have occurred in the RTH (today) than in the overnight, but, it could get hit overnight

Here's the chart to give you some perspective. This is CASH SPX.

BTW, a measured move down from the Bear Flag is roughly 1373 for the CASH.

pink histograms on the chart are just inside days.

back in August I showed a chart that included an indicator I have that carries a line across the chart at gaps that have been left open.

the line will not be extinguished unless the gap gets filled from the direction in which it was initiated. In other words, if there is a gap UP, won't be considered filled until price drops from above and fills. vice versa for Gap down, in order to stop the gap line from carrying across the chart, the price would have to have moved UP from below to fill.

Magenta Lines on the chart are created by GAPS DOWN

Cyan lines on the chart are created by GAPS UP.

I have been studying gaps for years. There is more to it than breakaway and exhaustion. I think the most important gaps are the initiating gaps, meaning the gap that forms as a reversal of trend kind of move.

The possibility of additional down is real. These observations are a larger time frame than the rapid fire scalping/trading that Bruce and NickP excel at.

I just wanted to show the chart because there is a possibility that an initiating (a gap that is created at the beginning of a reversal) could get filled today. and since it is a Friday, if this gap is even touched, it is often a bell-ringer for profit-taking intraday.

Ask yourself this...Who has made all the profits the last two days? The Bears. How do Bears Take Profits? They BUY TO COVER.

Here's the chart. I like using the CASH because even though the open of a gap day is not as large as the ES it is real usually big money(Cash Open on gap days does not mimic Future's gaps because S&P has to get an index price on the board as soon as bell rings in NYC...So CASH open is artificial, BUT REAL...this has to do with the fact that in order to get values of the S&P 500 up on the board in a violent gap day, the opening Index price is generated as soon as one single stock in the index starts trading, and they use the closing prices of the previous day for all the other components until they start trading, then the new price for the individual stocks is incorporated into the index value and it is posted.

Here is the initiating/reversing gap on the CA$H SPX, it technically runs from 1365.45 down to 1365.00. Just getting close to this area is going to make (IMHO) bears with short-side profits start licking their chops to make the cash register ring (Buy to Cover). Does it have to get touched? NO. Can the market reverse intraday anyway, YES. This is just a heads up...Look to your shorter-term measures if you see prices come close to the gap.

GAP UP was created on the morning of August 3, 2012.

For some perspective (and satisfaction of gap in ES filling), the corresponding ES gap on a continuous contract ala Trade Station is 1371.75 down to 1355, but I have noticed that just hitting the High of the day preceding the Gap can be all that is needed. That High is 1362.50 ES. and that would be much better to have occurred in the RTH (today) than in the overnight, but, it could get hit overnight

Here's the chart to give you some perspective. This is CASH SPX.

BTW, a measured move down from the Bear Flag is roughly 1373 for the CASH.

pink histograms on the chart are just inside days.

Looks like overnight Low was it, and coincidentally just at or after my comment (I wasn't looking at PA while I was writing the comment, now I remember why I do not make many comments, and for the life of me, when Bruce and NickP are doing it, I can't fathom how they manage to comment and trade on such a short-term time-frame).

since no one is commenting...

Here's something absolutely non-technical, non chart pattern non-gap related (but it could serve to bolster my earlier expressed expectations that bears are taking profits today)

I saw somewhere that Obama is supposed to speak near 1pm ET today. I don't think Obama would hold a press conference to rub Republicans' faces in his victory, there is potential that he might talk about cooperation and bi-partisanship to address country's fiscal cliff problems (Republican bid to oust Obama has failed and they have to re-build base.) Working constructively for the country's good might be a theme of the speech. (could add a scare to the bears)

ES could hit 1388-1389 or higher.

But without me. I'm done for the day.

Good Trading to all.

since no one is commenting...

Here's something absolutely non-technical, non chart pattern non-gap related (but it could serve to bolster my earlier expressed expectations that bears are taking profits today)

I saw somewhere that Obama is supposed to speak near 1pm ET today. I don't think Obama would hold a press conference to rub Republicans' faces in his victory, there is potential that he might talk about cooperation and bi-partisanship to address country's fiscal cliff problems (Republican bid to oust Obama has failed and they have to re-build base.) Working constructively for the country's good might be a theme of the speech. (could add a scare to the bears)

ES could hit 1388-1389 or higher.

But without me. I'm done for the day.

Good Trading to all.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.