ES Monday August 6th

Current O/N low falls at the cleavage point from Fridays session so

1387 is a key area today and I think they will fill that in RTH. Also the 4 pm volume was there Friday. My bias is to the short side above Fridays RTH high to get that 1387.

Other numbers: 1390 - 1391.50 = Fridays high and peak volume from the O/N session

1383 - 1384.50 = ****The afternoon pullback low and the high volume bars that went untested on Friday.. First critical support point.

1377 - 1378 = old untested Vpoc and poc

Besides the obvious range extremes we need to watch the 1373 - 1375 *****area closely...this is where the report volume came in on friday in the O/N session and buyers won from that point. so what happens when we come back to test it ? It's also the midpoint between Thursdays High and fridays low !!

all the critical areas have about 10 points between them so you can see where the O/N high sits and add 10 points from 1383 - 1384. A further rally will try to push above 1400 mark into 1403 - 1404 but I don't expect that today.

1369 - 1371 has an LVN and a unfilled gap close along with Thursdays high!!

Another key area below is 1364 - 1365

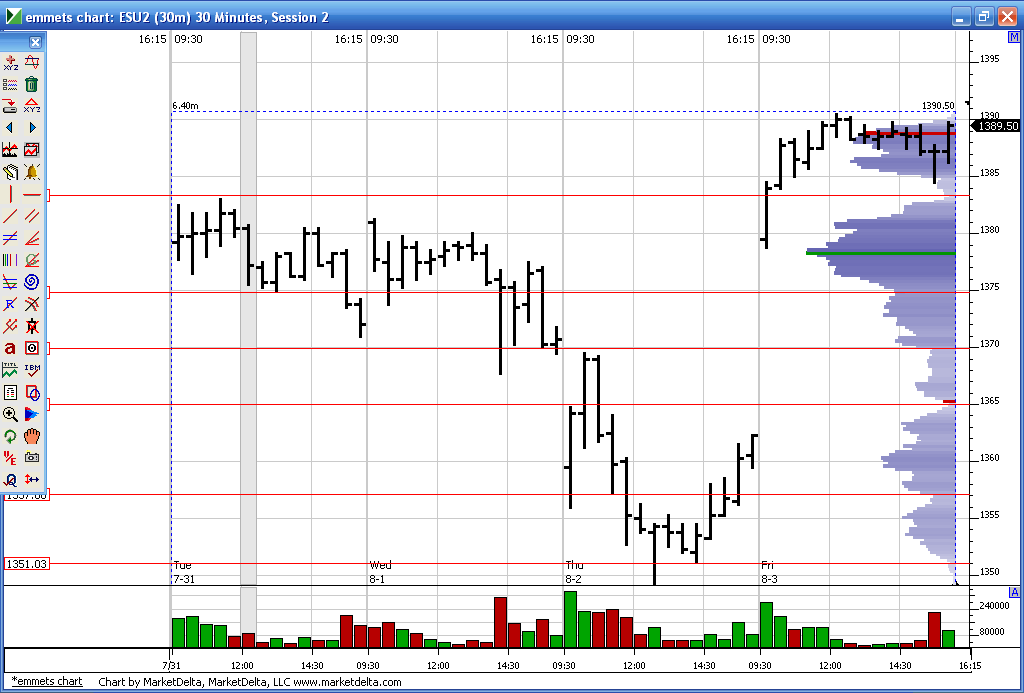

here is a quick chart for some to see the key areas..

1387 is a key area today and I think they will fill that in RTH. Also the 4 pm volume was there Friday. My bias is to the short side above Fridays RTH high to get that 1387.

Other numbers: 1390 - 1391.50 = Fridays high and peak volume from the O/N session

1383 - 1384.50 = ****The afternoon pullback low and the high volume bars that went untested on Friday.. First critical support point.

1377 - 1378 = old untested Vpoc and poc

Besides the obvious range extremes we need to watch the 1373 - 1375 *****area closely...this is where the report volume came in on friday in the O/N session and buyers won from that point. so what happens when we come back to test it ? It's also the midpoint between Thursdays High and fridays low !!

all the critical areas have about 10 points between them so you can see where the O/N high sits and add 10 points from 1383 - 1384. A further rally will try to push above 1400 mark into 1403 - 1404 but I don't expect that today.

1369 - 1371 has an LVN and a unfilled gap close along with Thursdays high!!

Another key area below is 1364 - 1365

here is a quick chart for some to see the key areas..

beautiful example and almost on schedule..this is a bell curve still and they are jerking it around between the two volume points of interest...on a trend day the volume acts very different...

in theory if the 95 players have the power they will drive it 3 - 4 points down in the 91-92 but we always need to be careful when other volume spikes are nearby and keep things in context

it's always good to ask yourself "why is volume flowing in here ?" today it is IB and O/N high

in theory if the 95 players have the power they will drive it 3 - 4 points down in the 91-92 but we always need to be careful when other volume spikes are nearby and keep things in context

it's always good to ask yourself "why is volume flowing in here ?" today it is IB and O/N high

ok..nuff said..today was tuff and it required tons of patience...and some luck..

vertigo3 August 6, 2012 at 12:10:06 There’s a whole lotta nuthin’ goin’ on… well, who would be surprised by a day of consolidation after a monster gaining day like Friday?

I don’t know whether this matters, But I am going to mention it.

There is a gap (created by a gap down open on 5-2-12) that is still OPEN.

The ES 4:00 C of the day before, 5-1-12, was 1396.00 according to a continuous contract . (On a day like today, it would not be a surprise to see ES fool around and then make a little push to print 1396.00. If price reversed immediately, that 1396.00 would be a one tick takeout of the current day’s High…(stranger things have happened)

The 4:15C on 5-1-12 was 1394.00 so that gap has already been closed, but so far, the High today is 1 tick from a fill of that 1396.00 (4:00C) (and the fill of the 1394 didn’t initiate a tidal wave of sellers).

CA$H has that same dated gap still open. The CA$H Close on 5-1-12 was 1405.82,

CA$H hasn’t even come close to that yet.

SPY has the same gap still open. wouldn’t fill unless there is a print of 140.74

The SPY High so far has only been 140.17

I don’t know whether this matters, But I am going to mention it.

There is a gap (created by a gap down open on 5-2-12) that is still OPEN.

The ES 4:00 C of the day before, 5-1-12, was 1396.00 according to a continuous contract . (On a day like today, it would not be a surprise to see ES fool around and then make a little push to print 1396.00. If price reversed immediately, that 1396.00 would be a one tick takeout of the current day’s High…(stranger things have happened)

The 4:15C on 5-1-12 was 1394.00 so that gap has already been closed, but so far, the High today is 1 tick from a fill of that 1396.00 (4:00C) (and the fill of the 1394 didn’t initiate a tidal wave of sellers).

CA$H has that same dated gap still open. The CA$H Close on 5-1-12 was 1405.82,

CA$H hasn’t even come close to that yet.

SPY has the same gap still open. wouldn’t fill unless there is a print of 140.74

The SPY High so far has only been 140.17

what are we suppose to try and hold all day ?? ridiculous!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.