ES Friday 3-23-12

well, it seems that the volatility has dried up trading and participation. It isn't unique to our forum but hopefully the markets will let those of us who stick with it prosper. Part of the problem with many who day trade in my opinion is that they not only jump from method to method but they also switch markets too often.

I can only imagine that many have spent so much time trying to understand the personality of the ES and then when they get so close they give up due to the lack of volatility. Now is the time to dig in and trade. Take small risks and small targets. Practice good methods of entry and exit while volatility is low so you can apply the same ideas when things pick up. mean reversion in the ES hasn't changed. Only the size of the ranges. All the same concepts apply except perhaps the pitbull numbers may be using a plus/minus 2.5 instead of the plus/minus 4 etc. Those are secondary anyway.

ok,ok..I'll shut up ! Now that my speech is over here is today's video. Hope it's a great day for all.

I can only imagine that many have spent so much time trying to understand the personality of the ES and then when they get so close they give up due to the lack of volatility. Now is the time to dig in and trade. Take small risks and small targets. Practice good methods of entry and exit while volatility is low so you can apply the same ideas when things pick up. mean reversion in the ES hasn't changed. Only the size of the ranges. All the same concepts apply except perhaps the pitbull numbers may be using a plus/minus 2.5 instead of the plus/minus 4 etc. Those are secondary anyway.

ok,ok..I'll shut up ! Now that my speech is over here is today's video. Hope it's a great day for all.

well, it seems that the volatility has dried up trading and participation. It isn't unique to our forum but hopefully the markets will let those of us who stick with it prosper. Part of the problem with many who day trade in my opinion is that they not only jump from method to method but they also switch markets too often.

I can only imagine that many have spent so much time trying to understand the personality of the ES and then when they get so close they give up due to the lack of volatility. Now is the time to dig in and trade. Take small risks and small targets. Practice good methods of entry and exit while volatility is low so you can apply the same ideas when things pick up. mean reversion in the ES hasn't changed. Only the size of the ranges. All the same concepts apply except perhaps the pitbull numbers may be using a plus/minus 2.5 instead of the plus/minus 4 etc. Those are secondary anyway

this is how i feel today bruce..thanks for pep talk to get me back on the path..

I can only imagine that many have spent so much time trying to understand the personality of the ES and then when they get so close they give up due to the lack of volatility. Now is the time to dig in and trade. Take small risks and small targets. Practice good methods of entry and exit while volatility is low so you can apply the same ideas when things pick up. mean reversion in the ES hasn't changed. Only the size of the ranges. All the same concepts apply except perhaps the pitbull numbers may be using a plus/minus 2.5 instead of the plus/minus 4 etc. Those are secondary anyway

this is how i feel today bruce..thanks for pep talk to get me back on the path..

buying into 86.50 with target back to open print and 1390..agressive as it is in high volume zone from Thursday..expecting two way trade in here before direction is formed..

L 86 even..and now we wait

adding at 85...hard part of this is knowing that a report is a 10 am..targeting 86.75 to take something off

Bruce,

Thanks again for your videos.

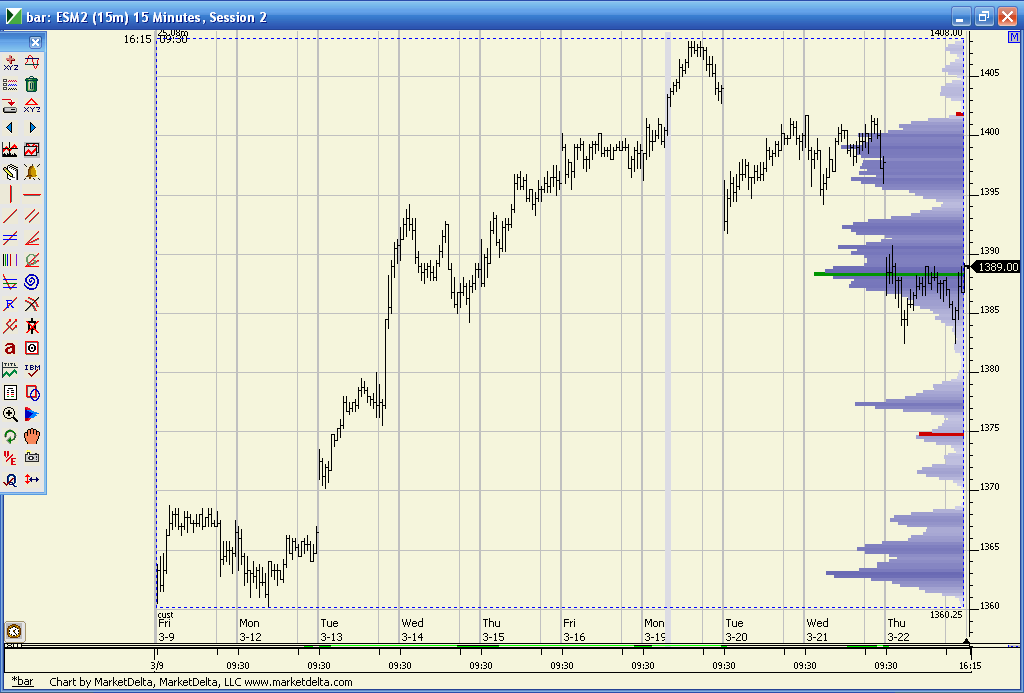

That chart (opening comment) you posted showing multiple days VP, there you go, your thin volume reversal zone, right on.

If you get a chance can you explain what you meant about the DB yesterday being low quality?

RE yesterday's PA, when there is a late session rebound, tends to carryover into overnight action.

I had to leave the computers yesterday near noon, but I can't help but wonder how much manipulation goes on when I see such a DB as yesterday, then the late session lift that saw price in the overnight go to and tag the measured move off the DB (Just take H between the two Lows, minus the Low price and take that range and add it to the High, that measured move came in in the overnight and price reversed.

there are higher authorities at work in the markets.

Bruce, If you get a chance can you explain what you meant about the DB yesterday being low quality?

Thanks again for your videos.

That chart (opening comment) you posted showing multiple days VP, there you go, your thin volume reversal zone, right on.

If you get a chance can you explain what you meant about the DB yesterday being low quality?

RE yesterday's PA, when there is a late session rebound, tends to carryover into overnight action.

I had to leave the computers yesterday near noon, but I can't help but wonder how much manipulation goes on when I see such a DB as yesterday, then the late session lift that saw price in the overnight go to and tag the measured move off the DB (Just take H between the two Lows, minus the Low price and take that range and add it to the High, that measured move came in in the overnight and price reversed.

there are higher authorities at work in the markets.

Bruce, If you get a chance can you explain what you meant about the DB yesterday being low quality?

Originally posted by duck

well, it seems that the volatility has dried up trading and participation. It isn't unique to our forum but hopefully the markets will let those of us who stick with it prosper...

It's spring break in the United States at the moment so that might be a factor.

starting next campaign at 84 but will be more aggressive under YD lows if it prints, 86.50 is target again

Originally posted by BruceM

just went flat at 90.25. biggest trade in 4 years too in terms of getting a price swing..not boasting just pointing out that there are still opportunities in these markets. hope all have a great weekend

Congrats Bruce on that trade!

You're right, there are still a lot of opportunities in ES and the volatility will likely pick up in the future.

I missed the buy at 1380.50 which did fit my set ups and here are some reasons:

- An identified level at 1380.50

- Price expanded to 3-4 pts outside of 20min OR/Outer extremity of ATR

- VOLD was not consistent to the downside. If it was, I may have still taken it but would have exited at a closer level like lower OR/VWAP and etc.. In this particular trade, had I taken it, I would have looked to exit at HV@87ish, which was your set from LV to HV..

Question: What made you aim for the other side of the bell curve?

thx

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.