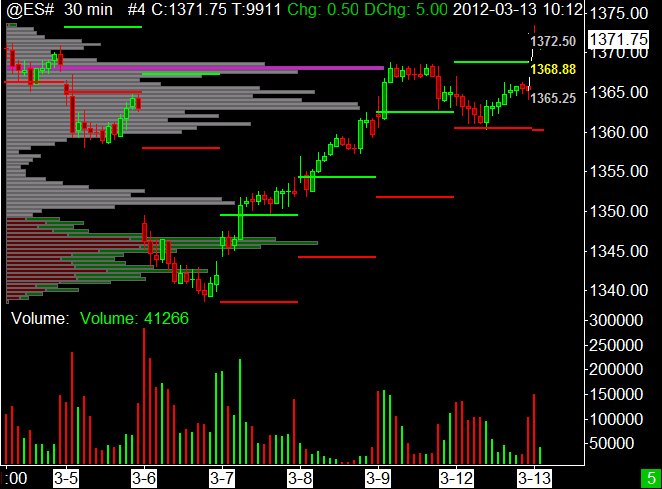

ES Tuesday 3-13-12

i will buy the 136875 with 4 point stop..

i will sell the 137650 with 4 point stop.

is everybody on march break?

i will sell the 137650 with 4 point stop.

is everybody on march break?

I agree with this numbers.

Originally posted by duck

i will buy the 136875 with 4 point stop..

i will sell the 137650 with 4 point stop.

is everybody on march break?

johnpr2010 whenever you have a chance, can you please post the chart you are using to come up with those numbers?

Thanks in advance

AYN

Thanks in advance

AYN

Originally posted by johnpr2010

I agree with this numbers.

Originally posted by duck

i will buy the 136875 with 4 point stop..

i will sell the 137650 with 4 point stop.

is everybody on march break?

1368.25 is the exact 1/2 (half) gap from yesterday's close to today's open. The weekly POC is the same number, and the -4 pitbull zone is here tooo. I would be placing my longs in this number tooo. Looking for 2 to 4 pts out of it. Since 72.50 would be a magnet for today.

Thanks, I thought you were talking about some fib projections. Don't mind my question.

Thanks, I thought you were talking about some fib projections. Don't mind my question.

71.25 was the prior rth high for the year so we are obviously toying with that; 70-71 is some low volume from overnight that as of now has been rejected...below i have the 67.5-68 volume from last week, which coincides with the 4-5.5 pitbull area...65 and 63 are peak volume nodes from yest...above 73.5 was peak volume o/n and has served as resistance thus far...above we have te o/n highs in the 76 area (coincides with +4 pitbull area) and not a whole lot more expect for weekly r1 at 79.25

there might not be a lot of opportunity this morning with the fed expected to release its statement at 2.15pm...71-71.5 seems to be the magnet thus far for target purposes

there might not be a lot of opportunity this morning with the fed expected to release its statement at 2.15pm...71-71.5 seems to be the magnet thus far for target purposes

I hope someone bought that dip at 71, which was a classic VOLD tip off today.

VOLD smooth and directional, ADD came against it holding it rangebound.but held the low and VOLD's pattern remained intact. The assumption or hope is that ADD will turn to align with VOLD and it happened.. The stop would have been below that low in case VOLD turned to align with the ADD to the downside, which was less likely..

VOLD smooth and directional, ADD came against it holding it rangebound.but held the low and VOLD's pattern remained intact. The assumption or hope is that ADD will turn to align with VOLD and it happened.. The stop would have been below that low in case VOLD turned to align with the ADD to the downside, which was less likely..

Originally posted by BruceM

only small tries up here. Obvious data issues today so like a trapeze without a net and only via laptop.

Sounds like you were trading from a hammock on a beach.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.