ES Friday 3-9-12

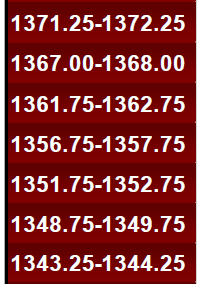

1371 is the yearly high for june contract also David

david exit around 1369-71 area and short

I know Bruce uses the pit bull numbers as guideposts and I use something similar, which I'll share with you here. Its the only ATR tool I use on ES, which comes from the ACD concept.

- I use the 20min OR at the opening and project out 3-4 points. Those are levels I will consider fades according to the ATR of ES.

- If there is some confluence at the OR, I will consider fading it. Otherwise, the 3-4 pts band outside of the 20min OR is the better fade and if there is some confluence with other levels or if its the outside of a bell curve, I'll take it. The 2 targets are the OR, 1'st target at closest OR and 2'nd target at the other OR.

- Here's where the VOLD comes in again. If the VOLD is smooth and one sided against your fade, be careful for possible trend. If the VOLD shows inconsistent behavior, the odds of this fade will be enhanced..

- If you get stopped out 2-3 pts outside the 3-4 pt range outside of OR - This means price stretched 5-6 pts outside OR, you consider taking the OR in the direction of the trend if it pulls back that far...

- I use the 20min OR at the opening and project out 3-4 points. Those are levels I will consider fades according to the ATR of ES.

- If there is some confluence at the OR, I will consider fading it. Otherwise, the 3-4 pts band outside of the 20min OR is the better fade and if there is some confluence with other levels or if its the outside of a bell curve, I'll take it. The 2 targets are the OR, 1'st target at closest OR and 2'nd target at the other OR.

- Here's where the VOLD comes in again. If the VOLD is smooth and one sided against your fade, be careful for possible trend. If the VOLD shows inconsistent behavior, the odds of this fade will be enhanced..

- If you get stopped out 2-3 pts outside the 3-4 pt range outside of OR - This means price stretched 5-6 pts outside OR, you consider taking the OR in the direction of the trend if it pulls back that far...

Today, the 20min OR is 1370.50. Where did price stall? 1373-1374, 3-4 pts outside of OR. If you back test this, you'll see it has validity.

Again, its not a stand alone trade signal but something to be aware of.. additional reasons to take the trade when you see compelling reasons..

Note: Currently as we stand, lots of people are shorting this 73 indicating price should advance further...

Again, its not a stand alone trade signal but something to be aware of.. additional reasons to take the trade when you see compelling reasons..

Note: Currently as we stand, lots of people are shorting this 73 indicating price should advance further...

Jedi do you use Mark Fischers ACD method for CL?

Originally posted by vasuki

Jedi do you use Mark Fischers ACD method for CL?

Y, I use it for directional bias in CL.

interesting.. I was thinking just the opposite...everybody wants the new yearly high at 77 March or 71 as per June..statistically only 4% chance of the OVB on the weekly..no sure thing though!

Bruce do you trade the OVB just like an engulfing candle?

futures are shorting into this level pretty good.. If cash don't go lower, you'll probably get the 77

I shouldn't say short but that's what I assume - It could just be distribution at the bid..

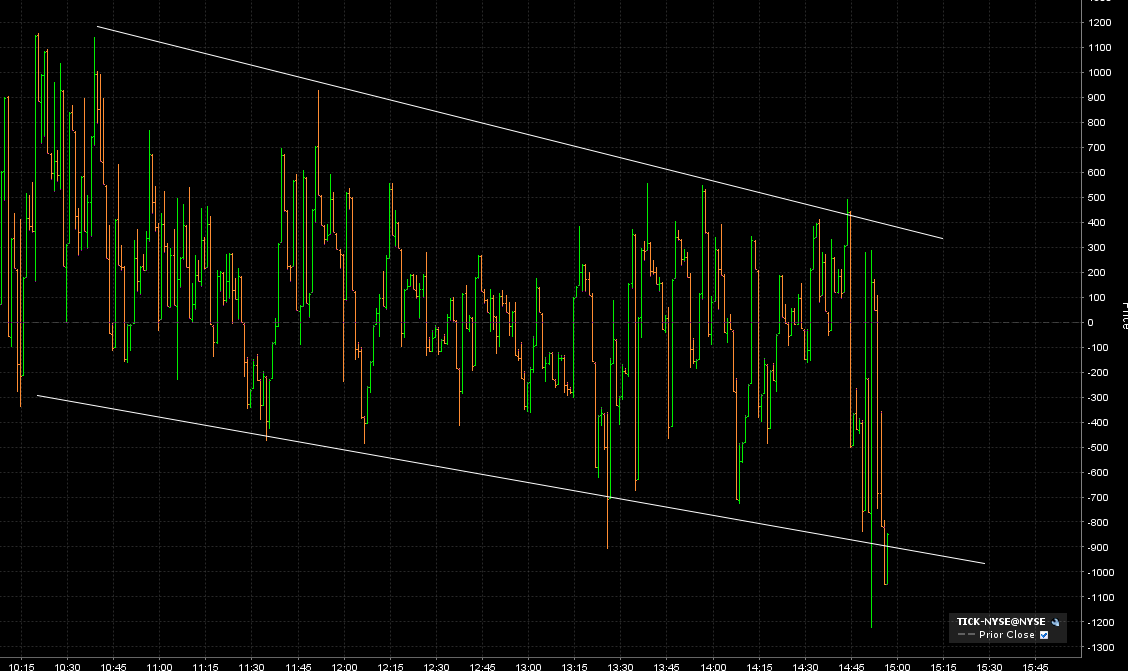

here was part of the internal picture I was watching and a good place to leave off on a friday...the market was grinding back and forth as the $ticks where channeling down..not pefect but what is ? we also had that air pocket below...just pointing out some of the context even if it is after the fact..

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.