ES Tuesday 3-6-12

Kicking off Tuesday's trading topic with a question:

What would Bruce do?

It's an easy game and designed to make you think and become a better trader. Feel free to replace Bruce with KoolBlue or Monkey Meat or any other trader that you follow, understand or wish to emulate.

Before, at or after the market open and then at any time during the trading day ask yourself what that trader would do at this point. Post your trade (or non-trade) with the reason that you would have (or would not have) taken it. If you're learning and not posting an actual trade then say something like "I would have gone short here if I were trading real money because we hit up against the triples on..." etc.

If you see someone comment on a possible trade setup that you recognize then reply and confirm that you agree with the setup or what you think the setup should have been or why it is invalid.

Think of this as your midterm. You've been reading these topics for days, weeks, months or years. Now try it out and get feedback from your peers (hopefully).

Good luck everyone!

What would Bruce do?

It's an easy game and designed to make you think and become a better trader. Feel free to replace Bruce with KoolBlue or Monkey Meat or any other trader that you follow, understand or wish to emulate.

Before, at or after the market open and then at any time during the trading day ask yourself what that trader would do at this point. Post your trade (or non-trade) with the reason that you would have (or would not have) taken it. If you're learning and not posting an actual trade then say something like "I would have gone short here if I were trading real money because we hit up against the triples on..." etc.

If you see someone comment on a possible trade setup that you recognize then reply and confirm that you agree with the setup or what you think the setup should have been or why it is invalid.

Think of this as your midterm. You've been reading these topics for days, weeks, months or years. Now try it out and get feedback from your peers (hopefully).

Good luck everyone!

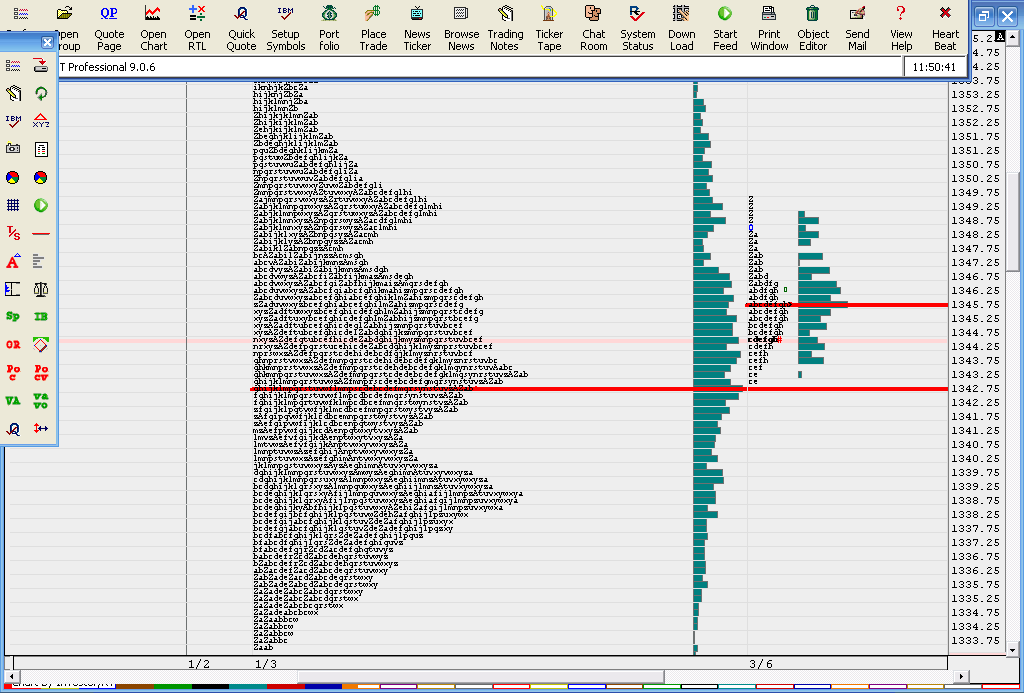

look at this beautiful structure today...all the volume is in the middle at that 46.25....so they kept it symetric..meaning that from the current high in RTH to the big volume is 3.25 points so we can subtract that from the bell to get the lower estimate..which gives us the 43 even...

I don't use it alone but we had lots of confluence down below to help us pull the trigger long...just pointing it out

I don't use it alone but we had lots of confluence down below to help us pull the trigger long...just pointing it out

thanks Paul.correct S2.for those looking for RTH only pivots here is a link. I still suggest doing them yourself as it gets one really involved with the data. This site won't get you all the key weekly pivots but it's a start

I know nothing else about this site ..hopefully the owners of mypivots won't get offended by me posting this

http://www.daytradingbias.com/?page_id=994&symbol=ES

I know nothing else about this site ..hopefully the owners of mypivots won't get offended by me posting this

http://www.daytradingbias.com/?page_id=994&symbol=ES

I'd like to see them push into 44.25 or lower to see if we can get the long trade going again with the assumption that 46.25 is still the volume magnet

I calculate the RTH pivots daily (based on 4:15 Close)

Today, Prior1

R3, 1377.58, 1381.08,

R2, 1372.42, 1377.17,

R1, 1368.33, 1372.83,

PP, 1363.17, 1368.92,

S1, 1359.08, 1364.58,

S2, 1353.92, 1360.67,

S3, 1349.83, 1356.33,

Today, Prior1

R3, 1377.58, 1381.08,

R2, 1372.42, 1377.17,

R1, 1368.33, 1372.83,

PP, 1363.17, 1368.92,

S1, 1359.08, 1364.58,

S2, 1353.92, 1360.67,

S3, 1349.83, 1356.33,

bruce i have 42 as s2 (using rth; last week's high 77.25, low 53, close 68.5...i think that gives 42 using mypivots calculator...

Originally posted by BruceM

weekly r2 is 43 even FWIW

I may have used settlement Nick . Yearly Peak volume price is 42.75.

gap in data up at 46.50 so I'm still looking to get longs off down here...no shorts for me with that peak volume and all the other crap down there..

gap in data up at 46.50 so I'm still looking to get longs off down here...no shorts for me with that peak volume and all the other crap down there..

I'd prefer to see them push out that low at 43 as it is just too perfect...shows no impulse to get long

your S3 seems off for today Paul...

Originally posted by PAUL9

I calculate the RTH pivots daily (based on 4:15 Close)

Today, Prior1

R3, 1377.58, 1381.08,

R2, 1372.42, 1377.17,

R1, 1368.33, 1372.83,

PP, 1363.17, 1368.92,

S1, 1359.08, 1364.58,

S2, 1353.92, 1360.67,

S3, 1349.83, 1356.33,

a close up of what I am looking at down here..profile on the right is today...on left is yearly totals..

my calculations are based on the Woodie formula as defined in the mypivots.

Woodie and Classic are the same for R2,R1,PP,S1,S2, it is beyond those measures (in boh directions that the calculations differ.

Weekly I have is

.WEEKLY........WEEKLY........WEEKLY..........WEEKLY.... WEEKLY

........WEEKLY........WEEKLY.........WEEKLY........WEEKLY.....

_Open, 1355.50, ,Pt Change, 5.75, ,

_High, 1377.25, , % Change, 0.40,

__Low, 1353.00, , Range, 24.25,

Close, 1368.50, Roll5Rng = , 26.10

C1600,_________,, Roll20Rng = , 40.30

5 week average of H vs O = 19.30 18.75 20.80 21.75 19.80

5 week average of L vs O = -6.80 -8.15 -7.80 -6.80 -8.85

.....This WK....Prior1

R3W, 1403.75, 1387.33,

R2W, 1390.50, 1377.42,

R1W, 1379.50, 1370.08,

PPW, 1366.25, 1360.17,

S1W, 1355.25, 1352.83,

S2W, 1342.00, 1342.92,

S3W, 1331.00, 1335.58,

As you have stated before, confluences are important, but you still have to pay attention to PA (although as I study your comments about LVN HVN, I am more inclined to believe that you need LVN, TOO. and maybe almost exclusively.

Woodie and Classic are the same for R2,R1,PP,S1,S2, it is beyond those measures (in boh directions that the calculations differ.

Weekly I have is

.WEEKLY........WEEKLY........WEEKLY..........WEEKLY.... WEEKLY

........WEEKLY........WEEKLY.........WEEKLY........WEEKLY.....

_Open, 1355.50, ,Pt Change, 5.75, ,

_High, 1377.25, , % Change, 0.40,

__Low, 1353.00, , Range, 24.25,

Close, 1368.50, Roll5Rng = , 26.10

C1600,_________,, Roll20Rng = , 40.30

5 week average of H vs O = 19.30 18.75 20.80 21.75 19.80

5 week average of L vs O = -6.80 -8.15 -7.80 -6.80 -8.85

.....This WK....Prior1

R3W, 1403.75, 1387.33,

R2W, 1390.50, 1377.42,

R1W, 1379.50, 1370.08,

PPW, 1366.25, 1360.17,

S1W, 1355.25, 1352.83,

S2W, 1342.00, 1342.92,

S3W, 1331.00, 1335.58,

As you have stated before, confluences are important, but you still have to pay attention to PA (although as I study your comments about LVN HVN, I am more inclined to believe that you need LVN, TOO. and maybe almost exclusively.

Originally posted by BruceM

great trade Horse...it's all cool APK..thanks for the recap..

final contract exit at 42.50.

thanks bruce! have a lot of respect for you and your thoughts for longs today added some conviction to my trade idea. when we have such a strong long term timeframe, it's easier to side with them, even on a day like today!

will be interesting to see what happens tomorrow.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.