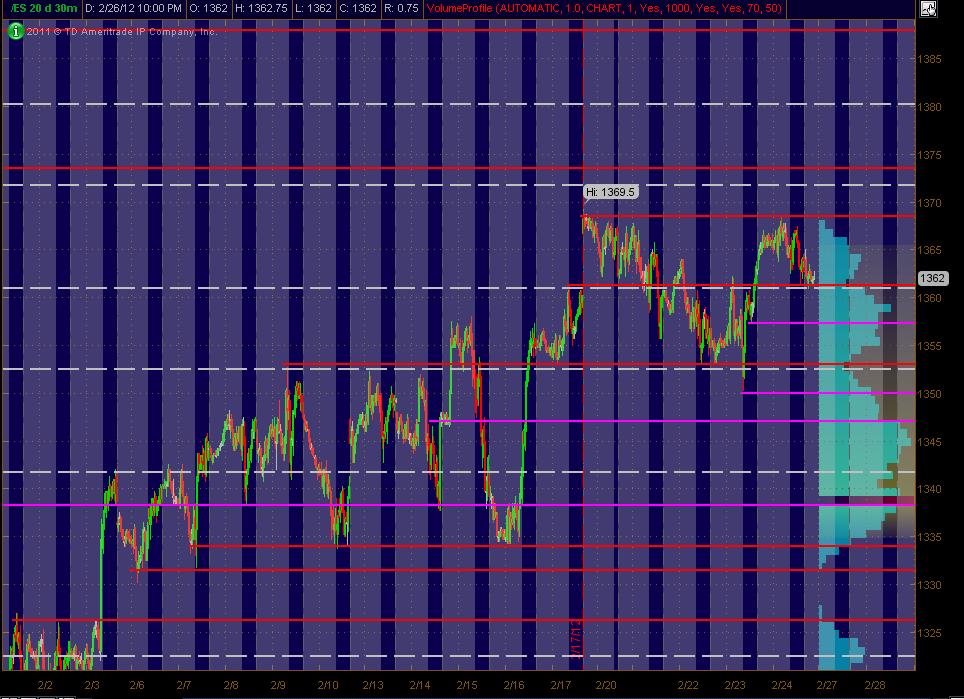

ES Monday 2-27-12

Here's what I've got for my ES MAP of PASR ZONES using a 30min chart of 20 days of data coming into Monday's trading. The Red lines are potential significant levels with Magenta lines as semi-significant. The White dashed lines are the Weekly Pivots (kind of a background thing to have on the chart). The Light Blue Volume Profile of the past "rolling" 20 days is displayed on the right vertical axis. The Gray background shows non-RTH price activity. Hope, as always, that this is helpful to some as a "MAP."

thanks Nick..just exited at 59.25..we'll let others get greedy and hold for 60 or gap fill

everything in context....as usualy we are using the O/N range as a possible breakout point that gets retested often..so we mean revert when those breakouts fail and I incorporate that into the plan based off of ONLY the day session data..

I still think higher is coming as long as that 56 can hold price declines now

bottom line is that trading isn't easy and you need a plan...most don't spend enough time on alternate scenarios

everything in context....as usualy we are using the O/N range as a possible breakout point that gets retested often..so we mean revert when those breakouts fail and I incorporate that into the plan based off of ONLY the day session data..

I still think higher is coming as long as that 56 can hold price declines now

bottom line is that trading isn't easy and you need a plan...most don't spend enough time on alternate scenarios

Thanks Pharlap..hope the reasons come through...lots of ways to trade and great ideas posted here but basically I would advise any trader to avoid breakout trades in the ES. IMHO it isn't worth trend trading unless your personality can take 70% or more small losses in order to hold for a bigger win 30% of the time or LESS!

Mentally that is tough to do for most but for some that style fits well.

Mentally that is tough to do for most but for some that style fits well.

good chance that we retest 1360 again

I have small shorts at 66.50 and this is second try...they are using second deviation off vwap today with 60 as the center.....we also have Fridays highs at the same place above

we need this last push up to fail to go back to low volume at 61.25...( 60 magnet too).so that area is a magnet still....not much has changed until we get some consolidation ABOVE that 67 price..

we need this last push up to fail to go back to low volume at 61.25...( 60 magnet too).so that area is a magnet still....not much has changed until we get some consolidation ABOVE that 67 price..

a bit early to have 3 sets of single prints on the charts!! so statistically we can expect at least one of those below to fill in...

targeting 63.50 ..good time for some back fill over lunch......no question we had some big volume on that move up...was it just a fake out ? Not really sure....this is a low confidence trade for me due to that big volume

trying one last time from 68.75....trying for 63.50.....

bruce how wide are your stops in general ?i am asking since you mentioned that you have several tries in a zone...so if a zone you are looking at is 3 or so points wide how do u deal with stops there? i know u r in a trade so by all means take your time to respond

Like most I feel the rally is a bit over done....I'm wondering why the VIX bottomed out a couple of days ago...? Could it be that somebody or a group of traders has started to become a bit fearful up at these lofty levels ? And the summation index has flashed a warning that we should try to press the short side up here.

Adv/ dec are even today and down volume is twice up volume so don't be fooled by this potential breakout today..I would not be surprised to see a late day sell off and trade back to 60 again. We'll see...nobody really knows but we can sometimes look at a few subtle hints...

Adv/ dec are even today and down volume is twice up volume so don't be fooled by this potential breakout today..I would not be surprised to see a late day sell off and trade back to 60 again. We'll see...nobody really knows but we can sometimes look at a few subtle hints...

Nick, this reduced volatility has let me give the market more room....usually I would just look for flips in my footprint to ENTER trades in my zones and then use targets for exits but when I am wrong I will usually just exit on a new low or high depending on what other numbers are nearby. I often will start small and add heavier...today was a good example as I know that 52.75 number was sitting below the O/N lows. I have tried to make it more systematic but my discretionary style and sometimes just my gut feel get in the way.

You may remember that I have a matrix that I use SPECIFICALLY in the first 90 minutes which helps me decide how agressive I want to be. ten a.m reports put a limit on being too agressive so today I was not trading heavy contracts on those lows.

I find that the flips of the footprint usually come about .75 - 1.25 off a high or low and I have no problem taking multiple tries if I see mutiple flips...

Now my stops on runners are often just chart points or my original entry point because I don't want to agressively watch them....so I ask myself what price would I no longer want to be in this long or short...

These trades outside of the first 90 minutes are very small compared to the early trades and I tend to manage them different because I get these wrong a lot....I will also allow these afternoon trades to breathe more when I have had a good morning. I don't mind being a bit loose in an attempt to gain more profit and allow myself to relax a bit more while trading.....morning trades are a bit more of a frenzy to me..

as I'm typing I just took 4 contracts off at 66.75 and if it goes back to 69.50 I will lose money on the last two contracts..as I entered at 68.75 so sometimes I will give a bit more room to try and stay out of the noise.....many would think that is foolish and perhaps it is...why not take them all off ? Well, I think we may sell off to some of those air pockets below and don't want the stress of entering and exiting multiple times but in the morning I am undaunted by trends and in higher volatility I am VERY agressive and will just exit when the footprint gives me a clue.

sorry if I can't be more precise. What I really need to do is get my computer that has the footprints up to speed so I can get some charts from it posted.

You may remember that I have a matrix that I use SPECIFICALLY in the first 90 minutes which helps me decide how agressive I want to be. ten a.m reports put a limit on being too agressive so today I was not trading heavy contracts on those lows.

I find that the flips of the footprint usually come about .75 - 1.25 off a high or low and I have no problem taking multiple tries if I see mutiple flips...

Now my stops on runners are often just chart points or my original entry point because I don't want to agressively watch them....so I ask myself what price would I no longer want to be in this long or short...

These trades outside of the first 90 minutes are very small compared to the early trades and I tend to manage them different because I get these wrong a lot....I will also allow these afternoon trades to breathe more when I have had a good morning. I don't mind being a bit loose in an attempt to gain more profit and allow myself to relax a bit more while trading.....morning trades are a bit more of a frenzy to me..

as I'm typing I just took 4 contracts off at 66.75 and if it goes back to 69.50 I will lose money on the last two contracts..as I entered at 68.75 so sometimes I will give a bit more room to try and stay out of the noise.....many would think that is foolish and perhaps it is...why not take them all off ? Well, I think we may sell off to some of those air pockets below and don't want the stress of entering and exiting multiple times but in the morning I am undaunted by trends and in higher volatility I am VERY agressive and will just exit when the footprint gives me a clue.

sorry if I can't be more precise. What I really need to do is get my computer that has the footprints up to speed so I can get some charts from it posted.

Originally posted by NickP

bruce how wide are your stops in general ?i am asking since you mentioned that you have several tries in a zone...so if a zone you are looking at is 3 or so points wide how do u deal with stops there? i know u r in a trade so by all means take your time to respond

well up is up..my eyesight may be failing but on my chart that line goes at an up angle...3.25 points up is not that big a deal..unless of course you are short 50 contracts!...just saying..nice night everyone

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.