ES Tuesday 01-10-12

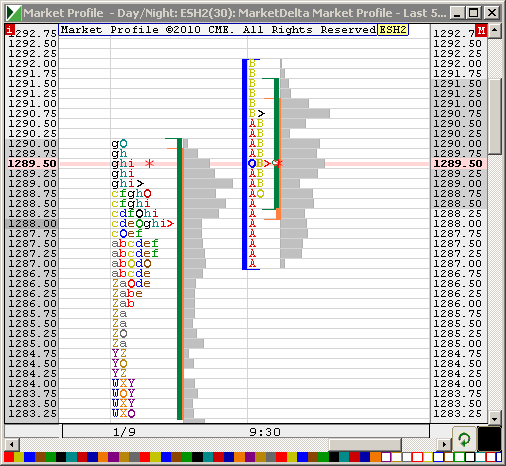

As I type the market is moving higher in the Overnight and up against that 88-89 area mentioned last week. I think the most important level to monitor will be 1283 - 1284 to see if that can hold as support.

We have daily and weekly pivot players there, Octobers monthly highs and now a low volume area in the overnight also.

Moving higher we get into the 94 - 96 area and then the evil 1300.

Below 83 - 84 is last weeks RTH high so 77.50 - 79 is a key zone.

Everything seems to be playing out in 4 - 5 point increments in this diminished volatility. Lets hope we begin to expand soon.

We have daily and weekly pivot players there, Octobers monthly highs and now a low volume area in the overnight also.

Moving higher we get into the 94 - 96 area and then the evil 1300.

Below 83 - 84 is last weeks RTH high so 77.50 - 79 is a key zone.

Everything seems to be playing out in 4 - 5 point increments in this diminished volatility. Lets hope we begin to expand soon.

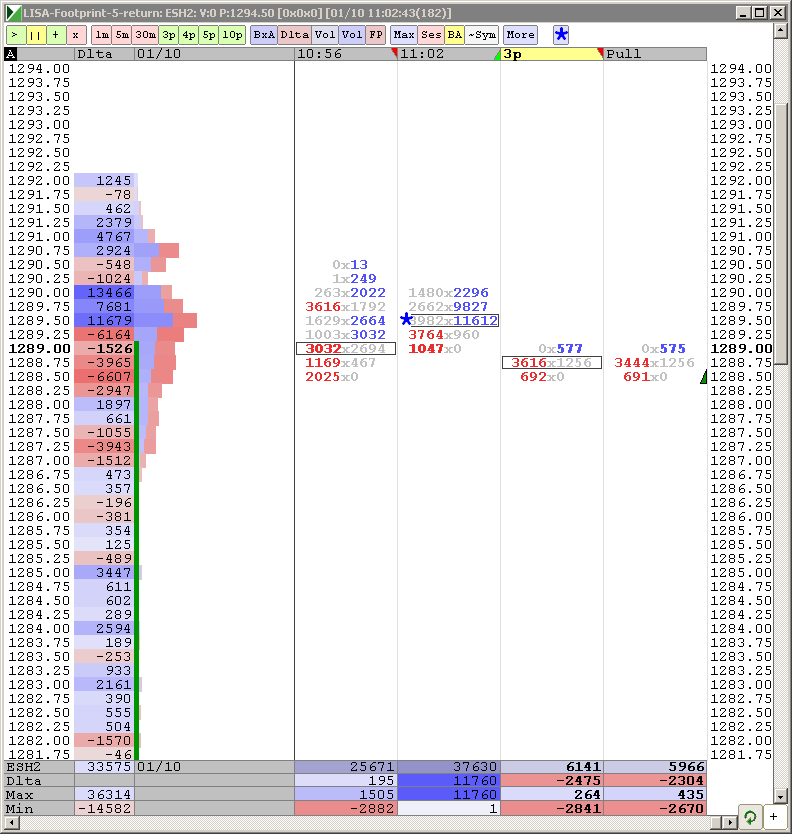

I would really like to see them reject all that volume at 90.75 a bit faster than this...that is the price to beat for the bulls

the dreaded hour range again..this is becoming a real habit!

the dreaded hour range again..this is becoming a real habit!

i agree, i have used the pitbull numbers in conjunction with other stuff but only when the +/- 4-5.5 come into play...i avoid completely the +/- 2.5 ones

thanks again !

thanks again !

Originally posted by BruceM

LOL..u got it Nick....and that to me is the hardest trades in general out of all the pitbull trades... so much goes on at the open print.....to me that is the high risk trades..

so far a tough day to make money

unless you got long at 6pm

scalps on pullbacks...and small scalps at that. stops larger than profit targets, ugghhh

It is very rare that we gap outside a previous months high in the real time session and not trade back to that high at some point on a monthly basis...

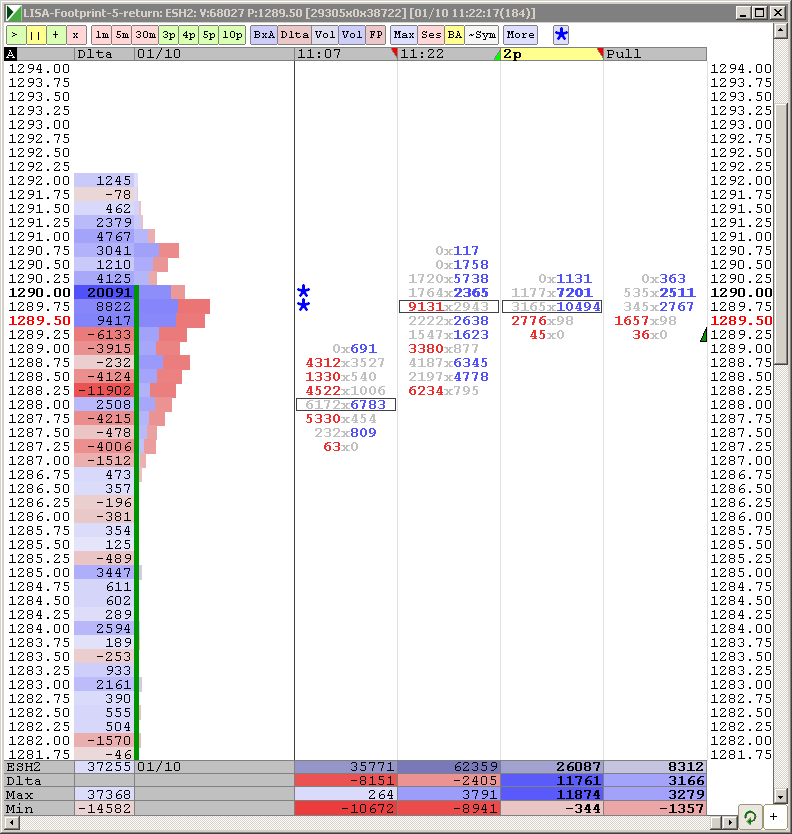

certainly doesn't mean it will happen today...so statistically we will trade back to 1283 but we don't know when this month we will do that...my plan is to look for shorts as long as the hour high stays in tact today....then if that breaks the only fades will be up near 93 - 95 and then again up near the 1300 level..

that is my long winded way of saying that 1283 is a big magnet for me as we move forward from here....a nice rally up into days end will have me buy puts..

certainly doesn't mean it will happen today...so statistically we will trade back to 1283 but we don't know when this month we will do that...my plan is to look for shorts as long as the hour high stays in tact today....then if that breaks the only fades will be up near 93 - 95 and then again up near the 1300 level..

that is my long winded way of saying that 1283 is a big magnet for me as we move forward from here....a nice rally up into days end will have me buy puts..

look at all those 30 minute closes at 89 area..yikes....they need a better close to signal some direction..

so far I am unimpressed with the volume on this breakout from a major bracket...volume was higher last thursday and friday.....evidence is pointing to weak participation on this gap so far

so far I am unimpressed with the volume on this breakout from a major bracket...volume was higher last thursday and friday.....evidence is pointing to weak participation on this gap so far

Agree, Lisa and Bruce. The gap up into 1290 should've had much more action with either an end of day run up towards 1300 or have been slammed by selling. The doodling around and "relatively" narrow range has me wondering what's up with big money [the actual market movers] out there currently.

Need some more revealing price action in the next day or so to "recalculate" where the mkt wants to go. I'd expected a run up to 1300 based on analysis I'd posted a few places during the past few days (NOT). Go figger?!?

Need some more revealing price action in the next day or so to "recalculate" where the mkt wants to go. I'd expected a run up to 1300 based on analysis I'd posted a few places during the past few days (NOT). Go figger?!?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.