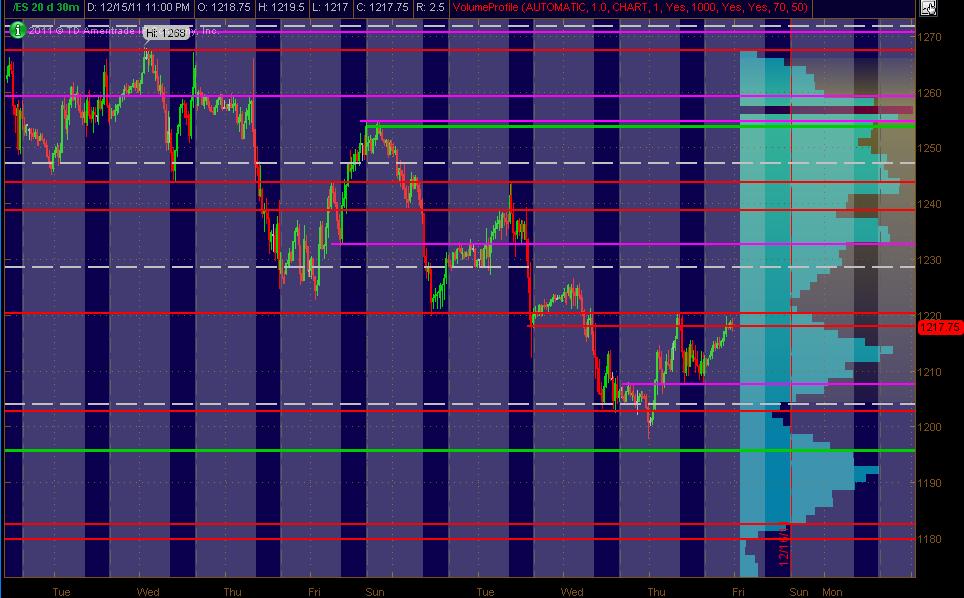

ES Friday 12-16-11

Here's what I've got for my ES MAP of PASR ZONES using a 30min chart of 20 days of data coming into Friday's trading. The Red lines are potential significant levels with Magenta lines as semi-significant. The White dashed lines are the Weekly Pivots. The Green line(s) is an unclosed gap level. The Light Blue Volume Profile of the past "rolling" 20 days is displayed on the right vertical axis. The Gray background shows non-RTH price activity. Hope, as always, that this is helpful to some as a "MAP."

Don't forget it's Crazy Friday Witching Day ... lots of atypical crosscurrents.

As for levels above and below current trading as of the post:

1233 Fib cluster / Minor PASR / Daily R2

1229 Wkly Pvt / Minor PASR

1218-20 PASR / Trendline down on 30m chart

1207 Minor PASR / Fib Rtc / 1 to 2 Day VolProf LVN

1202-04 Wkly Pvt / PASR / 20day VolProf Low Volume Area

Don't forget it's Crazy Friday Witching Day ... lots of atypical crosscurrents.

As for levels above and below current trading as of the post:

1233 Fib cluster / Minor PASR / Daily R2

1229 Wkly Pvt / Minor PASR

1218-20 PASR / Trendline down on 30m chart

1207 Minor PASR / Fib Rtc / 1 to 2 Day VolProf LVN

1202-04 Wkly Pvt / PASR / 20day VolProf Low Volume Area

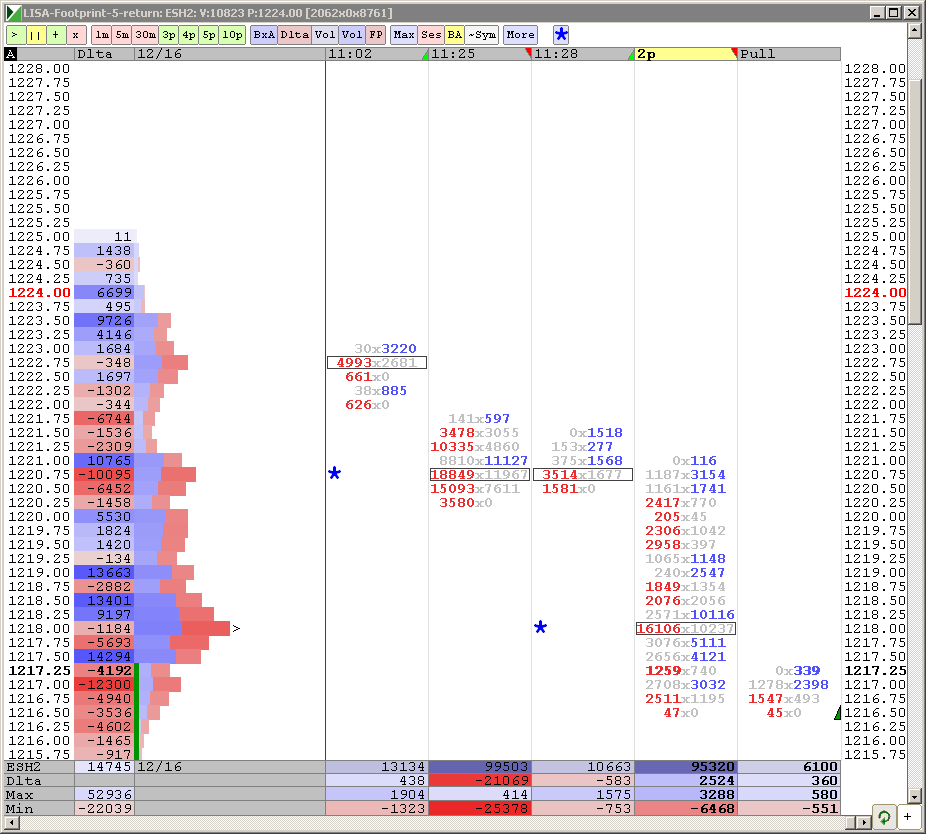

MM I like your 20 day rolling profile. Notice price held the LVN Wed afternoon and the probe early yesterday morning, and now this choppy rally has taken price right up to the LVN at 1222.50 this morning.

There are single prints from Tuesday's wide range day that run from 1221.00 up to 1224.00, clearly that zone is in play early this morning.

Above that zone is another LVN from Tuesday at 1229.00 which lines up exactly on your weekly pivot point.

Also of note is a nice HVN at 1235.75 also from Tuesday

There are single prints from Tuesday's wide range day that run from 1221.00 up to 1224.00, clearly that zone is in play early this morning.

Above that zone is another LVN from Tuesday at 1229.00 which lines up exactly on your weekly pivot point.

Also of note is a nice HVN at 1235.75 also from Tuesday

I'm framing it out like this...

22 - 23 is key inflection point and they WILL go for either 1234 or 1211 as a magnet today....stumbling blocks to reach those main targets will be the 29.75 or the 1215 numbers......

so I'm still using low volume to fade but will be quicker to reverse in order to trade for the 1211 or 1234...

PT and Monkey posted the reasons for the numbers...mine are the same..

22 - 23 is key inflection point and they WILL go for either 1234 or 1211 as a magnet today....stumbling blocks to reach those main targets will be the 29.75 or the 1215 numbers......

so I'm still using low volume to fade but will be quicker to reverse in order to trade for the 1211 or 1234...

PT and Monkey posted the reasons for the numbers...mine are the same..

sold into 20.25 but may be early...air pockets below

air filled ..runners trying for 16.75 and 1211

we can only assume that since the 15 held and the 22- 23 broke through they are trying for the 34. This could change but that''s all we have to go on now...29.75 is key resistance...getting back under the Overnight high causes initial questioning for this upmove

Ym is lagging and hasn't broken out of key highs....will wait for the hour to complete to come up with a better plan unless 29 area comes into view first

Ym is lagging and hasn't broken out of key highs....will wait for the hour to complete to come up with a better plan unless 29 area comes into view first

Es is following the euro almost in lockstep. If the euro heads to 1.25 as some speculate we may be looking for 1170 not too far away..

with the Ym barely able to get outside YD highs and the ES back under the key upper zone there is only one way to trade now IMHO.....

thanks bruce , enjoy the weekend

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.