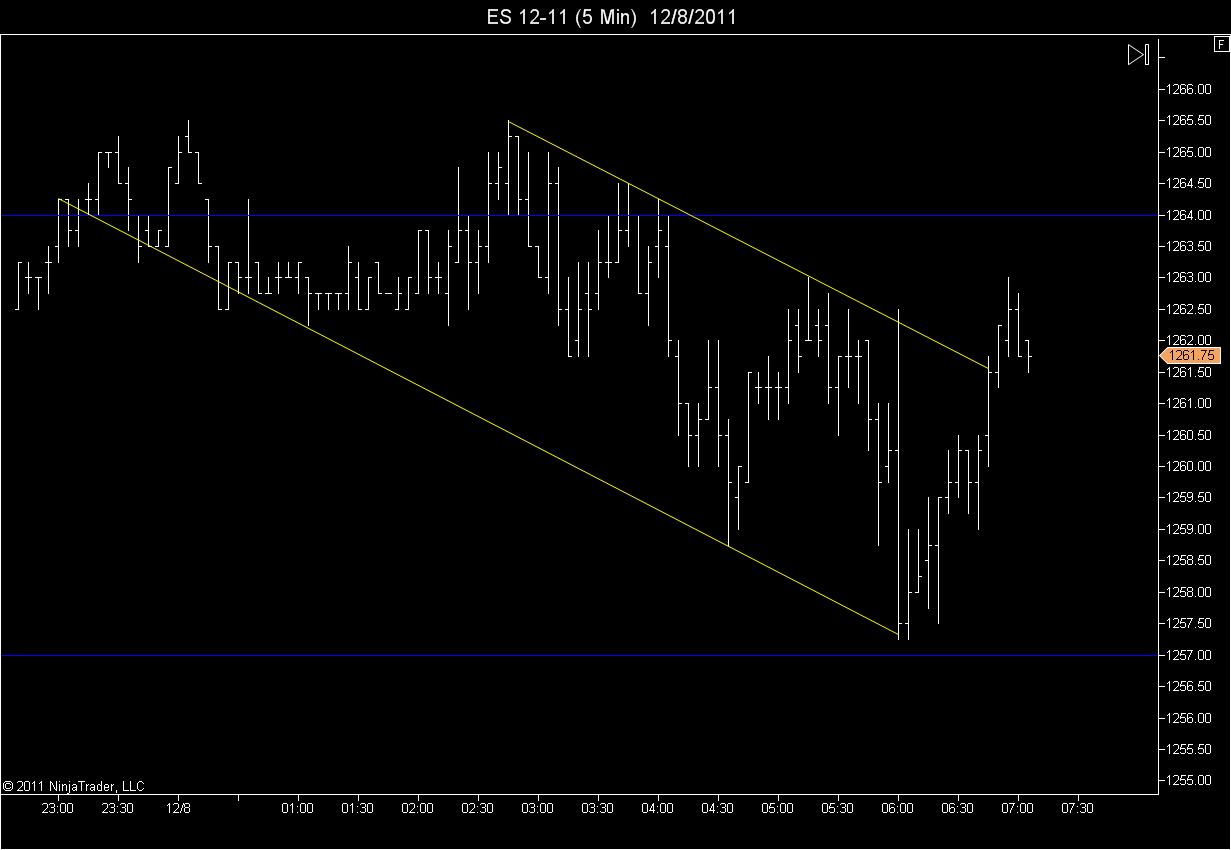

ES Thursday 12-8-11

Contract Rollover today !

In the 'old' Dec contract I have:

HVN's at 1264.00 , 1257.00 , 1254.00 and 1249.00

LVN's at 1259.75 and 1251.00

In the 'old' Dec contract I have:

HVN's at 1264.00 , 1257.00 , 1254.00 and 1249.00

LVN's at 1259.75 and 1251.00

tons of volume has accumulated over time down at this 43 - 45 area....so I'm looking for longs for the hour low retest....keeping in mind that the 56 has failed and the 51 area has failed so it is obvious that sellers are in here...trading light for me

also keeping in mind that trading at high volume nodes is high risk and we can chop around at them for a while....

on 43.50 long and this will the last trade for this contract today for me...keeping it tight and not taking multiple tries down here...would rather step aside

trying for 45.75 as to get out in front of that hour low..

this was also the extreme of the bracket I posted on page 1.....flat now at target...

great trading bruce

Bruce what stops do you normally use? Today I have been sitting on the sidelines. I get conflicted as I'm an optimist and when the market tanks I am easily influenced by my concern for my other portfolios and don't want to bet against myself!

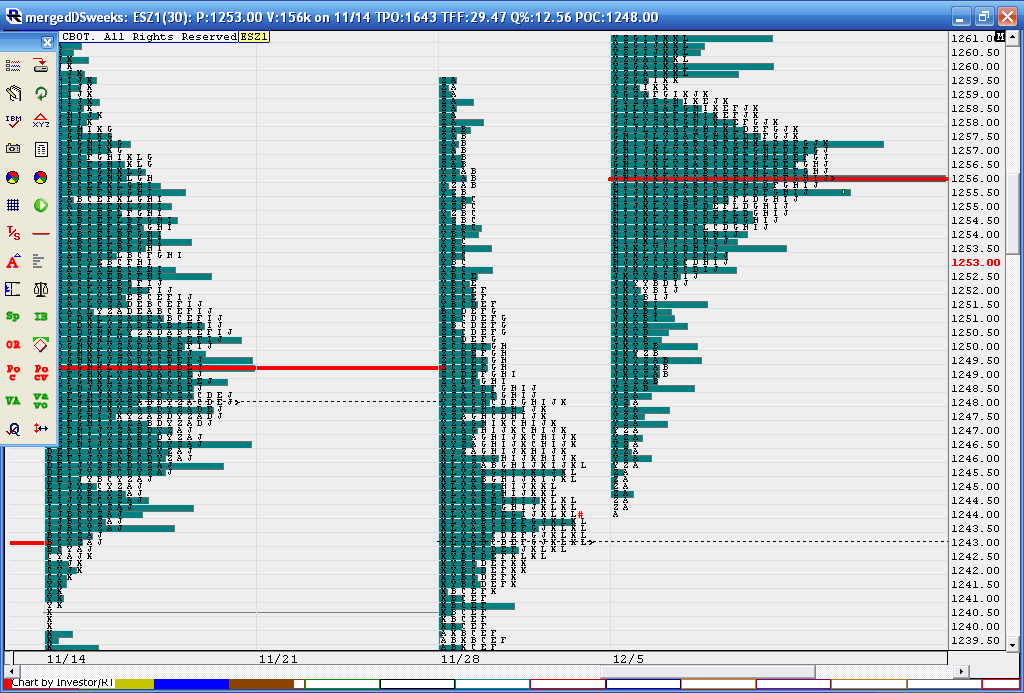

Here is a chart for some who like to combine the profiles...these are weekly profiles. I do not have today's data merged in yet. It shows a picture of the volume I was talking about down in the 43 - 45.50 are in "L" period. You can also see that 1256 volume above..

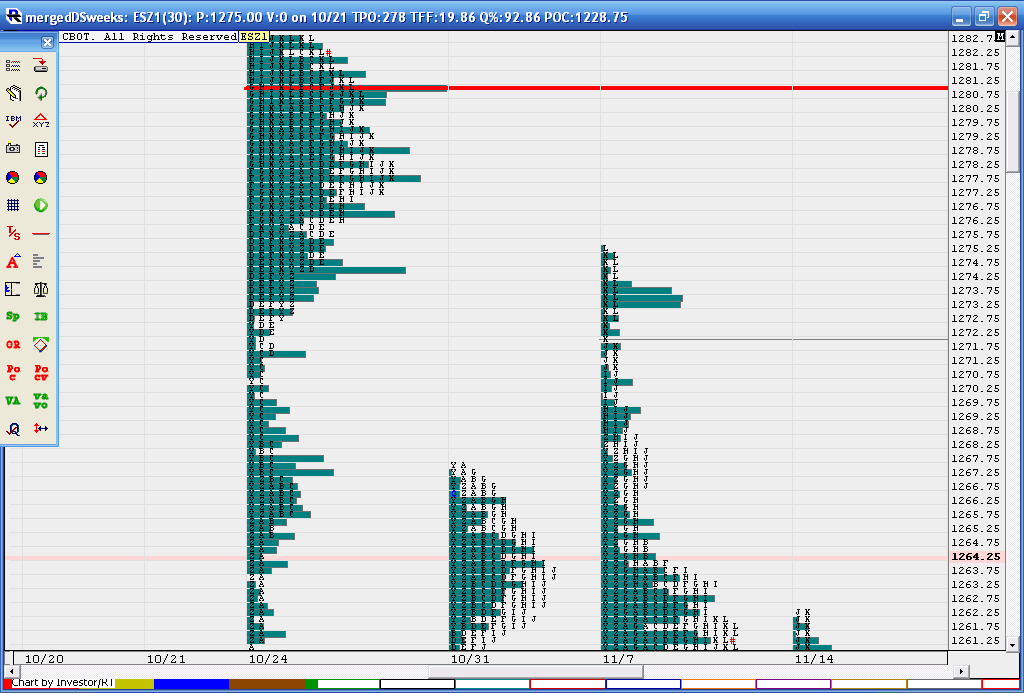

Hopefully this one won't be too complicated. It shows a few weeks but look at 11/7 and go to the 1272 - 73.50 area. My chart snaps that black line you see because that was a single print and then look at the volume at 73.50. Then go to week ending 10/24 and look at the volume at 1274.....so this became an area I was interested in this morning hence my shorts in the overnight

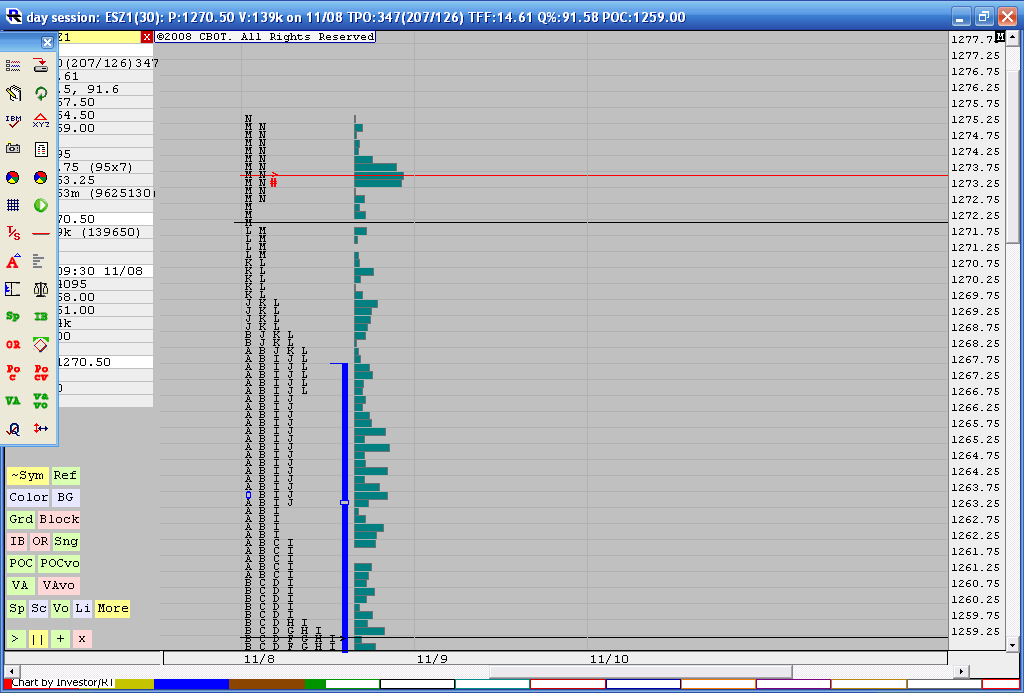

and here is the specific - day November 8th...note the single print and the big volume at 73.50. This is why I say that combining profiles isn't needed but it comes down to a matter of preference. However one sees the key areas is all that really counts!

I'm burned out now...I gotta go get some exercise....luckily it snowed last night and it's sunny...good time to be outside!

and here is the specific - day November 8th...note the single print and the big volume at 73.50. This is why I say that combining profiles isn't needed but it comes down to a matter of preference. However one sees the key areas is all that really counts!

I'm burned out now...I gotta go get some exercise....luckily it snowed last night and it's sunny...good time to be outside!

Hi MPW and welcome to the forum. You are new here so haven't been around in the days when I averaged into trades ( for years) and did well but also had some bad hits to my ego and account. I've been working hard for the past 9 months or more at taking many small tries at my key areas with the footprint charts. Even so I still am averaging about .75 up to about 2.25 points for my stops per contract.

These are not actual stops as I don't use hard stops. These are my losses per try in my zones. some days I am just too freakin slow at exiting when wrong and luckily my stubborn nature is getting "trained" to accept losses and move on.

Most of my orders are market orders so sometimes my slippage is a good thing and sometimes it just sucks. I prefer to use signs from the footprint to help get me in but I still need work on my poorly timed entries to limit my losses even more. Sorry I can't be more precise but the discretionary nature of the footprints makes it hard and illogical to me to use hard stops. I never used them before so not having a stop comes easy to me.

I work off a matrix that I have devised so I know how heavy or lite I want to trade depending on the setups which helps me scale out at targets when I get it right. I normally will not try more than 3 times in a zone especially when I get the trade wrong. Usually when I do get it right it happens on the first or second try and my accuracy drops off if I try a third time. That provides good feedback for me. Thanks for the ?????

These are not actual stops as I don't use hard stops. These are my losses per try in my zones. some days I am just too freakin slow at exiting when wrong and luckily my stubborn nature is getting "trained" to accept losses and move on.

Most of my orders are market orders so sometimes my slippage is a good thing and sometimes it just sucks. I prefer to use signs from the footprint to help get me in but I still need work on my poorly timed entries to limit my losses even more. Sorry I can't be more precise but the discretionary nature of the footprints makes it hard and illogical to me to use hard stops. I never used them before so not having a stop comes easy to me.

I work off a matrix that I have devised so I know how heavy or lite I want to trade depending on the setups which helps me scale out at targets when I get it right. I normally will not try more than 3 times in a zone especially when I get the trade wrong. Usually when I do get it right it happens on the first or second try and my accuracy drops off if I try a third time. That provides good feedback for me. Thanks for the ?????

Originally posted by MPW

Bruce what stops do you normally use? Today I have been sitting on the sidelines. I get conflicted as I'm an optimist and when the market tanks I am easily influenced by my concern for my other portfolios and don't want to bet against myself!

figures...

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.