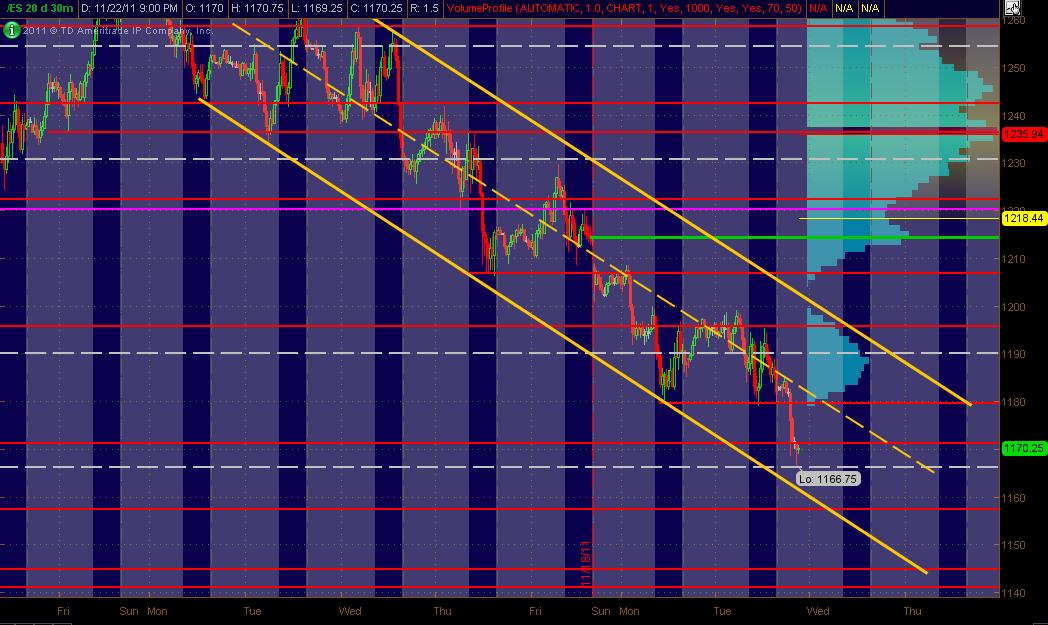

ES Wednesday 11-23-11

Here's what I've got for my ES MAP of PASR ZONES using a 30min chart of 20 days of data coming into Wednesday's trading. The Red lines are potential significant levels with Magenta lines as semi-significant. The White dashed lines are the Weekly Pivots and the Green line is a Gap to be closed. The Light Blue Volume Profile of the past "rolling" 20 days is displayed on the right vertical axis. The Gray background shows non-RTH price activity.

As of this post, the mkt has traded down to 1166.75 ... there's a Wkly Pvt there and also I had 3 (I think) Fibs clustered there. Anyway ... also drew in a Trend Channel in Yellow for some "perspective." Hope this is helpful to some!

Thangs are gettin' kind of whacky ... and we're in a holiday week, so beware!

MM

And Happy Thanksgiving to all who'll be celebrating it ... as I will, way too much good East Texas Turkey Day food!

As of this post, the mkt has traded down to 1166.75 ... there's a Wkly Pvt there and also I had 3 (I think) Fibs clustered there. Anyway ... also drew in a Trend Channel in Yellow for some "perspective." Hope this is helpful to some!

Thangs are gettin' kind of whacky ... and we're in a holiday week, so beware!

MM

And Happy Thanksgiving to all who'll be celebrating it ... as I will, way too much good East Texas Turkey Day food!

two reasons Nick.....that was from the Overnight trade.....look at day session and then the overnight for 10-9 and 10-10...the overnight created that 68....not as important...but now we have the CURRENT overnight low near that 68...more important to me...

the 5 minute air pocket sealed the deal on the long...even if it was quick.....61 - 62 is next important area to me...will watch to see if the 10:30 close is beyond the O/N low...failure down here will go back to 72 and much higher

the 5 minute air pocket sealed the deal on the long...even if it was quick.....61 - 62 is next important area to me...will watch to see if the 10:30 close is beyond the O/N low...failure down here will go back to 72 and much higher

got it...thanks much bruce and happy thanksgiving

Originally posted by BruceM

two reasons Nick.....that was from the Overnight trade.....look at day session and then the overnight for 10-9 and 10-10...the overnight created that 68....not as important...but now we have the CURRENT overnight low near that 68...more important to me...

the 5 minute air pocket sealed the deal on the long...even if it was quick.....61 - 62 is next important area to me...will watch to see if the 10:30 close is beyond the O/N low...failure down here will go back to 72 and much higher

trying the long again from 65.25...still low volume at 70 print....will take multiple stabs down here into the 61 - 62 if needed..higher risk as Ticks can't break the zero line

need this hour breakdown to fail and get back above the On low....the close below the O/N low is not a good thing and Ticks still in the gutter..

the Ticks are trying but this aint gonna be easy with this slow holiday trade..

that 68 with O/N low there is our trouble spot to clear...C'mon...lets get this long party started!!

we really need to see this 11 am bar ( 30 minute close) inside O/N range and inside the IB range...if we make new lows now I will get stopped out and will wait for 61 to print...hopefully with a good strong air pocket down...to loook for longs again..

on the 61.50...nice tick diverge intoour key #

66 - 68 is ultimate exit point..high vol now!

finally we get some long runners to move a bit ...this has been one of those days were runners go nowhere...like the 5 minute air fill earlier.....hits initial target and then stopped going up....

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.