The Fib Grid

Here is my master chart which has evolved out of my "Ratchet" concept I have mentioned on the day trading threads. With these levels you will never again need to measure moves, run fibs or dare I say possibly even draw market profile numbers on your charts. Ok, perhaps that is all a bit extreme but these levels will never change and work great on the stock index markets.

I've notice over a great many years that the market respects certain levels of prices. The basic ones are the numbers ending in "00", "50" and "75". What I have done is add in some key numbers that Lewis Borsellino used. These where the percentage retracement numbers of 12.50, 25 ,33, 50, 66, 75 and 88 percent numbers but in one interview ( I'll be damned if I can find it) he implied additional uses of the numbers. Sorry Jim Kane and Roofer but Lewis was the first one to make the 88% numbers available to me. Perhaps he stole it from you back in 1996!

For me the additional twist comes when you add in fib numbers....not the actually levels....this requires no measuring or deciding where to snap fib lines. We are only concerned with the fib numbers themselves. The missing ingredient comes with use the 6.25 point ratchets to fill in the gaps in the missing areas. We are basically having a key number at every 6.25 points with a few exceptions and greater emphasis in the confluence zones.

As usual the entries will come down to an understanding of price action and/or order flow. Closes on the 15 minute time frame after 10 a.m. Eastern time shows promise but I don't "do" system trades. Lets put the numbers down here first before we look at a few charts.

00 - the basis of it all and key rat

06.25 Ratchet number

12.50 - 1/8th

18.75 -rat

23.5 - Fib number

25 - key Rat 1/4

33 - 1/3

38 -Fib

43.75 - rat

50 fib - not officially - 1/2 key level not labelled on my chart

56.25 -Rat

62- fib

66- 2/3

70 -Fib

75-key rat 3/4

78 -fib

88-fib

93.75-rat

100

There they are. All the numbers you will ever need for the ES. It doesn't matter if we are at 1200 or 100 in the S&P we just use the last few digits....so we could be using 138 or 1238 for example of the 38 number...no snapping lines required.

Are these perfect? No,but what method or level actually is ? Numbers will hit over time..all numbers and all levels...posting numbers is the easy part but it does help others in being able to spot areas to potentially take trades from. These levels are best used in conjunction with your current methods. I use them with the market profile and the low volume numbers.

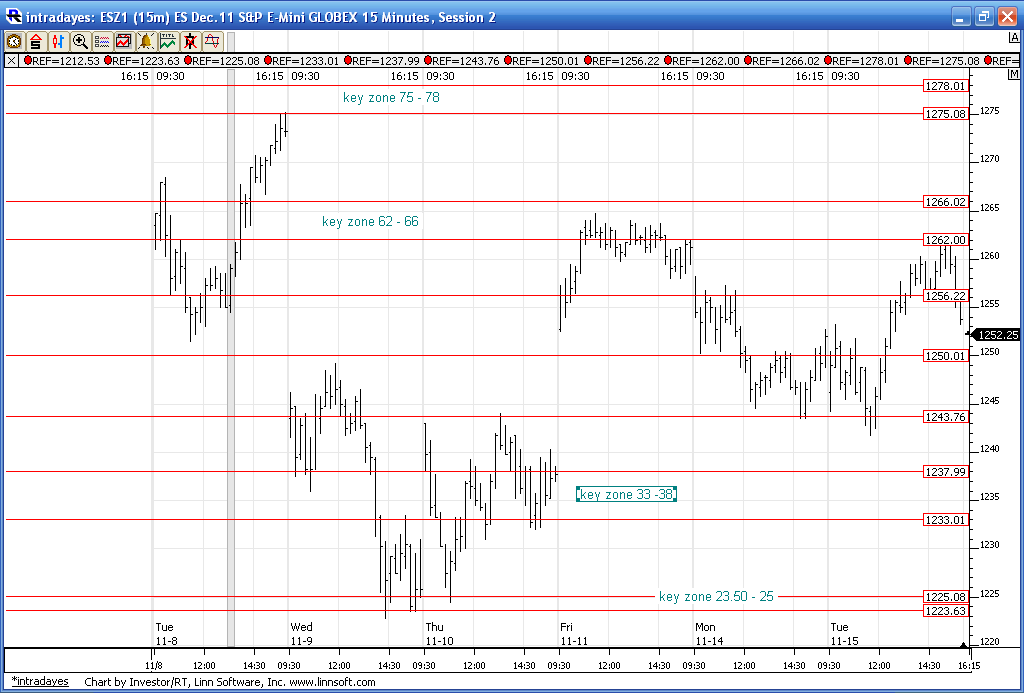

Here is a chart from the last week. You will notice how the clusters of numbers work very well at pointing out tops and bottoms. Those clusters are the 62 - 66 zone, the 23.50 - 25 zone and the 75 - 78 zone.

I've notice over a great many years that the market respects certain levels of prices. The basic ones are the numbers ending in "00", "50" and "75". What I have done is add in some key numbers that Lewis Borsellino used. These where the percentage retracement numbers of 12.50, 25 ,33, 50, 66, 75 and 88 percent numbers but in one interview ( I'll be damned if I can find it) he implied additional uses of the numbers. Sorry Jim Kane and Roofer but Lewis was the first one to make the 88% numbers available to me. Perhaps he stole it from you back in 1996!

For me the additional twist comes when you add in fib numbers....not the actually levels....this requires no measuring or deciding where to snap fib lines. We are only concerned with the fib numbers themselves. The missing ingredient comes with use the 6.25 point ratchets to fill in the gaps in the missing areas. We are basically having a key number at every 6.25 points with a few exceptions and greater emphasis in the confluence zones.

As usual the entries will come down to an understanding of price action and/or order flow. Closes on the 15 minute time frame after 10 a.m. Eastern time shows promise but I don't "do" system trades. Lets put the numbers down here first before we look at a few charts.

00 - the basis of it all and key rat

06.25 Ratchet number

12.50 - 1/8th

18.75 -rat

23.5 - Fib number

25 - key Rat 1/4

33 - 1/3

38 -Fib

43.75 - rat

50 fib - not officially - 1/2 key level not labelled on my chart

56.25 -Rat

62- fib

66- 2/3

70 -Fib

75-key rat 3/4

78 -fib

88-fib

93.75-rat

100

There they are. All the numbers you will ever need for the ES. It doesn't matter if we are at 1200 or 100 in the S&P we just use the last few digits....so we could be using 138 or 1238 for example of the 38 number...no snapping lines required.

Are these perfect? No,but what method or level actually is ? Numbers will hit over time..all numbers and all levels...posting numbers is the easy part but it does help others in being able to spot areas to potentially take trades from. These levels are best used in conjunction with your current methods. I use them with the market profile and the low volume numbers.

Here is a chart from the last week. You will notice how the clusters of numbers work very well at pointing out tops and bottoms. Those clusters are the 62 - 66 zone, the 23.50 - 25 zone and the 75 - 78 zone.

bruce welcome back and thanks for that grid...quite an interesting concept

we just broke upwards through the 600d movavg on the 5min chart, which lies right in the 49ish area, also peak volume from yesterday...so that area may be used as a destination if we edge down from here

we just broke upwards through the 600d movavg on the 5min chart, which lies right in the 49ish area, also peak volume from yesterday...so that area may be used as a destination if we edge down from here

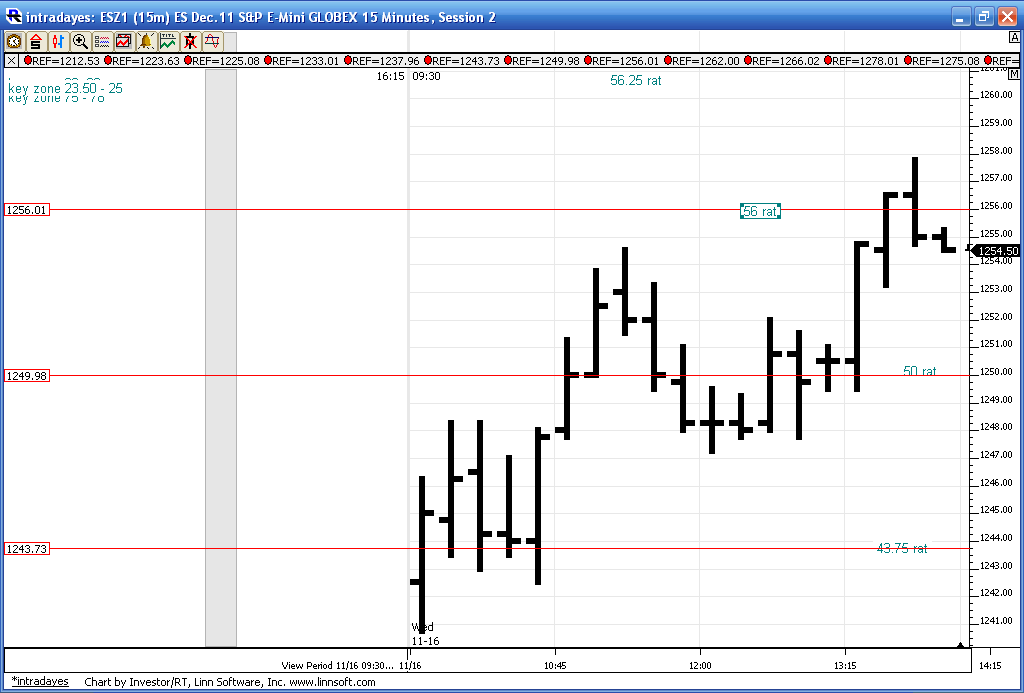

ok..here is today's day session so far ...note the failure to get a 15 minute close back below the 43.75 Rat...look at the low range bar at around the 13:15 at the 50 rat......now they are trying to get a reversal bar at the 56 rat....just some ideas...not gonna keep posting these charts...I think most get the ideas....you can spend your days snapping lines and pretending you have mastered the markets with common geometry found on all trading websites and in books etc....or you can just use the rats!! Makes no real difference to me....

here is the chart for that last one:

here is the chart for that last one:

logically trade gets real simple now....they will either go back for the 51.25 volume and the 50 rat or they will punch new highs and attempt to run for the 62 area...I'm hoping for the 51.25 on runners....

Bruce like the rat 0 to 100

That's all it is...options traders key off of the main rats...the 00, 25,50 and 75...we just fill in the rest...

Value is forming as Overlapping to lower on the day compared to yesterday...and on the bear side of yesterdays time POC...it will be an interesting end today...strange day...but not for us RATS!!

Value is forming as Overlapping to lower on the day compared to yesterday...and on the bear side of yesterdays time POC...it will be an interesting end today...strange day...but not for us RATS!!

Originally posted by della

Bruce like the rat 0 to 100

It just couldn't be any better for a day posting some of the rats.....I encourage all to throw them into your tool box and get rid of some of the other crap that may be holding you back as a trader.

I've only seen one person post real time trades that work with projections and that is Kool blue from our forum here. Many can post "lines" with projections and other methods but few actually trade them. Can't say I didn't worn you. I may not be the best trader in the world but I've been at the emini since 1998 and seen too many "line" and "wave" traders turn large sums of money into small ones.

My first mentor called it Elliott "wave Goodbye to your money" for a reason....

I've only seen one person post real time trades that work with projections and that is Kool blue from our forum here. Many can post "lines" with projections and other methods but few actually trade them. Can't say I didn't worn you. I may not be the best trader in the world but I've been at the emini since 1998 and seen too many "line" and "wave" traders turn large sums of money into small ones.

My first mentor called it Elliott "wave Goodbye to your money" for a reason....

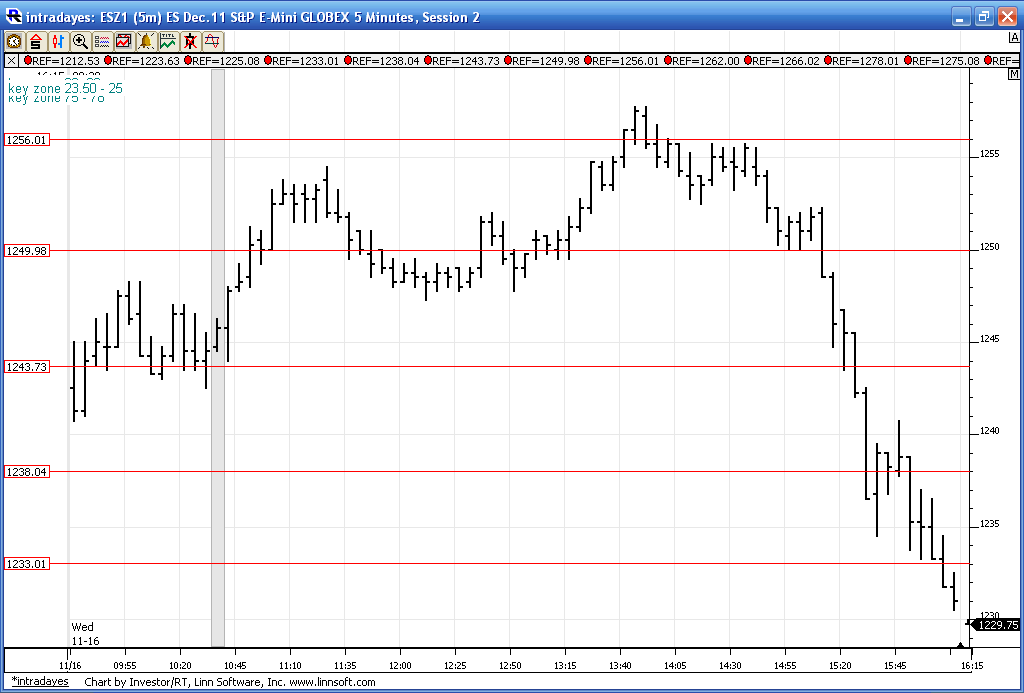

39 - 38 is the next key area and then the 33 but it is too late for me and fades,,,,good luck if u r in it from here..in other words ..it's too late for fades!!

That is so cool

Thanks Bruce for your explanations today. Good night everybody.

C ya pablo....

Della, the challenge for most with these kinds of numbers is that it is too simple so they assume it cannot work...after all how could a market that has such huge money participants "respect" these numbers ? The answer is that it won't when we trend but what method will ?

The other thing that happens is that if a number or zone stops short and doesn't "hit" correctly then they give up over time and move on to the next method...and over and over it goes.,...they keep looking for the grail.

My advice is to use these static numbers with other methods like the "bell" curve ideas we have talked about in recent weeks and other volume based ideas. Obviously I have a bias to volume based ideas too.

Here is how the day ended ..remember that the 33 - 38 becomes a zone of prices and you will tend to see more chop in those kinds of zones with more tests:

Della, the challenge for most with these kinds of numbers is that it is too simple so they assume it cannot work...after all how could a market that has such huge money participants "respect" these numbers ? The answer is that it won't when we trend but what method will ?

The other thing that happens is that if a number or zone stops short and doesn't "hit" correctly then they give up over time and move on to the next method...and over and over it goes.,...they keep looking for the grail.

My advice is to use these static numbers with other methods like the "bell" curve ideas we have talked about in recent weeks and other volume based ideas. Obviously I have a bias to volume based ideas too.

Here is how the day ended ..remember that the 33 - 38 becomes a zone of prices and you will tend to see more chop in those kinds of zones with more tests:

Sorry this is a bit off topic but was wondering if anyone is using X-Trader DOM? If so do you know how to display 10 levels of depth vs the standard 5? Thanks

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.