ES Monday 10-17-11

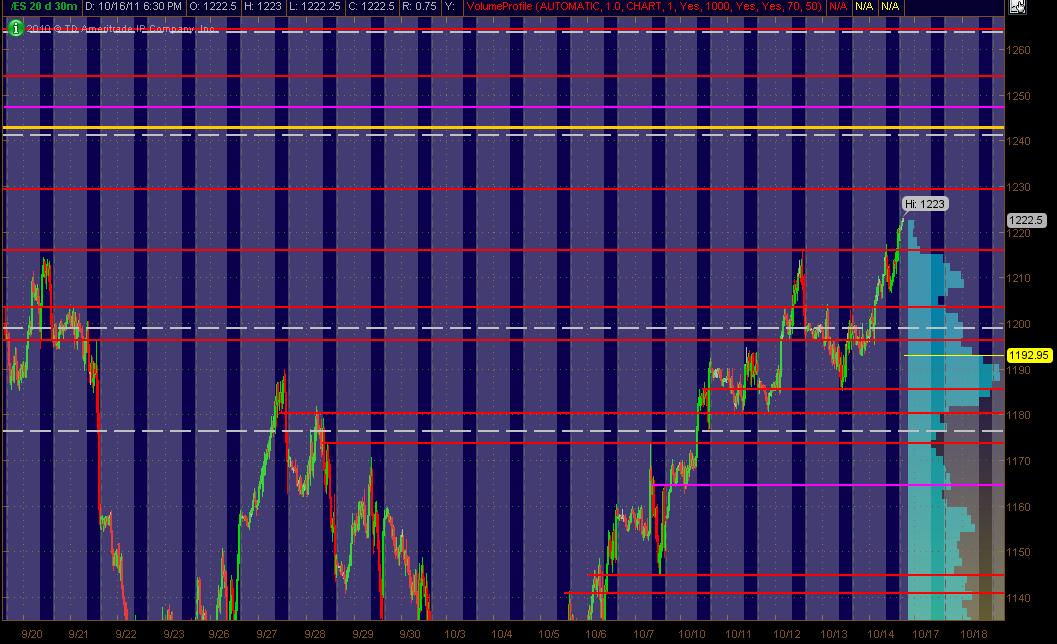

Here's what I've got in the way of a MAP for the ES coming into Monday's trading and the week. The Red Lines are potential significant PASR levels with any Magenta Lines as "semi" significant levels. White Dashed Lines are Wkly Pivots as per mypivots site. The Yellow line above the current market is a significant Fib Cluster fwiw.

The right vertical lighter Blue reflects 20 days of All Trading Hours Volume Profile. The Grayed out background is the non-RTH price activity. Hope this his helpful for some ... especially when incorporated with shorter term Volume Profile of the past 1 to several days ... looking at bell curves and more importantly, the High Volume Areas ... and the Low Volume Areas.

The right vertical lighter Blue reflects 20 days of All Trading Hours Volume Profile. The Grayed out background is the non-RTH price activity. Hope this his helpful for some ... especially when incorporated with shorter term Volume Profile of the past 1 to several days ... looking at bell curves and more importantly, the High Volume Areas ... and the Low Volume Areas.

Here's my short term Volume Profile as per Thinkorswim (seems is't always off by a point or two from Bruce's, Lorn's and others ... but close enough to work with).

So, cumulatively, what I've got right now as significant price levels/zones are the following:

1229 area: PASR, Daily Classic R1 and Woodie R1

1215 area: PASR, Daily Demark Pvt, 20day Vol Prof "Low Volume" ... and curiously enough, 2day Vol Prof "High Volume" ... gotta mean something, weighing more heavily on the past 2 trading day's activity.

1203-1199 ZONE: PASR, 1201 both Classic and Woodie Daily Pivots with 1199 Wkly Pvt ... also 2day Low Volume at bottom side of bell curve.

Anyone correct numbers I'm off on here ... especially regarding Volume Provile. Again, hople this helpful as a "MAP" for trading market movement.

So, cumulatively, what I've got right now as significant price levels/zones are the following:

1229 area: PASR, Daily Classic R1 and Woodie R1

1215 area: PASR, Daily Demark Pvt, 20day Vol Prof "Low Volume" ... and curiously enough, 2day Vol Prof "High Volume" ... gotta mean something, weighing more heavily on the past 2 trading day's activity.

1203-1199 ZONE: PASR, 1201 both Classic and Woodie Daily Pivots with 1199 Wkly Pvt ... also 2day Low Volume at bottom side of bell curve.

Anyone correct numbers I'm off on here ... especially regarding Volume Provile. Again, hople this helpful as a "MAP" for trading market movement.

Some congruency with 1229.00. The price needs to move over that if possible tonight. Jump it! The next resistance areas are at 1234, 1244, 1251.

People have 1215 and I have 1216/1214.50 -- looks like that area is very import!!

As always, the market has the last word and in due time will show us the way!

I see for you the same I see for my self: Having the best of luck, fun, and awesome profitable trading day!!!

People have 1215 and I have 1216/1214.50 -- looks like that area is very import!!

As always, the market has the last word and in due time will show us the way!

I see for you the same I see for my self: Having the best of luck, fun, and awesome profitable trading day!!!

Keeps going like this, it will most likely hits 1234 early morning 3:30/4:00 AM

Originally posted by sandoxe

Some congruency with 1229.00. The price needs to move over that if possible tonight. Jump it! The next resistance areas are at 1234, 1244, 1251.

People have 1215 and I have 1216/1214.50 -- looks like that area is very import!!

As always, the market has the last word and in due time will show us the way!

I see for you the same I see for my self: Having the best of luck, fun, and awesome profitable trading day!!!

Keeps probing that 1229 75 resistance. May need to back off a bit and try it again. Overcoming 1229.75 will give us 1234.00. possibly 1247. tomorrow.

Will see how we do here first at 1229.75.

ES now trading 1229.25 04:01 E.T.

Will see how we do here first at 1229.75.

ES now trading 1229.25 04:01 E.T.

Originally posted by sandoxe

Keeps going like this, it will most likely hits 1234 early morning 3:30/4:00 AMOriginally posted by sandoxe

Some congruency with 1229.00. The price needs to move over that if possible tonight. Jump it! The next resistance areas are at 1234, 1244, 1251.

People have 1215 and I have 1216/1214.50 -- looks like that area is very import!!

As always, the market has the last word and in due time will show us the way!

I see for you the same I see for my self: Having the best of luck, fun, and awesome profitable trading day!!!

I see it pulled back to 17.00 LV araea

Yes that 1117 zone is gonna be important. If RTH opens above it then it will be support. If RTH opens below it then resistance.

As you can see on the chart of Friday's trade, we have the LVN in that 1117-1119 plus Friday's 60 min high.

Other LVN's are below Friday's 60min low from 1206.75-1208.50 into Friday's low.

Below that is still that 1203-1204.75 LVN. This makes one imagine if prices in RTH come down to challenge Friday's low there is call for prices to poke on through and see what resides in this zone, especially since a gap exists here too.

The September monthly high is marked on the chart and even though price has traded through it here in the O/N action, it should still be considered heavy resistance in RTH.

As you can see on the chart of Friday's trade, we have the LVN in that 1117-1119 plus Friday's 60 min high.

Other LVN's are below Friday's 60min low from 1206.75-1208.50 into Friday's low.

Below that is still that 1203-1204.75 LVN. This makes one imagine if prices in RTH come down to challenge Friday's low there is call for prices to poke on through and see what resides in this zone, especially since a gap exists here too.

The September monthly high is marked on the chart and even though price has traded through it here in the O/N action, it should still be considered heavy resistance in RTH.

One other thing to watch....the euro. Last week is seemed clear equities were trying to correct but just couldn't get enough volume behind a sustainable move to the downside. If one watched the euro it was clear this hadn't given up the pony to the upside. The two markets are trading very much together these days. Weakness in the euro could be an early sign for equities and the other way around.

Is anyone looking at longer-term charts?

50% of the current year's range is 1224.58 (CASH SPX). price is testing that level from below. First test (from either direction) usually sees rejection (at least temporarily).

action in eurusd has powerful correlation right now. Stronger dollar (eurusd moving down) was exactly in stride with decline in ES in the overnight.

what happens if an LVN like the 1217 area does nothing in terms of stemming the selling? A move to the other side of Vprofile Bell curve from Friday?

-a move through the VPOC at 1211 from Friday?

huh, boy. It's a mess. OpEx week, too.

50% of the current year's range is 1224.58 (CASH SPX). price is testing that level from below. First test (from either direction) usually sees rejection (at least temporarily).

action in eurusd has powerful correlation right now. Stronger dollar (eurusd moving down) was exactly in stride with decline in ES in the overnight.

what happens if an LVN like the 1217 area does nothing in terms of stemming the selling? A move to the other side of Vprofile Bell curve from Friday?

-a move through the VPOC at 1211 from Friday?

huh, boy. It's a mess. OpEx week, too.

BTW, Lorn.

none of your comments had been published when I tagged the reply to the thread button and started writing.

I am so happy that I have something to look forward to today. A dentist appointment at 1pm. I will ask for no novacaine. it will be a blessing compared to trying to make sense out of this mess.

none of your comments had been published when I tagged the reply to the thread button and started writing.

I am so happy that I have something to look forward to today. A dentist appointment at 1pm. I will ask for no novacaine. it will be a blessing compared to trying to make sense out of this mess.

here is a link to Daltons Blog.

http://jamesdaltontrading.com/blog/

loads of good reading for those who haven't found it yet. He's an MP purist. Fridays post shows why the current overnight session has peak volume at the 23.75 - 24 area. That is the area that I believe the world will be watching as it represents a possible breakout point of a longer term bracket extreme !!

The afternoon pullback low on Friday was 1213.50 so that is critical as is the high volume of 1311 - 1310.50...that was a key area that we were watcing that turned into support on Friday.

Lots of volume in that entire area of 10.50 - 13.50...not my favorite place to initiate.

Perhaps Lorn with the super charts can post the volume profile above that 24.75 even if the volume is spotty as it wasn't the active contract at that time. I had the 30.50 and 31 area from a bell curve perspective and it is R1 as previously mentioned...Now it is the overnight high.

Once again the overnight is confirming day session numbers/area.

Preferred buys if we open below that 17.75 low volume is just under 13.75 as we have peak volume to slow price below. Prefereed sells will be just above 23.75 in the day session. opening above the 17.75 then we will try and buy that as Lorn already mentioned. I hope all have a great day.

http://jamesdaltontrading.com/blog/

loads of good reading for those who haven't found it yet. He's an MP purist. Fridays post shows why the current overnight session has peak volume at the 23.75 - 24 area. That is the area that I believe the world will be watching as it represents a possible breakout point of a longer term bracket extreme !!

The afternoon pullback low on Friday was 1213.50 so that is critical as is the high volume of 1311 - 1310.50...that was a key area that we were watcing that turned into support on Friday.

Lots of volume in that entire area of 10.50 - 13.50...not my favorite place to initiate.

Perhaps Lorn with the super charts can post the volume profile above that 24.75 even if the volume is spotty as it wasn't the active contract at that time. I had the 30.50 and 31 area from a bell curve perspective and it is R1 as previously mentioned...Now it is the overnight high.

Once again the overnight is confirming day session numbers/area.

Preferred buys if we open below that 17.75 low volume is just under 13.75 as we have peak volume to slow price below. Prefereed sells will be just above 23.75 in the day session. opening above the 17.75 then we will try and buy that as Lorn already mentioned. I hope all have a great day.

it really cool that when we come back down or go up you can go to that day on the forum and look back a see what was going on that day

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.