ES Wed 9-14-11

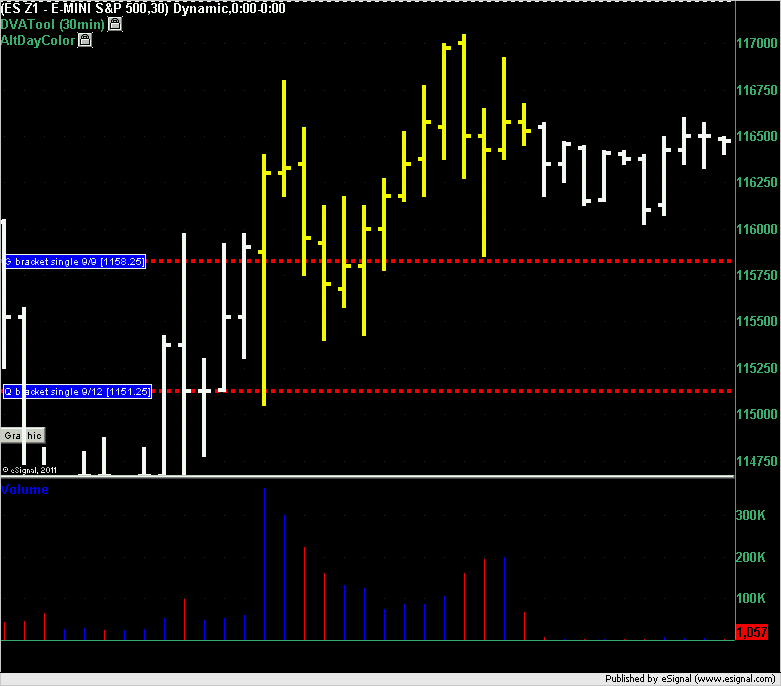

Yesterday's trading topic mentioned the single pritn of 1151.25 as the long signal from single prints if we were to trade down to it:

http://www.mypivots.com/board/topic/6953/-1/es-tue-9-13-11

Well shortly after the open we traded to the low of the day at 1150.50 triggering that long with 0.75 point draw down on the trade. The high of the day was 1170.50 so the best possible run-up/profit on that trade was 19.25 points.

The other red dotted line that you see on the chart at 1158.25 was a short signal for single prints created on 9/9 but because we opened above it it was untradable and considered filled in.

The other single prints that I have on my radar are 1205.75 from 9/1 in L bracket (short) and a long at 1125.25 from 8/23. Neither of which are very close at the moment so unlikely that there will be a single print trade today (Wednesday).

http://www.mypivots.com/board/topic/6953/-1/es-tue-9-13-11

Well shortly after the open we traded to the low of the day at 1150.50 triggering that long with 0.75 point draw down on the trade. The high of the day was 1170.50 so the best possible run-up/profit on that trade was 19.25 points.

The other red dotted line that you see on the chart at 1158.25 was a short signal for single prints created on 9/9 but because we opened above it it was untradable and considered filled in.

The other single prints that I have on my radar are 1205.75 from 9/1 in L bracket (short) and a long at 1125.25 from 8/23. Neither of which are very close at the moment so unlikely that there will be a single print trade today (Wednesday).

Reuters:

U.S. stocks zig-zagged, turning higher in a choppy session on Wednesday as investors reacted to a barrage of headlines from Europe, including proposals for joint euro zone bonds and an Austrian parliamentary committee's failure to pass changes to a bailout fund.

U.S. stocks zig-zagged, turning higher in a choppy session on Wednesday as investors reacted to a barrage of headlines from Europe, including proposals for joint euro zone bonds and an Austrian parliamentary committee's failure to pass changes to a bailout fund.

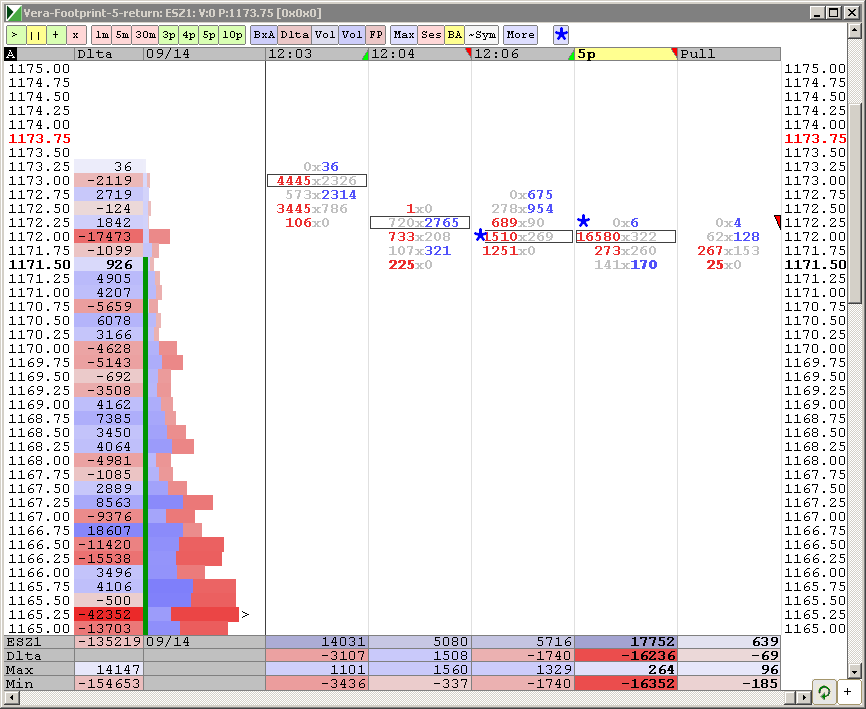

sorry for the delay....I just stopped in from outside from building my shed...a lunch break.....thanks for the support all....Nick I took the retrace back to the open ...I don't like the breakout from the opening range so I sold after I saw the buying dry up after we retested that open print...

let me know if anyone doesn't know what market profile traders will do on the opening range trade when we open outside of the previous days range....I will reply later as I am no longer trading today....

If I was trading I'd probab;y be thinking about another 1166 retest as that is low volume now!!

let me know if anyone doesn't know what market profile traders will do on the opening range trade when we open outside of the previous days range....I will reply later as I am no longer trading today....

If I was trading I'd probab;y be thinking about another 1166 retest as that is low volume now!!

Originally posted by NickP

what was your initial short Bruce ? thanks as always and great trading !

1173 key level, 1080.50 above and a target(38% 1362-1068)

1170.50 and 1166.50 below S levels here.

1172 the level to break hold as it could be the top of this wave

1170.50 and 1166.50 below S levels here.

1172 the level to break hold as it could be the top of this wave

i am not familiar with what mp traders do when we open outside of the previous days range...

Originally posted by BruceM

sorry for the delay....I just stopped in from outside from building my shed...a lunch break.....thanks for the support all....Nick I took the retrace back to the open ...I don't like the breakout from the opening range so I sold after I saw the buying dry up after we retested that open print...

let me know if anyone doesn't know what market profile traders will do on the opening range trade when we open outside of the previous days range....I will reply later as I am no longer trading today....

If I was trading I'd probab;y be thinking about another 1166 retest as that is low volume now!!

Originally posted by NickP

what was your initial short Bruce ? thanks as always and great trading !

DJI above, 11150 the 50% level, currently.

11179 the level to break,11150 the level to hold,11164.5 the mean(tested once already). 11210 and 11270 above both if it comes to that

fwiw I'm wary here,congested area of indicators with negative divergence,but hey, it is what it is til it isn't

ES 1172 and DJI 11150

11174 current hourly s/r level

11179 the level to break,11150 the level to hold,11164.5 the mean(tested once already). 11210 and 11270 above both if it comes to that

fwiw I'm wary here,congested area of indicators with negative divergence,but hey, it is what it is til it isn't

ES 1172 and DJI 11150

11174 current hourly s/r level

1180.50 retest from below broke and 1184.75 next R level to me.

1195,1198,1205, and 1215 above if it breaks and holds.

1195,1198,1205, and 1215 above if it breaks and holds.

well, well, well...this here is the only resitance i have up here at 86.50 - 87.50 as mentioned in todays early trade....obvious trending and two sets of singles with the closest air at 82.25.....the signal needs to be real good to fade up here

in other words, I'd be real selective about shorting into this...make sure it rocks...otherwise they will try to run out those folks that want to see the 92 - 93 area and soon...

good luck...I'm getting back outside

in other words, I'd be real selective about shorting into this...make sure it rocks...otherwise they will try to run out those folks that want to see the 92 - 93 area and soon...

good luck...I'm getting back outside

sorry

1180 and 1197.5 corrections to previous post

typing fast not my strong point

have a good night

1180 and 1197.5 corrections to previous post

typing fast not my strong point

have a good night

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.