ES Thu 9-8-11

Today is rollover day so adjust your trading platforms and charts to trade the December 2011 contract from today going forward.

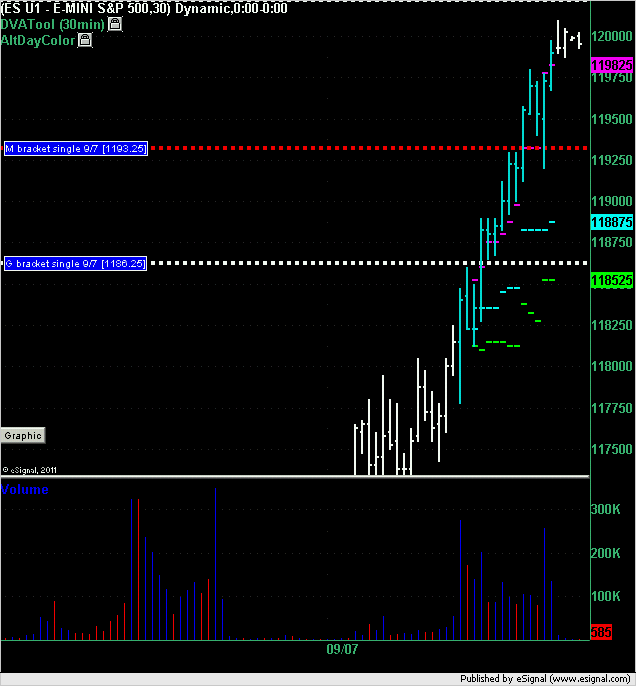

Market Profile Single prints from Wednesday in the September contract.

The market created 2 single prints on Wednesday. The second single print filled in a triggered a long at 1193.25 which had a 1.25 point draw down to 1192 even and then a best run up of 6.5 points to the high of the day of 1199.75. The following chart shows the single prints from Wednesday for the September contract.

In trading today (Thursday) there will be singles left from Wednesday at different price points because you will be trading the December contract.

Market Profile Single prints from Wednesday in the September contract.

The market created 2 single prints on Wednesday. The second single print filled in a triggered a long at 1193.25 which had a 1.25 point draw down to 1192 even and then a best run up of 6.5 points to the high of the day of 1199.75. The following chart shows the single prints from Wednesday for the September contract.

In trading today (Thursday) there will be singles left from Wednesday at different price points because you will be trading the December contract.

Not looking too good for the home team.

1183 is the 50% retrace of that last wave down(1229-1136)

below I have 76,73 and 71 areas. 1148 all I'll mention below as it's the key level between 1098 and 1198.

Above I have 84.50 and 91.25 as levels to break and hold for higher.

1183 is the 50% retrace of that last wave down(1229-1136)

below I have 76,73 and 71 areas. 1148 all I'll mention below as it's the key level between 1098 and 1198.

Above I have 84.50 and 91.25 as levels to break and hold for higher.

Nice! Thanks for the response. I think I got the basics and appreciate the time. Didn't mean to get you to write so much in rth and should have stated so in my post.

Anytime you want if you got more.

Anytime you want if you got more.

Originally posted by CharterJoe

I don't know what you call it, I'll post more later. basically no counter trend trades other than early morning. Look at the open this am 3 HH and 3 LL back to the open or when it books 3 LL's on the 5min. Short the first LL as its an imbalance and will most likely trade back to the open print. Rest of day look for H3 or better and take the first H1 after a pull back or the first L1 after a L3 or better all trades should be above ema for long and below for short, also best if above open print for longs and below for shorts. Same principle on the longer TF best if they all line up.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.