ES Tue 9-6-11

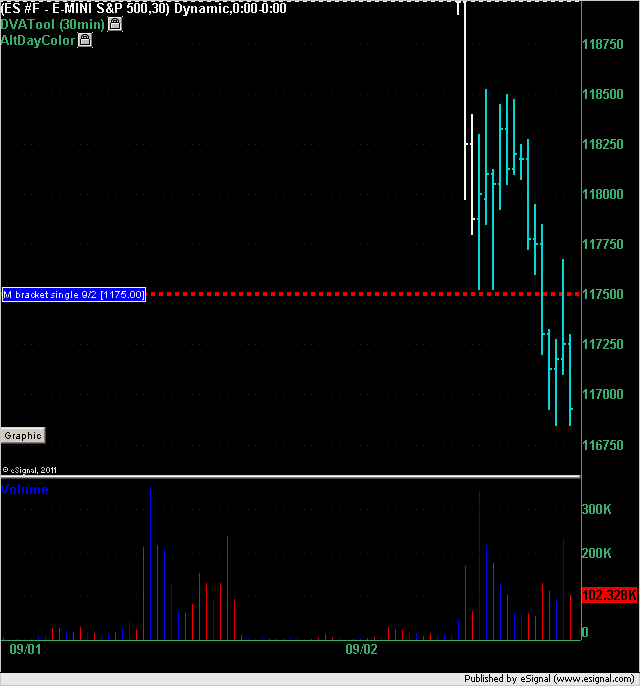

The chart below is from Friday's trading session. The market created a single print in the M bracket at 1175 even and then triggered a short in the last 45 minutes of the day at that price. The market rose to 1176.75 for 1.75 point draw down and then ran up to a best possible profit of 8.25 points at the low of the day 1168.50.

Anybody not trading that single print could be forgiven because it was so late into the day going into the Labor Day holiday weekend.

Anybody not trading that single print could be forgiven because it was so late into the day going into the Labor Day holiday weekend.

Yeah, those EU moves this morning were intense, as with Gold.

Nice retracement trade from 38 though....20 points.....

Nice retracement trade from 38 though....20 points.....

Every time, I doubt Mark Fisher system, i get proven wrong. market internals weak, Germany GDP numbers bad etc.. it did not matter. Once A up was confirmed at 1148 for /ES on Monday, trade was to go long in 1145-1148 area.

http://screencast.com/t/4p7VdqblrJ4

http://screencast.com/t/4p7VdqblrJ4

Which is why I don't watch the news just aware when its coming out during RTH. I'm not fast/smart enough to digest whats important and whats not. I just watch price action Can't tell you how many times I have argued with the other side that a loss of 100k jobs is still bad even though they were expecting a loss of 117k loss. There are rare times though when it helps but I'll just watch the PA

thx for the chart. Would you mind explaining a little better for me, it looks like you use the first 20min as the open range a 3 points above/below is the trigger.

Hi charter Joe,

You are correct. I use 20 minutes with 10 minutes as a FILTER for confirmation. One has to find the time period for OR one is comfortable with.

Most important thing about ACD system is to trade the instrument which is most VOLATILE on the day a trader is trading. Since system works on any instrument, traders who try to use ACD for same instrument day in - day out, get disappointed.

You are correct. I use 20 minutes with 10 minutes as a FILTER for confirmation. One has to find the time period for OR one is comfortable with.

Most important thing about ACD system is to trade the instrument which is most VOLATILE on the day a trader is trading. Since system works on any instrument, traders who try to use ACD for same instrument day in - day out, get disappointed.

There is ALWAYS something going off the hinges with Forex. Nat gas and heating oil (in the fall, never know why guess traders get cold and go buy HO) works well with my OR system fwiw I use a tiny 3min OR works good to get warmed up for the US session.

Originally posted by destiny

Thanks prestwickdrive for sharing. After reading your post, i looked into kool blue posts to get an understanding of these tools. Following is a note from one of kool blue posts. Looks like he is a scalper. My question to you is " Are you a scalper? or you use kool tolls to get maximum gains out of projected price levels".

" Predicting a turning point is frankly, not that difficult, but knowing if that turn will be 5 ticks or 500 is. That's why I'm a scalper . All I really care about is the next few minutes. Any way remember I commented on the cycles thread that I knew by around 10:15 that the market 'wanted' 984? Here's how that came about. Remember, the theory is that every initial move times 1.618 and added to the end of that initial thrust gives the point at which it will run out of gas so to speak."

Sorry for the delay in responding. I have been on the road and just saw your question. I scalp also and use the KT projectons as an aid for trade placement. If I could master better stop discipline I believe I could generate more trading profits by believing the KT projections and riding them for much more than a scalp. Perhaps someday ... :-)

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.