slate pile 6941

warning.. there is no holy grail... all trade setups have failures..

'' before you add a setup to your trading, know that setup so well that you will be willing to risk your family's financial well being on that setup alone to the exclusion of all others..short of that... don't trade it'' joed

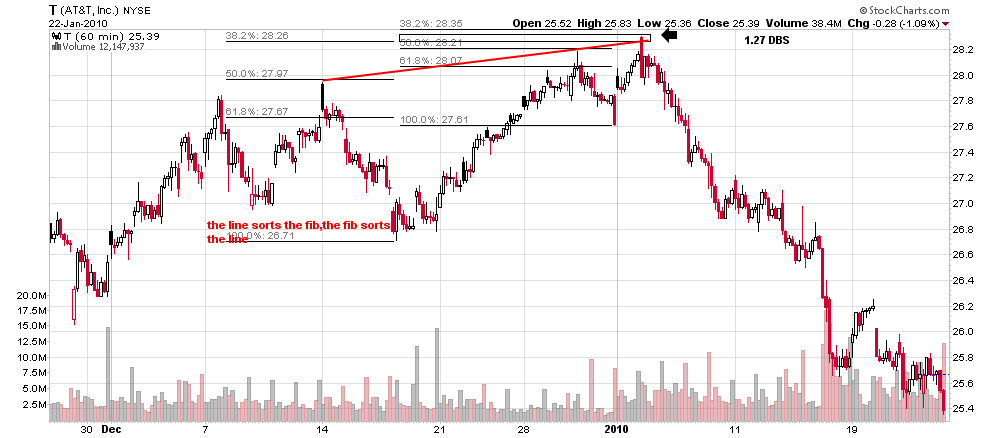

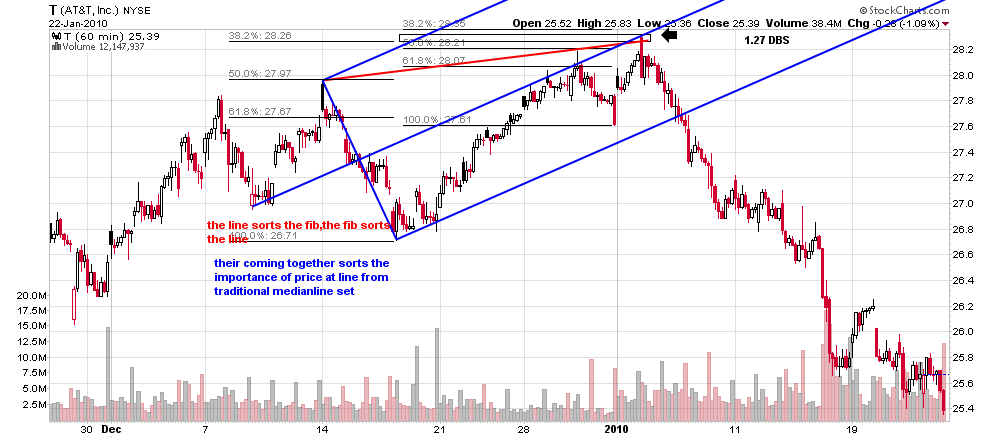

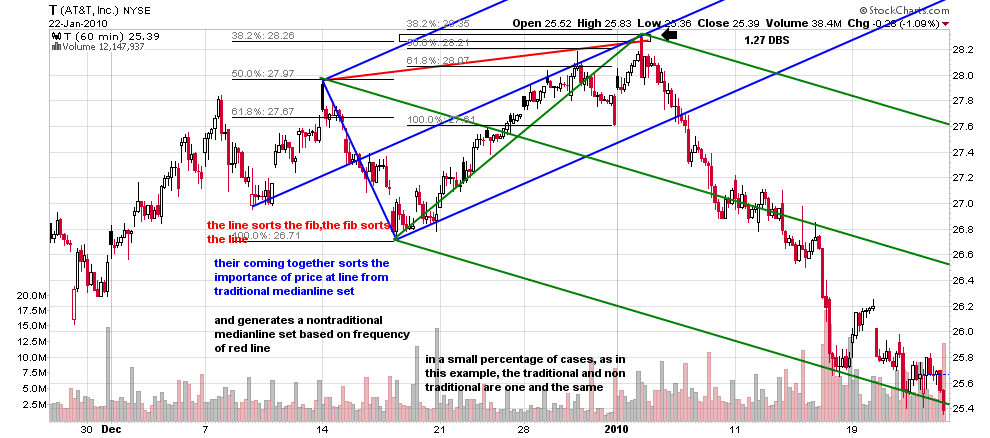

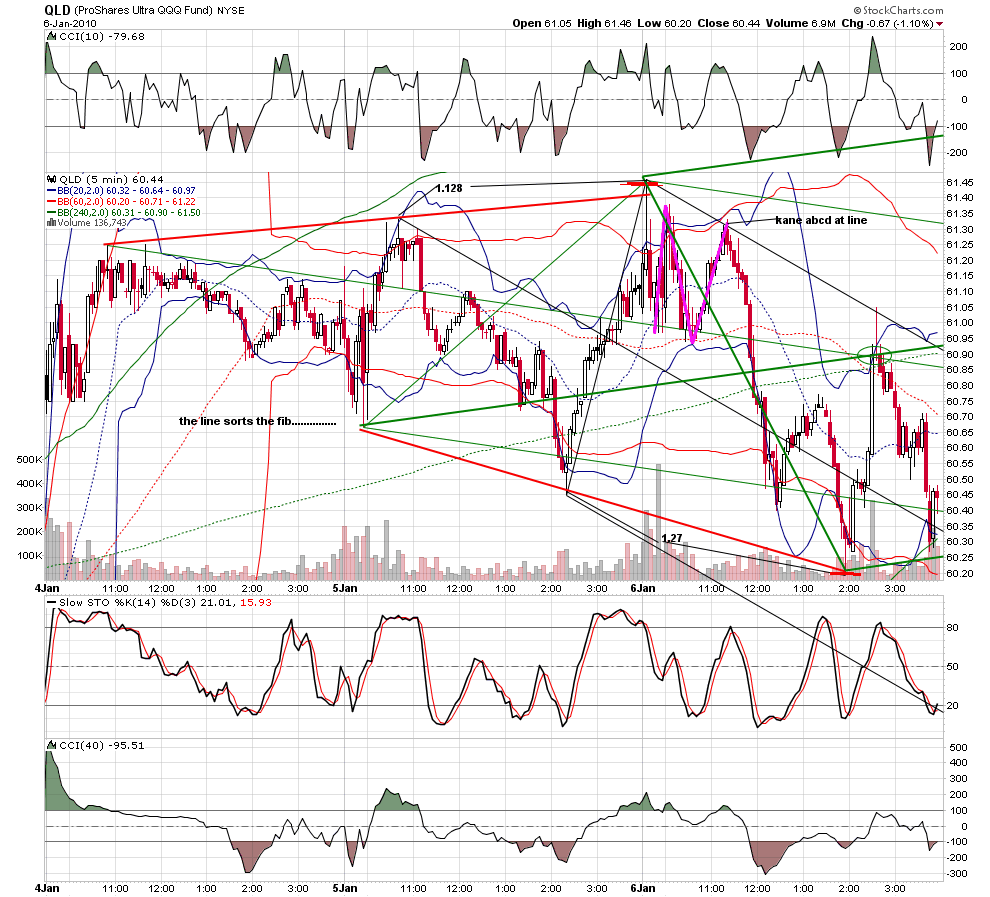

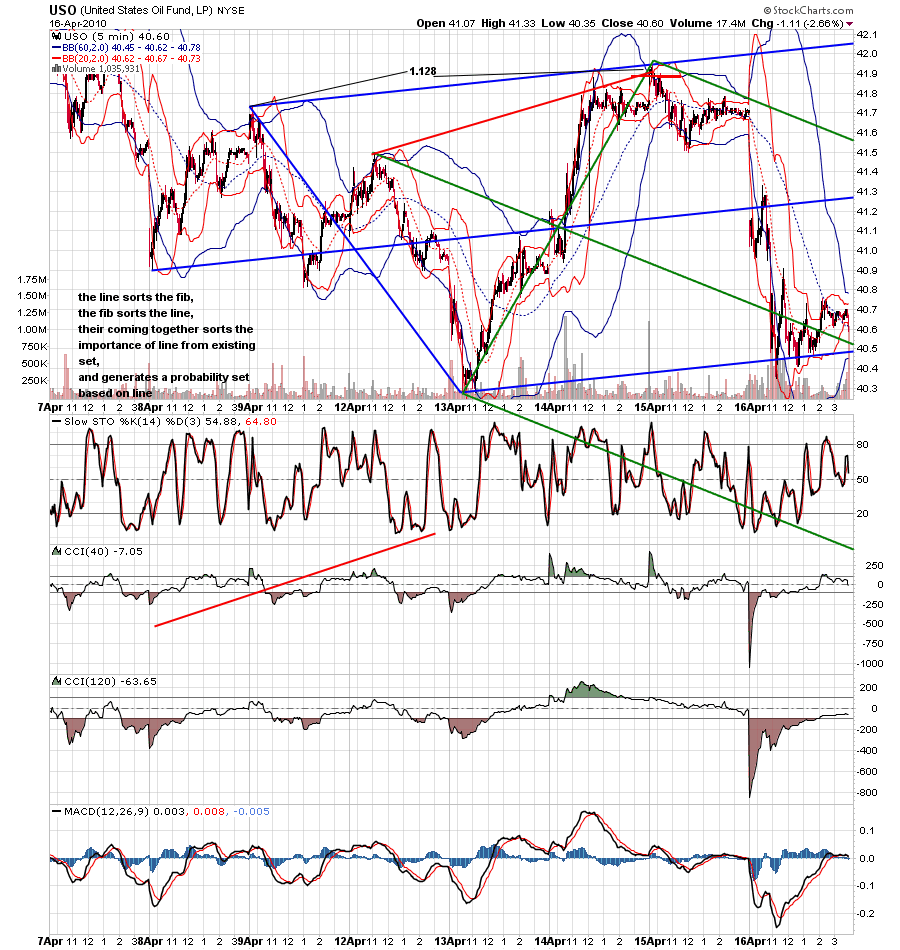

trading this setup requires 4 things .. a mastery of medianlines, a mastery of fib, a setup that allows you to do a constant scan of a set group of traders...then collecting at least 1000 examples of the setup you have found on your own...thus making it your own.

the setup is the [email protected] have been showing it relentlessly at the kane forum for the last 4.5 years.

'' before you add a setup to your trading, know that setup so well that you will be willing to risk your family's financial well being on that setup alone to the exclusion of all others..short of that... don't trade it'' joed

trading this setup requires 4 things .. a mastery of medianlines, a mastery of fib, a setup that allows you to do a constant scan of a set group of traders...then collecting at least 1000 examples of the setup you have found on your own...thus making it your own.

the setup is the [email protected] have been showing it relentlessly at the kane forum for the last 4.5 years.

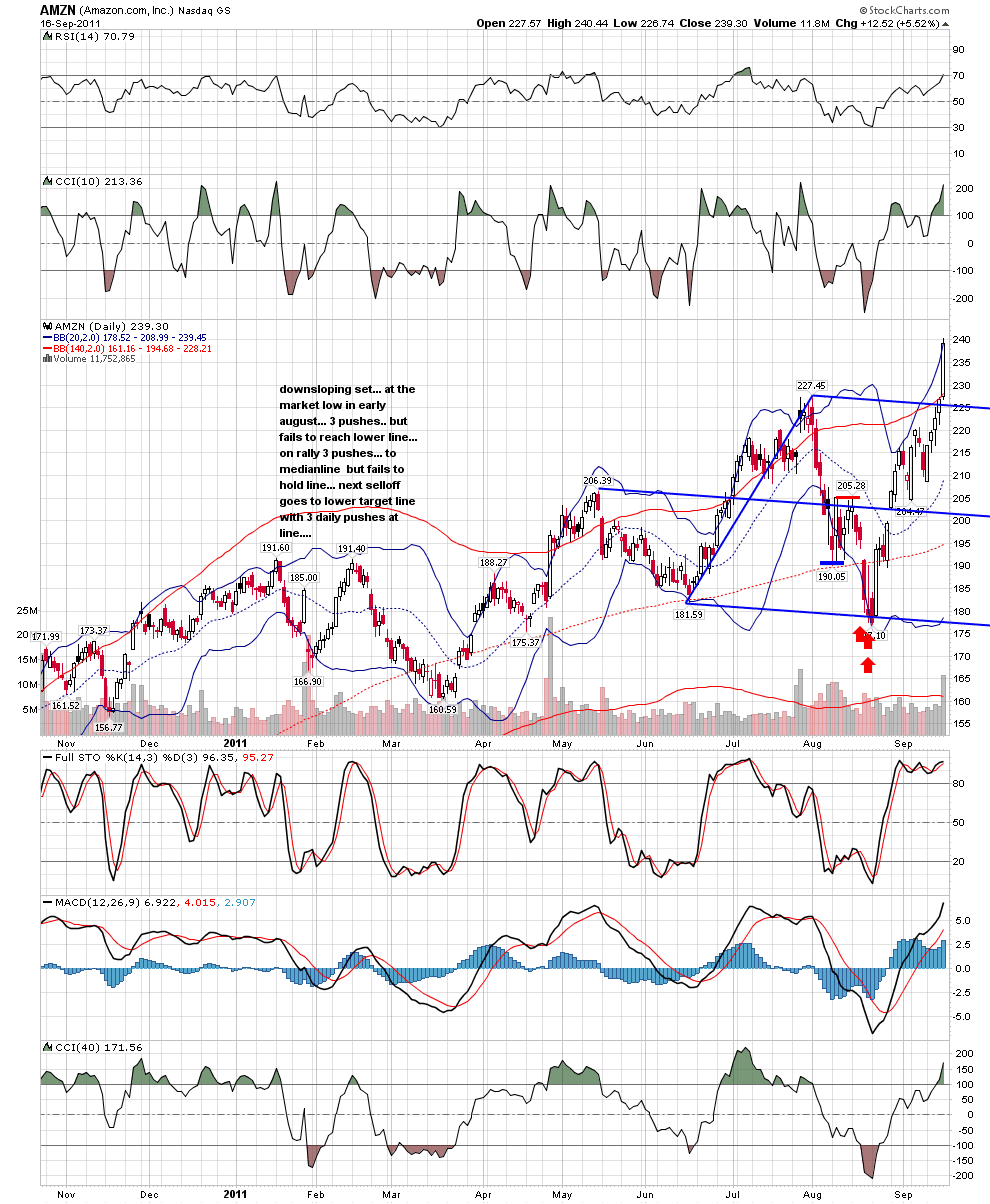

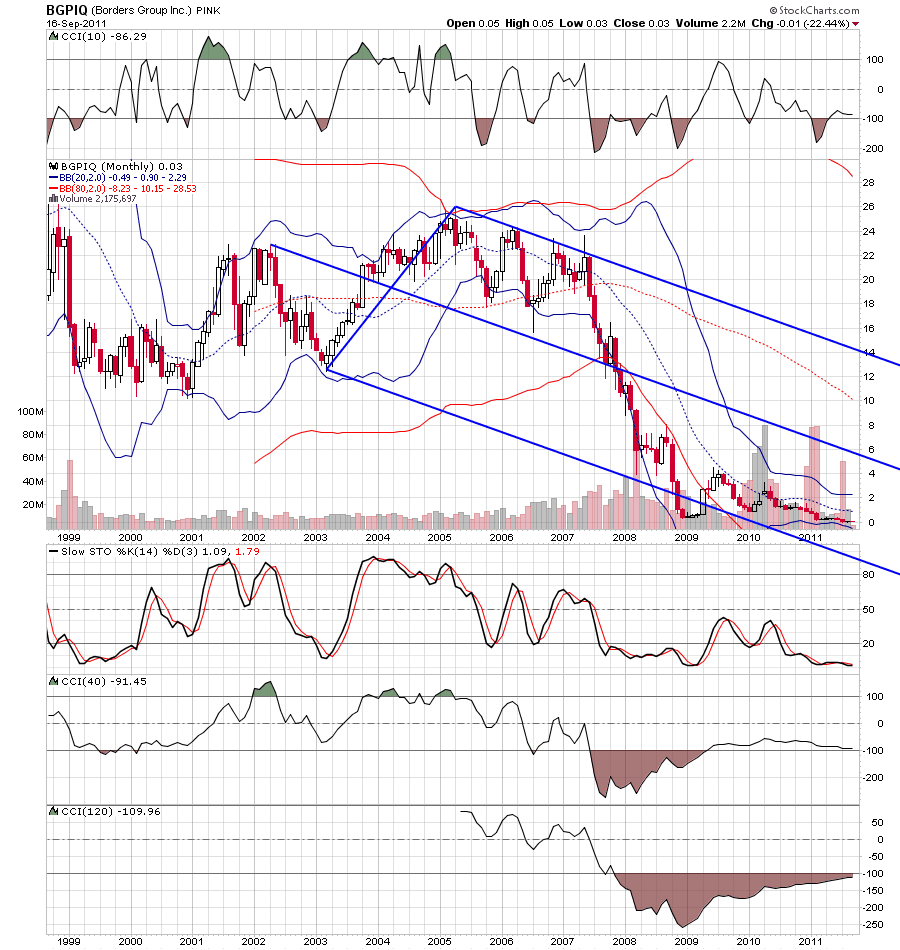

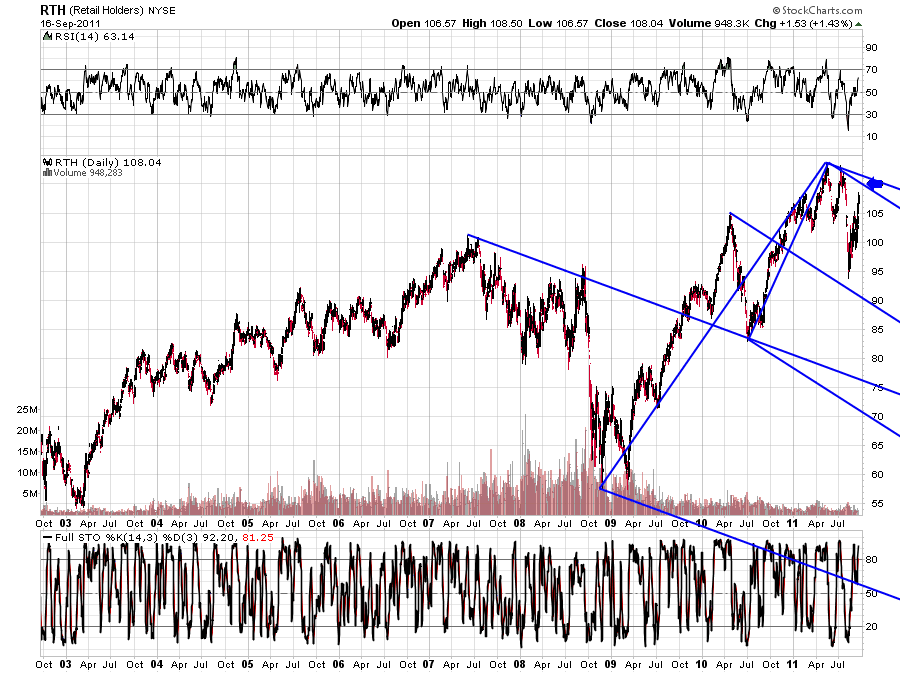

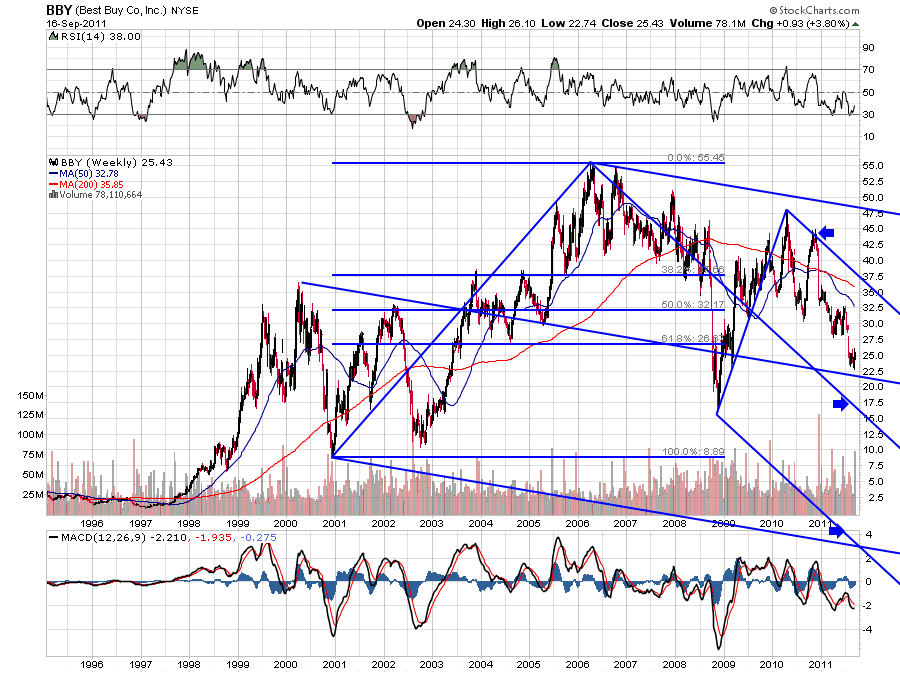

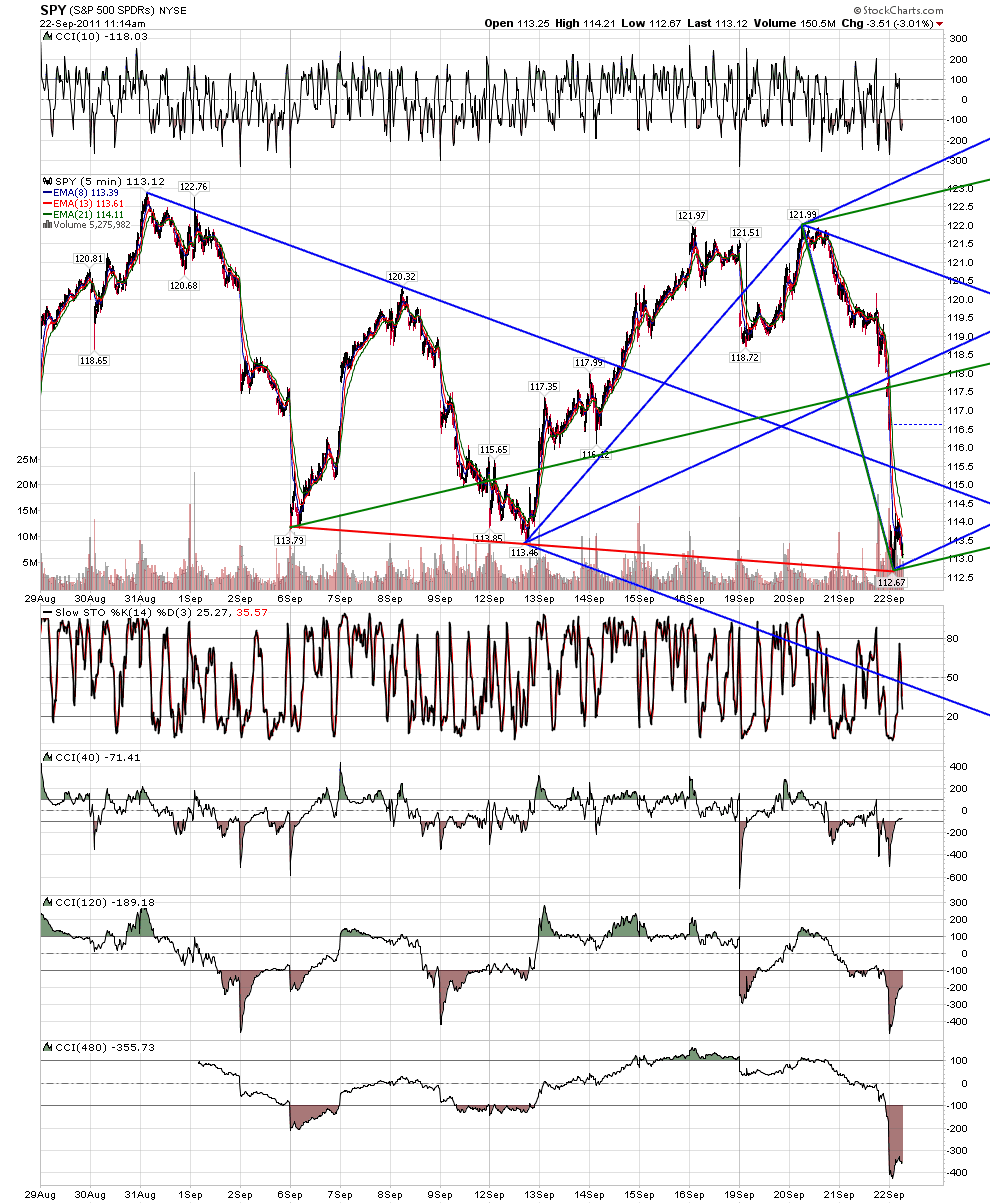

more slate on the pile... in the end, this is no big deal... just reporting on the game being played by the computers....

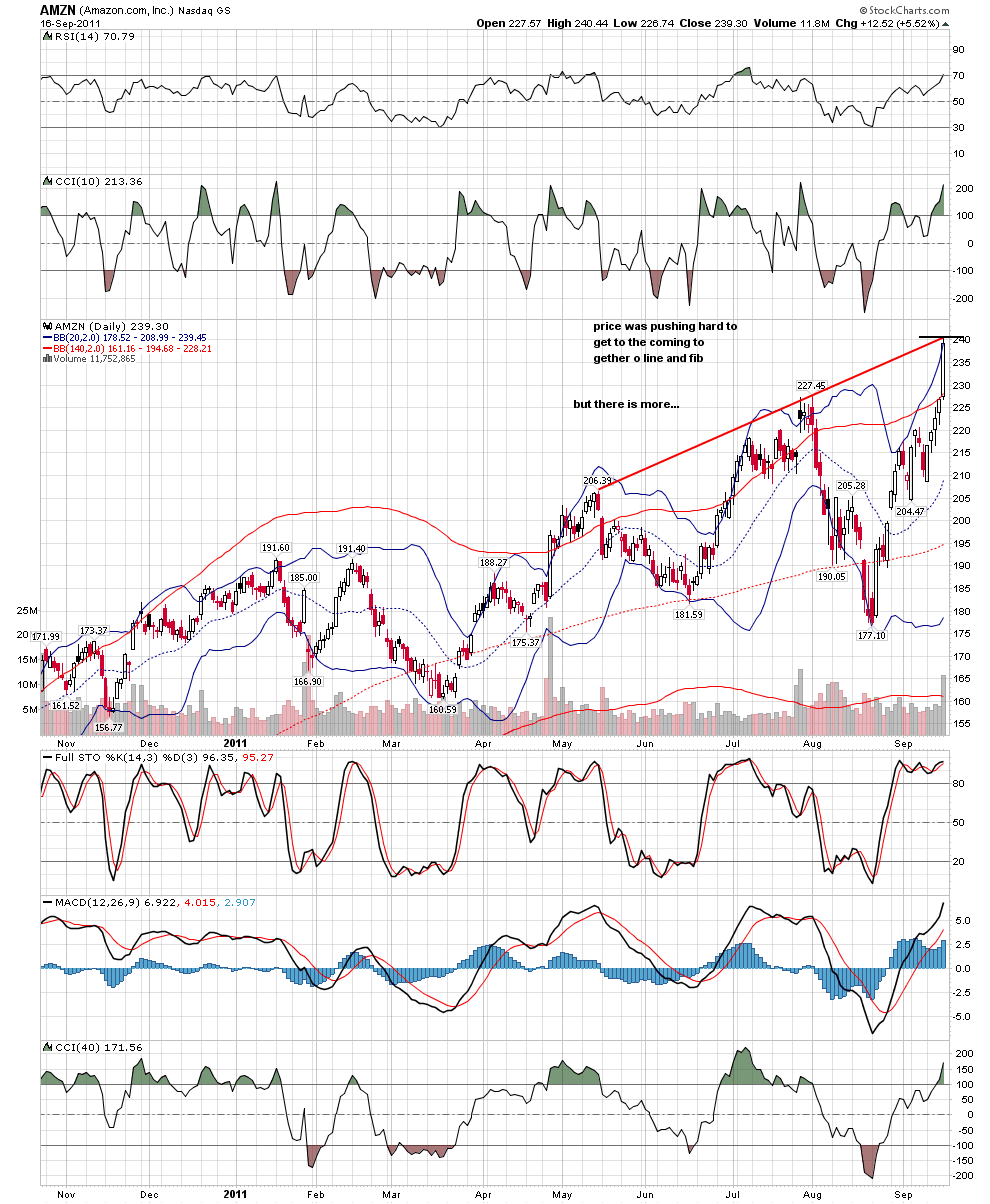

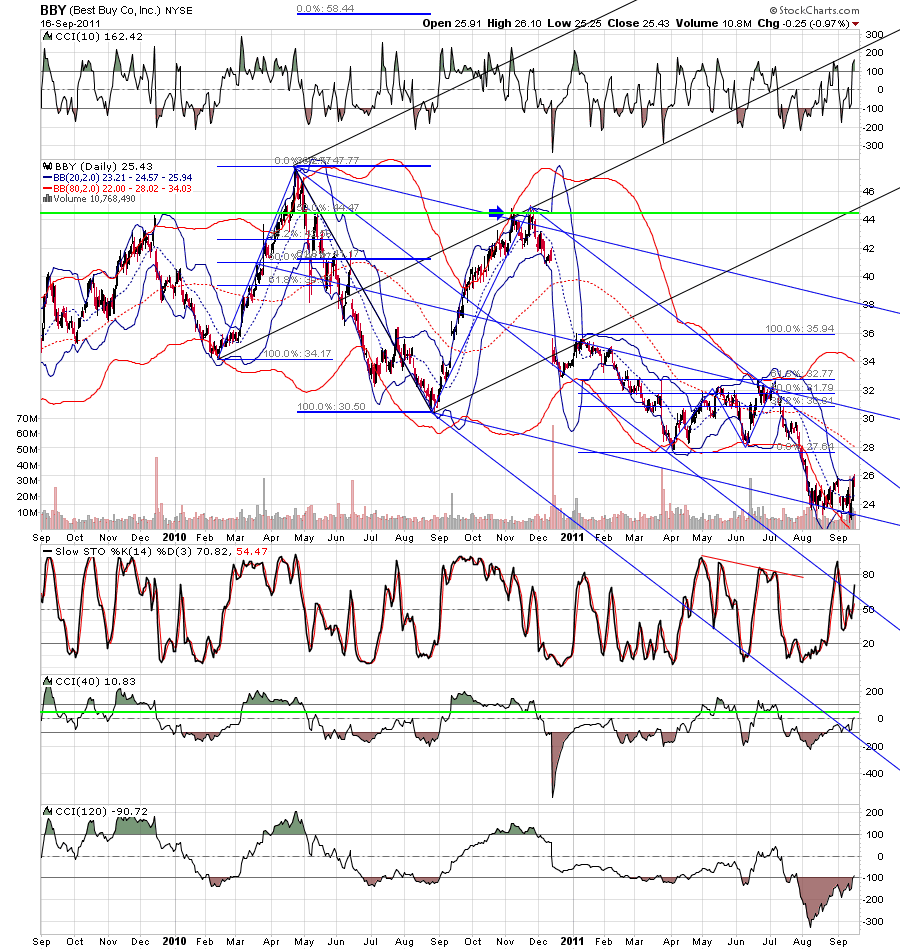

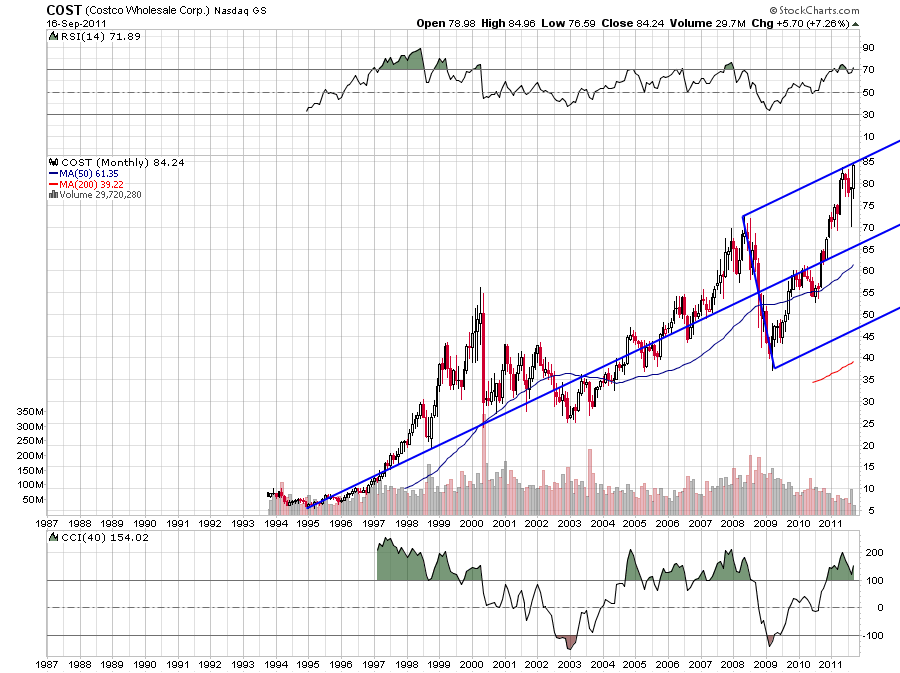

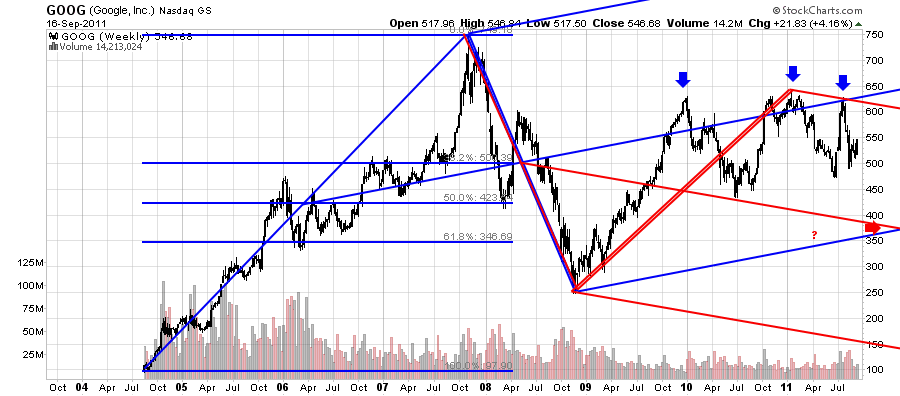

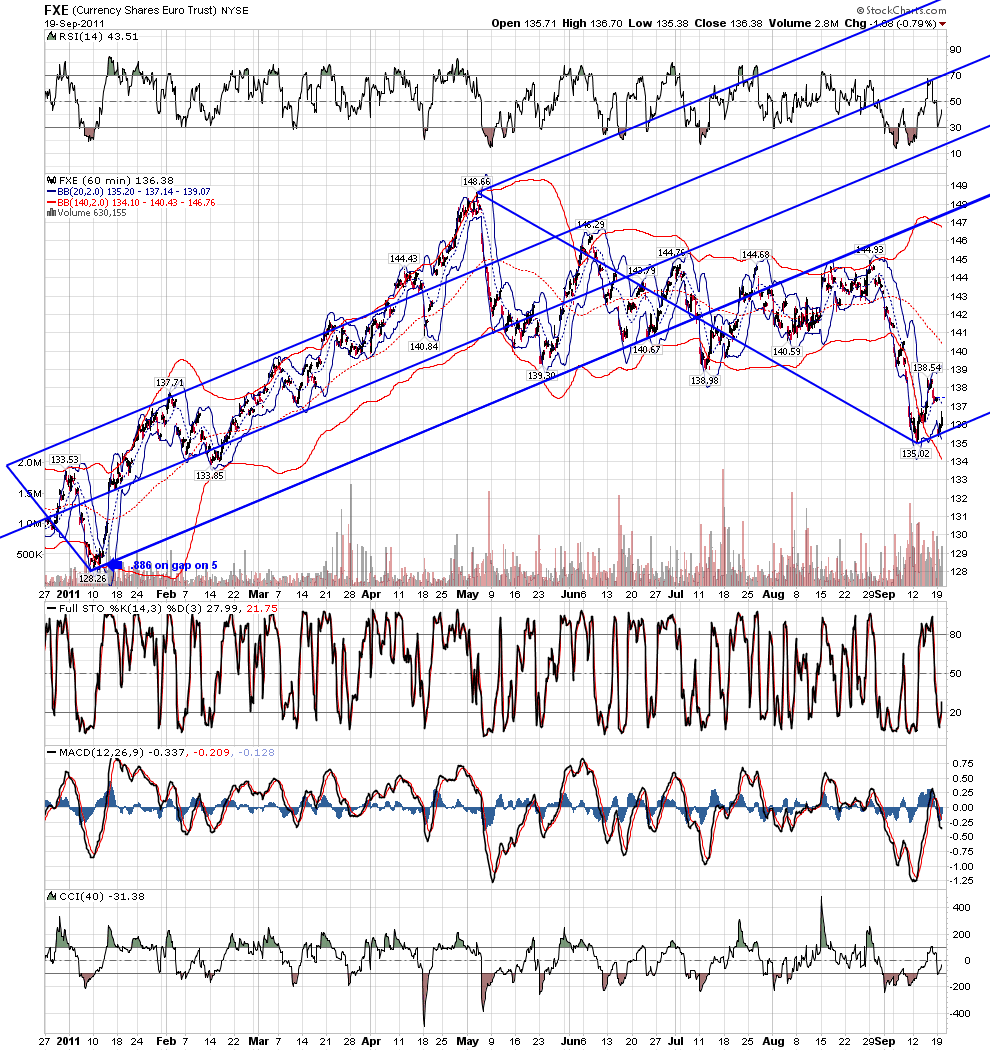

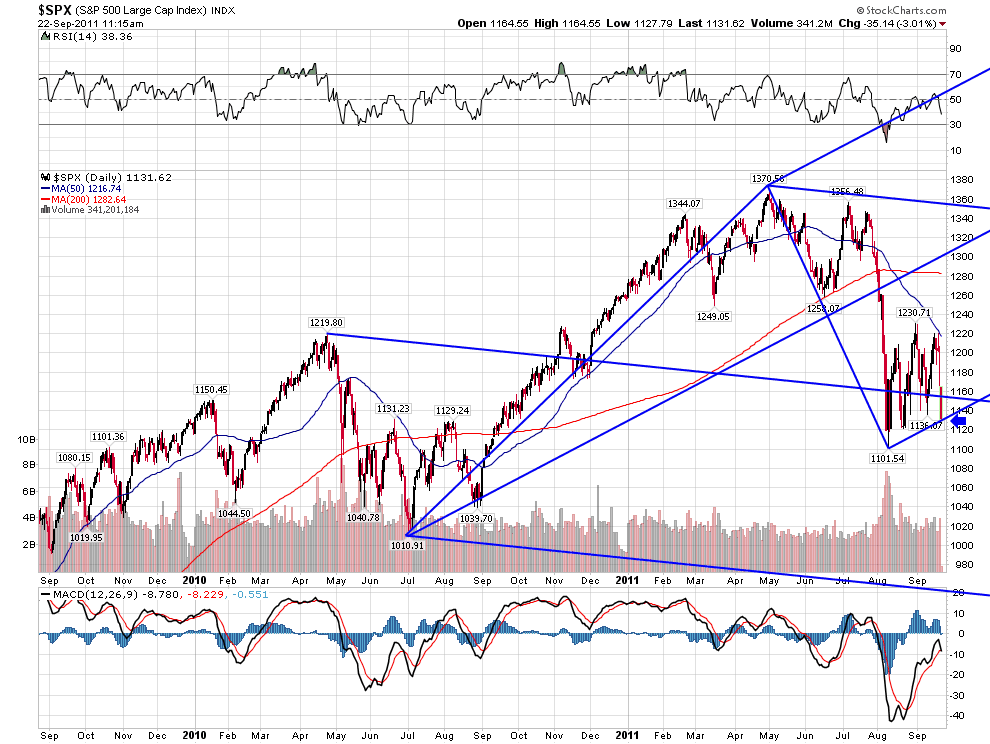

longer term charts

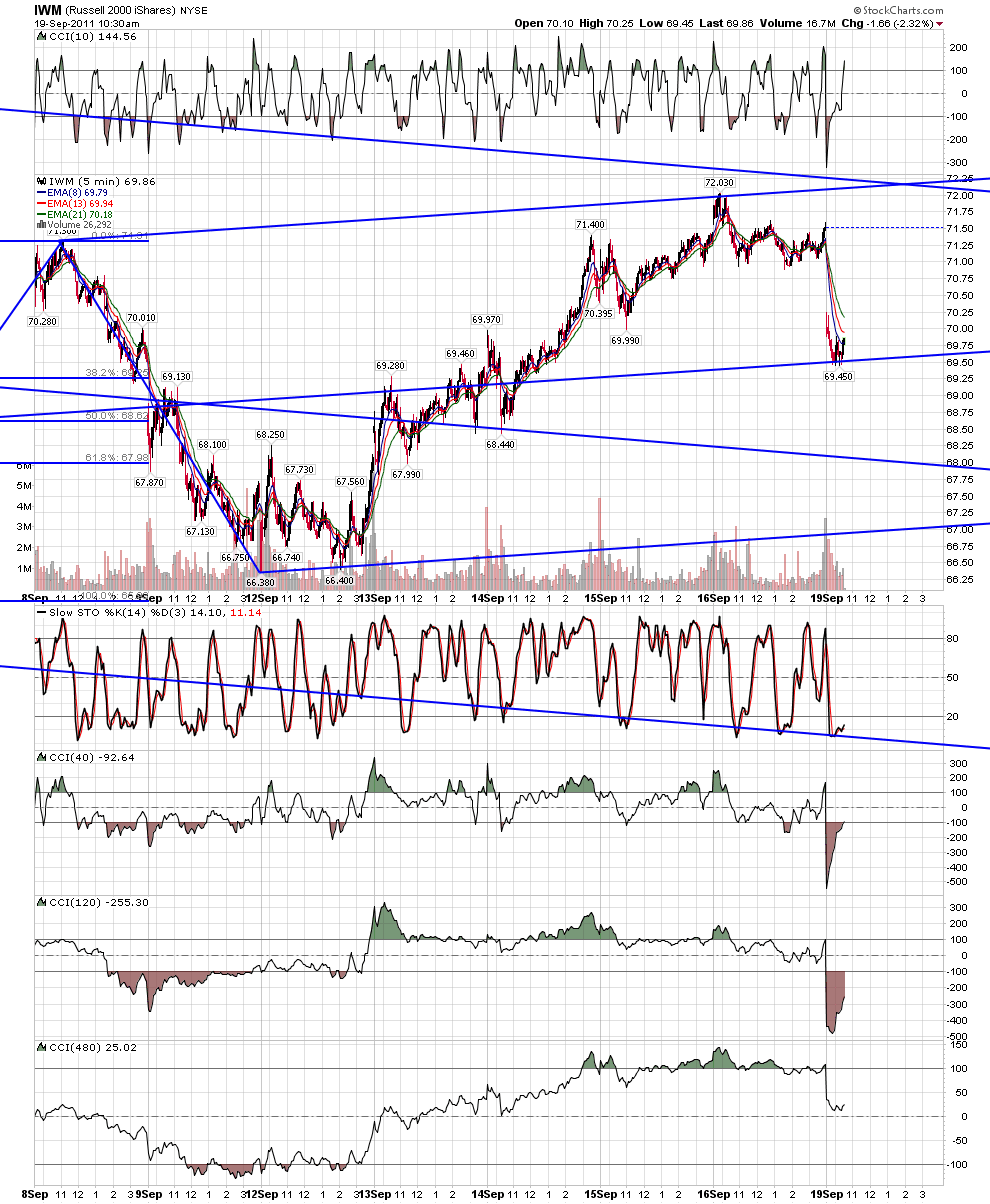

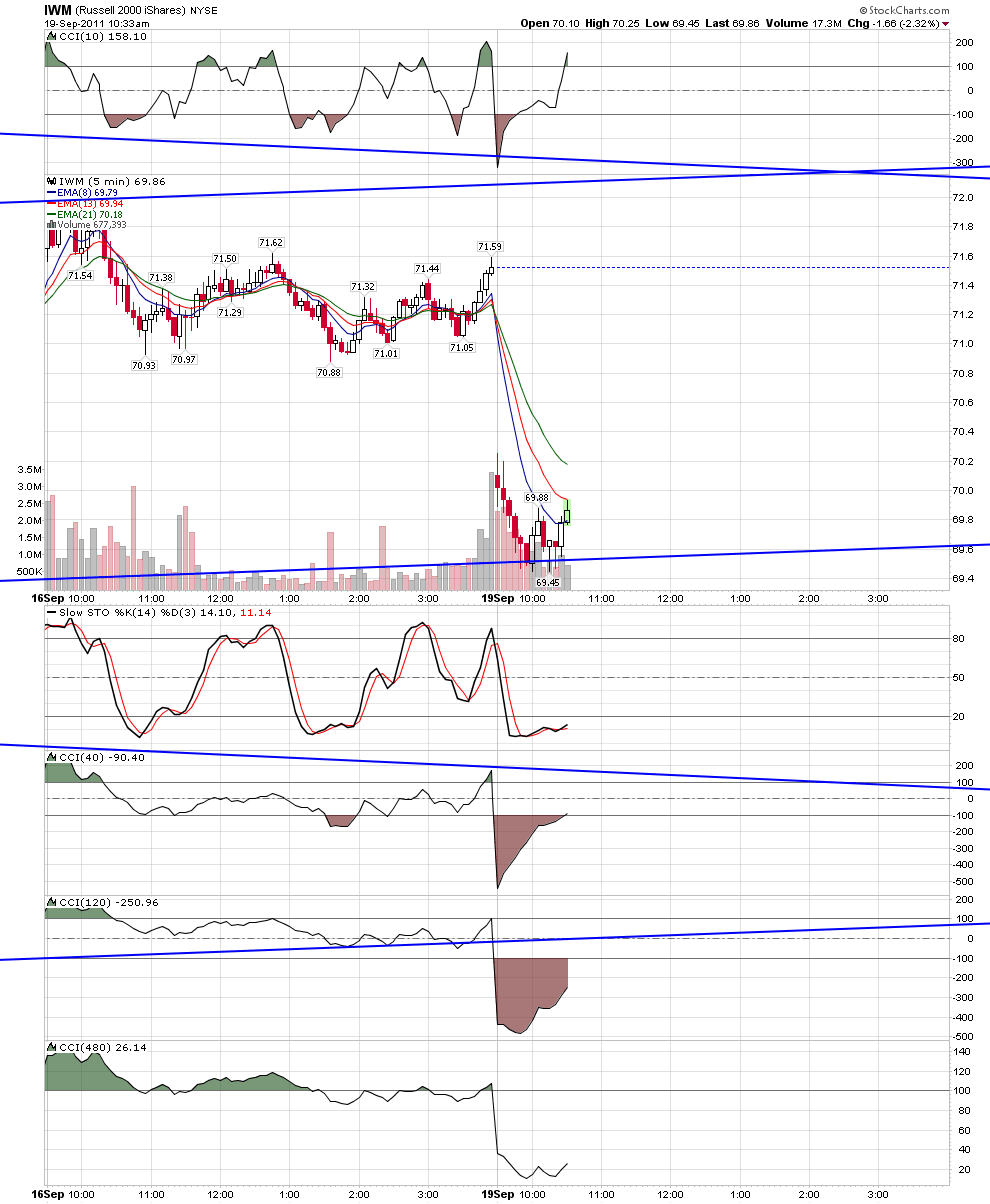

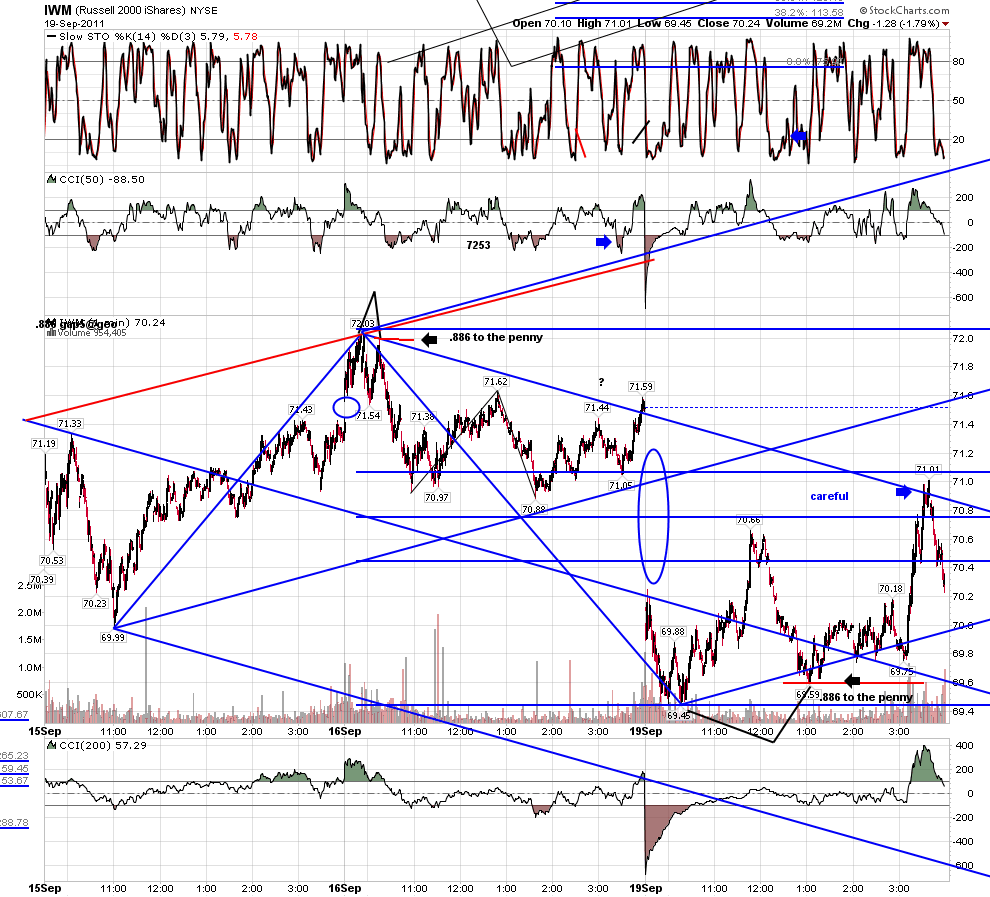

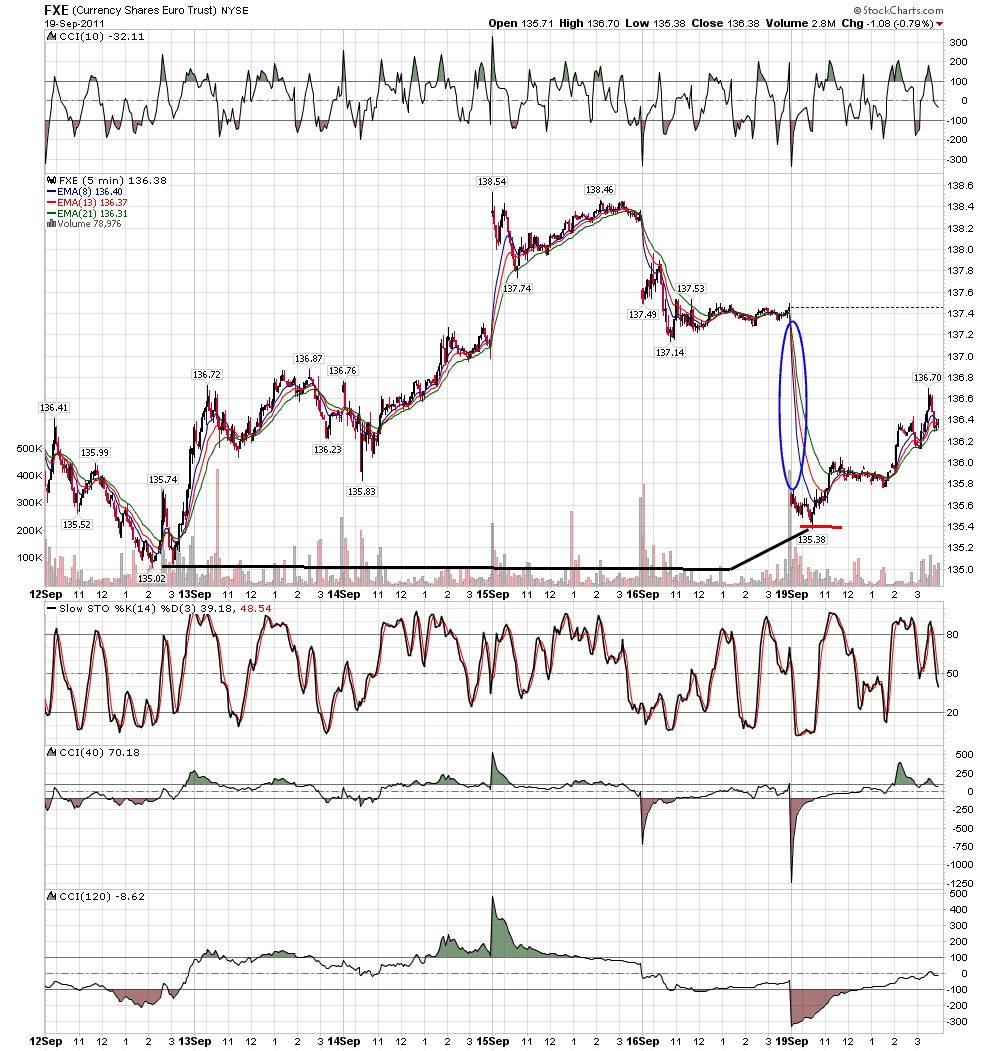

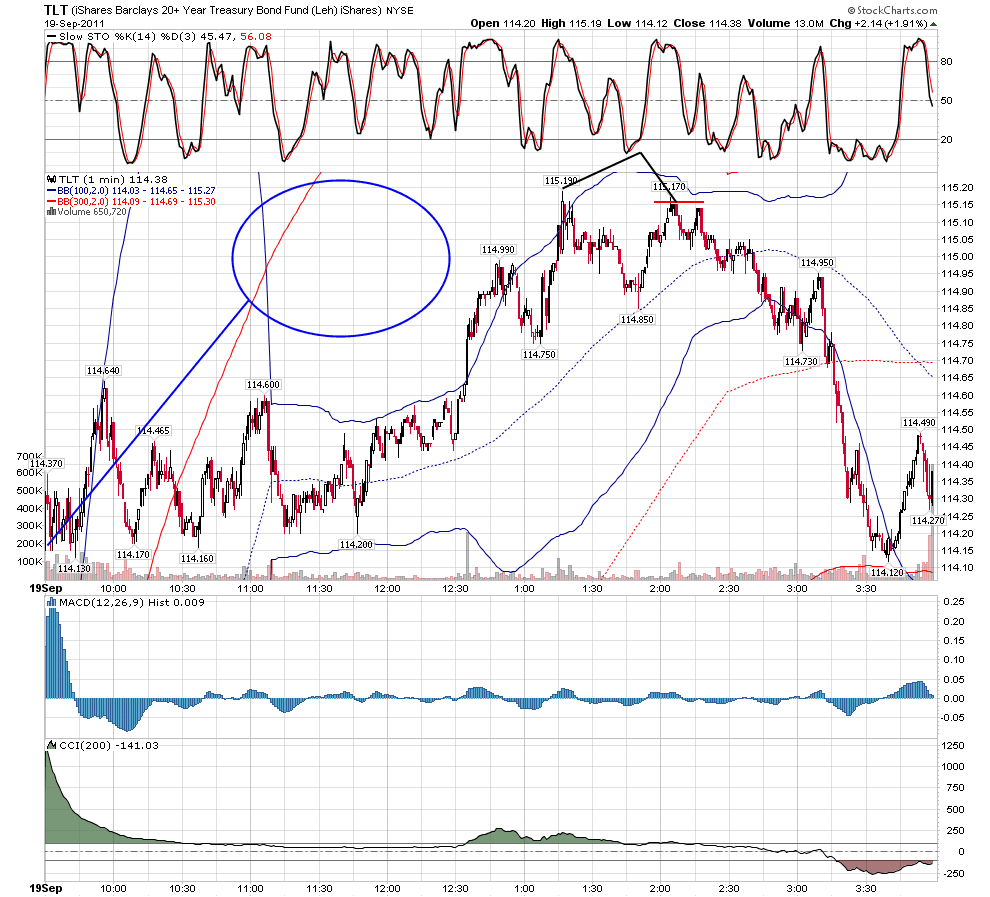

last call.even after all these years, the algo remains the go to algo for the computers.... today was just another day in algo land...IWM, SLV, TLT,FXE..... in all of them, it was the algo that turned price..

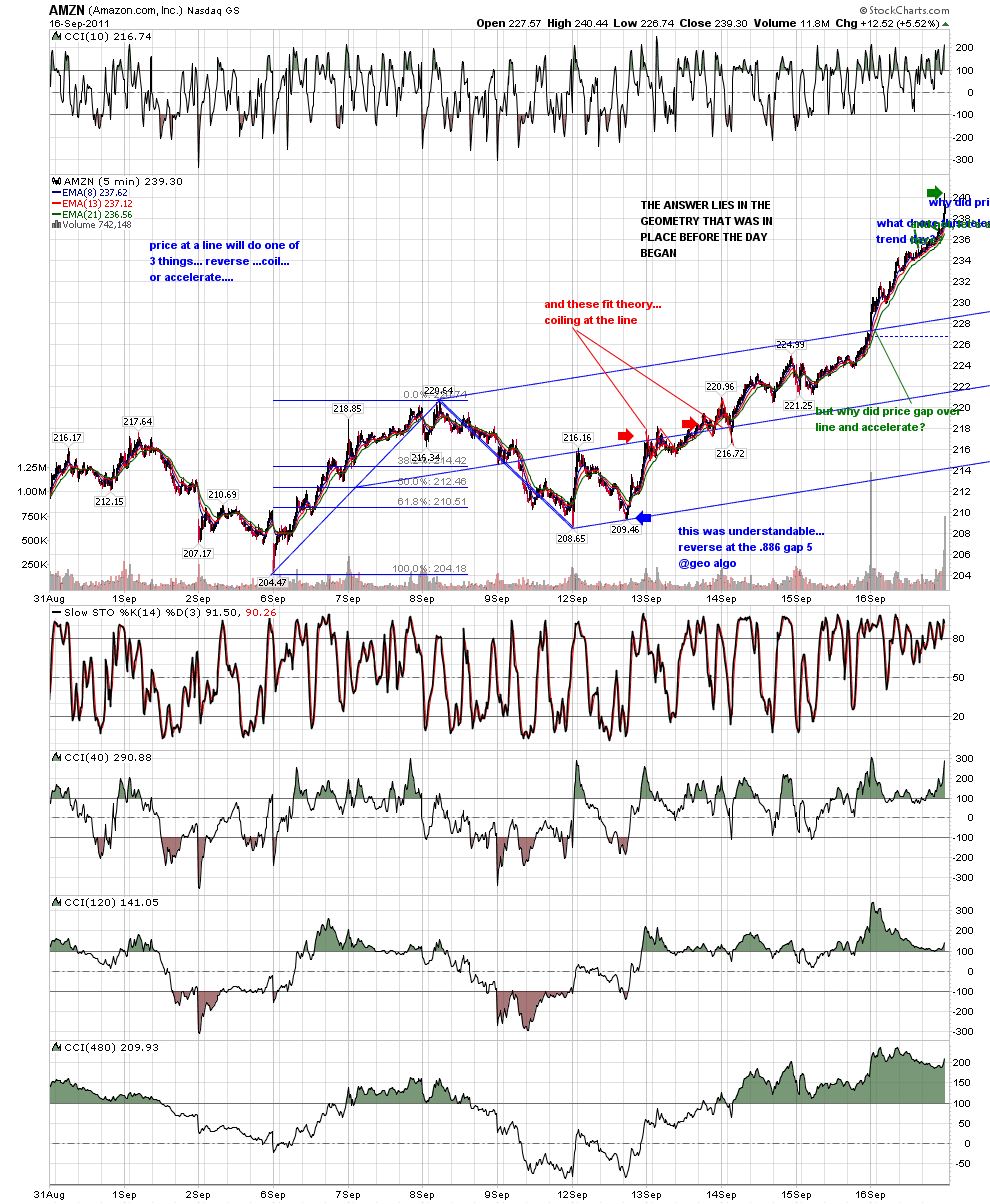

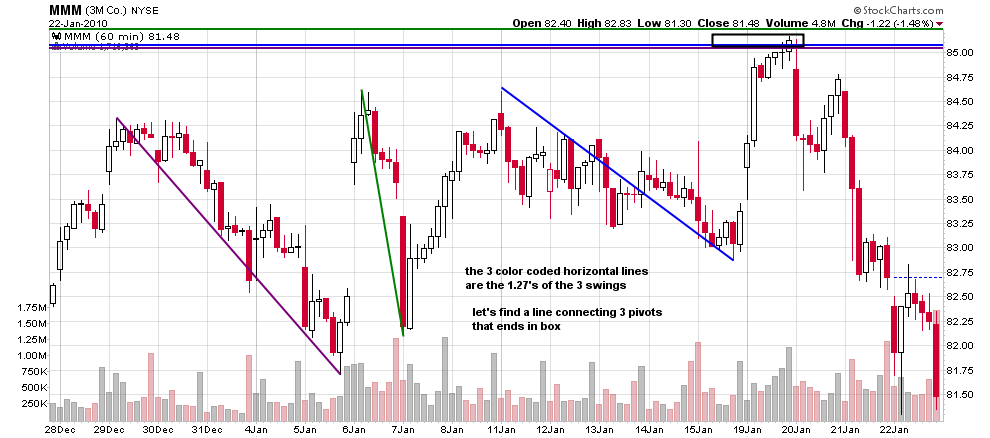

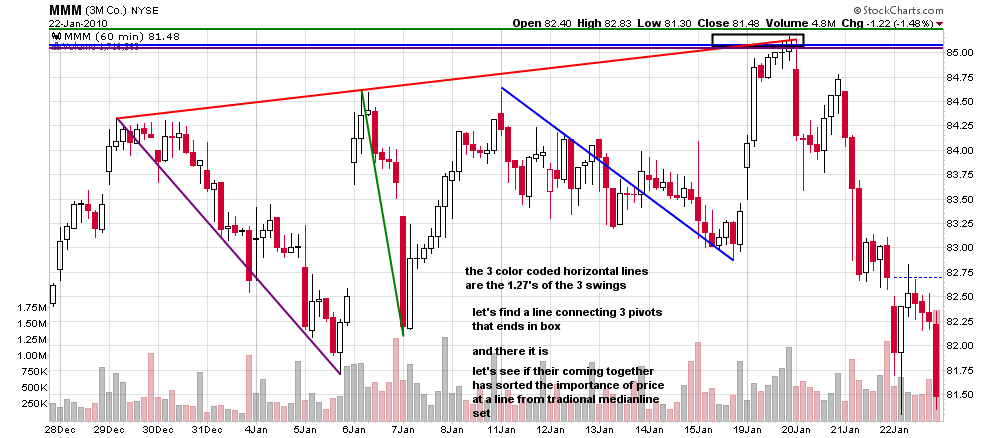

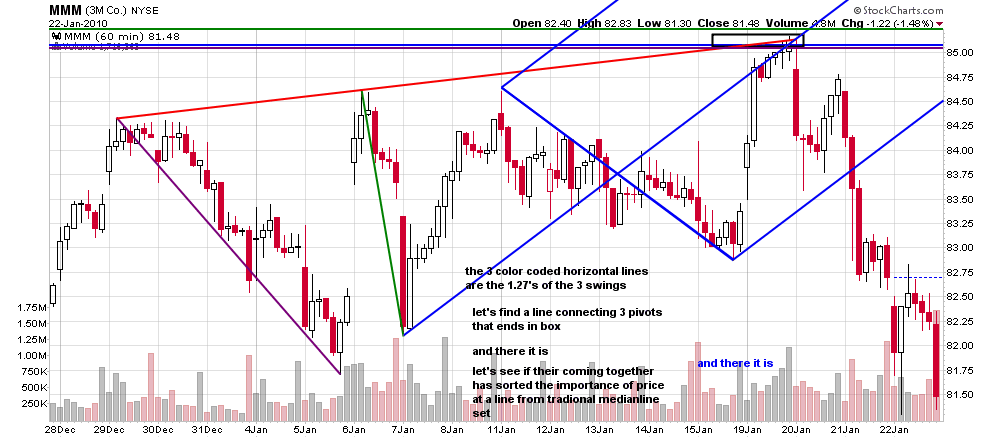

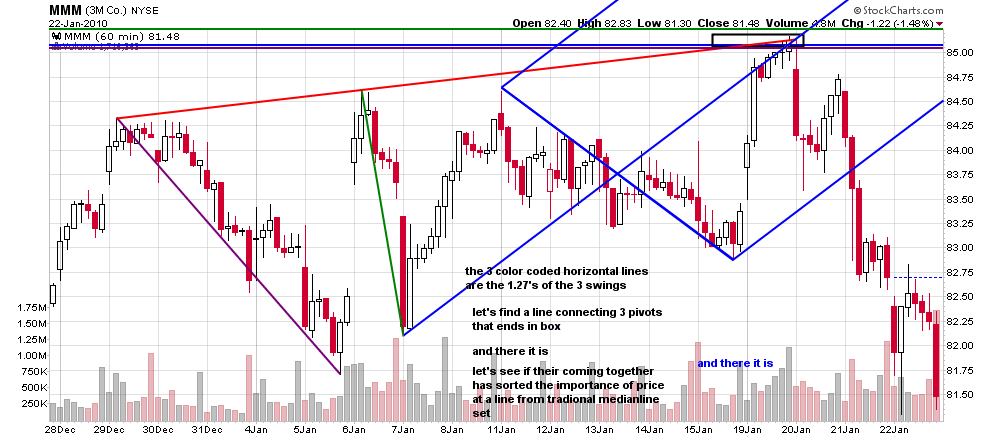

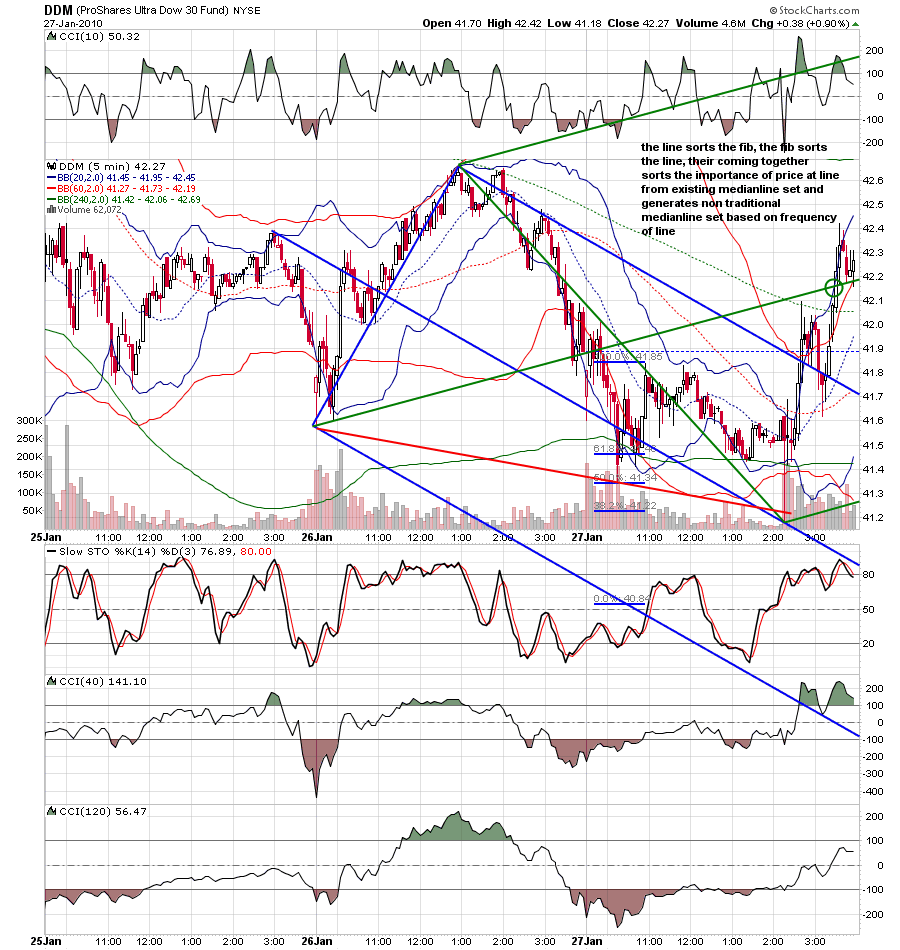

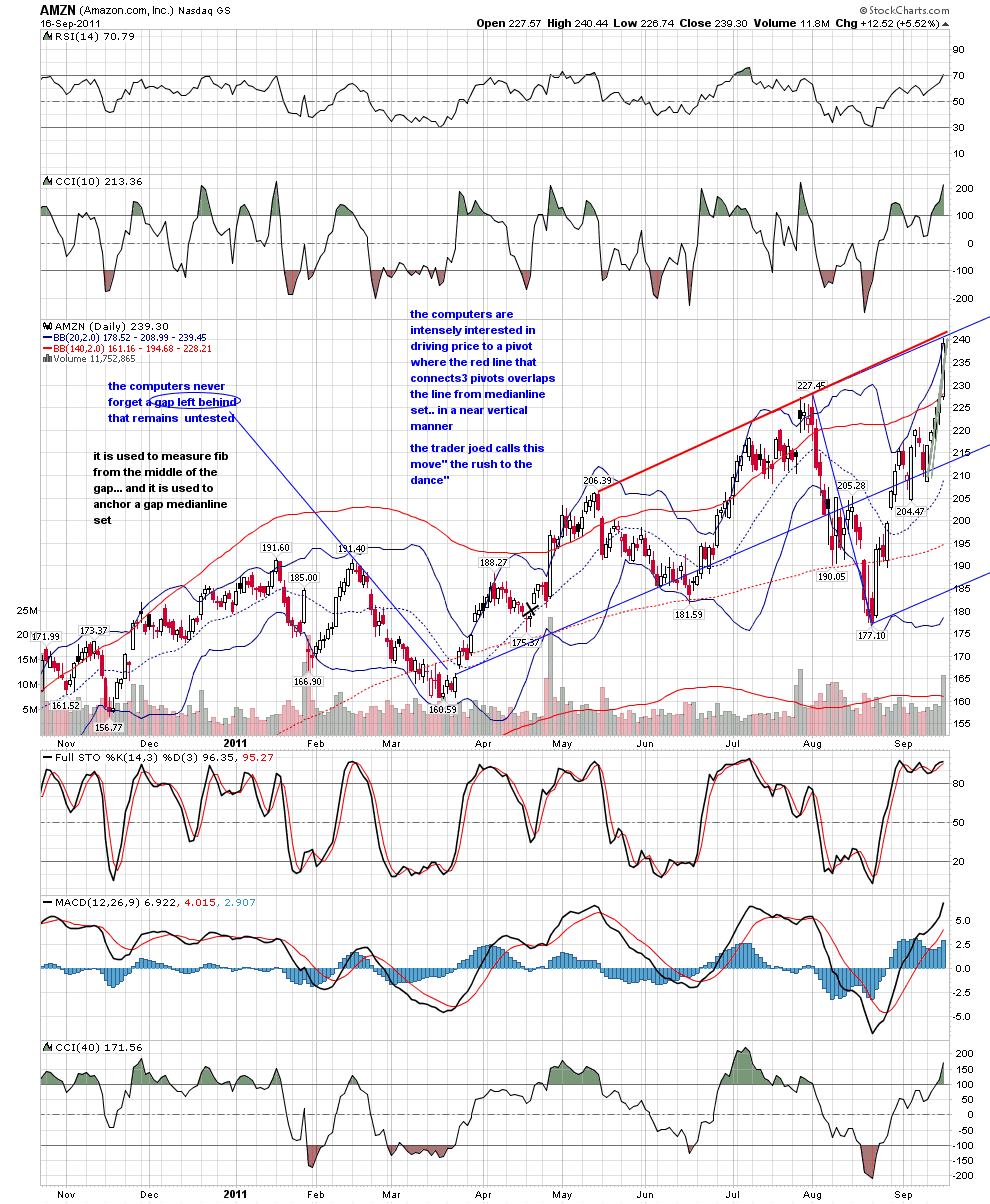

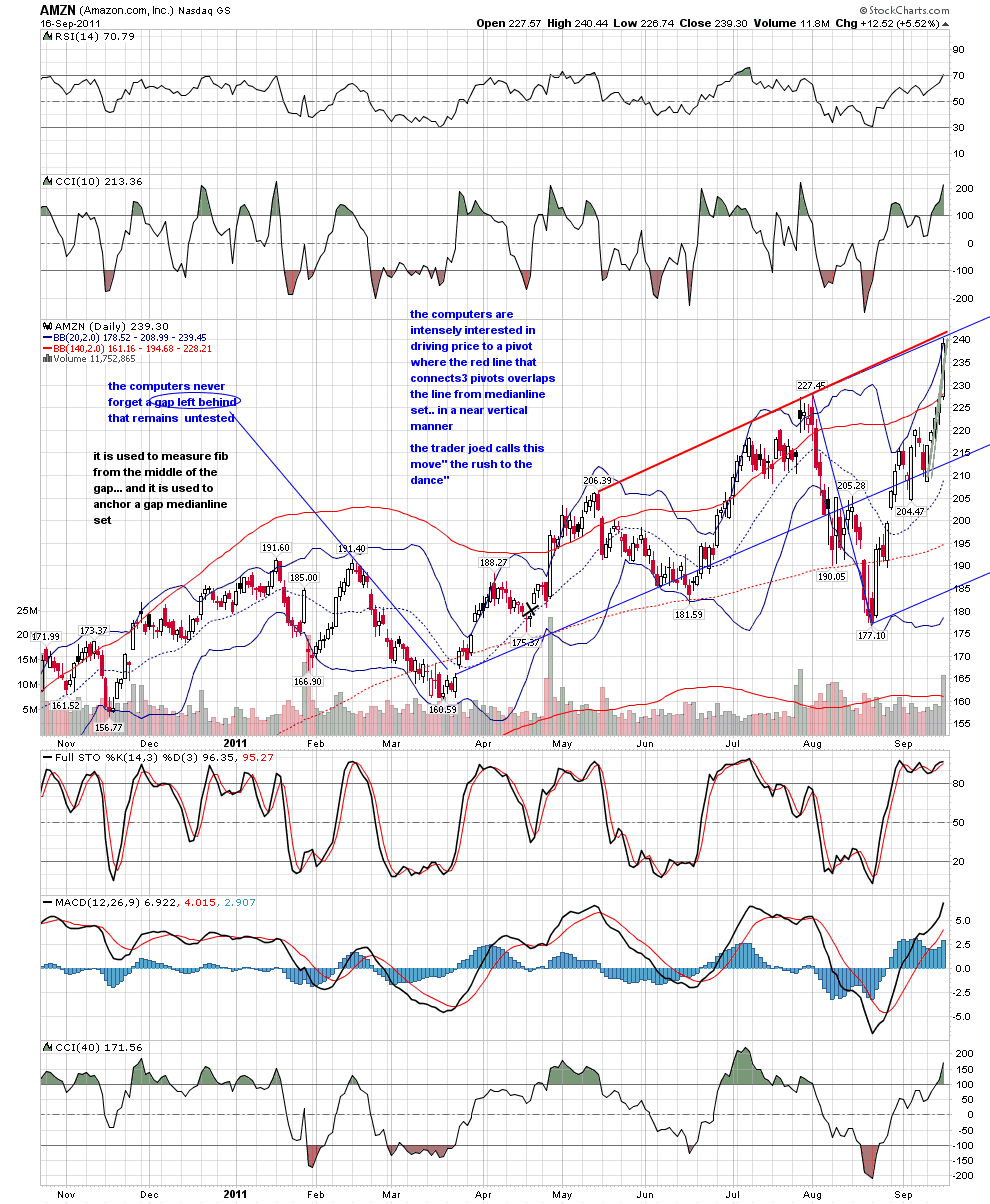

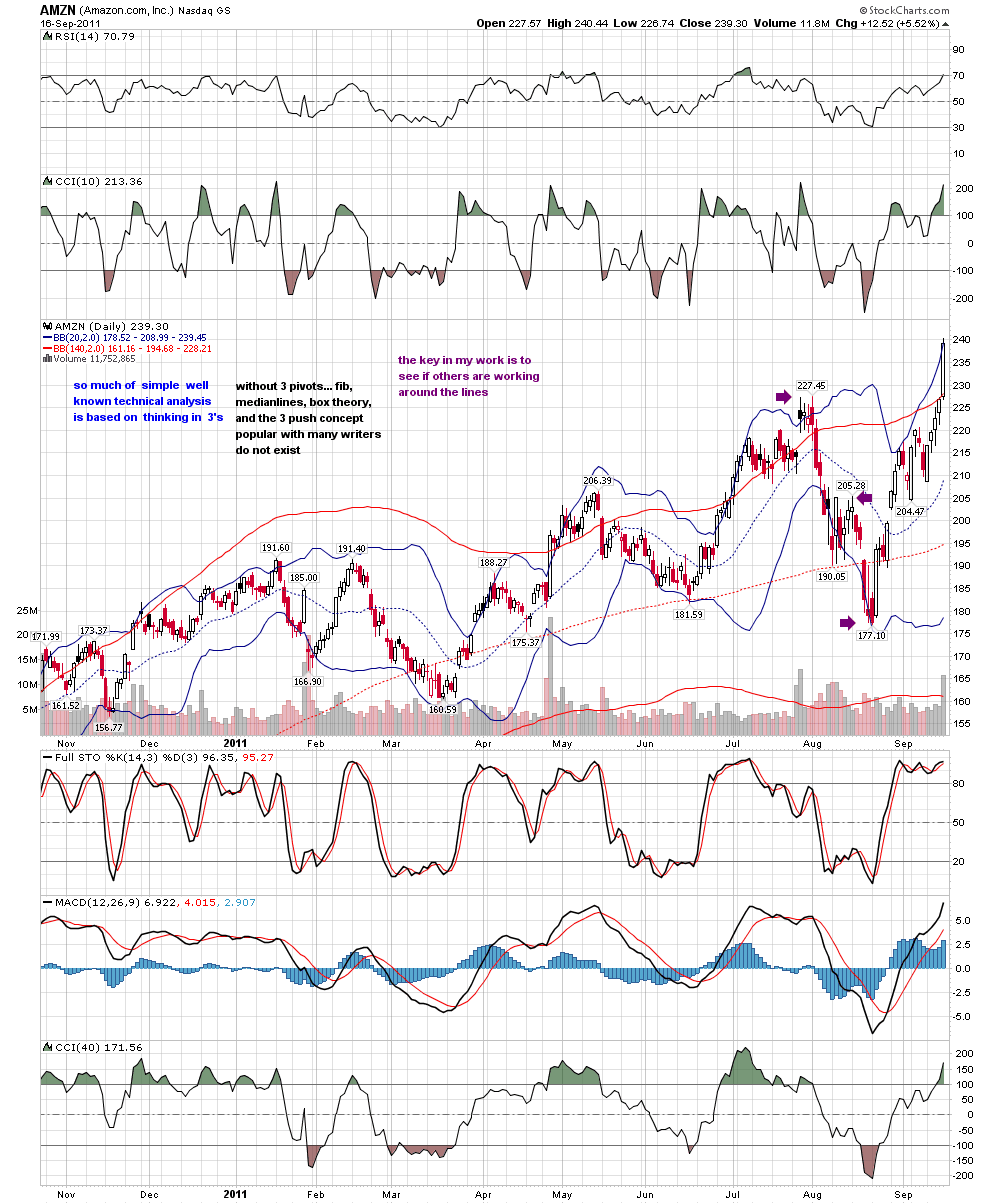

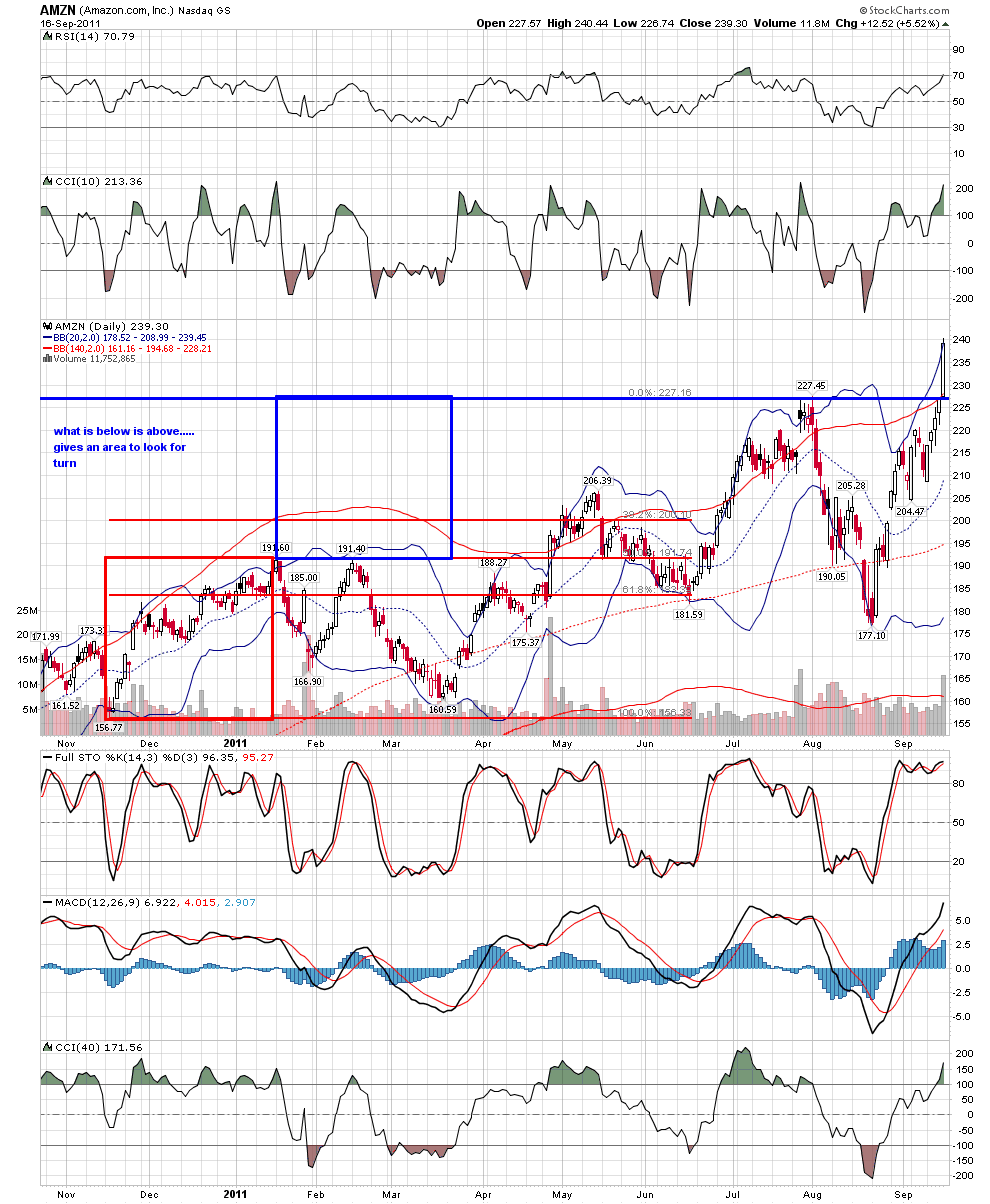

over the weekend i showed the red line green set work, with emphasis on the computers intense focus when the red line overlaps the line from existing medianline set....theoretical construct...here two days later were the computers hitting it... in practice....

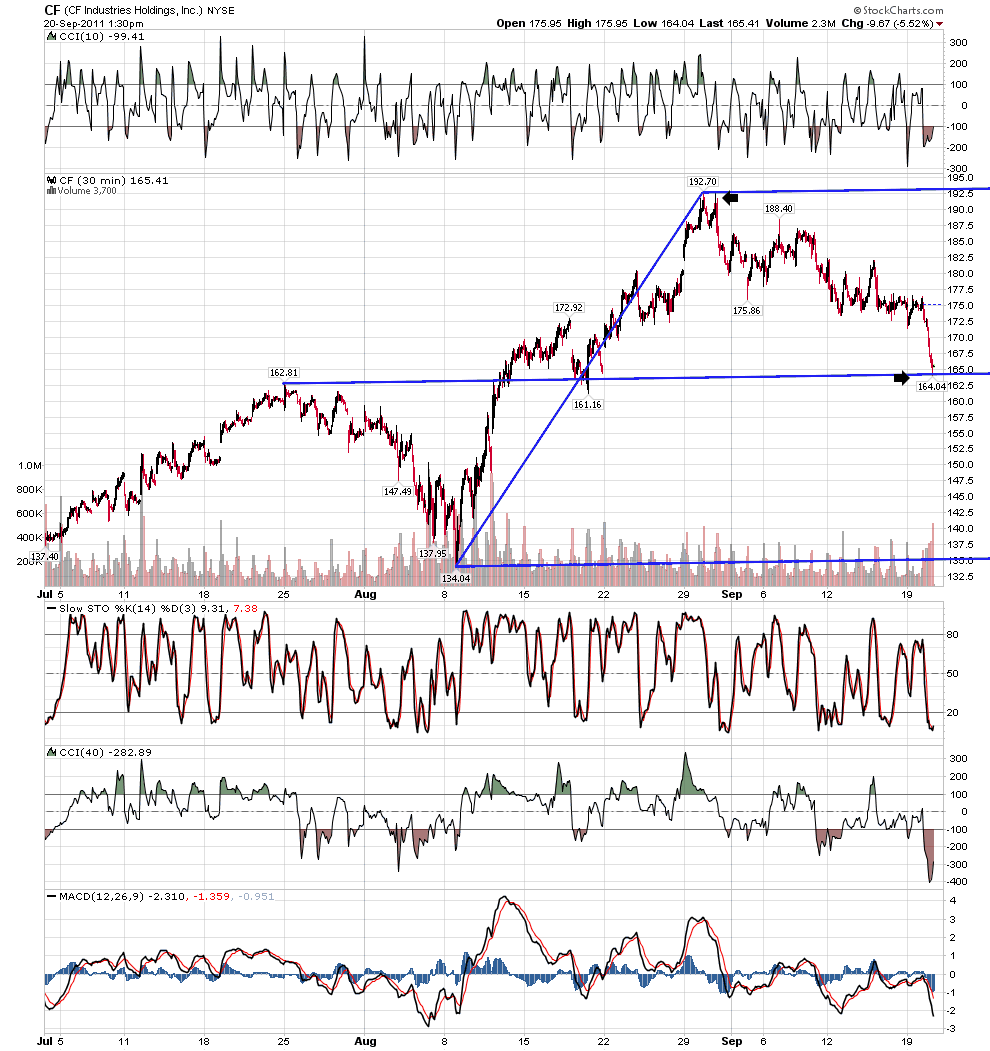

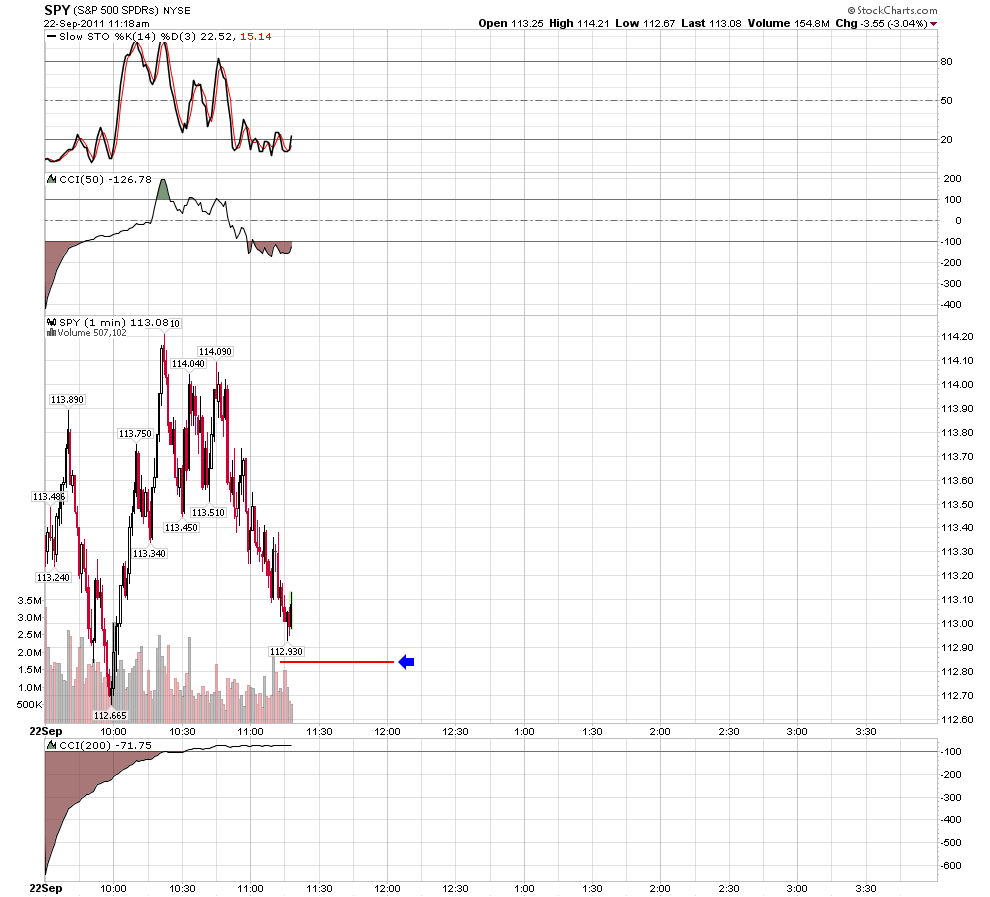

the very first chart at the pile was a CF chart showing 2/3rds of the position taken off.... the rest was left on as a swing trade with the medianline as the target... closed out today...

in the first post i stressed that the trading of the .886 takes place in the context of medianline sets....i stressed that before you added the setup to your trading you needed to be able to do what the trader joed said... else don't trade it...

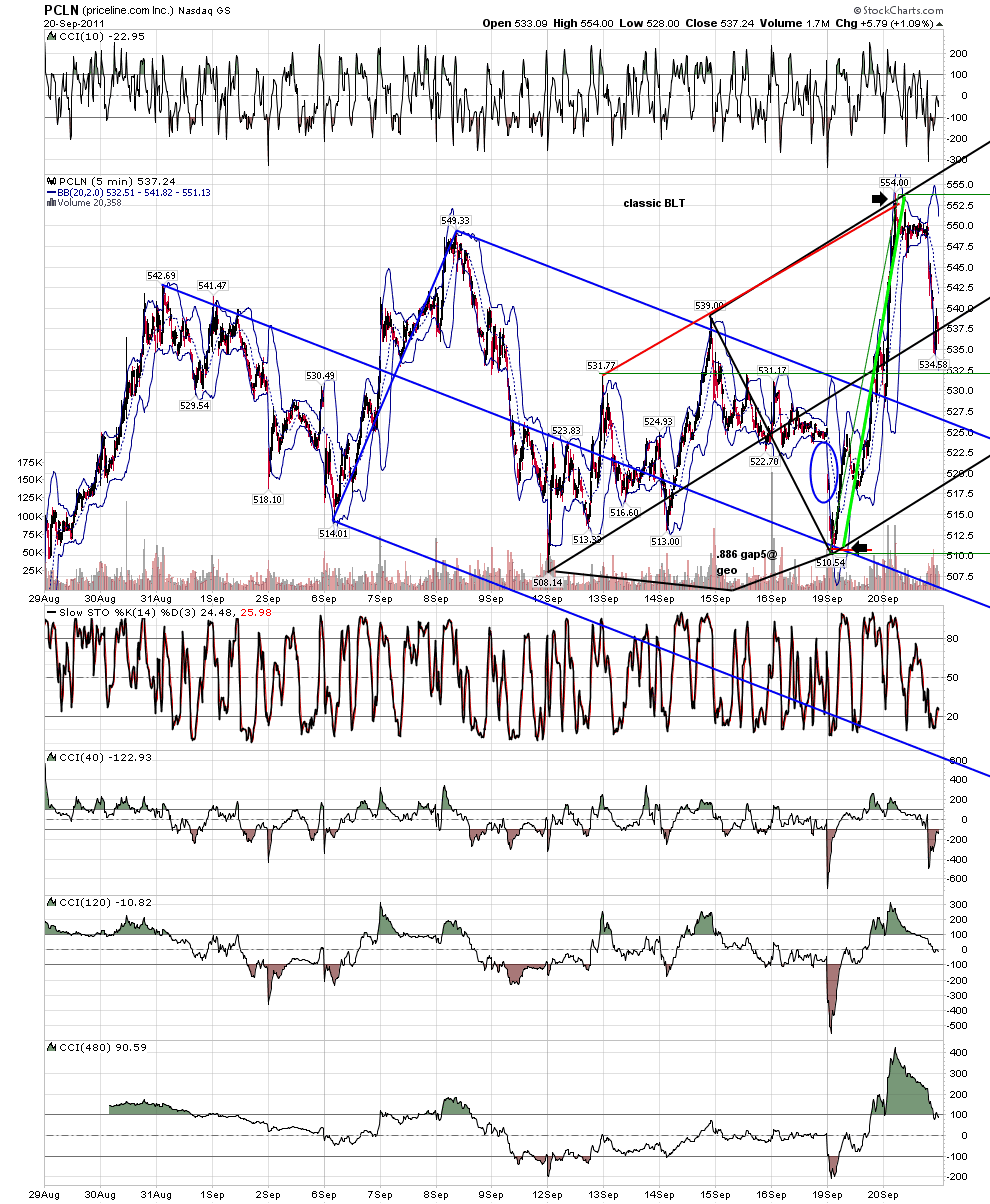

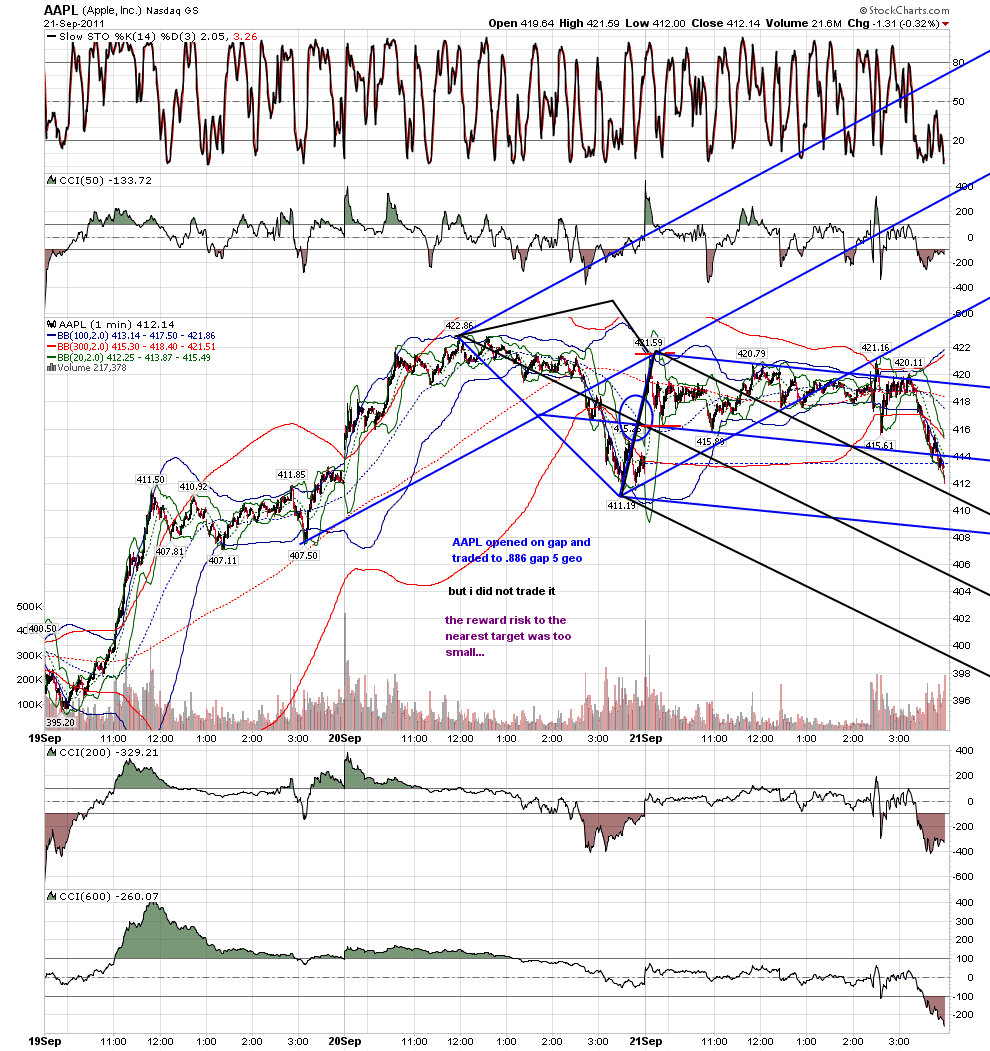

today i passed on 3 .886 trades.... AAPL set up perfectly... but because the only possible target lines were so close.... the risk was not worth the reward.... the trade worked, and at the end of the day the move was worth the risk.... but that is hindsight... at the moment of trade... the only possible targets did not justify the risk... compare that to the previously posted setup in PCLN....same setup...but the closest target was far enough away to justify the risk...

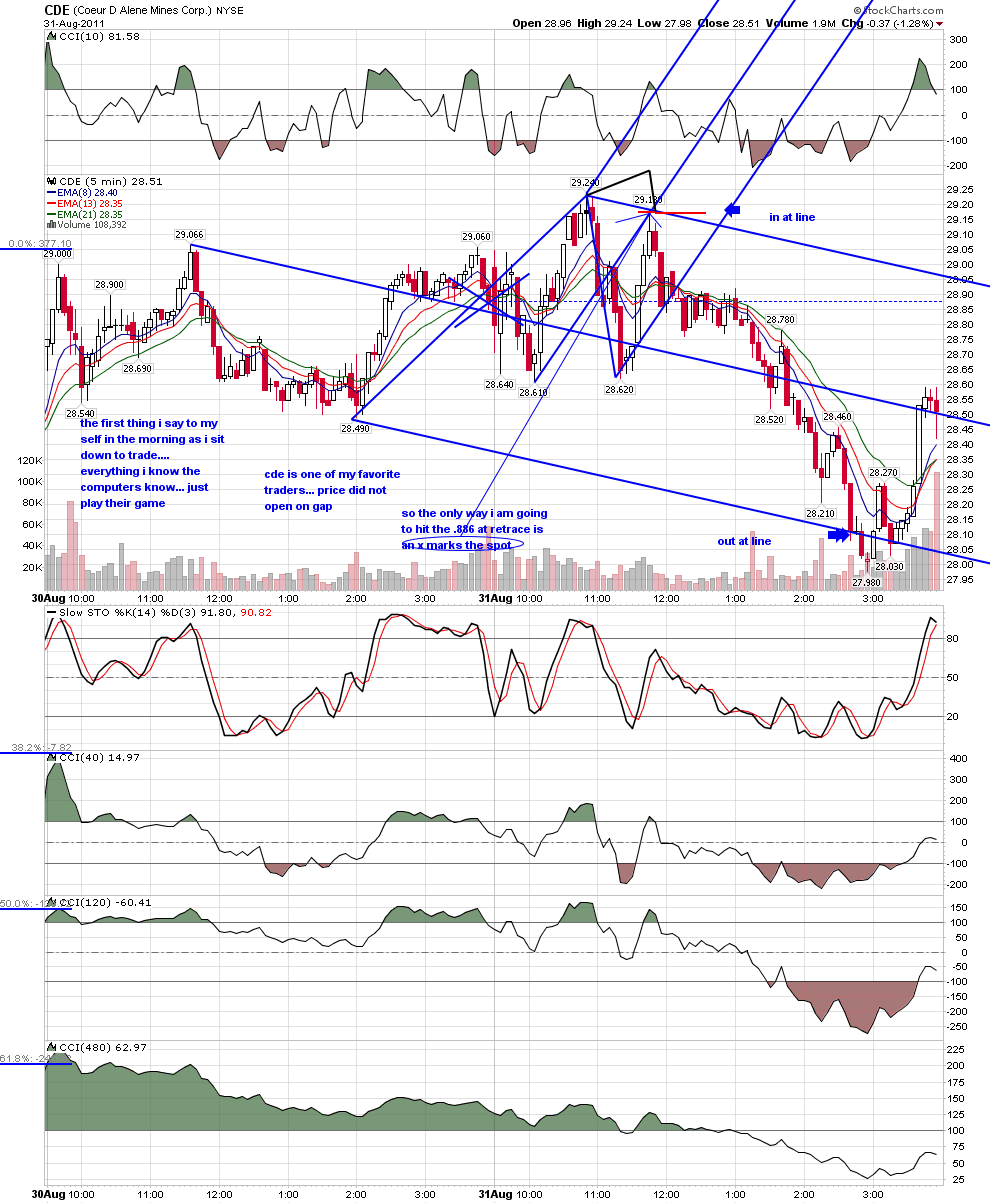

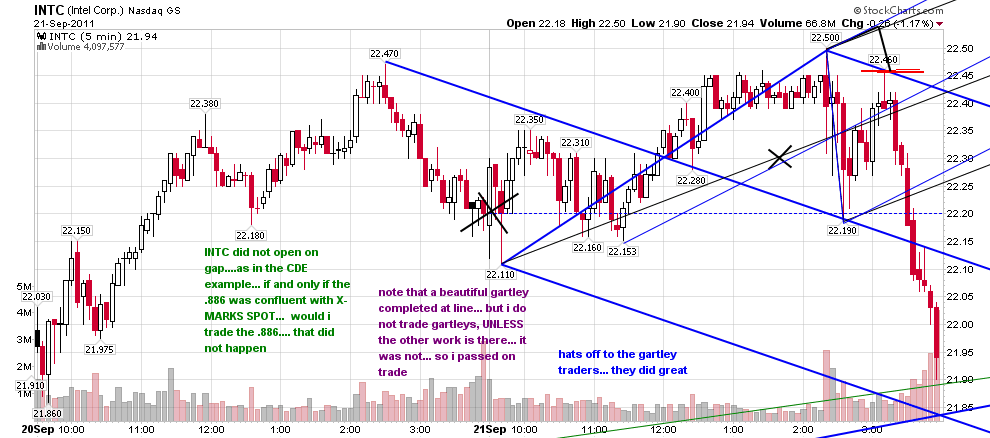

INTC did not open on gap.. but as in the CDE example posted as the 4th chart for the very specific reason of showing how the computers WILL hit the .886 if it is at X- MARKS SPOT.. if the .886 was at xmarks spot i would have hit it .. but it was not.. so i passed... note the perfect gartley that setup... but i do not trade gartleys except as a byproduct of the other tools... they were not there so i passed on the trade...

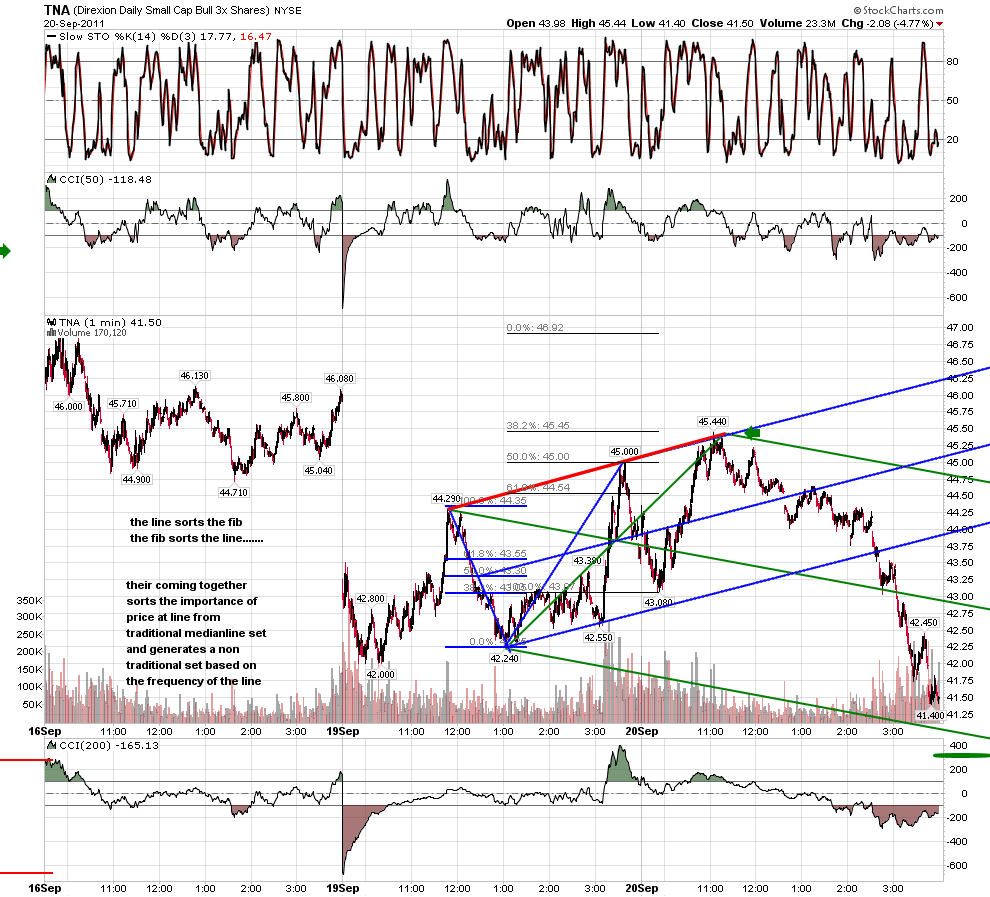

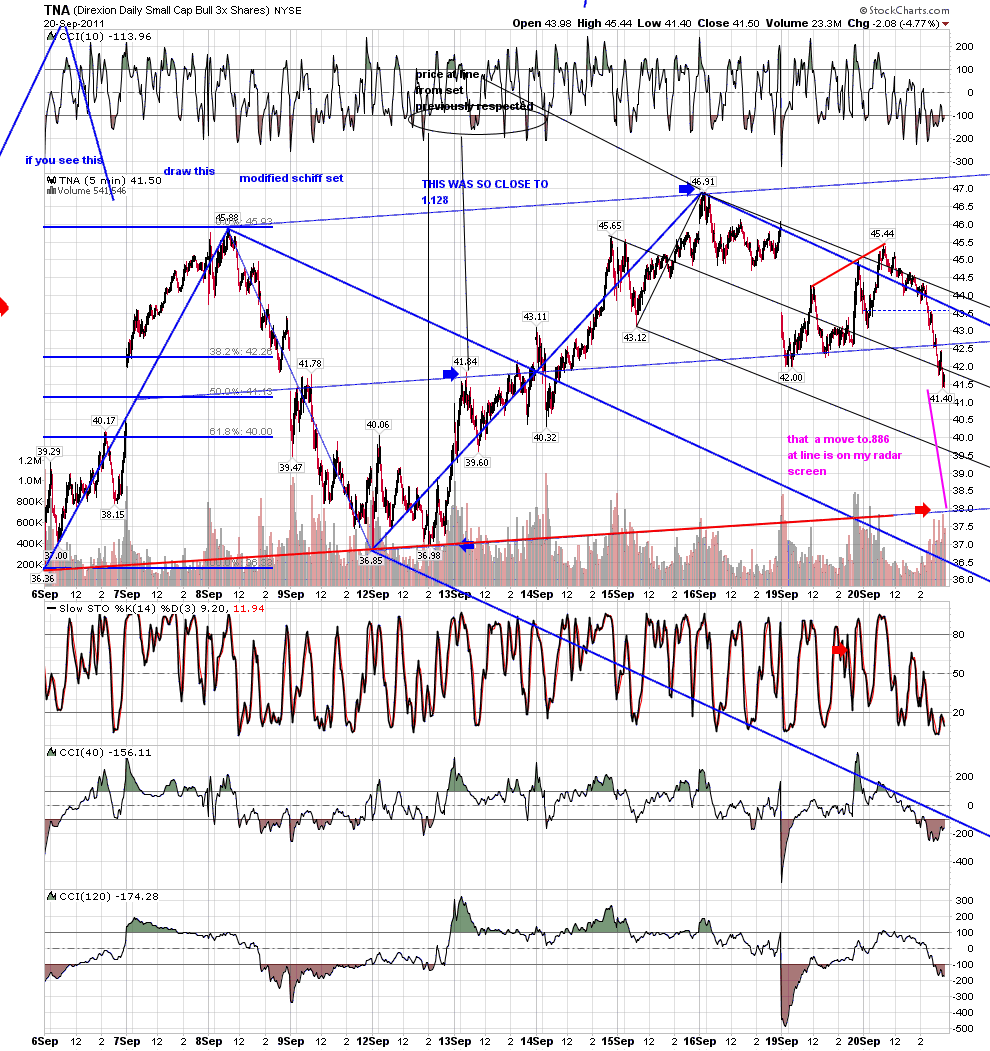

i showed the red line green set entry yesterday in TNA... came into today short and speculated over nite at the forum about the .886 being the target...price did not open on gap.... if it had i would have automatically been a buyer at the .886 gap5@geo.... the only other possibility was if there was an x marks spot.... but as the chart shows,, there was non... so 3800 became simply the target to exit trade...

today i passed on 3 .886 trades.... AAPL set up perfectly... but because the only possible target lines were so close.... the risk was not worth the reward.... the trade worked, and at the end of the day the move was worth the risk.... but that is hindsight... at the moment of trade... the only possible targets did not justify the risk... compare that to the previously posted setup in PCLN....same setup...but the closest target was far enough away to justify the risk...

INTC did not open on gap.. but as in the CDE example posted as the 4th chart for the very specific reason of showing how the computers WILL hit the .886 if it is at X- MARKS SPOT.. if the .886 was at xmarks spot i would have hit it .. but it was not.. so i passed... note the perfect gartley that setup... but i do not trade gartleys except as a byproduct of the other tools... they were not there so i passed on the trade...

i showed the red line green set entry yesterday in TNA... came into today short and speculated over nite at the forum about the .886 being the target...price did not open on gap.... if it had i would have automatically been a buyer at the .886 gap5@geo.... the only other possibility was if there was an x marks spot.... but as the chart shows,, there was non... so 3800 became simply the target to exit trade...

BULLS LAST STAND!

and they threw in the towel.......

Hi all!

I can't get this thread to scroll down properly??

Hmm...

What was that near 50% retrace again? Was it 48.1%

Can a moderator fix this thread, or am I doing it wrong?

peace

r247

I can't get this thread to scroll down properly??

Hmm...

What was that near 50% retrace again? Was it 48.1%

Can a moderator fix this thread, or am I doing it wrong?

peace

r247

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.