Potential options strategy

Hi

Can you please tell me why this strategy sounds to good to be true? A person with two different trading accounts goes long and short a contract, at the same time, writes a covered call and a covered put. Then places a long order at the strike price (or just above) of the covered call option to protect loss against the short position. And place an order to go short at the strike price (or just below) of the covered put to protect against the long position. And if ever BOTH options get exercised, close out position completely.

It seems like a trader can just collect the money for the premiums with little to no risk to him/her. It appears to be a no lose situation. Can you tell me what I'm missing? Because if this were possible, it seems like everyone would be doing it. Thank you for your time.

Grasshopper

Can you please tell me why this strategy sounds to good to be true? A person with two different trading accounts goes long and short a contract, at the same time, writes a covered call and a covered put. Then places a long order at the strike price (or just above) of the covered call option to protect loss against the short position. And place an order to go short at the strike price (or just below) of the covered put to protect against the long position. And if ever BOTH options get exercised, close out position completely.

It seems like a trader can just collect the money for the premiums with little to no risk to him/her. It appears to be a no lose situation. Can you tell me what I'm missing? Because if this were possible, it seems like everyone would be doing it. Thank you for your time.

Grasshopper

If I understand it correctly this strategy will work if the market stays inside your stop orders and moves sideways or if it trends outside of the stop orders. If, however, the market triggers one of the stop orders and then moves back to the other side and triggers that stop order you no longer have a protected position and you be at the risk of the market moving away from the original entry price.

I have to confess that I am struggling to get my mind fully around this strategy. Any further explanation with examples or diagrams would help.

I have to confess that I am struggling to get my mind fully around this strategy. Any further explanation with examples or diagrams would help.

My turn to watch tonight so I saw your post......

Conceptually it sounds good....but your trade has the same inverted yeild curve of a condor....which is dangerous in a high vol (atility) environment.....with velocity and instant reversals.

If you are using ES (ES pays the most premium...ATM today was $800 for friday) you don't need two accounts.....just use the current and forward contract (long and short)...when you get assigned they will cancel out and just exit sunday night or monday. Its best to go into the money about 25-30 points....for a flatter yeild curve. What you have is actually an ATM or ITM strangle (short and long cancel) and they will lose money as they travel down one side of the curve. Paper trade it first because it has to be managed.....which is tough when ES moves 70 points over night.

TOS has a good analyzer for this which will show the curve P&L numbers as the price changes.

Hope that helps....good luck!

Conceptually it sounds good....but your trade has the same inverted yeild curve of a condor....which is dangerous in a high vol (atility) environment.....with velocity and instant reversals.

If you are using ES (ES pays the most premium...ATM today was $800 for friday) you don't need two accounts.....just use the current and forward contract (long and short)...when you get assigned they will cancel out and just exit sunday night or monday. Its best to go into the money about 25-30 points....for a flatter yeild curve. What you have is actually an ATM or ITM strangle (short and long cancel) and they will lose money as they travel down one side of the curve. Paper trade it first because it has to be managed.....which is tough when ES moves 70 points over night.

TOS has a good analyzer for this which will show the curve P&L numbers as the price changes.

Hope that helps....good luck!

Great answer grednfer - thanks - you understand this better than I do. From what I could work out and tried to convey in my previous answer is that it will make money if the market moves sideways and the time decay takes place to benefit the writing of the options but if it trends away from the entry price(s) then it will lose.

No Prob DT.....

I love options and I really love ES options. You are right on with the "if it stays within the range" it'll make money. But there are very few ranges these days that the MMs don't take out.

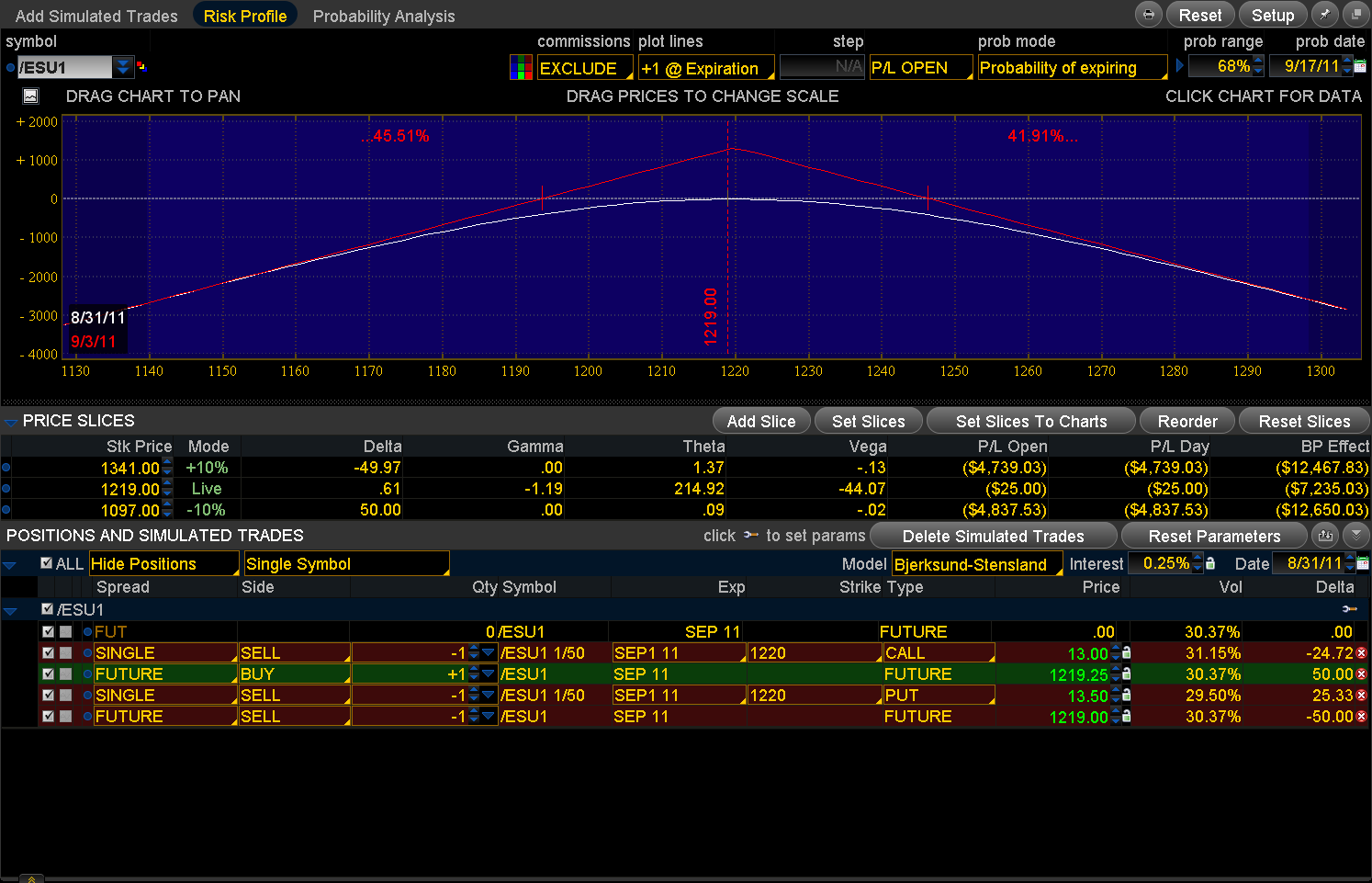

Even if you put orders at the outer boundaries of what you've sold, equal to the points that you've sold, it loses money as it proceeds to that point. The technical reason is while the trade at origin is delta neutral, as the price moves in either direction one delta is approaching 1 while the other delta is approaching 0. In other words one is losing money faster than the opposing is making money. I've a attached a pic for your review...the white line is the yeild curve.

It would absolutely work if you could buy protection with both calls and puts at the outer boundaries......but you'll find that eliminates ALL of your profit if you do it simultaneously.

We (here) sell alot of covered calls on ES....especially when the weekly payout is 900-1100 per contract.......but within a few days when it moves away.....we put protection there....buy a put at the call strike to lock in the profit. Then the trade is just assigned on Friday at 1:15....PAYDAY!

I love options and I really love ES options. You are right on with the "if it stays within the range" it'll make money. But there are very few ranges these days that the MMs don't take out.

Even if you put orders at the outer boundaries of what you've sold, equal to the points that you've sold, it loses money as it proceeds to that point. The technical reason is while the trade at origin is delta neutral, as the price moves in either direction one delta is approaching 1 while the other delta is approaching 0. In other words one is losing money faster than the opposing is making money. I've a attached a pic for your review...the white line is the yeild curve.

It would absolutely work if you could buy protection with both calls and puts at the outer boundaries......but you'll find that eliminates ALL of your profit if you do it simultaneously.

We (here) sell alot of covered calls on ES....especially when the weekly payout is 900-1100 per contract.......but within a few days when it moves away.....we put protection there....buy a put at the call strike to lock in the profit. Then the trade is just assigned on Friday at 1:15....PAYDAY!

Thanks DT and grednfer! I too love the thought of working with options on the ES grednfer, but I know ABSOLUTELY nothing about them. I didn't even think a ES contract or option could be held overnight. You seem to know a lot about them. Is there any website or book that you can lead me to that will enlighten me on the subject? Thanks again guys!

Grasshopper

Grasshopper

Here's a freebie......

Easiest option trade since they introduced the weeklys.

Entry

Buy a weekly ATM call at the close on Friday. I use ES but this works on any index or ETF that has weekly options. See the ascending yield curve in the PIC? Its opposite of the strangle trade.

Exit

Sell an ES contract where the number of points away from you strike is double. Like last friday....1175....paid $850 (17 points) per call.

The order sold on Monday at 1209 (1175+34). That option expires today, so they just take it.....no commissions. Double your money.

Always calls not puts. The entire market is designed for longs.

I actually held a few (cuz I think I know where its giong....bad assumption) and sold them today for 52, but don't do that.

Always hold until friday and let them take it.

Your risk is defined.....premium owned.

Trade is for 1 week only.

It sounds senseless but there are reasons why it works and why over time it yeilds great returns. You have to do it every week though.....

Yeah, sometimes it loses (fixed) but up weeks outnumber down weeks in the S&P......like forever.

And MMs always have to move the price by the amount of premium to make money.....usually more....its a business and its run by computers.

As you get better.....you'll learn not to buy at weekly resistance but wait for the drop.....this not necessary but only better your returns.....like now ES is approaching weekly resistance and needs to finish its downtrend (there I go again...thinking I know...I don't)

In the market there is great beauty in simplicity.

Good Luck......

Easiest option trade since they introduced the weeklys.

Entry

Buy a weekly ATM call at the close on Friday. I use ES but this works on any index or ETF that has weekly options. See the ascending yield curve in the PIC? Its opposite of the strangle trade.

Exit

Sell an ES contract where the number of points away from you strike is double. Like last friday....1175....paid $850 (17 points) per call.

The order sold on Monday at 1209 (1175+34). That option expires today, so they just take it.....no commissions. Double your money.

Always calls not puts. The entire market is designed for longs.

I actually held a few (cuz I think I know where its giong....bad assumption) and sold them today for 52, but don't do that.

Always hold until friday and let them take it.

Your risk is defined.....premium owned.

Trade is for 1 week only.

It sounds senseless but there are reasons why it works and why over time it yeilds great returns. You have to do it every week though.....

Yeah, sometimes it loses (fixed) but up weeks outnumber down weeks in the S&P......like forever.

And MMs always have to move the price by the amount of premium to make money.....usually more....its a business and its run by computers.

As you get better.....you'll learn not to buy at weekly resistance but wait for the drop.....this not necessary but only better your returns.....like now ES is approaching weekly resistance and needs to finish its downtrend (there I go again...thinking I know...I don't)

In the market there is great beauty in simplicity.

Good Luck......

Thanks grednfer! Good stuff!

Grasshopper

Grasshopper

I don't know of any good books....I've read some but they are all junk. There are schools like optionetics, but you could spend thousands and never find the weekly es call trade.

Try it.....it only takes what like 10 minutes per week? Think of your hourly rate. paper trade it.....no risk.

When the VIX is at 15 ES weekly ATM calls are only 250-300....so it works in low and high vol.

Try it.....it only takes what like 10 minutes per week? Think of your hourly rate. paper trade it.....no risk.

When the VIX is at 15 ES weekly ATM calls are only 250-300....so it works in low and high vol.

So let me get this straight: I buy a call option ATM at the close of a Friday, say, at 1800. The call option is selling for say $900(18 points). Then I place an order to sell an underlying contract for 36 points(double) hire than my option strike price. That would be 1836.

Now my understanding is that if the call option makes it up to the sell order, I will be locking in a profit that is double what I paid for the option premium. Hold the call option all the way 'til Friday until they take it. Over time, The trade will win more times than it losses because the ES have more up weeks than down weeks.

Am I beginning to understand?

Grasshopper

Now my understanding is that if the call option makes it up to the sell order, I will be locking in a profit that is double what I paid for the option premium. Hold the call option all the way 'til Friday until they take it. Over time, The trade will win more times than it losses because the ES have more up weeks than down weeks.

Am I beginning to understand?

Grasshopper

Anything that sounds like too good to be true... probably is :(

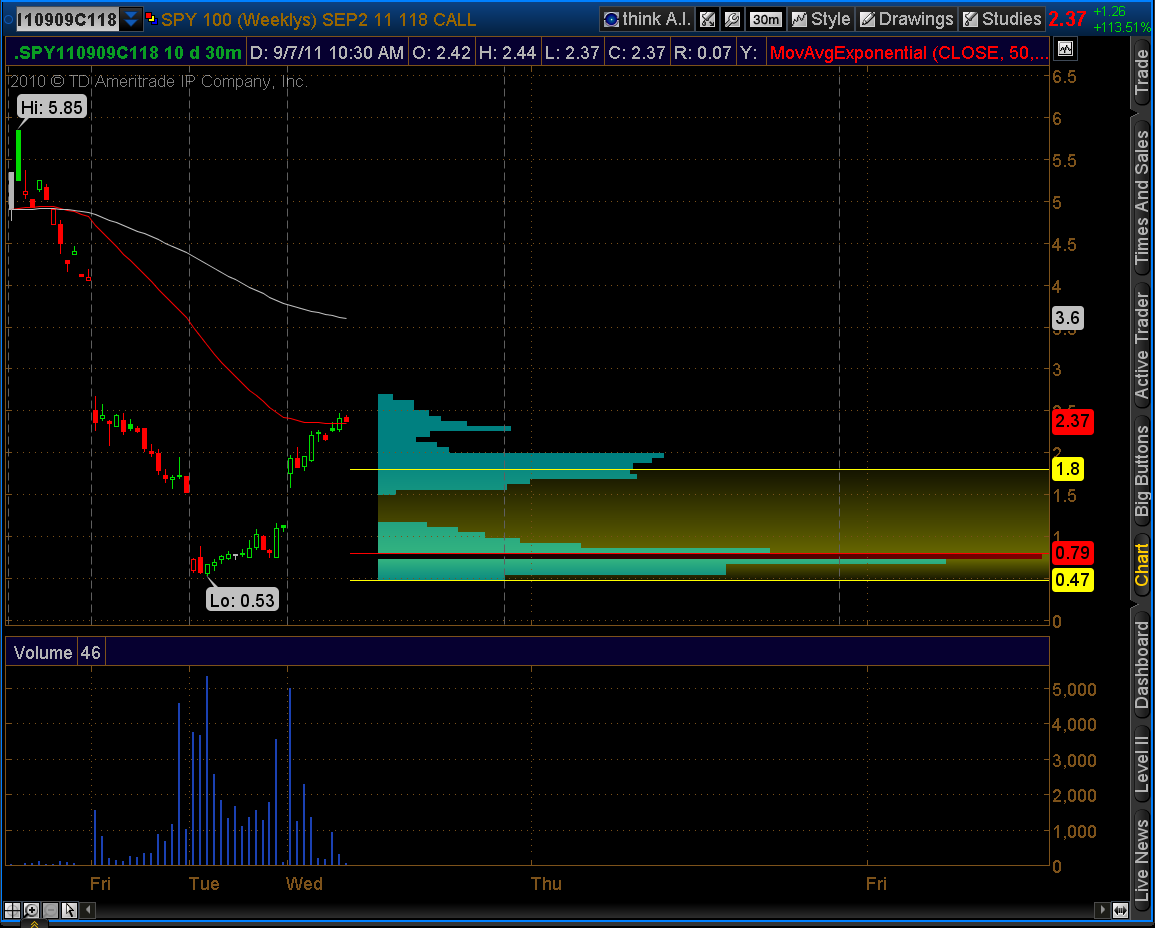

Wanted to show last week on SPY....

The 118 calls were bought at the close for 1.55

Although they got hammered at the open from Tuesday, they rebounded and sold em off for 2.5 today.....I would normally hold em but I'm seeing something and not worth the risk.

Bought the 114 calls yesterday for 2.4......sold em today for 5.8

Weird how this always catches a double.

I don't know why this weekly thing works, maybe its the simplicity......but it does well. And the efficiency ratio is very high since you don't have to monitor the squwiggles.

I hate the spy calls......equivalent to es is 5-6 contracts which is just more commissions.......ES ones are already there for next week....good! And good luck!

The 118 calls were bought at the close for 1.55

Although they got hammered at the open from Tuesday, they rebounded and sold em off for 2.5 today.....I would normally hold em but I'm seeing something and not worth the risk.

Bought the 114 calls yesterday for 2.4......sold em today for 5.8

Weird how this always catches a double.

I don't know why this weekly thing works, maybe its the simplicity......but it does well. And the efficiency ratio is very high since you don't have to monitor the squwiggles.

I hate the spy calls......equivalent to es is 5-6 contracts which is just more commissions.......ES ones are already there for next week....good! And good luck!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.