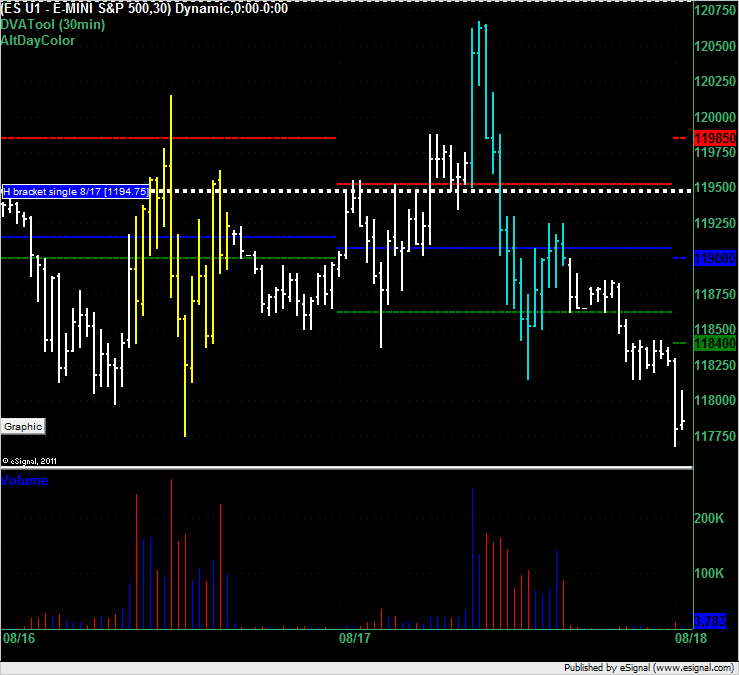

ES Thu 8-18-11

Single print left behind above us a 1194.75 in the H bracket on 8/17 (Wednesday). Coincidence that Wednesday's Market Profile long trade at the market was from the VAH at 1195.25 and now that support price has become a resistance line?

I got a short signal at 42.50 for the 39 retest but didn't reverse to short..I just used it to exit my last long

Longs need the es to hold 1139 and the Nq to hold 2076 ..key prices and I won't be surprised to see price consolidate around those prices now

good luck if you are in this!!

Longs need the es to hold 1139 and the Nq to hold 2076 ..key prices and I won't be surprised to see price consolidate around those prices now

good luck if you are in this!!

first hour 31.00 to 61.oo

Originally posted by BruceM

I got a short signal at 42.50 for the 39 retest but didn't reverse to short..I just used it to exit my last long

Bruce, what do you use as a "signal"?

when you are out of your trade, of course

If im rite we move back up to test that pocket of low VOL area from 43.50 to around 48.25 triing to move on it now

I use my renko and the footprint Lisa....I posted a chart last night in yesterdays thread...I'm basically watching the volume and the delta at key areas......much different then my previous style of averaging in......I prefer in this volatility to take a few shots at key zones with smaller stops

Confirmed single at 1149.25 in the E bracket today. This is an MP short trigger if we move up to hit it.

Originally posted by BruceM

I use my renko and the footprint Lisa....I posted a chart last night in yesterdays thread...I'm basically watching the volume and the delta at key areas......much different then my previous style of averaging in......I prefer in this volatility to take a few shots at key zones with smaller stops

Small stops? Does this mean your long @36.50 failed and you re-entered @32.50 long?

Trying to follow along, thanks.

FWIW, the KT full projection off of the 1131.0 low to the 1137.75 inflection high is 1148.75.

I still show low 47.50 to 50.25

Big Mike,

question 1)

The market will not always blow past a low volume node and go to the high volume node . Quite often it just over shoots it and then I get the signal to get short or long. The overshoot runs out the stops from the people who are expecting the market to stop right at the low volume zone. You will see this quite often at single prints for example. Many use fixed stops on that trade and often they get taken out and the market returns to the low volume zone.

question 2) Correct..I used that day because it was below the open of yesterday so I want to know where the key numbers are below and above the open price so I have some references to work from

question 1)

The market will not always blow past a low volume node and go to the high volume node . Quite often it just over shoots it and then I get the signal to get short or long. The overshoot runs out the stops from the people who are expecting the market to stop right at the low volume zone. You will see this quite often at single prints for example. Many use fixed stops on that trade and often they get taken out and the market returns to the low volume zone.

question 2) Correct..I used that day because it was below the open of yesterday so I want to know where the key numbers are below and above the open price so I have some references to work from

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.