ES Thu 8-11-11

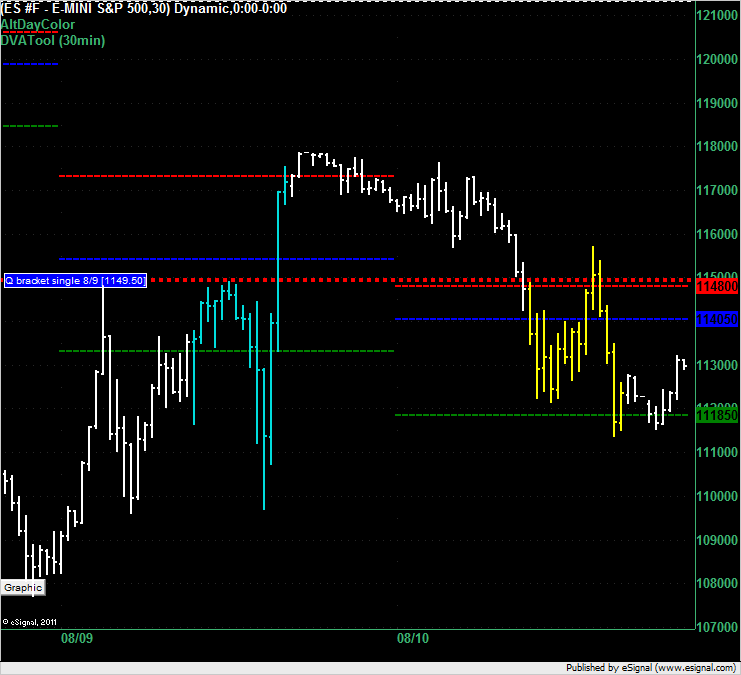

This is the ES at 8:30pm ET on Wednesday. On yesterday's ES topic I called a buy at 1148 or 1148.5 based on the single print and VAH but that call was nullified because we opened in the value area and the Initial Balance (IB) was formed inside the value area.

Market Profile theory looks for a day to be contained inside the value area when the IB is formed inside the value area. The market followed the theory and traded mostly inside in the value area and you will notice that the value area for today's trading is now, as a result, inside the previous day's value area.

Even though the market traded off the value areas it was, in my opinion, a truly scary market to trade off those lines with such fast markets and such a large range.

Have a look at the 5, 10, 20 and 40 day average ranges on this page:

http://www.mypivots.com/dailynotes/symbol/445/-1/e-mini-sp500-september-2011

We don't often see 70+ average ranges over 5 trading days.

Had you shorted the 1148 VAH on Wednesday you would have suffered through a 9 point draw down (or been stopped out) however the VAL target was only 1.5 points above the low of the day so you couldn't have wanted for a better target down there.

Market Profile theory looks for a day to be contained inside the value area when the IB is formed inside the value area. The market followed the theory and traded mostly inside in the value area and you will notice that the value area for today's trading is now, as a result, inside the previous day's value area.

Even though the market traded off the value areas it was, in my opinion, a truly scary market to trade off those lines with such fast markets and such a large range.

Have a look at the 5, 10, 20 and 40 day average ranges on this page:

http://www.mypivots.com/dailynotes/symbol/445/-1/e-mini-sp500-september-2011

We don't often see 70+ average ranges over 5 trading days.

Had you shorted the 1148 VAH on Wednesday you would have suffered through a 9 point draw down (or been stopped out) however the VAL target was only 1.5 points above the low of the day so you couldn't have wanted for a better target down there.

I saw low vol areas today at 34.25 did you see that???

I'm expecting the low volume at 24 - 25 to be messed with early on...that is also Va low.

will also be wathcing 17.50 and 37.50 as per low volume from day and overnight...above va high of 42.50 we have 49.50..

will also be wathcing 17.50 and 37.50 as per low volume from day and overnight...above va high of 42.50 we have 49.50..

We are clearly in down trend market when we see Value Areas and Point of Control shifting down on daily basis, I am assuming on the opening, it will be a good entry point to go short at the VAL (1124.00) with a 1.5 stop right?

With bars on my charts 3-5 points long a 1.5 point stop won't work very well in this environ..IMHO

shorting into the 39 area....expecting 37 retest first...report coming in 8 minutes

correct...1.5 is too tight unless u take many tries at key areas

What you recommend as a stop, and usually target approaching the value area?.......

with 12 plus points of range in the first 14 minutes this is not for the faint hearted....stops??????? 5-7 points may be in the ballpark assuming you are going in the correct direction.....in this market the machines are in control lots of the time and they can seemingly blow through any stops at will..trade at your own peril....

thanks for your help.

Nice trade bruce off of 39.00 back to that 25.00area

80 is my last key number.....too late for me though

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.