ES Thu 8-4-11

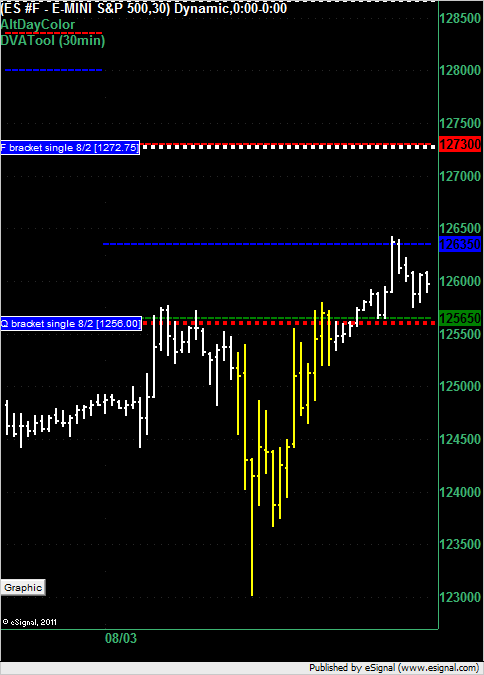

Depending on how you used Tuesday's single print at 1256.00 in Wednesday's trading you wouldn't have lost money had you used it to short late in the day but you wouldn't have made much either. Had you shorted at 1256 even you would have had a draw down of 2 points and a best run up of 4 points.

Had you used it as a target from a long during the day then you would have been golden as it was 2 points off the high. That single print is no longer in play but the F bracket from Tuesday at 1272.75 is still above us and is a target and a reversal point.

Had you used it as a target from a long during the day then you would have been golden as it was 2 points off the high. That single print is no longer in play but the F bracket from Tuesday at 1272.75 is still above us and is a target and a reversal point.

The other day I mentioned the value of using Kools Tools price projections off of major market moves. Any up projection based on the favorable jobless claims number was negated by the reaction to Trichet's comments which broke the ES below the pre-claims level. Those comments brought a move from 1248.75-1239 before a green candle. That move gives an initial projection of 1233.0 and a full projection of 1223.25. If it gets down there I would expect a tradable bounce in the 1233 area. If 1248.75 is touched again these down projections will have failed. I find Kools Tools projections work about 85% of the time. No guarantees ... just probabilities as in this market anyuthing is possible.

I have $SPX 1240 (cash) as a support. LOD was 1236. Watching for possible bounce

Originally posted by prestwickdrive

The other day I mentioned the value of using Kools Tools price projections off of major market moves. Any up projection based on the favorable jobless claims number was negated by the reaction to Trichet's comments which broke the ES below the pre-claims level. Those comments brought a move from 1248.75-1239 before a green candle. That move gives an initial projection of 1233.0 and a full projection of 1223.25. If it gets down there I would expect a tradable bounce in the 1233 area. If 1248.75 is touched again these down projections will have failed. I find Kools Tools projections work about 85% of the time. No guarantees ... just probabilities as in this market anyuthing is possible.

We got to the 1233 so watch for the length move of the initial up move from 1232.25 to do an up projection. If the downtrend is intact we should not appreciably exceed the initial up projection which would indicate a decent chance for a short targeting the 1223.25 area unless 1248.75 is taken out. Again, no guarantees.

thanks for the explanation, what chart time frame are you using to measure the initial up projection ?

Originally posted by prestwickdrive

Originally posted by prestwickdrive

The other day I mentioned the value of using Kools Tools price projections off of major market moves. Any up projection based on the favorable jobless claims number was negated by the reaction to Trichet's comments which broke the ES below the pre-claims level. Those comments brought a move from 1248.75-1239 before a green candle. That move gives an initial projection of 1233.0 and a full projection of 1223.25. If it gets down there I would expect a tradable bounce in the 1233 area. If 1248.75 is touched again these down projections will have failed. I find Kools Tools projections work about 85% of the time. No guarantees ... just probabilities as in this market anyuthing is possible.

We got to the 1233 so watch for the length move of the initial up move from 1232.25 to do an up projection. If the downtrend is intact we should not appreciably exceed the initial up projection which would indicate a decent chance for a short targeting the 1223.25 area unless 1248.75 is taken out. Again, no guarantees.

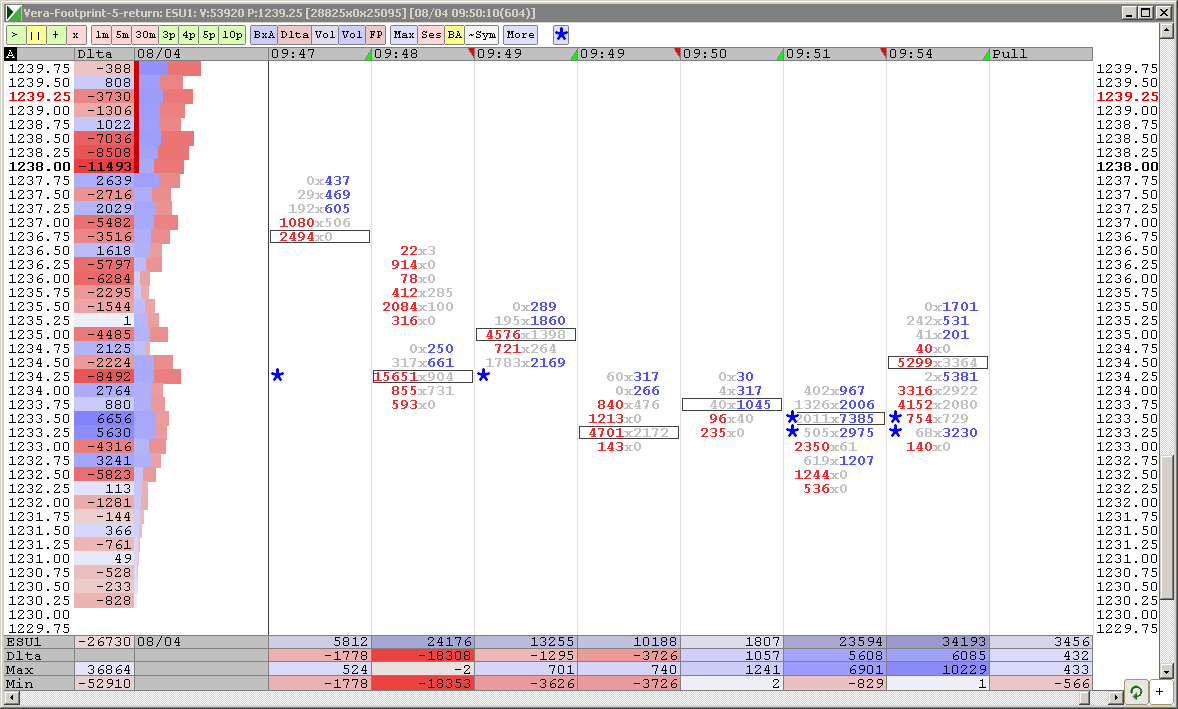

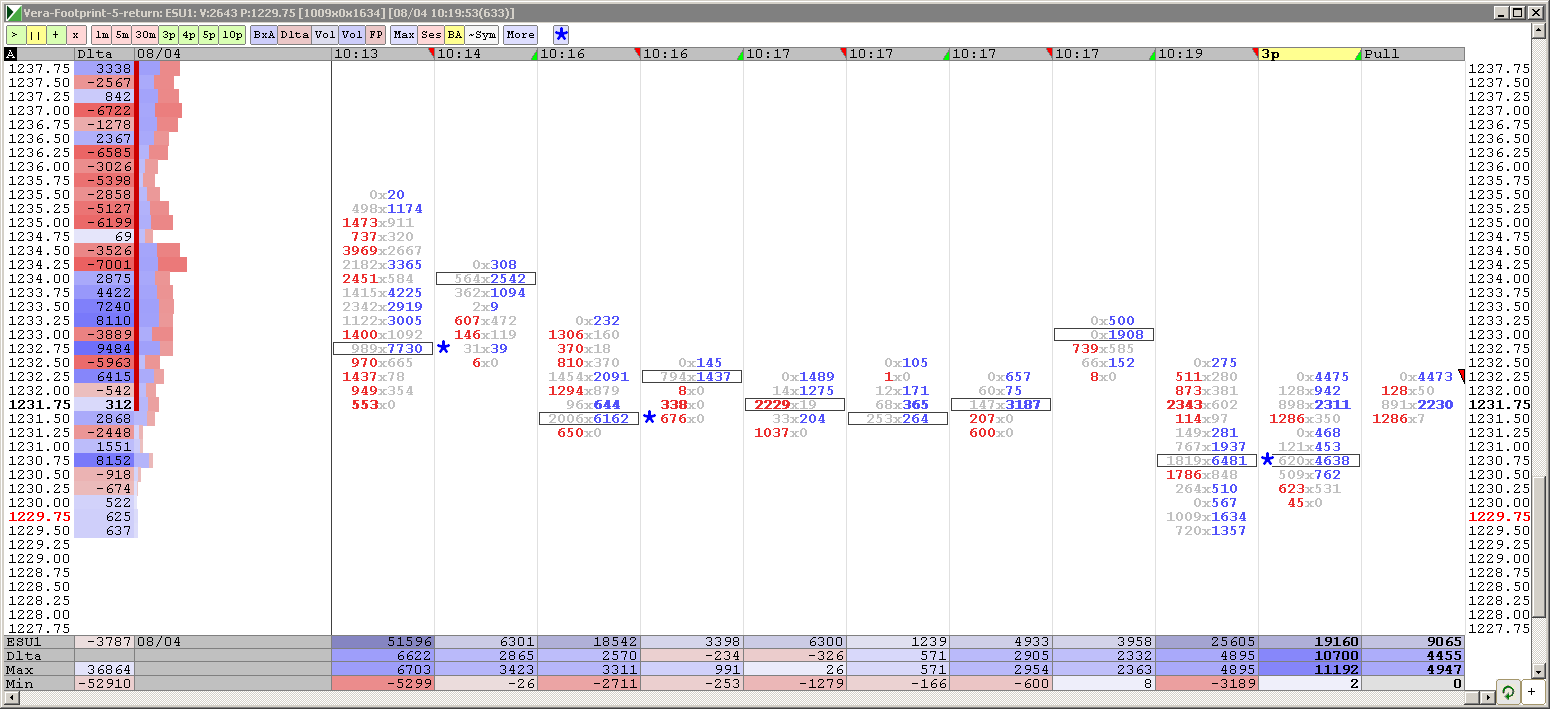

numbers are still very low, we have not hit big buyers (or sellers) since open

Originally posted by ayn

thanks for the explanation, what chart time frame are you using to measure the initial up projection ?

Originally posted by prestwickdrive

Originally posted by prestwickdrive

The other day I mentioned the value of using Kools Tools price projections off of major market moves. Any up projection based on the favorable jobless claims number was negated by the reaction to Trichet's comments which broke the ES below the pre-claims level. Those comments brought a move from 1248.75-1239 before a green candle. That move gives an initial projection of 1233.0 and a full projection of 1223.25. If it gets down there I would expect a tradable bounce in the 1233 area. If 1248.75 is touched again these down projections will have failed. I find Kools Tools projections work about 85% of the time. No guarantees ... just probabilities as in this market anyuthing is possible.

We got to the 1233 so watch for the length move of the initial up move from 1232.25 to do an up projection. If the downtrend is intact we should not appreciably exceed the initial up projection which would indicate a decent chance for a short targeting the 1223.25 area unless 1248.75 is taken out. Again, no guarantees.

I am using a 1 minute candle chart for this but I will use a 3 minute sometimes. Note that the up projection off of 32.25 gave an initial of 41.75 and a full of 46.0. The break below 32.25 negated those giving us a stronger message that the market still wants lower. The move from the cycle high of 38.5 to the first decent retrace of 34.75 now gives us an initial of 32.5 which was hit and a full of 28.75 until 38.5 is taken out. The longer term projection to 23.25 is still valid too. The bounce from that initial 32.0 area was pretty sick.

WOuld someone please let me know if there is interest in Footprint charts. If there is no interest (as I see no comments) I will stop posting them. Thanks.

1196 and 1190 1st 2 sub 1200 targets

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.