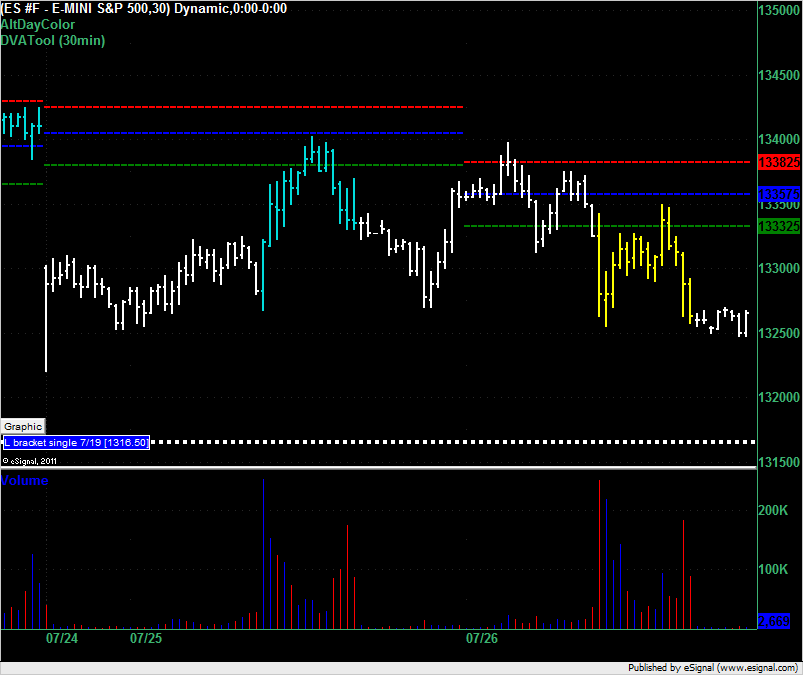

ES Tue 7-26-11

Market opens below value area so market profile theory would have you shorting the market at 1333.25 and so far you would have suffered a 1 point draw down when the market moved up to the high of 1334.25.

The L bracket single from 7/19 at 1316.50 would be a typical target or reversal point for this MP trade.

The L bracket single from 7/19 at 1316.50 would be a typical target or reversal point for this MP trade.

this is a risky long IMHO ...we are still below the open, stuck inside the IB and more importantly we are accepting price below the LOW volume area from yesterday that created the buying yesterday..

I hope it goes up for you though...seems like they are trying to make a high volume node in the 32.50 area if we combine both days...

u do have a ledge up there at 32.75 but I'd prefer to watch now..

I hope it goes up for you though...seems like they are trying to make a high volume node in the 32.50 area if we combine both days...

u do have a ledge up there at 32.75 but I'd prefer to watch now..

Originally posted by BruceM

this is a risky long IMHO ...we are still below the open, stuck inside the IB and more importantly we are accepting price below the LOW volume area from yesterday that created the buying yesterday..

I hope it goes up for you though...seems like they are trying to make a high volume node in the 32.50 area if we combine both days...

u do have a ledge up there at 32.75 but I'd prefer to watch now..

yup, stopped out BE

Market Profile summary for the day. My first post showed how a market profile trader, following the common MP strategies, would have sold the VAL at 1333.25. That trade showed an immediate 1 point draw down followed by a best-case run up of 7.75 points followed by a 1.75 point draw down before moving into profit again for a subsequent best run-up of 7.5 points. This assumes that you held the trade from the initial short at the VAL through to the end of the day which is unlikely given the trigger happy nature of your average day trader

I hope that some are finding value in these market profile oriented posts. I'm trying to be as objective as possible. Feel free to call me out if I've miscalculated one of the figures or missed a classic MP trade etc.

I hope that some are finding value in these market profile oriented posts. I'm trying to be as objective as possible. Feel free to call me out if I've miscalculated one of the figures or missed a classic MP trade etc.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.