ES 7-19-11

cleanup aisle 3

1291 is the 61.8% retrace level of 1252-1354

perfection as the cross of 1293 only allows for a diagonal for higher

3 waves up to 1354

3 waves down to 1291

only problem is the alternates can be quite bearish

I'm no expert but am considering the possibility that 1354 could be the peak of a truncated 5th wave

no one said it was easy

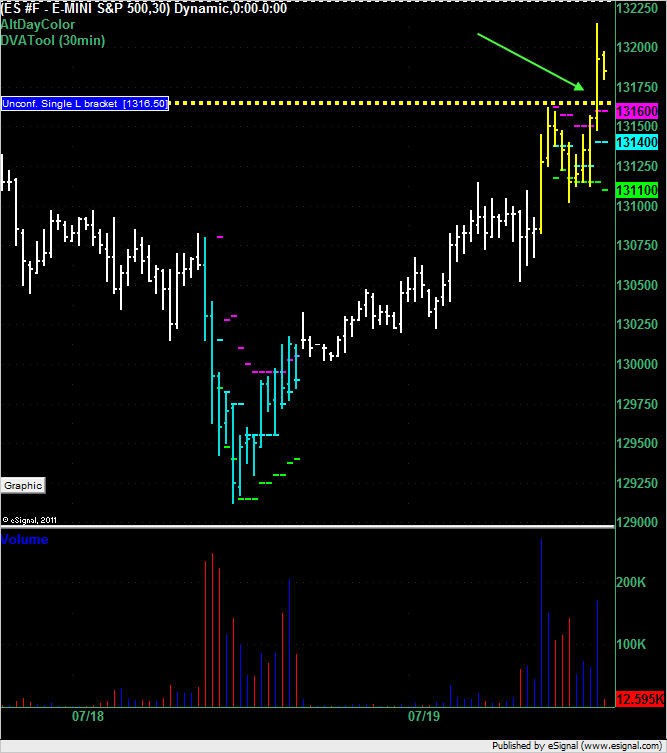

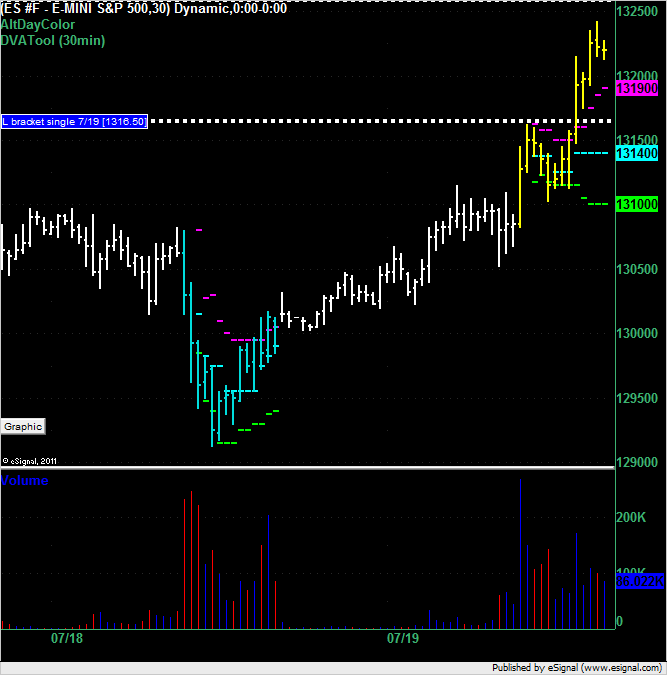

looking for 1312.50 top possibly

other areas to consider here are 1315 and 1322 fib levels

1307 and 1303.5 50% levels below

I try to time the market and had mentioned Tues in a note Friday

My weakness is timing but expect the direction to be revealed this week

1291 is the 61.8% retrace level of 1252-1354

perfection as the cross of 1293 only allows for a diagonal for higher

3 waves up to 1354

3 waves down to 1291

only problem is the alternates can be quite bearish

I'm no expert but am considering the possibility that 1354 could be the peak of a truncated 5th wave

no one said it was easy

looking for 1312.50 top possibly

other areas to consider here are 1315 and 1322 fib levels

1307 and 1303.5 50% levels below

I try to time the market and had mentioned Tues in a note Friday

My weakness is timing but expect the direction to be revealed this week

INDU at 12,500 support

news: Moody's put US on review for possible downdgrade

Article in the WSJ on US spending. Chart tells it all

http://online.wsj.com/article/SB10001424052702304203304576446332084493902.html

http://online.wsj.com/article/SB10001424052702304203304576446332084493902.html

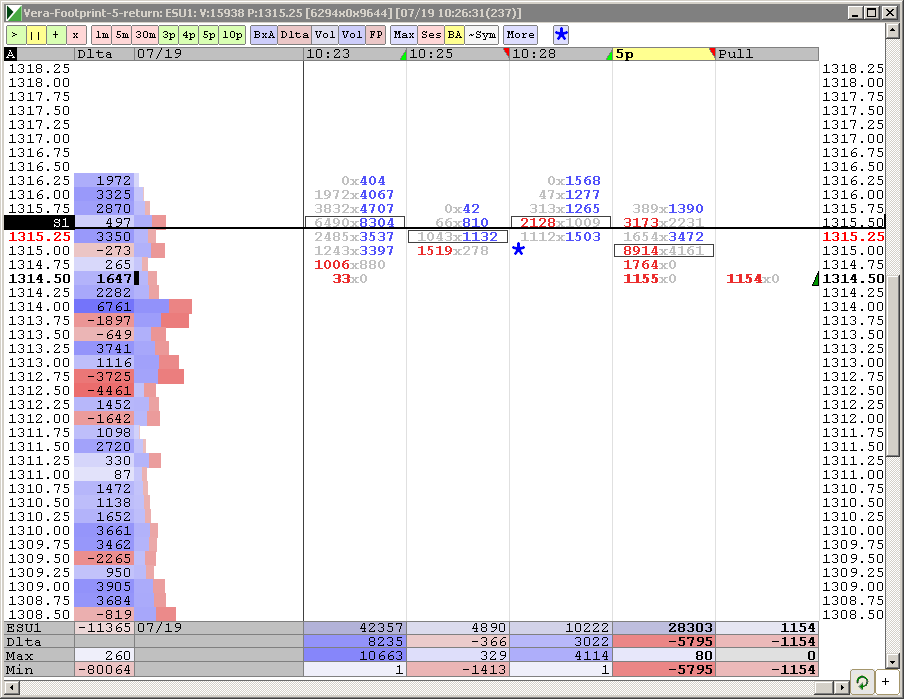

Here's the profile for the previously posted L bracket single print.

[1324.25] P

[1324.00] P

[1323.75] P

[1323.50] NP

[1323.25] NP

[1323.00] NP

[1322.75] NPQ

[1322.50] NPQ

[1322.25] NPQ

[1322.00] NPQ

[1321.75] NPQ

[1321.50] LNPQ

[1321.25] LNQ

[1321.00] LN

[1320.75] LN

[1320.50] LN

[1320.25] LMN

[1320.00] LMN

[1319.75] LMN

[1319.50] LMN

[1319.25] LMN

[1319.00] LM [DVAH]

[1318.75] LM

[1318.50] LM

[1318.25] LM

[1318.00] LM

[1317.75] LM

[1317.50] LM

[1317.25] L

[1317.00] L

[1316.75] L

[1316.50] L (single print confirmed)

[1316.25] EL

[1316.00] EFL

[1315.75] EFKL

[1315.50] EFKL

[1315.25] EFKL

[1315.00] EFKL

[1314.75] EFGKL

[1314.50] DEFGJK

[1314.25] DEFGJK

[1314.00] DEFGHJK [DPOC]

[1313.75] DEFGHJK

[1313.50] DEGHJK

[1313.25] DEGHIJK

[1313.00] DEGHIJK

[1312.75] DEGHIJK

[1312.50] DEGHIJK

[1312.25] DGHIJK

[1312.00] DHIJK

[1311.75] DHIJK

[1311.50] DHIJK

[1311.25] DHIK

[1311.00] DH

[1310.75] DH

[1310.50] DH

[1310.25] DH

[1310.00] D [DVAL]

[1309.75] D

[1309.50] D

[1309.25] D

[1309.00] D

[1308.75] D

[1308.50] D

[1308.25] D

[1324.25] P

[1324.00] P

[1323.75] P

[1323.50] NP

[1323.25] NP

[1323.00] NP

[1322.75] NPQ

[1322.50] NPQ

[1322.25] NPQ

[1322.00] NPQ

[1321.75] NPQ

[1321.50] LNPQ

[1321.25] LNQ

[1321.00] LN

[1320.75] LN

[1320.50] LN

[1320.25] LMN

[1320.00] LMN

[1319.75] LMN

[1319.50] LMN

[1319.25] LMN

[1319.00] LM [DVAH]

[1318.75] LM

[1318.50] LM

[1318.25] LM

[1318.00] LM

[1317.75] LM

[1317.50] LM

[1317.25] L

[1317.00] L

[1316.75] L

[1316.50] L (single print confirmed)

[1316.25] EL

[1316.00] EFL

[1315.75] EFKL

[1315.50] EFKL

[1315.25] EFKL

[1315.00] EFKL

[1314.75] EFGKL

[1314.50] DEFGJK

[1314.25] DEFGJK

[1314.00] DEFGHJK [DPOC]

[1313.75] DEFGHJK

[1313.50] DEGHJK

[1313.25] DEGHIJK

[1313.00] DEGHIJK

[1312.75] DEGHIJK

[1312.50] DEGHIJK

[1312.25] DGHIJK

[1312.00] DHIJK

[1311.75] DHIJK

[1311.50] DHIJK

[1311.25] DHIK

[1311.00] DH

[1310.75] DH

[1310.50] DH

[1310.25] DH

[1310.00] D [DVAL]

[1309.75] D

[1309.50] D

[1309.25] D

[1309.00] D

[1308.75] D

[1308.50] D

[1308.25] D

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.