ES 7-01-2011

Important reference numbers starting today.

Monthly close 1314.75 (4:15pm), keep in mind this is also a quarterly close.

Monthly High/Low 1342.25/1252.25

Quarterly High/Low 1368/1252.25

50% of quarterly range is 1310.25, so we have closed above that.

VPOC for the Quarter was 1323.00 and the profile has peaks in two places, at the lows between 1260-1280 then again near the June highs between 1220-1240.

Keep in mind these are all based on the September contract.

Monthly close 1314.75 (4:15pm), keep in mind this is also a quarterly close.

Monthly High/Low 1342.25/1252.25

Quarterly High/Low 1368/1252.25

50% of quarterly range is 1310.25, so we have closed above that.

VPOC for the Quarter was 1323.00 and the profile has peaks in two places, at the lows between 1260-1280 then again near the June highs between 1220-1240.

Keep in mind these are all based on the September contract.

If you will recall from yesterday Bruce and I were talking about a HVN around 1307.75 from the weekly selloff from early June.

Now yesterday has created a weekly LVN at 1307.75.

This number is now critical support for the bulls.

Now yesterday has created a weekly LVN at 1307.75.

This number is now critical support for the bulls.

June highs should read 1320-1340....

I blame Bruce!

I blame Bruce!

Originally posted by Lorn

VPOC for the Quarter was 1323.00 and the profile has peaks in two places, at the lows between 1260-1280 then again near the June highs between 1220-1240.

Keep in mind these are all based on the September contract.

If one notices, the first of the month has been negative the last 2 months in a row. Prior to that, the 1st of the month had been positive for quite a run. Not saying it will happen today. Just adding to your awareness.

Parabolic moves usually end with severe and sharp retraces,when they end.

Holiday weekend pending.

That, and the levels posted yesterday. Currnetly above 1310.50 s/r.

1313.50-1314 intermediate s/r level.

Parabolic moves usually end with severe and sharp retraces,when they end.

Holiday weekend pending.

That, and the levels posted yesterday. Currnetly above 1310.50 s/r.

1313.50-1314 intermediate s/r level.

Good observation Dave.

Originally posted by DavidS

If one notices, the first of the month has been negative the last 2 months in a row. Prior to that, the 1st of the month had been positive for quite a run. Not saying it will happen today. Just adding to your awareness.

Yours too. Also noting the hourly 50 sma at 1207 area.

overnight has the bell curve so only using those highs and lows early...would like to sell higher....reports in early trade today

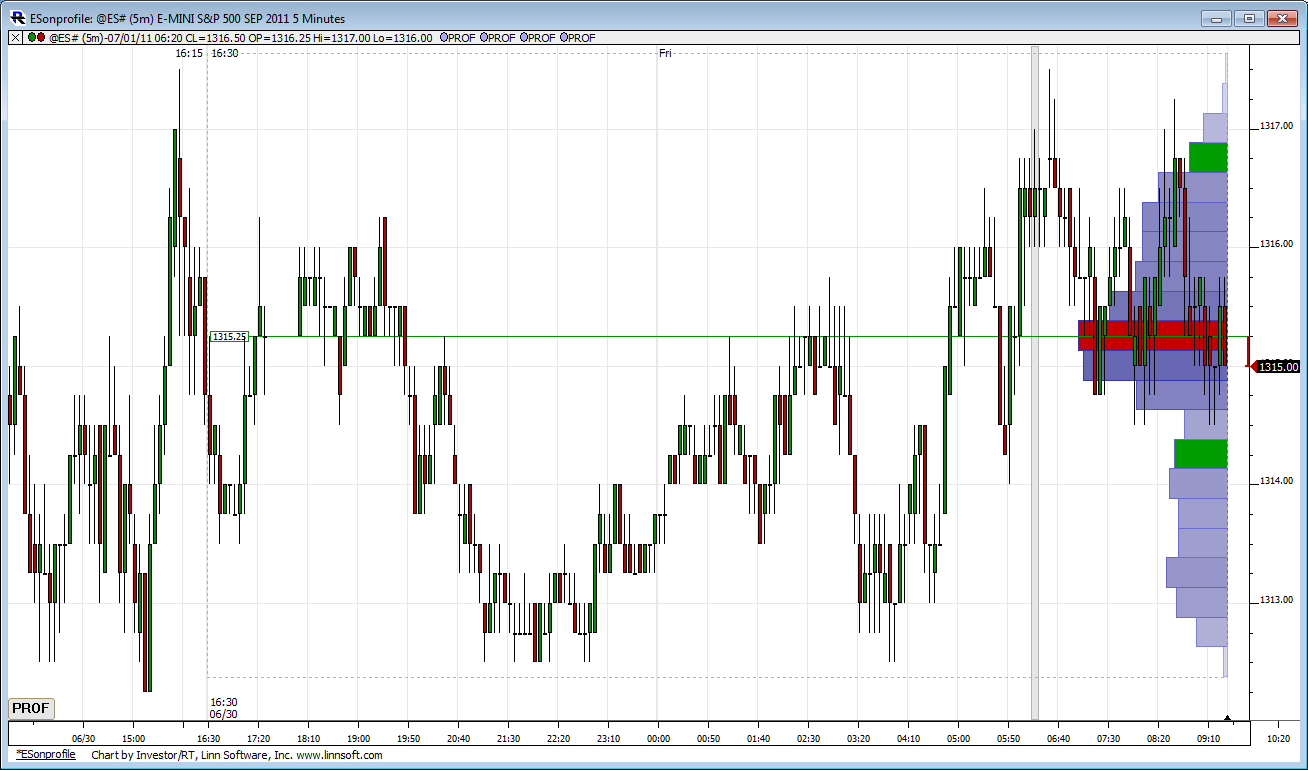

O/N Profile.

5 point range while the 5 day average range is currently 20. First day in a week prices are opening within yesterdays value.

5 point range while the 5 day average range is currently 20. First day in a week prices are opening within yesterdays value.

Also noting this is now the third lower high from the April high now even if it retraces right here. Downtrend line at 1315 level currently.It can be higher. No requirement it stops hereby that.

Also will add the 223 extension is about 1323 and that 61.8 level from the range is 1324.

Also keeping the 1315 level in mind from the Gann mention yesterday.

Thanks again for that.

Even if a correction , can run a lot higher without violating the downtrend.

Also will add the 223 extension is about 1323 and that 61.8 level from the range is 1324.

Also keeping the 1315 level in mind from the Gann mention yesterday.

Thanks again for that.

Even if a correction , can run a lot higher without violating the downtrend.

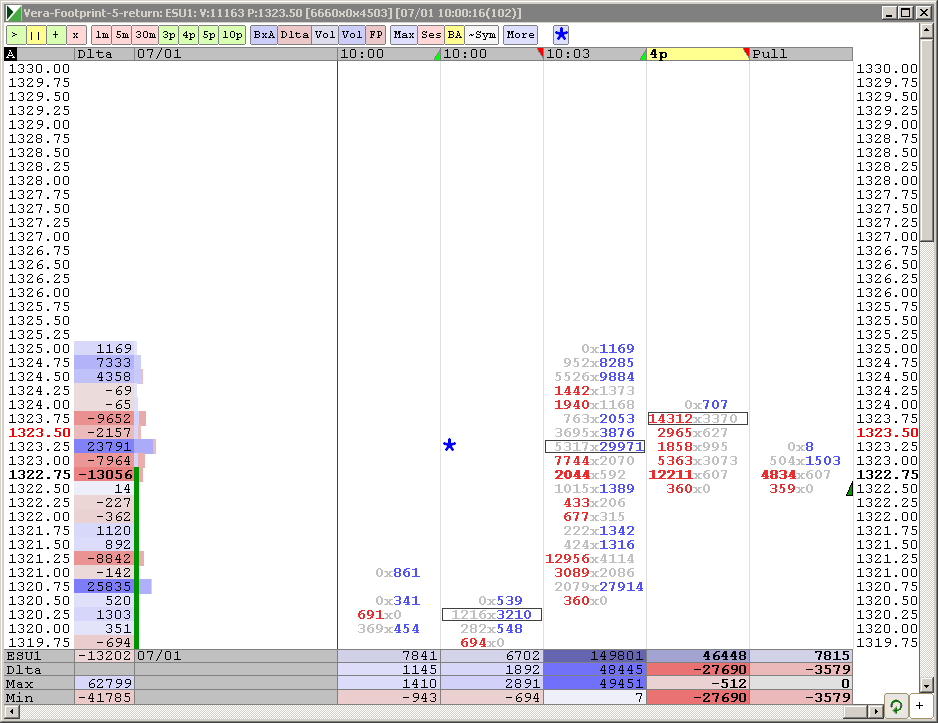

sold the plus 8 just now...25 is a key rat....

They maade us wait until Tuesday...lol

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.