ES 6/30/11

Straight up usually stays that way until it doesn't if you think about it.

Maybe some surprising numbers you haven't thought about.

From the April high to the June low the fib levels are;

1280-23.6%

1297-38.2%

1310.50-50%

1324.25-62%

For June range the levels are;

1273.50

1286.50

1297

1307.75

respectively.

I'm currently using two different extensions(when in doubt)and the one previously mentioned has 1309 as the 161.8% level.

Alternatively,the other has 1305, 1310.50, and 1319.50 as the 123,138,and 161% levels.

Personally, I take the 50% levels as the strongest tell. Strength above,and weakness below. Note the levels that match up with others and they too are given a little more weight(ie;1297).

End of quarter really is only displayed in relative performance to peer funds and what looks best in required publishings to investors. I don't know if this lift is corrective or impulsive(5th wave). It doesn't really matter to me,yet.

I will point out it negated a head and shoulders down pattern and took out 6 previous highs on it's way up.

Trade em how you like as that's what it's all about.

Maybe some surprising numbers you haven't thought about.

From the April high to the June low the fib levels are;

1280-23.6%

1297-38.2%

1310.50-50%

1324.25-62%

For June range the levels are;

1273.50

1286.50

1297

1307.75

respectively.

I'm currently using two different extensions(when in doubt)and the one previously mentioned has 1309 as the 161.8% level.

Alternatively,the other has 1305, 1310.50, and 1319.50 as the 123,138,and 161% levels.

Personally, I take the 50% levels as the strongest tell. Strength above,and weakness below. Note the levels that match up with others and they too are given a little more weight(ie;1297).

End of quarter really is only displayed in relative performance to peer funds and what looks best in required publishings to investors. I don't know if this lift is corrective or impulsive(5th wave). It doesn't really matter to me,yet.

I will point out it negated a head and shoulders down pattern and took out 6 previous highs on it's way up.

Trade em how you like as that's what it's all about.

Also 8.75 and 9.25 - forgot to mark

paul, the chicago pmi number is released at 9:42am et to those who pay to have that data in advance; the official release is at 9:45 et for the rest of the world ! it is the only piece of data where this is the case

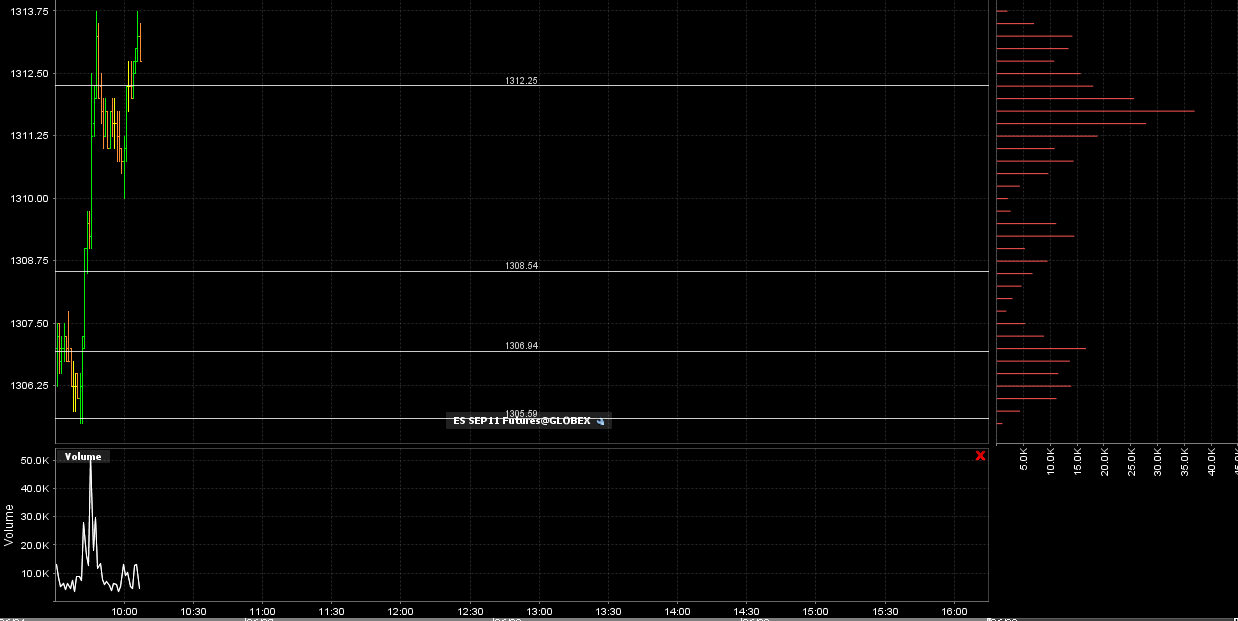

first target is 1310.25...that is slightly above air pocket highs

5 points above the O/N high was 1313.50...!!

thanks apk, I forgot.

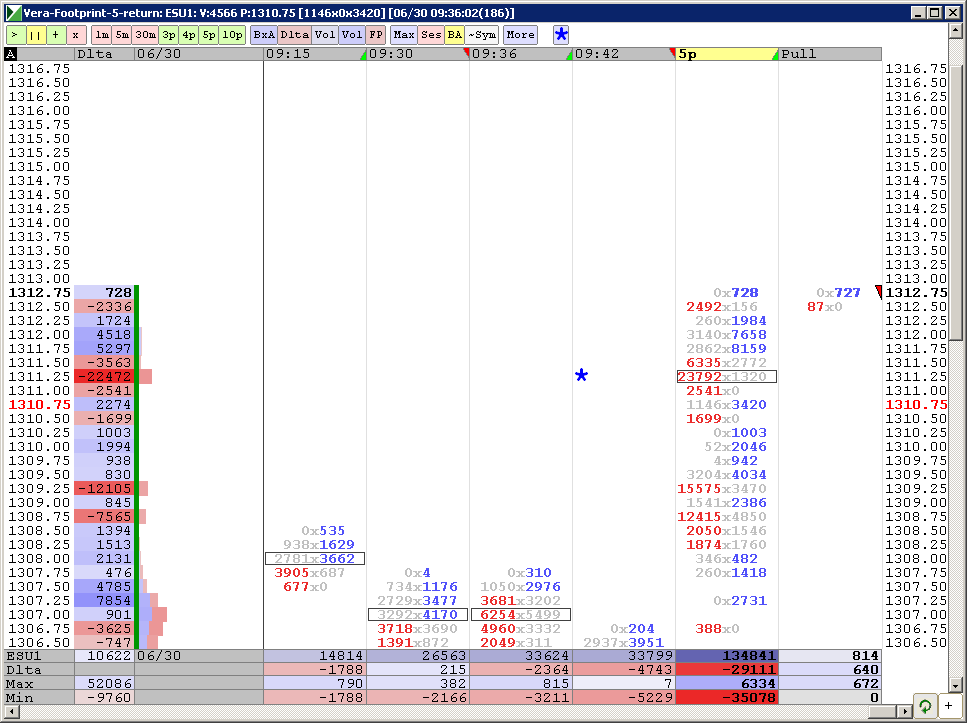

starting new sells at 1313.75.....will add only above 15.50 if needed..plus 8 - 10 range is up there for add ons...1311.50 is target...High volume there

profile is ugly and a possible double top that probably won't hold

was gonna post a picture of myself but here is what UGLY looks like to me...all those low and high volume spots.......still hoping they push out those highs..

11.75 is revised HV target

11.75 is revised HV target

i am hoping they push it all the way up to the 19-20 area, have a daily 1.618 projection there (coming from the 52.25-93.75 move) along with hourly and 30 min projections, so hopefully a good place for a nice retrace.

Before that i don't have anything i trust too much...had the 12-13 area fully loaded with projections of all types as well and has served as a stop point for now with the pitbull number there and 1.618 of the stretch as well.

Before that i don't have anything i trust too much...had the 12-13 area fully loaded with projections of all types as well and has served as a stop point for now with the pitbull number there and 1.618 of the stretch as well.

Bruce - continued success and a happy Holiday weekend to you and the family. Many of us appreciate the sharing. Thanks.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.