ES 06-21-11

I thought that if I at least opened a thread about today, that others would post some things.

the gap today has created an island below because price opened inside the gap

Gap is 75.75 to 84.50, it was created by the down open on 6-15-11 and subsequently has never filled,

the open today gapped up, retreated to a low of 77.50, that leaves island style gap 77.50 down to 75.75.

I would expect small moves, and odds favor a fill of the ES lower ghap today.

I consider yesterday a trend day.

today (day following trend day) often has consolidation, intraday zigging and zagging.

Some one else can post something now.

the gap today has created an island below because price opened inside the gap

Gap is 75.75 to 84.50, it was created by the down open on 6-15-11 and subsequently has never filled,

the open today gapped up, retreated to a low of 77.50, that leaves island style gap 77.50 down to 75.75.

I would expect small moves, and odds favor a fill of the ES lower ghap today.

I consider yesterday a trend day.

today (day following trend day) often has consolidation, intraday zigging and zagging.

Some one else can post something now.

Looking at 1275 buy with multiple support confirmation. Unless it wants to go long, and will sell the NPOC at 83.75

Can someone enlighten me as far as what people look for regarding the RTH range of Monday? Is it merely, if we reach 1.618, then look for 2.0? Is there more to look for?

neo,

Yes.

if RTH during the week can print at the 1.618 of Monday's RTH Range then odds historically have been about 8 in 10 that the full extension (Monday's RTH range added to Monday's RTH H) will print before the next Monday.

1.618 up of Monday this week = 1284.00 (actually 1283.90)

This has printed.

full extension up is 1289.25

Things to be aware of.

It is OK if after having printed at 1.618 without moving up to full extension, price can retreat to test Monday's RTH H, but really should bounce there for a run (bullish)

A move to 50% of Monday's range raises real doubts about ability to make a full extension.

Monday's H 1275.25

50% of Monday's range = 1268.25

BTW I have a friend who SELLS the first print of 1.618, looking to scalp 2 points on a retracement.

Yes.

if RTH during the week can print at the 1.618 of Monday's RTH Range then odds historically have been about 8 in 10 that the full extension (Monday's RTH range added to Monday's RTH H) will print before the next Monday.

1.618 up of Monday this week = 1284.00 (actually 1283.90)

This has printed.

full extension up is 1289.25

Things to be aware of.

It is OK if after having printed at 1.618 without moving up to full extension, price can retreat to test Monday's RTH H, but really should bounce there for a run (bullish)

A move to 50% of Monday's range raises real doubts about ability to make a full extension.

Monday's H 1275.25

50% of Monday's range = 1268.25

BTW I have a friend who SELLS the first print of 1.618, looking to scalp 2 points on a retracement.

Originally posted by PAUL9

neo,

Yes.

if RTH during the week can print at the 1.618 of Monday's RTH Range then odds historically have been about 8 in 10 that the full extension (Monday's RTH range added to Monday's RTH H) will print before the next Monday.

1.618 up of Monday this week = 1284.00 (actually 1283.90)

This has printed.

full extension up is 1289.25

Things to be aware of.

It is OK if after having printed at 1.618 without moving up to full extension, price can retreat to test Monday's RTH H, but really should bounce there for a run (bullish)

A move to 50% of Monday's range raises real doubts about ability to make a full extension.

Monday's H 1275.25

50% of Monday's range = 1268.25

BTW I have a friend who SELLS the first print of 1.618, looking to scalp 2 points on a retracement.

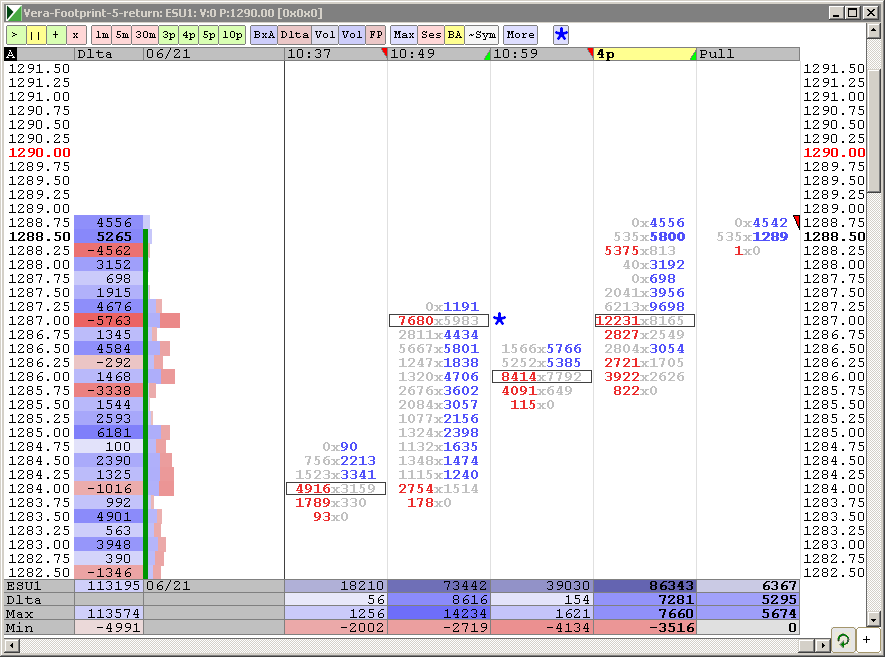

Great! Thanks for the explanation. My numbers seem to match yours, though I am adding 0.618 of the range to the High, versus adding 1.618 of the range from the low. Either way, it gets to the same 1284. (as you can see from the screenshot.

Coincidentally, we are fighting there now...

I was going to comment that I've seen resistance there and a return to the high. Sometimes it only gets to the 52.8% of the range (152.8% from the low) and find resistance (or support from the other side).

Got 1 handle. Runner stopped out at break even - was looking for 1281. Next effort at 87 short.

neo,

RE the .618 and 1.618 labels.

Technically (for me) taking .618 of Monday's range and adding it to Monday's H is a 618 extension.

I have used the 1.618 label due to the fact that most fibbo drawing tools label the .618 extension as 1.618 or 161.8%, the "1" in the front of the number representing Monday's range.

technically it is a .618 extension of the range.

and if someone has a fibbo drawing tool labeled 1.618, then understand that the full extension would be represented by 2.000 value

RE the .618 and 1.618 labels.

Technically (for me) taking .618 of Monday's range and adding it to Monday's H is a 618 extension.

I have used the 1.618 label due to the fact that most fibbo drawing tools label the .618 extension as 1.618 or 161.8%, the "1" in the front of the number representing Monday's range.

technically it is a .618 extension of the range.

and if someone has a fibbo drawing tool labeled 1.618, then understand that the full extension would be represented by 2.000 value

Originally posted by PAUL9

Technically (for me) taking .618 of Monday's range and adding it to Monday's H is a 618 extension.

And to make things even more complicated, some charting software call it a "projection". ;]

So, in this instance are you saying you prefer to call the 1284 level 1.618 or 0.618 of Monday's Range? Just looking to see what people consider it. (From your explanation, it seemed like 0.618)

yes, 618 extension is what I prefer to call it, because that's what it is.

One off at 1285.50. Runner at BE 1287. Looking for 84

as per dalton:

"I’m only looking at the POC for the afternoon rather than the full day; when a market converts from trend to rotational I treat the rotational market as a separate day or auction."

makes sense to me...that's why I attempted those higher sells..

"I’m only looking at the POC for the afternoon rather than the full day; when a market converts from trend to rotational I treat the rotational market as a separate day or auction."

makes sense to me...that's why I attempted those higher sells..

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.