ES 06-17-11

Very interesting.

here's an old school chart read.

Thursday: price probed lower (Lower than Wednesday Lows) and discovered buyers, not sellers (if price had probed lower and triggered sell stops, price would have fallen further).

So, the presence of buyers has been established to exist ES SEP 55-52 area

there is a gap overhead at 75.75 to 84.50 SEP

If price can get above Thursday's H (1275.75, oh S%#*!!, it's already doing it, starting to print above 75.75 as I type), then the logical upside is half gap fill (1280.00) and then 84.50 (full fill)

the move above yesterday's H (75.75) is squeezing all the bears who never got out of their short positions yesterday.

As I write, ES has already exceeded 75.75 (beginning of gap), so (ideally for full) that area now has to act like support (support 75-72.50 area)

a stall near 77.50 would be natural (77.50-77.75 is 50% of last week's range).

here's an old school chart read.

Thursday: price probed lower (Lower than Wednesday Lows) and discovered buyers, not sellers (if price had probed lower and triggered sell stops, price would have fallen further).

So, the presence of buyers has been established to exist ES SEP 55-52 area

there is a gap overhead at 75.75 to 84.50 SEP

If price can get above Thursday's H (1275.75, oh S%#*!!, it's already doing it, starting to print above 75.75 as I type), then the logical upside is half gap fill (1280.00) and then 84.50 (full fill)

the move above yesterday's H (75.75) is squeezing all the bears who never got out of their short positions yesterday.

As I write, ES has already exceeded 75.75 (beginning of gap), so (ideally for full) that area now has to act like support (support 75-72.50 area)

a stall near 77.50 would be natural (77.50-77.75 is 50% of last week's range).

Originally posted by PAUL9

Very interesting.

here's an old school chart read.

Thursday: price probed lower (Lower than Wednesday Lows) and discovered buyers, not sellers (if price had probed lower and triggered sell stops, price would have fallen further).

So, the presence of buyers has been established to exist ES SEP 55-52 area

there is a gap overhead at 75.75 to 84.50 SEP

If price can get above Thursday's H (1275.75, oh S%#*!!, it's already doing it, starting to print above 75.75 as I type), then the logical upside is half gap fill (1280.00) and then 84.50 (full fill) I assume you are referring to ESM1? I have 74.50 as it's high?the move above yesterday's H (75.75) is squeezing all the bears who never got out of their short positions yesterday.

As I write, ES has already exceeded 75.75 (beginning of gap), so (ideally for full) that area now has to act like support (support 75-72.50 area)

a stall near 77.50 would be natural (77.50-77.75 is 50% of last week's range).

Orders at 1283.75 Sell NPOC and Paul's reference.

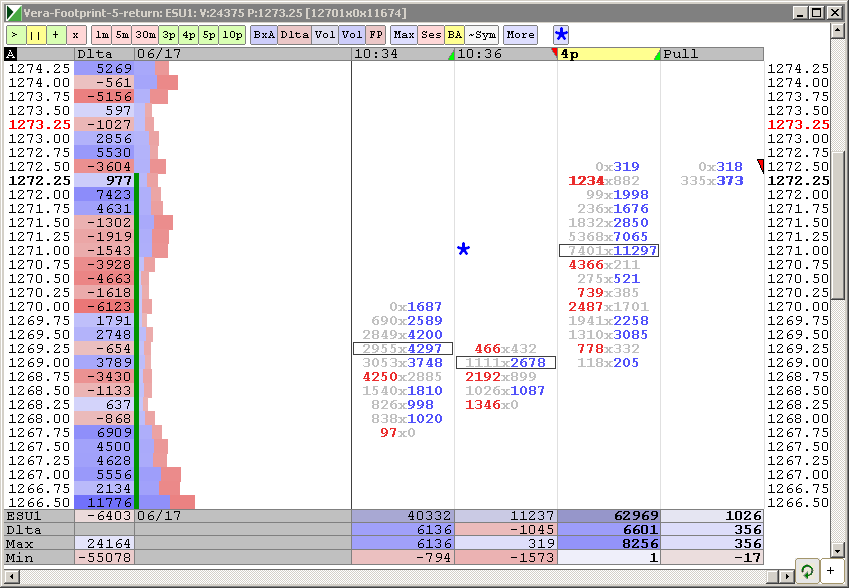

Buying at 1268.50 around yeasterday's high and VAH.

ESU1

Good luck to all!

Forest and trees.

We look at minutia. I constantly have to keep reminding myself to see the 'forest'

I'm want to post a chart, can soemone help me out here...

do I 'attach' it

or do I upload it

in order to just get a chart to be visible in the thread

We look at minutia. I constantly have to keep reminding myself to see the 'forest'

I'm want to post a chart, can soemone help me out here...

do I 'attach' it

or do I upload it

in order to just get a chart to be visible in the thread

Mich consumer Sentiment in 4 minutes

If I remember correctly... BOTH..

the file needs to be uploaded first and then it will show up on a list in the attached area.

Have your cursor where the image will be and select the uploaded file from the attached list. I think that should do it.

the file needs to be uploaded first and then it will show up on a list in the attached area.

Have your cursor where the image will be and select the uploaded file from the attached list. I think that should do it.

Originally posted by PAUL9

Forest and trees.

We look at minutia. I constantly have to keep reminding myself to see the 'forest'

I'm want to post a chart, can soemone help me out here...

do I 'attach' it

or do I upload it

in order to just get a chart to be visible in the thread

Originally posted by PAUL9

Forest and trees.

We look at minutia. I constantly have to keep reminding myself to see the 'forest'

I'm want to post a chart, can soemone help me out here...

do I 'attach' it

or do I upload it

in order to just get a chart to be visible in the thread

http://www.mypivots.com/board/topic/10/1/how-to-upload-charts-and-images-to-the-forum

fwiw... June contract closed at 1281, wonder if we will test that level at all, I have 80.5 as a 30 min range expansion target to the upside if can BO

thanks for explanations (TY MM)

we are always looking at the trees. here's a picture of the forest

make your own assumptions about what might be important in the "forest."

(Prior year H (2010) not shown because it is virtually identical to Close of the year 2010 (close of the prior year is the thick Red line marked close 2010)

money managers peg yearly returns to the close of the prior year.

Chart is CASH S&P500

we are always looking at the trees. here's a picture of the forest

make your own assumptions about what might be important in the "forest."

(Prior year H (2010) not shown because it is virtually identical to Close of the year 2010 (close of the prior year is the thick Red line marked close 2010)

money managers peg yearly returns to the close of the prior year.

Chart is CASH S&P500

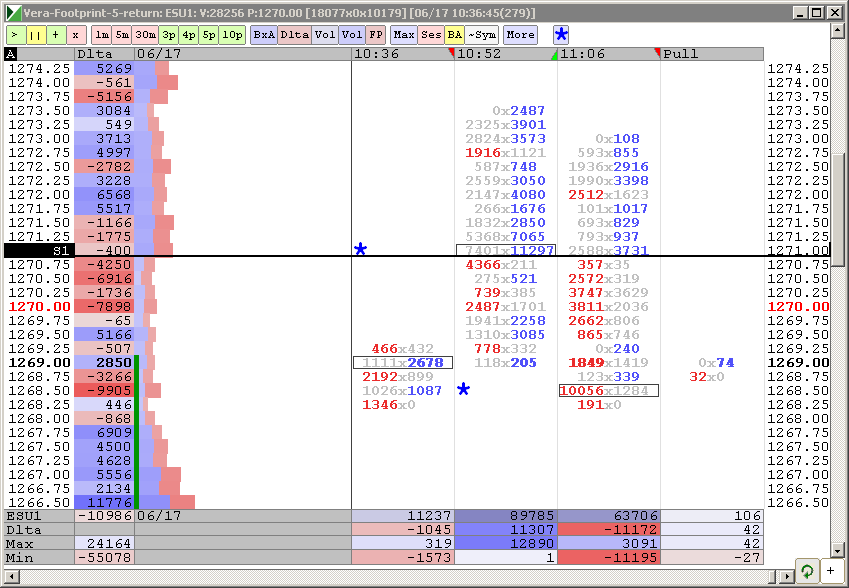

Filled at 1268.50 flat at 1271.25. Have a great weekend, done for the week.

two unfilled Triples. I've been losing this late in the day. So I'm out, but there are two unfilled Triples. one at 68.5 and 72.25. FYI

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.