ES 6-9-2011

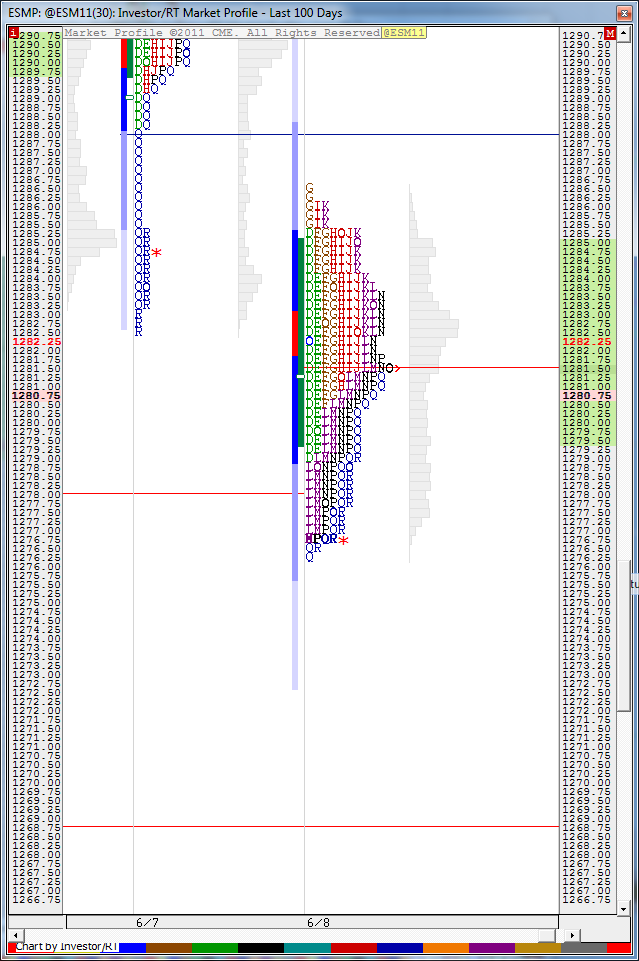

From an MP perspective. We have a NPOC below (red line) and single prints above in the Q's (blue line).

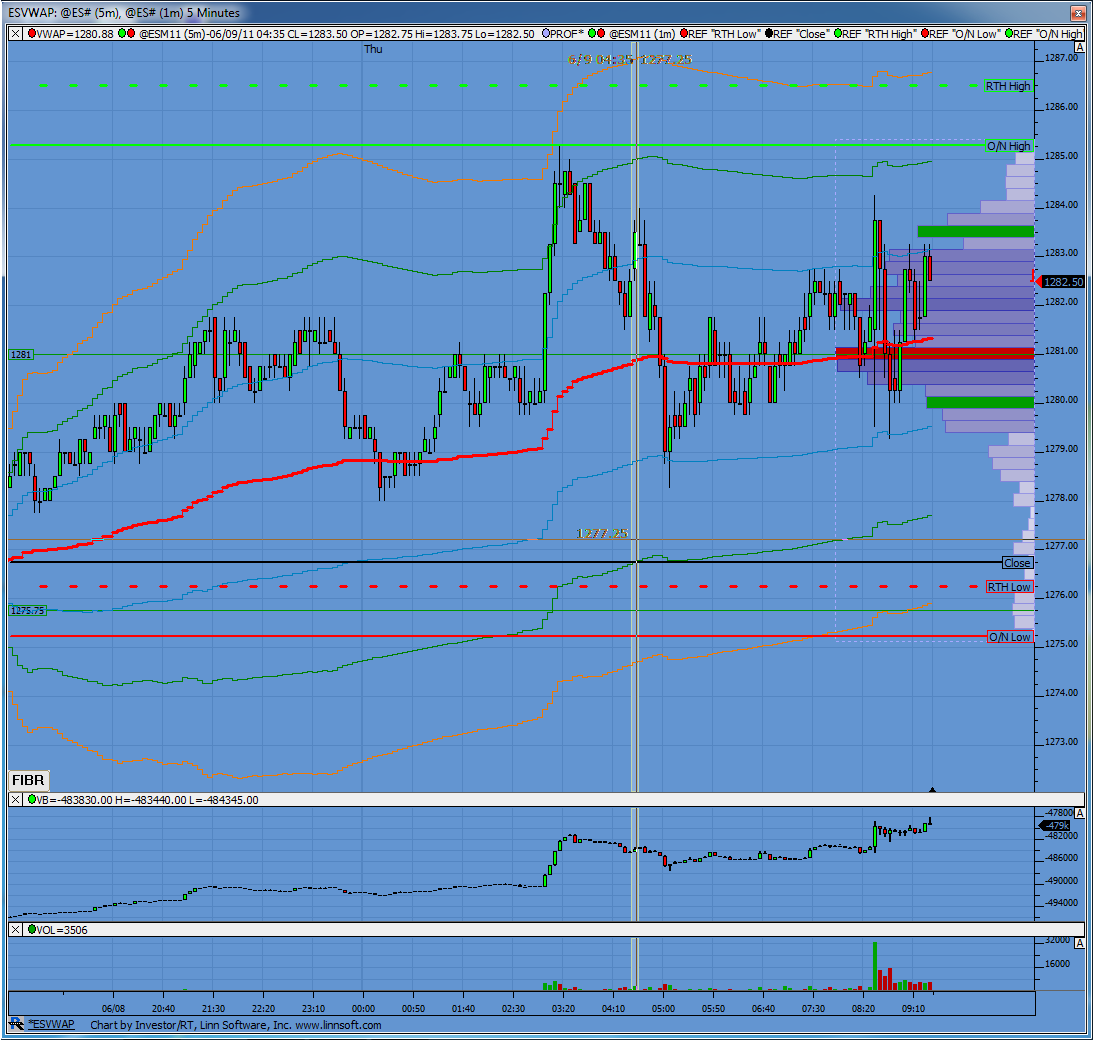

nice visuals for us Lorn...only one trade for me today and that will be for the 82.50 retest in day session....June contract...I find rollover is confusing for all and doesn't trend well.....no reports will help the fade trade today

pitbullers know where the minus 2.5 and minus 4 -5.5 zone is....starting at 79.25 today long !!

Welcome back to yesterday.

ON low piecred the 1276.75 level but hour chart had no seperation yet.

1279.50 still a factor so far. Those need to hold for anything positive.

Above those the level to break and hold 1285.50 for higher.

ON low piecred the 1276.75 level but hour chart had no seperation yet.

1279.50 still a factor so far. Those need to hold for anything positive.

Above those the level to break and hold 1285.50 for higher.

last runner came off at 83.50...hope all have a great day

I noticed the Monday fibs were mentioned yesterday. I ran the fibs for the SEP Contract (not really as reliable because all traders' attention is not directed to the next contract on the Monday of rollover week".

Here are the Monday fibs based on SEP ES

"Fxu" Fibbo Xpansion UP

"Fxd" Fibbo Xpansion Down

REM These are all SEP (ESU11) prics

Fxu200, 1322.25

Fxu161, 1316.62

Fxu100, 1307.50

>>>>>>>>>>>>>>>>>>>>< Fxu061, 1301.87

50% of Monday's Range, 1285.38 (SEP CONTRACT)

>>>>>>>>>>>>>>>>>>>>< FxD061, 1268.88

FxD100, 1263.25

FxD161, 1254.13

SEP has not printed the the 618 down (neither has the JUN, JUN 618 (=to 1.618 or 161.8% on drawing tools), JUN 618 down is 1274.00, full extension down of Monday's range (monday's range subtracted from Monday's RTH L (4:15 Close) = 1268.25

This market is ripe for rebound and if yesterday's RTH H is exceeded it should generate at the least) an intraday short-covering jump

yesterday's H in SEP was 1281.00

yesterday's H in JUN was 1286.50

why are these prices important to me?

because bears will be trapped short, forced to "buy to cover."

BTW 50% of MOnday's JUN = 1290.75

Here are the Monday fibs based on SEP ES

"Fxu" Fibbo Xpansion UP

"Fxd" Fibbo Xpansion Down

REM These are all SEP (ESU11) prics

Fxu200, 1322.25

Fxu161, 1316.62

Fxu100, 1307.50

>>>>>>>>>>>>>>>>>>>>< Fxu061, 1301.87

50% of Monday's Range, 1285.38 (SEP CONTRACT)

>>>>>>>>>>>>>>>>>>>>< FxD061, 1268.88

FxD100, 1263.25

FxD161, 1254.13

SEP has not printed the the 618 down (neither has the JUN, JUN 618 (=to 1.618 or 161.8% on drawing tools), JUN 618 down is 1274.00, full extension down of Monday's range (monday's range subtracted from Monday's RTH L (4:15 Close) = 1268.25

This market is ripe for rebound and if yesterday's RTH H is exceeded it should generate at the least) an intraday short-covering jump

yesterday's H in SEP was 1281.00

yesterday's H in JUN was 1286.50

why are these prices important to me?

because bears will be trapped short, forced to "buy to cover."

BTW 50% of MOnday's JUN = 1290.75

For those watching NakedPOCs, do the NPOCs for the June contract remain as reference for the Sept. contract?

Thanks Bruce, got the pitbull -2.5 on the Sept. contract.

Thanks Bruce, got the pitbull -2.5 on the Sept. contract.

Parabolic move off 1279.50 1 min chart with retrace and bounce off 1285'50 so far from the open. 1285.50 the level to hold. Always great numbers Paul!

Originally posted by BruceM

pitbullers know where the minus 2.5 and minus 4 -5.5 zone is....starting at 79.25 today long !!

In for a short while today. Bruce, what are the "pitbullers" please?

Needs to get above the 50%

50% is 1292.50 for clue here. Can spike as long as 1291 holds.

maybe not todays business?

50% is 1292.50 for clue here. Can spike as long as 1291 holds.

maybe not todays business?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.