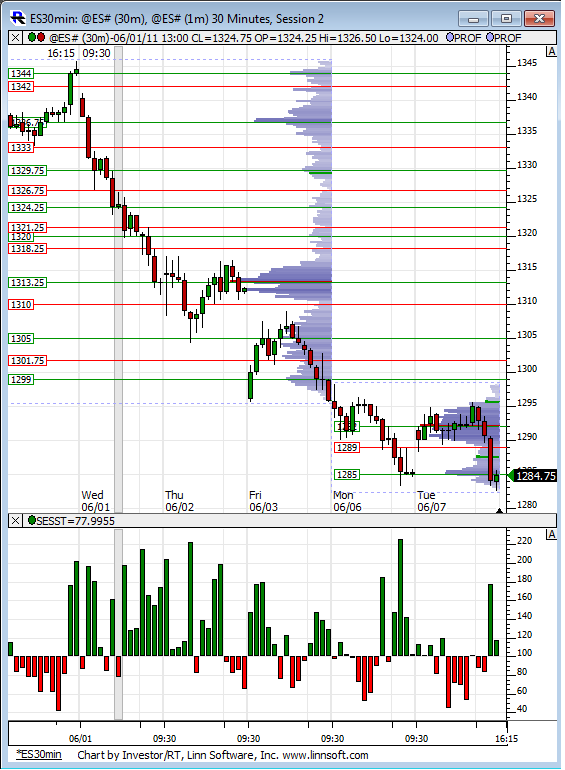

ES 6-8-2011

From the perspective of the RTH session only as on this chart, you can see that Monday/Tuesday have been a big consolidation from last weeks down move. Are we seeing a break of the range to the downside here in the O/N? The only clue on this chart is down moves have come on surging volume, up moves on decreasing volume.

Low from 3-23 of 1279 has now been breached and if you look at a daily all session chart there is a gap in the data from the open on 3-18 of 1268.50 to the low on 3-21 of 1274.75.

Low from 3-23 of 1279 has now been breached and if you look at a daily all session chart there is a gap in the data from the open on 3-18 of 1268.50 to the low on 3-21 of 1274.75.

what report? Beige book at 2:00pm?

82.50 will be a magnet and air is before that

nice call Bruce

here is what was came out at 10.....it would be nice know just how much POTENTIAL each report has to move the market ...some are bigger market movers than others but I never assume anything.

http://www.mypivots.com/dictionary/definition/395/quarterly-services-survey

That 82.50 is peak volume......new lows now would really mess up the long side and would probably push for O/N lows....I'd prefer to see the new highs as all that low volume is up there and it might be easier to get through that for the O/N highs

http://www.mypivots.com/dictionary/definition/395/quarterly-services-survey

That 82.50 is peak volume......new lows now would really mess up the long side and would probably push for O/N lows....I'd prefer to see the new highs as all that low volume is up there and it might be easier to get through that for the O/N highs

Thanks Palmer.. it was just the pitbull numbers with the big difference being that I would have added near that volume Lorn mentioned from the O/N session...as that was also near the minus 5.5 number...

also we had that air pocket to help pull us back up...and I saw that 82.50 volume....we know they will go for volume...now the big question is will they go for the 87.50 volume from yesterday or go for that volume from the O/N session....which side of the open print and the day session volume can help as a filter but certaily isn't perfect...I'm hoping for the 87.50....but then again I am on my third day of hoping for the low to high day...so soon I will be right LOL!!!

also we had that air pocket to help pull us back up...and I saw that 82.50 volume....we know they will go for volume...now the big question is will they go for the 87.50 volume from yesterday or go for that volume from the O/N session....which side of the open print and the day session volume can help as a filter but certaily isn't perfect...I'm hoping for the 87.50....but then again I am on my third day of hoping for the low to high day...so soon I will be right LOL!!!

Originally posted by palmer

nice call Bruce

Thanks, Bruce.

That report is not anything I have ever seen as a market mover.

could I be wrong about its market impact?

I can be wrong every single day of the week.

That report is not anything I have ever seen as a market mover.

could I be wrong about its market impact?

I can be wrong every single day of the week.

that report is a non event

i am sure most of you are familiar with this website: http://fidweek.econoday.com/

for those of you that don't know which reports are relevant and which are not (aside from the unemployment numbers and so on) there is a star next to the time of the announcement that indicates its importance: ie red very important, yellow somewhat important , etc

i am sure most of you are familiar with this website: http://fidweek.econoday.com/

for those of you that don't know which reports are relevant and which are not (aside from the unemployment numbers and so on) there is a star next to the time of the announcement that indicates its importance: ie red very important, yellow somewhat important , etc

Is there any good resource to see which reports are traditionally big market movers and ones that are meaningless..We know employment is biggie but what about these other ones...? I wonder if anyone has tracked the average market moves based on the specific reports.. Would be a good study for reference.

How convenient that the market is stuck near O/N midpoint

How convenient that the market is stuck near O/N midpoint

Originally posted by PAUL9

Thanks, Bruce.

That report is not anything I have ever seen as a market mover.

could I be wrong about its market impact?

I can be wrong every single day of the week.

Bruce - where can I find what is PITBULL #. never heard of that

bruce see my response above...i used to work on wall street and i am well aware of the importance of each report, and the categorization done on the website i mentioned is pretty accurate

Originally posted by BruceM

Is there any good resource to see which reports are traditionally big market movers and ones that are meaningless..We know employment is biggie but what about these other ones...? I wonder if anyone has tracked the average market moves based on the specific reports.. Would be a good study for reference.

How convenient that the market is stuck near O/N midpointOriginally posted by PAUL9

Thanks, Bruce.

That report is not anything I have ever seen as a market mover.

could I be wrong about its market impact?

I can be wrong every single day of the week.

Originally posted by NickP

i thought the same thing when i looked at my screen after 4.30pm but then i noticed dtn-iq had rolled over to sep; don't know why, jun is still good till tomorrow afternoon, volume wise

My research shows that volume switches to the new contract at 9:30am tomorrow morning:

http://www.mypivots.com/articles/articles.aspx?artnum=10&page=5

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.