ES 6-7-11

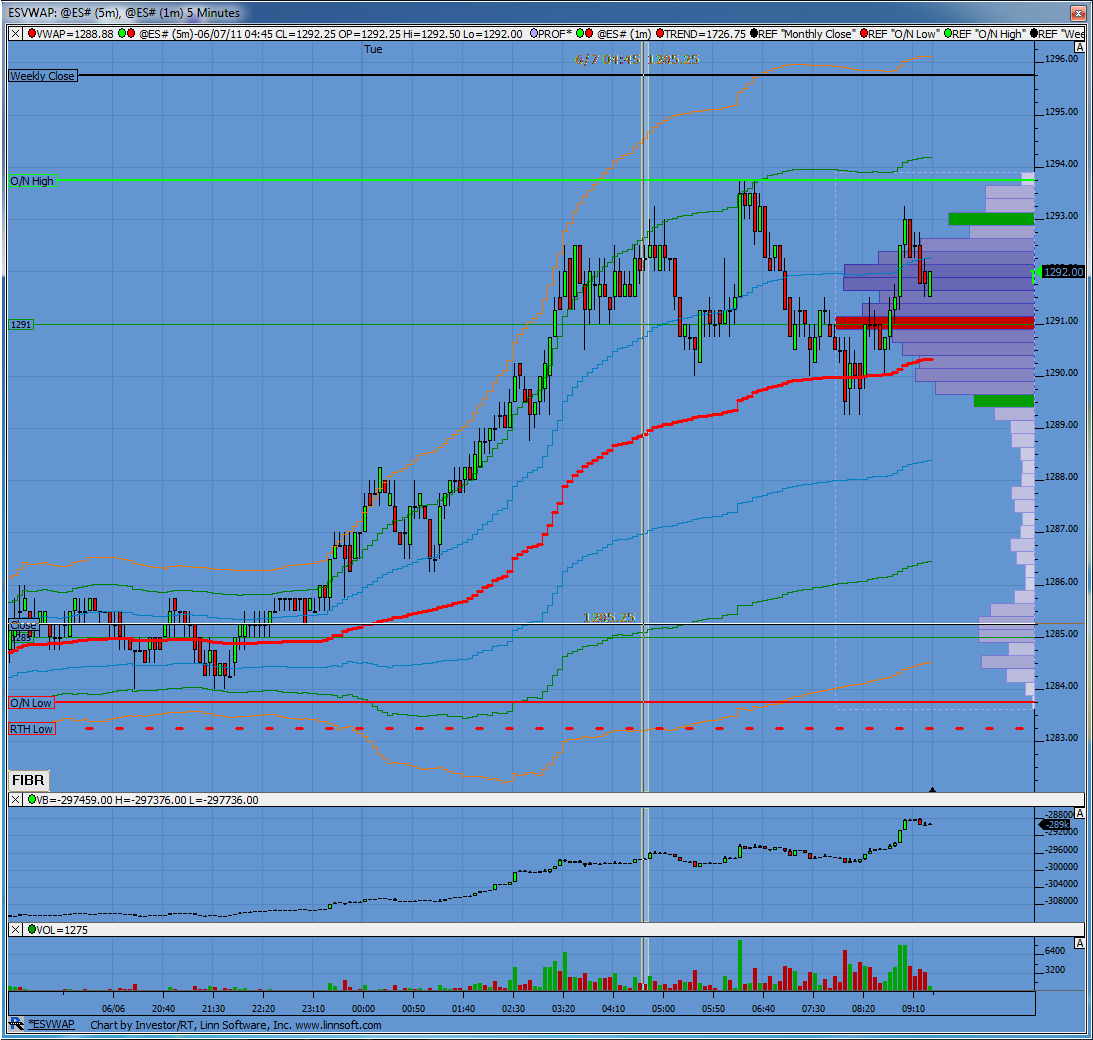

Most important today will be the 89 - 90 area...that is the April swing low point we mentioned yesterday. It is also the afternoon swing high point from yesterday and the VA low.

Best thing for bulls will be to hold that and avoid any gap fill from the higher open. We are currently at 90.50 in the O/N session and the close of yesterday is down at 85.

On the upside we have the current O/N high, the open from Monday, last weeks lows and the POC all at the 94 - 96 area....key resistance for early trade. I still have my eyes on that 1302 - 1304 area as a price that needs to be tested and soon. Hopefully today.

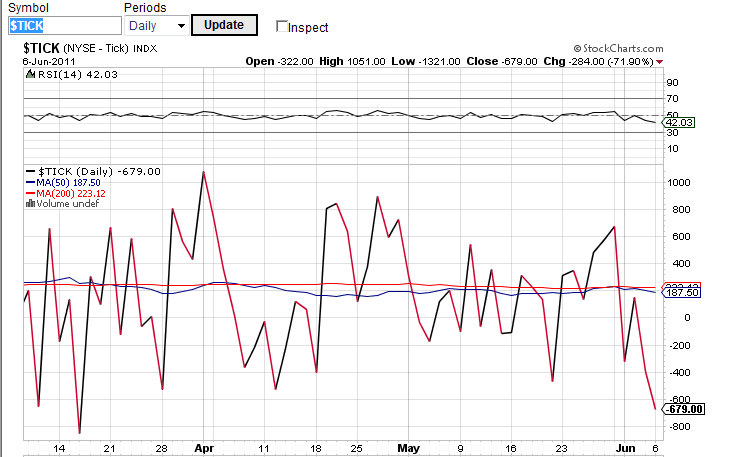

I was hoping yesterday would have been the rally day and was wrong. We have had 4 down days now and the $tick closes are now oversold so a bounce or consolidation is in order. Still lots of work on the upside and the areas mentioned in YD posts are still valid .

Here is a screen shot of the tick closes. Yesterday we had the lowest close since mid March and we are in a place where we see some snap back. Odds have increased for the up day I think. We need to watch to see if they attempt to fill the gap and then come back up through the open. They tried to come back through the open multiple times yesterday and failed.

Best thing for bulls will be to hold that and avoid any gap fill from the higher open. We are currently at 90.50 in the O/N session and the close of yesterday is down at 85.

On the upside we have the current O/N high, the open from Monday, last weeks lows and the POC all at the 94 - 96 area....key resistance for early trade. I still have my eyes on that 1302 - 1304 area as a price that needs to be tested and soon. Hopefully today.

I was hoping yesterday would have been the rally day and was wrong. We have had 4 down days now and the $tick closes are now oversold so a bounce or consolidation is in order. Still lots of work on the upside and the areas mentioned in YD posts are still valid .

Here is a screen shot of the tick closes. Yesterday we had the lowest close since mid March and we are in a place where we see some snap back. Odds have increased for the up day I think. We need to watch to see if they attempt to fill the gap and then come back up through the open. They tried to come back through the open multiple times yesterday and failed.

On the downside we have a swing low at 79.50 from 3-23 and yesterdays lows at 83.25....so that will be first support IF we happen to trade lower today....I'm not expecting that to hit but as usual anything is possible

A bearish note, but it is O/N data, I'm tracking O/N volume spikes coming in at 1292 and the largest so far at 1293.5 zone, which is the O/N high so far.

Still an hour to go.

Still an hour to go.

it should be mentioned that the closing $tick concept comes from our good friend KoolBlue here at the forum.

The POC just flipped from 1285.25 up to 1291.50 for the O/N session. Lots of space between the two.

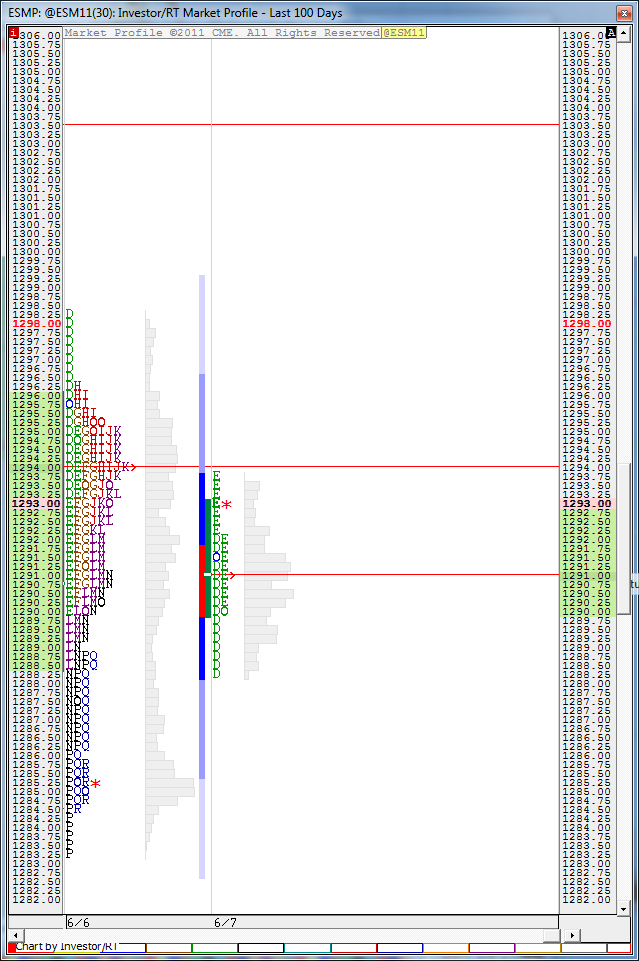

there are those out there who like to trade for the volume ( like me)so if we define the volume above and below we get the following as targets

1303

1295.50

1291.50

1285

so we can trade for the volume retests since price gets attracted back to volume

simple truths we use everyday here in the forum

1303

1295.50

1291.50

1285

so we can trade for the volume retests since price gets attracted back to volume

simple truths we use everyday here in the forum

Another spike at 1293 just again.

Nice how that O/N high respected that..double top now between that O/N high and day session high......I was planning to short above the O/N high and the plus 2.5 but it looks like they front ran the numbers...

will need to be more selective when we break that double top

Hopefully some saw how we hit the minus 2.5 into our key support zone

Lorns volume chart should not be taken lightly...that was a perfcet bell curve at the upper distribution of O/N data

will need to be more selective when we break that double top

Hopefully some saw how we hit the minus 2.5 into our key support zone

Lorns volume chart should not be taken lightly...that was a perfcet bell curve at the upper distribution of O/N data

hehe...you liked that?

Originally posted by BruceM

that was a bit greedy on your part LORN !!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.