ES Day Trading 6-1-2011

Some early observations.

Divergence between ES and NQ at there respective O/N highs as NQ surpassed the 8:00pm highs made while ES did not.

ES has now traded back to yesterday's POC of 1337.75 and trying to stabilize.

1338.25 is the 2.618 projection down off the 30-min initial move. 1333.25 is YD RTH low while just below that is 4.236 projection of 1332.25 off the 30 min initial move down.

CD divergence at the high also indicates to me O/N inventory is currently short. Do they have the strength to keep prices going lower?

Divergence between ES and NQ at there respective O/N highs as NQ surpassed the 8:00pm highs made while ES did not.

ES has now traded back to yesterday's POC of 1337.75 and trying to stabilize.

1338.25 is the 2.618 projection down off the 30-min initial move. 1333.25 is YD RTH low while just below that is 4.236 projection of 1332.25 off the 30 min initial move down.

CD divergence at the high also indicates to me O/N inventory is currently short. Do they have the strength to keep prices going lower?

dollar and stocks were going the same direction for a while (down) , very odd

one of the markets is wrong

one of the markets is wrong

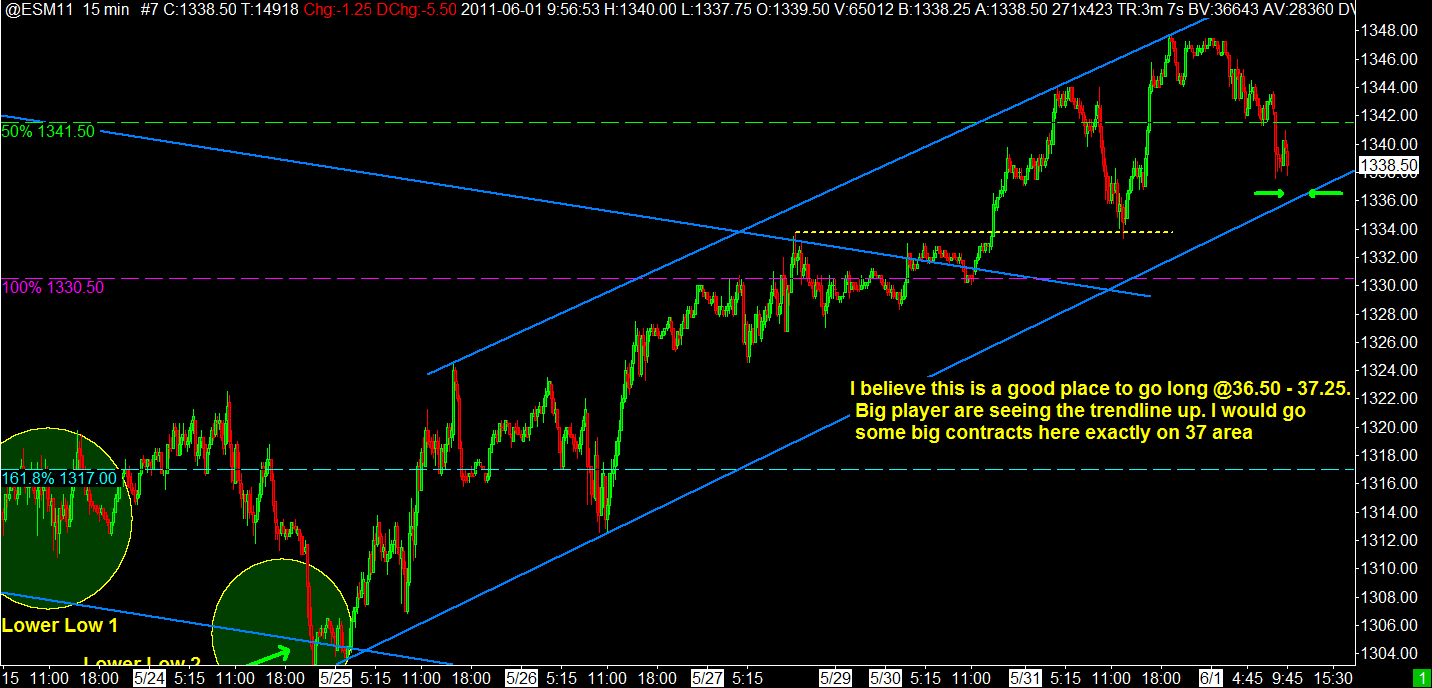

I'm using 1330 - 1333.75 as the key big daddy support zone... we have

Fridays closing VWAP and poc there, last weeks highs, Tuesdays lows, Fridays VA high...lots of interested in there

Then above there we have Tuesdays closing Vwap and the point where the buyers stepped in at and overnight low volume in the 40 - 42 area....that is resistence buyers need to overtake

Naturally the O/N range extremes become important as usual

Fridays closing VWAP and poc there, last weeks highs, Tuesdays lows, Fridays VA high...lots of interested in there

Then above there we have Tuesdays closing Vwap and the point where the buyers stepped in at and overnight low volume in the 40 - 42 area....that is resistence buyers need to overtake

Naturally the O/N range extremes become important as usual

Might have worked if not for lousy reports at 10

Extremely bearish pattern here. Expecting 1332 to fail. Alternative requires O/N high to be broken and held. Watching BKX sub 50 S/R level.

long 31.25 a bit agressive but think one of the two sets of air will fill in back to YD low point.....will manage below 29 for add ons

I am long here at 1331.25

the poc based on time has shifted lower so we may need to go down to find buyers

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.