CME Emini Futures on MSCI EAFE Index

CME Announces Futures on MSCI EAFE Index

CME, the global leader in stock-index futures, has teamed with MSCI Barra Inc. to deliver an exciting new product for investors in the international markets – CME E-mini MSCI EAFE futures.

The new product is scheduled to launch March 20, 2006 and will be the first futures contract based on the MSCI EAFE (Europe, Australasia, and Far East) Index, widely regarded as the preeminent benchmark for measuring international stock market performance.

CME E-mini MSCI EAFE futures offer investors a simple, cost-effective way to gain exposure to international markets without the complexities associated with managing multiple issues, time zones and foreign currencies. Created in 1969, the MSCI EAFE Index tracks over 1,100 stocks from 21 developed market countries, excluding the U.S. and Canada. Approximately $1.5 trillion globally is benchmarked to the MSCI EAFE Index, which also is the basis for the second largest exchange traded fund in the world.

CME E-mini MSCI EAFE futures will use the time-tested E-mini design pioneered by CME, making them available for trading virtually 24 hours a day on the CME Globex electronic trading platform. The contract will trade the March Quarterly Cycle with a tick size of 0.10 index points ($5.00).

CME, the global leader in stock-index futures, has teamed with MSCI Barra Inc. to deliver an exciting new product for investors in the international markets – CME E-mini MSCI EAFE futures.

The new product is scheduled to launch March 20, 2006 and will be the first futures contract based on the MSCI EAFE (Europe, Australasia, and Far East) Index, widely regarded as the preeminent benchmark for measuring international stock market performance.

CME E-mini MSCI EAFE futures offer investors a simple, cost-effective way to gain exposure to international markets without the complexities associated with managing multiple issues, time zones and foreign currencies. Created in 1969, the MSCI EAFE Index tracks over 1,100 stocks from 21 developed market countries, excluding the U.S. and Canada. Approximately $1.5 trillion globally is benchmarked to the MSCI EAFE Index, which also is the basis for the second largest exchange traded fund in the world.

CME E-mini MSCI EAFE futures will use the time-tested E-mini design pioneered by CME, making them available for trading virtually 24 hours a day on the CME Globex electronic trading platform. The contract will trade the March Quarterly Cycle with a tick size of 0.10 index points ($5.00).

This brings to a total 9 E-mini index future products that CME provide.

The E-mini Index futures that I'm aware of from CME are:

1. CME E-mini S&P 500

2. CME E-mini NASDAQ-100

3. CME E-mini NASDAQ

4. CME E-mini NASDAQ Ccomposite

5. CME E-mini MSCI EAFE

6. CME E-mini S&P MidCap 400

7. CME E-mini Russell 2000

8. CME E-mini Russell 1000

9. CME E-mini S&P Asia 50

Now answer these questions honestly:

1. Did you know there were that many E-mini index futures you could trade?

2. Had you heard of all of them?

3. Had you heard of more than half of them?

(Remember that these are just the E-mini index future contracts that are traded electronically and do not include the pit trade contracts.)

The E-mini Index futures that I'm aware of from CME are:

1. CME E-mini S&P 500

2. CME E-mini NASDAQ-100

3. CME E-mini NASDAQ

4. CME E-mini NASDAQ Ccomposite

5. CME E-mini MSCI EAFE

6. CME E-mini S&P MidCap 400

7. CME E-mini Russell 2000

8. CME E-mini Russell 1000

9. CME E-mini S&P Asia 50

Now answer these questions honestly:

1. Did you know there were that many E-mini index futures you could trade?

2. Had you heard of all of them?

3. Had you heard of more than half of them?

(Remember that these are just the E-mini index future contracts that are traded electronically and do not include the pit trade contracts.)

on a somewhat related topic, any chance of adding 6E to Daily Notes or maybe replacing EC with 6E? since about mid-Nov 2005, EC has dried up and 6E has beefed up.

if this would be better suited for the Daily Notes section, i'll post it there.

take care

omni

if this would be better suited for the Daily Notes section, i'll post it there.

take care

omni

The 6E is the Globex Euro and the EC is the pit traded Euro right?

The reason that I use the EC is so that gaps and ranges during the most liquid periods can be monitored. Using the 6E in the EC timeframe should give us the same figures so we wouldn't gain anything by switching from one symbol to the other. What would happen is that the opening and closing values would change because they would be based on different times of the day.

It's really just a difference between the RTH contract and the continuous contract.

Feel free to continue petitioning for me to change from EC to 6E - If you give me a good enough reason I will.

The reason that I use the EC is so that gaps and ranges during the most liquid periods can be monitored. Using the 6E in the EC timeframe should give us the same figures so we wouldn't gain anything by switching from one symbol to the other. What would happen is that the opening and closing values would change because they would be based on different times of the day.

It's really just a difference between the RTH contract and the continuous contract.

Feel free to continue petitioning for me to change from EC to 6E - If you give me a good enough reason I will.

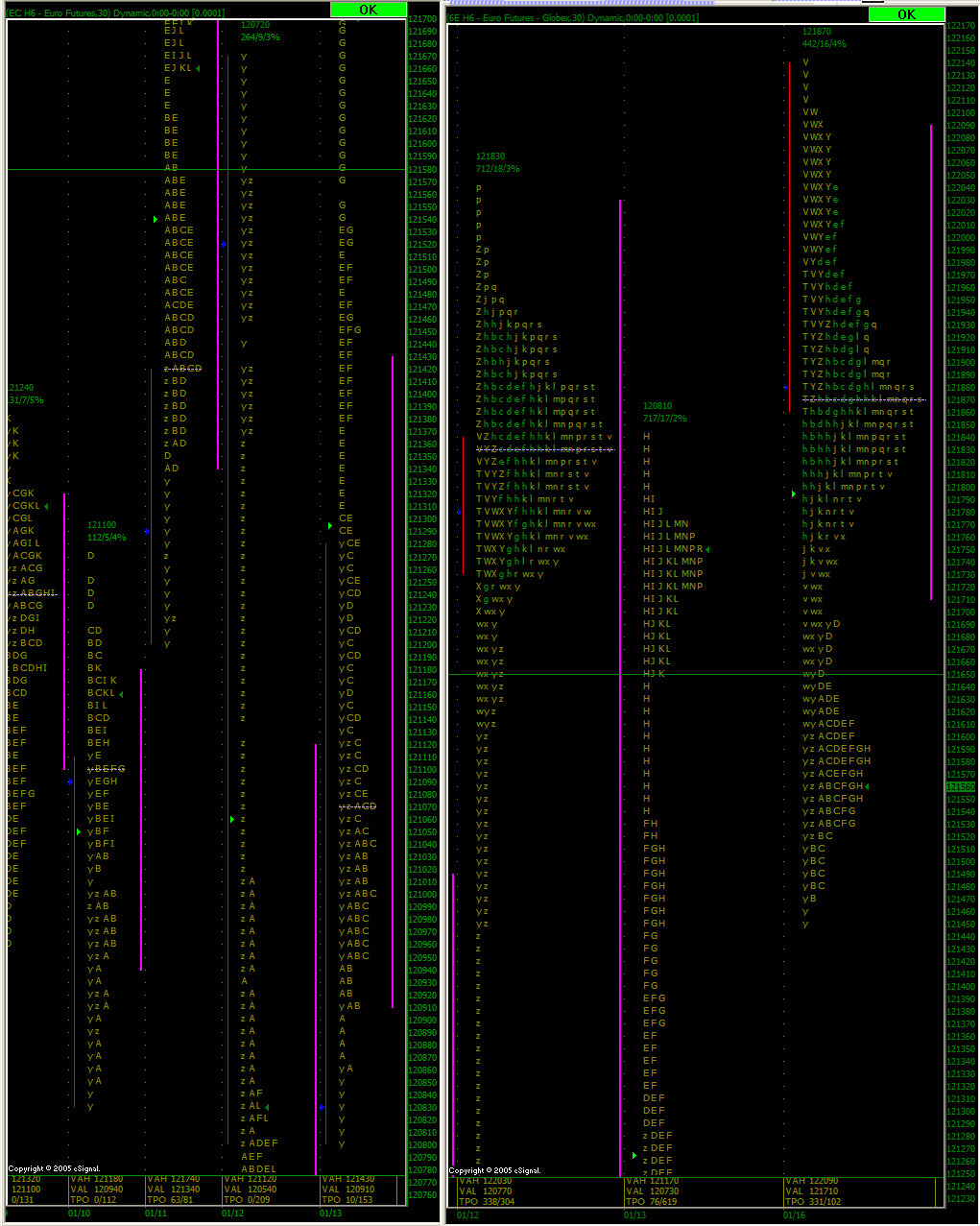

thx for your input on 6E vs EC. the 6E is the Globex 24h mini. however, imo it more accurately reflects the actual market (more liquid, truer trading hours, don't see the intra-session price gaps as often, etc). much like ZB vs US or ES vs SP or ER2 vs RUT. here are a couple of screenshot comparisons of 6E and EC:

i guess another thing about using 6E vs EC is that it seems more consistent with using other minis (ES, ER2, ZB, NQ, etc).

all right, there's my current petition. next up is adding ET (Euro Stoxx) and AX (FDAX) ...

again, thx for your consideration. hope you had a great weekend.

take care

omni

i guess another thing about using 6E vs EC is that it seems more consistent with using other minis (ES, ER2, ZB, NQ, etc).

all right, there's my current petition. next up is adding ET (Euro Stoxx) and AX (FDAX) ...

again, thx for your consideration. hope you had a great weekend.

take care

omni

I'd love to add all symbols that are out there. Let me look into improving the web and finding a way of doing that.

Which figures do you find most usefull and why? Do you or anybody else look at the Toby Crabel TRUE/FALSE numbers? Are the pivots the most imprtant? Or the gap data? Or the 10/20/40 day high/low stats?

Perhaps I can start something new which has less data but covers more symbols...

Which figures do you find most usefull and why? Do you or anybody else look at the Toby Crabel TRUE/FALSE numbers? Are the pivots the most imprtant? Or the gap data? Or the 10/20/40 day high/low stats?

Perhaps I can start something new which has less data but covers more symbols...

quote:

Originally posted by daytrader

I'd love to add all symbols that are out there. Let me look into improving the web and finding a way of doing that.

Which figures do you find most usefull and why? Do you or anybody else look at the Toby Crabel TRUE/FALSE numbers? Are the pivots the most imprtant? Or the gap data? Or the 10/20/40 day high/low stats?

Perhaps I can start something new which has less data but covers more symbols...

okay, since you asked ...

1. i don't trade the TC signals, so i don't use that data any longer. i used to look at it (given TC's massive respect throughout the industry) off and on, but eventually realized, "Oh, yeah. i have enough of a time really learning/adopting MP and applying its principles." maybe later the TC info will be more useful.

2. i think, and bear with me on this one, the best format would be user-defined. you know, dropdowns, lists, check-boxes, radio buttons, and so forth. that way, if i wanted to run a querry for just two markets and include MP, daily PSR, weekly PSR, and 10 day H/L/R info i could do that. someone else might to run daily PSR and fibs on five markets. my assumption is that since all this data has already been pulled and/or calculated, it would just be a matter of each user request to call up specific data. so essentially you might have a generic daily notes page with all the variables ready to be customized. it may be prudent to limit the number of markets to 5 or 10 something, but you'd have a much better idea if that would be necessary. i'd love to hear your thoughts on this type of format, or some variation of it. i think adding this level of interaction would really expand the utility of an already very useful site.

3. a'ight. another wish ... rolling multi-day MP figures. for example, maybe a selection of canned periods (3, 5, 10, and 20 days). you could do a completely user-defined variable here, but i thought if you used canned periods then there would be less data to pull, calculate, and store. dunno if it would matter, but i'm at least trying to be coder-considerate in my wishes

4. i'd also like to see WIB (WIB-H/L, 2xWIB-H/L, .5WIB-H/M/L) info in the MP area. that only has to be collected and calculated once - at the close of the second trading day for the week. then the data carries over until close of the second day of trading the following week.

5. and i'd also like a new pony.

seriously, i can really see your site becoming a powerhouse of interactive information. i'd be thrilled to discuss ideas with you and be part of a test group if you needed. i'd offer to code stuff for ya, but i'm not sure if my code would be very useful by the time i got if finished - i mean who knows what type of language we will be using in 2025, right?

anyway, thx again for your time and your work.

take care

omni

I agree with your conceptual design of how this should be done. In fact that's exactly what I was thinking of doing and have been for about a year now. One of the major problems is sorting out the hosting company. Once that is stable I can think more along the lines of customizing how each person sees their daily notes - or rather allowing each person to select the symbols and data that they want to see.

Thanks for all your ideas and input - much appreciated!!

Thanks for all your ideas and input - much appreciated!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.