ES Short Term Trading for 4-20-2011

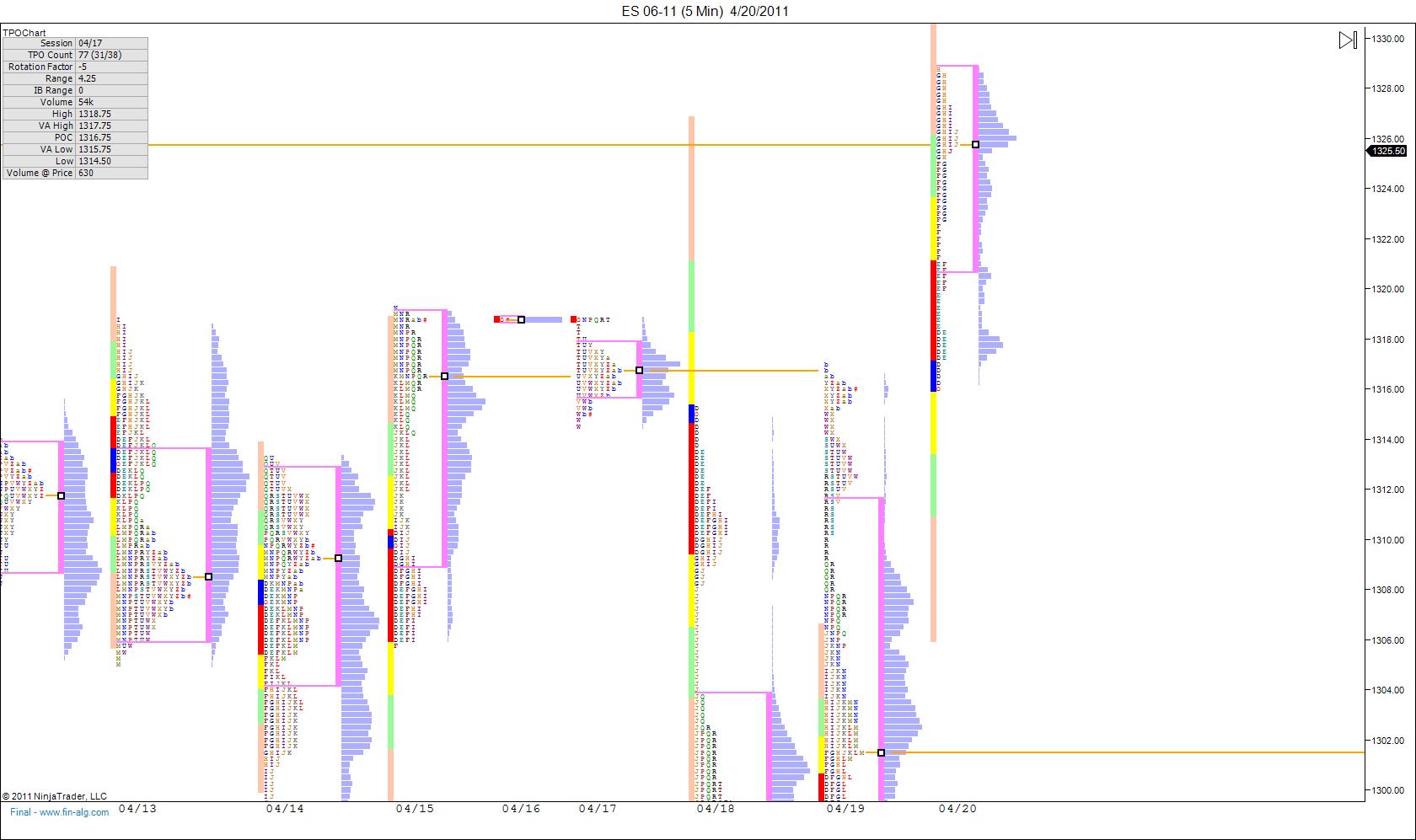

here's a look at a profile chart this morning. We have a huge opening gap up this morning and it has left some single prints down at the 22.50 to 21.25 range. I am thinking to go short just after the open around the O/N highs of 28.50 to 1320.75 which is the bottom of the value range today.

only a 6 point range and basically 1 hr and 45 minutes to trade...I'd be careful if you try to fade the hour range high or low....just no time left to trade out if the break really does attract the buyers or sellers

strange that he doesn't include babbling on forums........LOL!! and thanks for getting vwap question answered earlier

Originally posted by Lorn

Thought this was worthwhile sharing. Was reading some Dr. Brett over lunch and came across a post of what to do between trades. This comment on what he does is superb..

I stay engaged by watching unfolding sentiment (NYSE TICK, Market Delta), seeing how price and volume behave at the edges of market ranges, and by seeing how markets correlated to my own are behaving.

What is happening at the EDGES of RANGES is a massive statement.

these are also the type of days that the gap fill traders sometimes start to realize that they may not get even a small part of a gap fill......so they start buying to cover shorts which helps fuel a rally

Obviously I have no clue what will happen...so 28 is still a reasonable stop for me since I'm trying to get down to the 20 area...that's gonna take a lot in this volatility

But if they do start buying then I will be taken out and fine with that....still good risk to reward on these runners....if new lows come, then risk to reward will be in a bad place so i will need to take something off again or move stop down

Obviously I have no clue what will happen...so 28 is still a reasonable stop for me since I'm trying to get down to the 20 area...that's gonna take a lot in this volatility

But if they do start buying then I will be taken out and fine with that....still good risk to reward on these runners....if new lows come, then risk to reward will be in a bad place so i will need to take something off again or move stop down

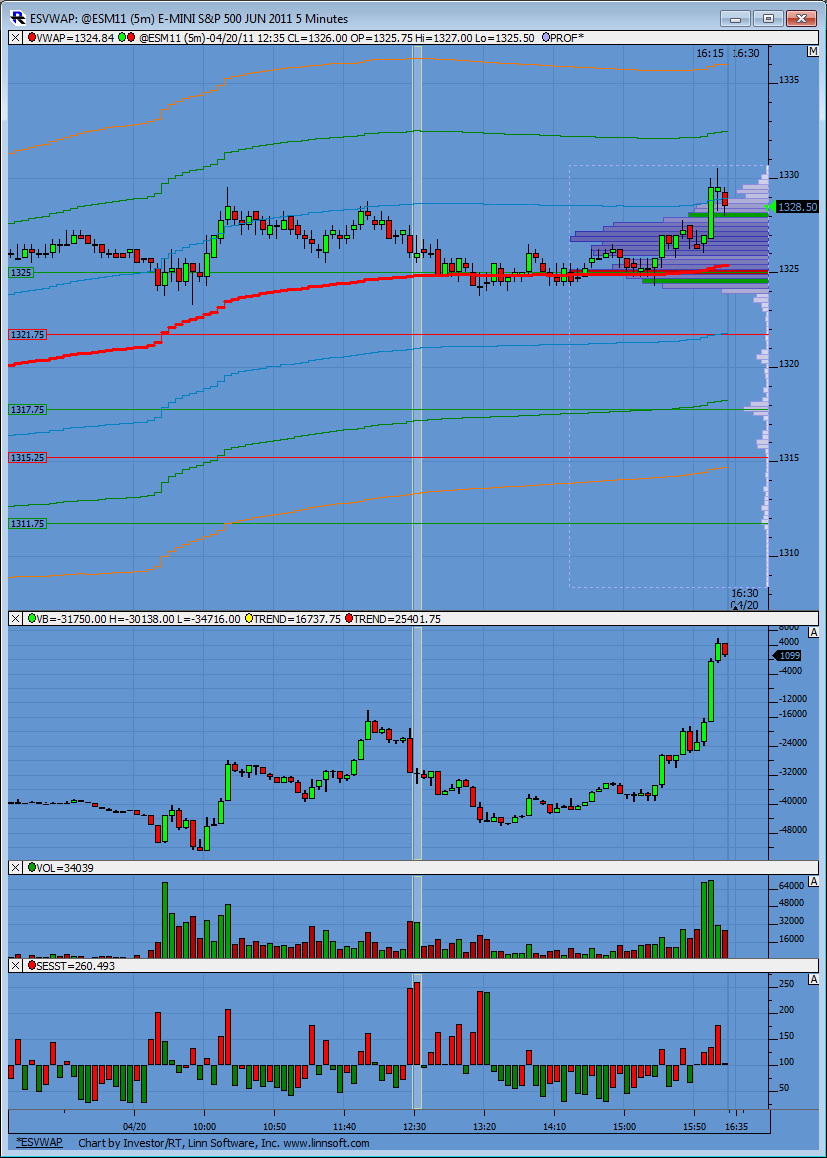

Here is the end of day chart to study. I've added a new pane at the bottom of relative volume. The bars compare volume to that specific time frame over 200 days of trading to give a relative percent reading compared to the normal (average) volume of that period. So for instance, the two big red bars at 12:25 and 12:30 were saying the volume at those time stamps was 250% greater in relative strength then the average over the last 200 days.

Not sure if it helps any. I'm just experimenting with it.

Not sure if it helps any. I'm just experimenting with it.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.