ES key numbers for 3-30-11

1300 - 1301.25 *** this is Tuesdays low and an area we have been watching recently that held. Volume spike at 1301.25 today.

1305.75 - 1307.00 - *****This is the value area low and a volume area that was created today. Also a Low volume area and some rejected that area quickly today. The opening range is in here too from Tuesday. Standard pivot formula S1 is in here.

1310.75 - 1311.75 ******* the big kahuna...we have the POC in here, volume spikes, and the standard pivot is in here. We also have a low volume area and the market moved away swiftly from the 1311.75. Any good shorts and buying failure will go back to this point. A big magnet that needs to be remembered even if it doesn't fill in on Wednesday. The opening range for the Week is also in this zone.

1315 - 1315.50 - *****This is Monday's High and the 4PM close sits here from Tuesday. Value area high is here too.

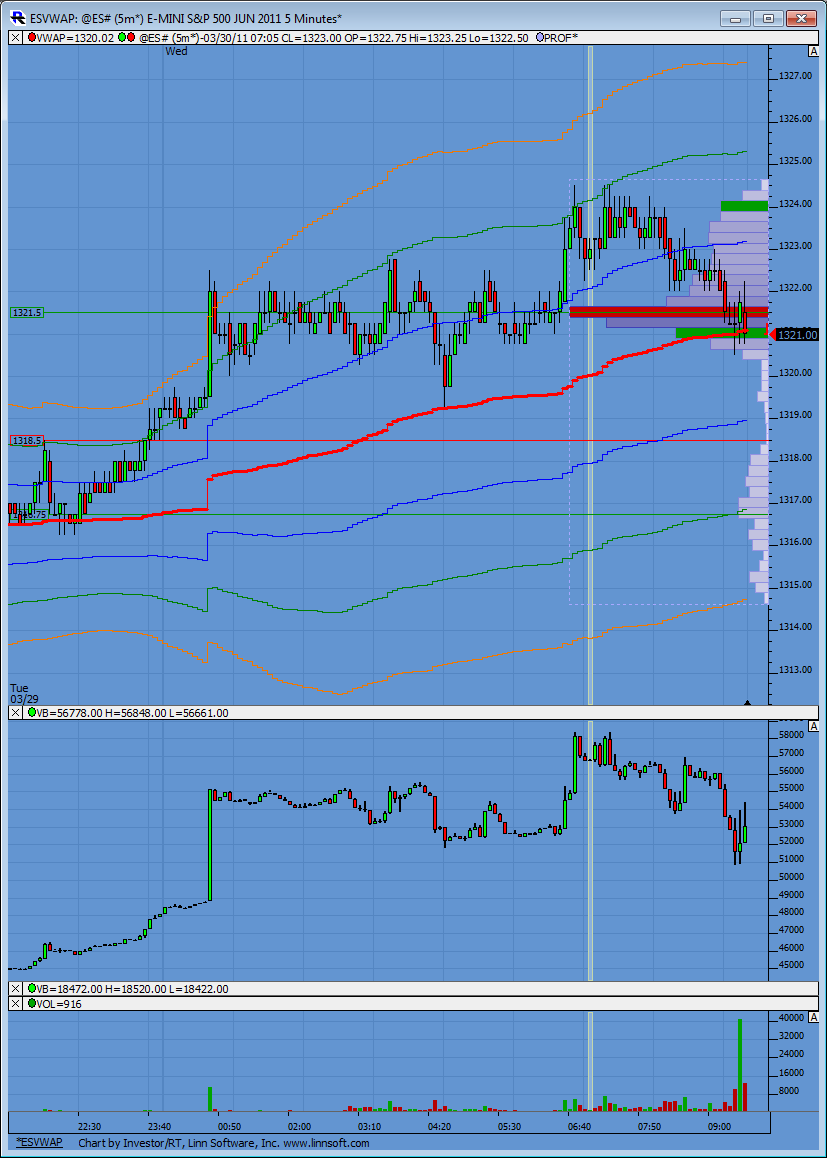

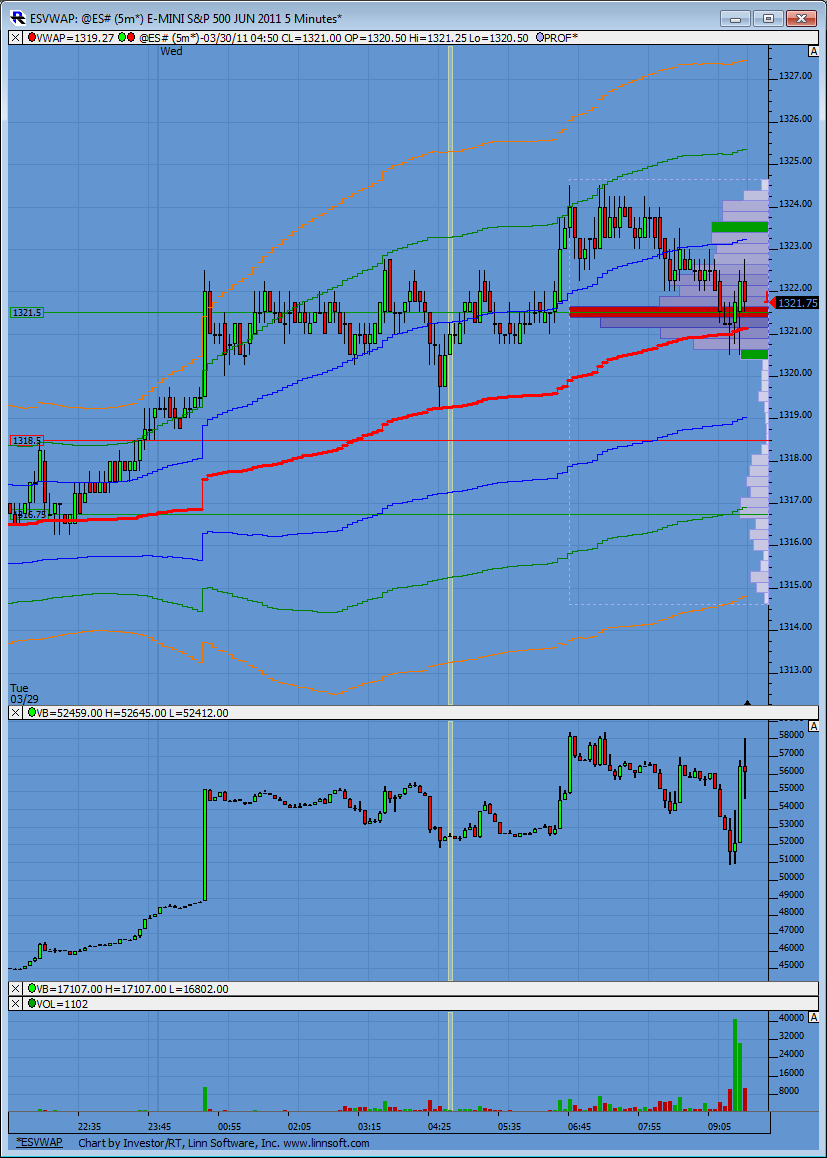

1320-1322.50 - we have multiple tops here and the R1 level sits up there.....monitor for poor volume and lack of follow through on any breach of that area

There are no 10 a.m reports on Wednesday but a few before 8:30 in the morning. This was some what of a trend today so it should be a better day tomorrow to buy into breaks and sell rallies early in the session. I prefer the sell side but not on declines.

1305.75 - 1307.00 - *****This is the value area low and a volume area that was created today. Also a Low volume area and some rejected that area quickly today. The opening range is in here too from Tuesday. Standard pivot formula S1 is in here.

1310.75 - 1311.75 ******* the big kahuna...we have the POC in here, volume spikes, and the standard pivot is in here. We also have a low volume area and the market moved away swiftly from the 1311.75. Any good shorts and buying failure will go back to this point. A big magnet that needs to be remembered even if it doesn't fill in on Wednesday. The opening range for the Week is also in this zone.

1315 - 1315.50 - *****This is Monday's High and the 4PM close sits here from Tuesday. Value area high is here too.

1320-1322.50 - we have multiple tops here and the R1 level sits up there.....monitor for poor volume and lack of follow through on any breach of that area

There are no 10 a.m reports on Wednesday but a few before 8:30 in the morning. This was some what of a trend today so it should be a better day tomorrow to buy into breaks and sell rallies early in the session. I prefer the sell side but not on declines.

I haven't experienced any correlation between CD and gaps Bruce.

Originally posted by BruceM

what clue does CD give us on gap opens Lorn?

Originally posted by LornHuge gap up above yesterday's range so chances are that the gap won't be filled and hopefully we could see a trend day again today.

I haven't experienced any correlation between CD and gaps Bruce.

Originally posted by BruceM

what clue does CD give us on gap opens Lorn?

starting new shorts at 22.25 print....

EXITED MY SHORT AT 1321.00.. plus 3.25 but only had one contract on, otherwise id still be holding the runner for the 1318.50 projection....

Bit of a bullish hidden divergence right now in CD. Prices fighting with VWAP. Need to give it more time to sort itself out.

$ticks strong so far

upper sell area is 23.50 but $ticks not confirming this latest up probe so far.....I think shorts will win

You can see the upward spike now on CD. This to me is saying all the sellers at the open have covered as price couldn't make it down through VWAP. NOW we should see if the bulls/bears are in charge...

i'll be a seller at 1323.25 if they get there... target of 1318.50 remains unless 1324.50 is touched again

I see it now, Kool. Thanks

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.