CL April crude oil

yup, 102.05 from 100.15 = projection of 103.22! pretty freakin close!

From yesterday's low I am looking for 10363 based on the 10015-10148 move. I tried to buy 10304 based on the 10336-10316 retrace but it only got within 2 cents so I missed it.

We just hit 10357 so maybe that's it.

We just hit 10357 so maybe that's it.

Now looking for 10292 based on 10357-10317 retrace but they will defend 10300 and a break of it could trigger a nice stop run. The pit open in 2 min. will be interesting.

Originally posted by prestwickdrive

Now looking for 10292 based on 10357-10317 retrace but they will defend 10300 and a break of it could trigger a nice stop run. The pit open in 2 min. will be interesting.

10292 got overrun on 10300 stop run. looking for 10252 full projection

KB - I don't know if you notice this with other futures contracts but on larger projections - like off the 10357-10317 move that's working now - it seems that the midpoint between the initial and full projections seem to be a great place for a counter trade. On this move the initial projection was 10292 and the full is 10252. The midpoint is 10272 and it held 10275 so far. I was able to get two nice longs off of 10276 playng that area (I figured they would defend the round number 10275 which is why I cheated on 10272).

Originally posted by prestwickdrive..very interesting!. Thats a little nuance i guess ive never noticed.

KB - I don't know if you notice this with other futures contracts but on larger projections - like off the 10357-10317 move that's working now - it seems that the midpoint between the initial and full projections seem to be a great place for a counter trade. On this move the initial projection was 10292 and the full is 10252. The midpoint is 10272 and it held 10275 so far. I was able to get two nice longs off of 10276 playng that area (I figured they would defend the round number 10275 which is why I cheated on 10272).

Originally posted by koolblue

Originally posted by prestwickdrive..very interesting!. Thats a little nuance i guess ive never noticed.

KB - I don't know if you notice this with other futures contracts but on larger projections - like off the 10357-10317 move that's working now - it seems that the midpoint between the initial and full projections seem to be a great place for a counter trade. On this move the initial projection was 10292 and the full is 10252. The midpoint is 10272 and it held 10275 so far. I was able to get two nice longs off of 10276 playng that area (I figured they would defend the round number 10275 which is why I cheated on 10272).

OK. Just thought I'd check. On this last retrace it pretty much worked again. The move 10350-10326 gave an initial of 10311 and full of 10287 with a 10299 midpoint. We got a nice bounce so far off of 10296 which is was close enough to the mid for me.

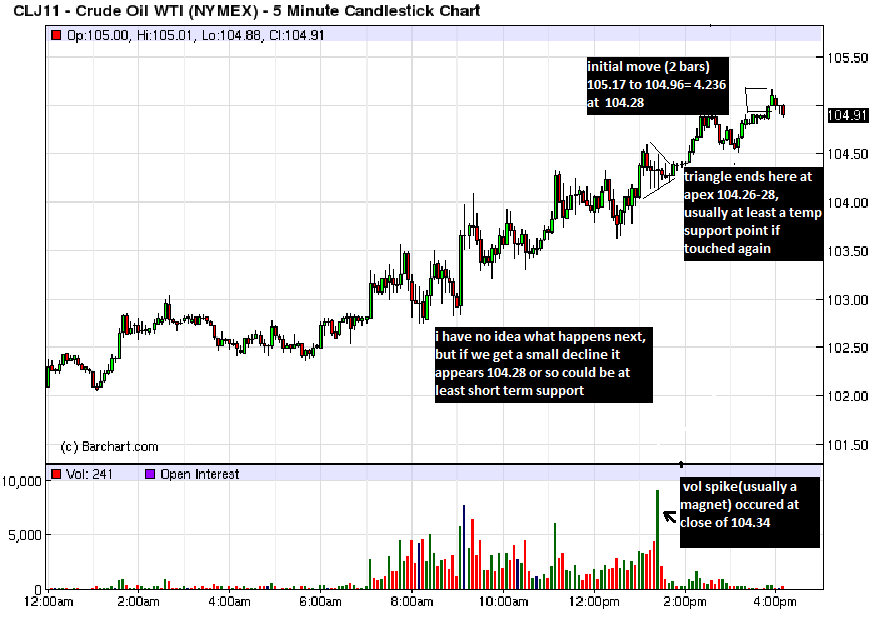

Crude is extemely difficult to analyse due to the 'news driven'volatility of the market,lately, but a few things stand out...a) much higher prices may be seen b) if we get a pullback,104.13-104.34,centering on 104.28, may provide a short term scalp. c) in the event of a decline, that 102.94 area seems a likely point of at least some support....

...Keep in mind that these are just educated guesses at this point and intraday price action may completely change things..

...Keep in mind that these are just educated guesses at this point and intraday price action may completely change things..

Resistance may be seen at 105.53, 106.12 and 106.49, but again, we need to see the intraday price action to modify these numbers

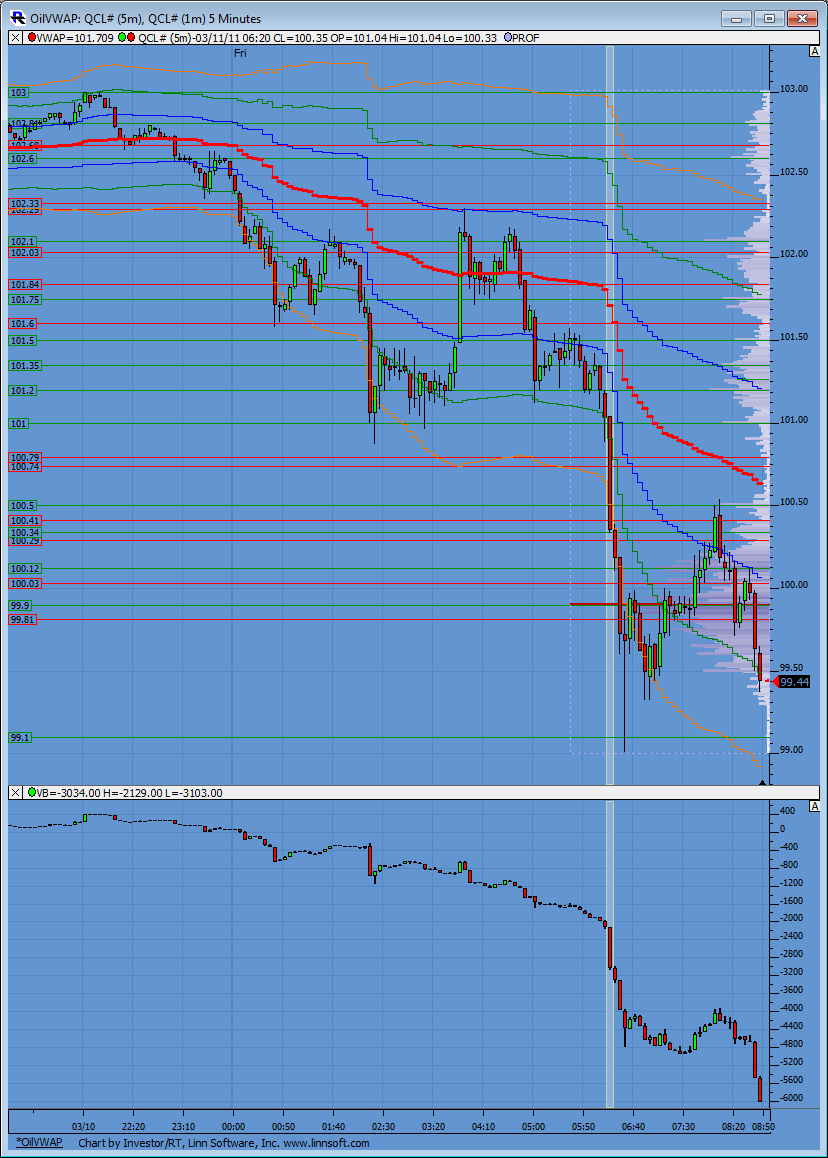

Here is a look at VWAP for you oil traders. Down trending VWAP line, volume profile consistently building peaks at lower prices, CD showing sellers but this 6:40am low needs to be taken out or else VWAP at least will be retested.

On the "Here goes" thread it was mentioned how dangerous the CL is to trade and I couldn't agree more. With more risk comes potential for greater rewards but one has to stay alive by prudently and aggressively managing risk in order to live long enough to capture the reward.

Everything with the CL moves faster and farther than an instrument like the ES. The following is an example of what I mean from last week with the CLJ contract which was the front month then. This first chart shows a typical ascending wedge.

Because the underlying trend of the market was up one could reasonably expect an up breakout. On top of that they "usual" ascending wedge continuation pattern is up and the following is what happened in the next eleven minutes after the above picture was taken:

The extent of the berakout was way more than one would usually expect from an instrument like the ES or NQ as it moved 80 cents in 11 minutes. That is $800 per contract or the equivalent of 16 ES points. What compounded the situation was the breakout point was the round number of $101. When stop losses at $101 got hit for those who were short it got really nasty. Even shorts with stops at $101 likely got hurt more than they expected because the market is so thin and their stop market orders likely got very poor fills. Those with stop limit orders just above $101 likely did not get fills at all.

The point of this is to point out the volatility of the crude oil contract and the need to be well capitilized to trade it and to really protect one's capital.

Everything with the CL moves faster and farther than an instrument like the ES. The following is an example of what I mean from last week with the CLJ contract which was the front month then. This first chart shows a typical ascending wedge.

Because the underlying trend of the market was up one could reasonably expect an up breakout. On top of that they "usual" ascending wedge continuation pattern is up and the following is what happened in the next eleven minutes after the above picture was taken:

The extent of the berakout was way more than one would usually expect from an instrument like the ES or NQ as it moved 80 cents in 11 minutes. That is $800 per contract or the equivalent of 16 ES points. What compounded the situation was the breakout point was the round number of $101. When stop losses at $101 got hit for those who were short it got really nasty. Even shorts with stops at $101 likely got hurt more than they expected because the market is so thin and their stop market orders likely got very poor fills. Those with stop limit orders just above $101 likely did not get fills at all.

The point of this is to point out the volatility of the crude oil contract and the need to be well capitilized to trade it and to really protect one's capital.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.