ES Trading for 03-02-11

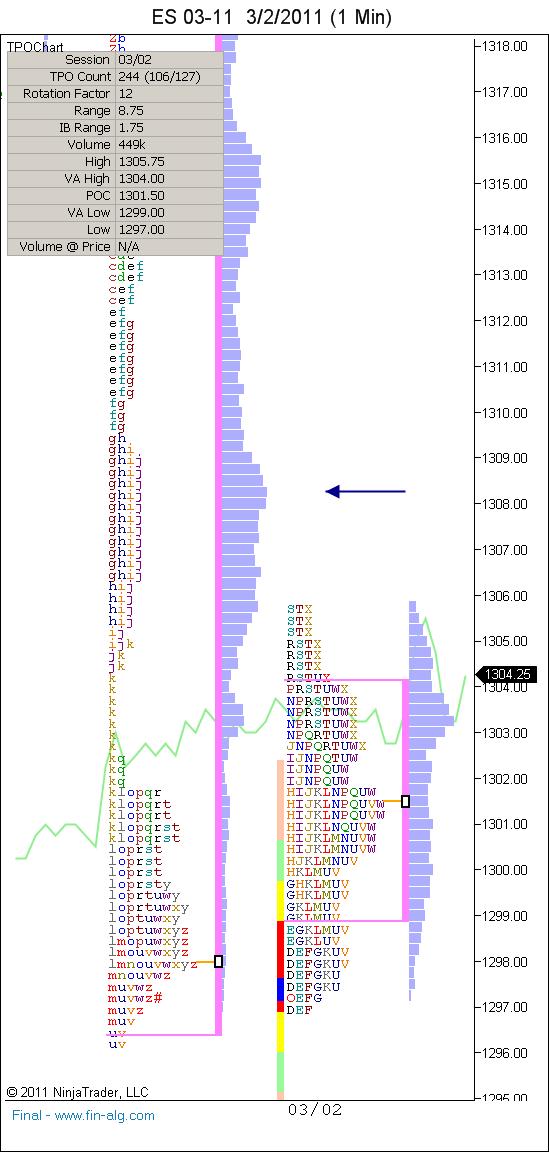

Opening Profile

Consolidated overnight at lows of yesterday's 36 point range.

Consolidated overnight at lows of yesterday's 36 point range.

looking for sells near 1309 ...I think 05.50 needs retest but will settle for the 07 number again..still a neutral day but for how long is the big money question...getting a bit late for fades...

Agreed. The fills on the ES are truly pathetic these days and I don't like using market orders.

Originally posted by prestwickdrive

Originally posted by koolblue

right here the one min proj at 1307.50 would have been my exit!...sheese!.. i give up

Come back to trading the CL KB. It has been wild and, with the help of Kools Tools, a great trader. You sure won't get bored waiting for fills.

on 1309.25 and light...don't want to get caught on the wrong side now...magnet is still 07 area as long as new volume doesn't enter to mess us up

tried to sell 1309.50, hit but once again no fill.. that does it for me.. they just dont want me to play today!....

flat at 07.25....still think they will clean up that 05.50 area ( gap in data)but this 07 is a tricky spot still

This will probably bore most but perhaps there are some new folks....

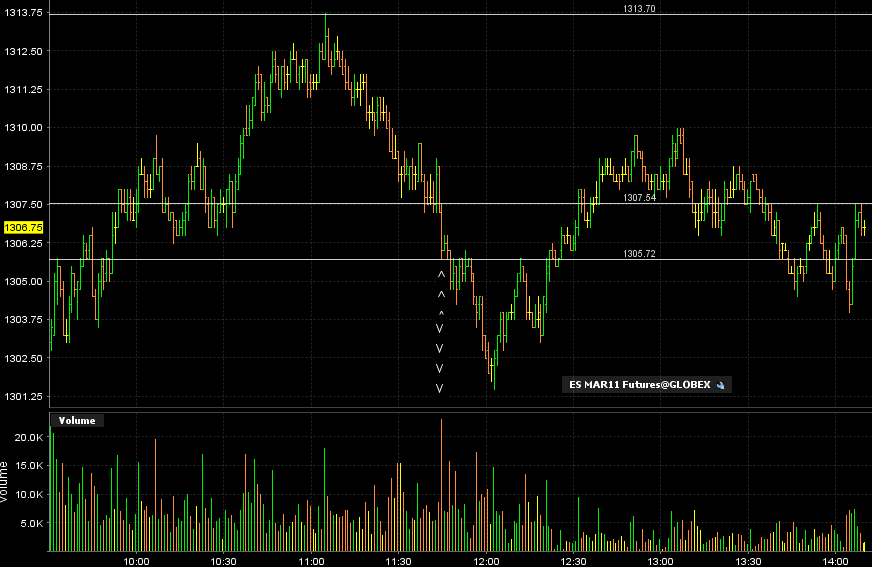

Today is a neutral day with trade on both sides of the IB ( 60 minute high and low) so the center of the range becomes real important. Now the other thing is that at 11:44 EST we had a volume surge at that same area before the day became neutral. I snapped two horizontal lines at that one minute bars highs and lows.

From yesterday we had 3 key volume area: the 1309 - 1310, the 1317.50 - 1318 and the 1323 - 1325.....and the 1309 area was the Ib High so a natural area anyway....so if the day is to stay neutral they will bring it back to the center but the key for me was that we had that big volume as an attractor too.....a double whammy as an attractor!!!

Here is a rough chart showing the volkume spike at the 1307 area; We know somebody was using that area because the volume couldn't hide from us

Today is a neutral day with trade on both sides of the IB ( 60 minute high and low) so the center of the range becomes real important. Now the other thing is that at 11:44 EST we had a volume surge at that same area before the day became neutral. I snapped two horizontal lines at that one minute bars highs and lows.

From yesterday we had 3 key volume area: the 1309 - 1310, the 1317.50 - 1318 and the 1323 - 1325.....and the 1309 area was the Ib High so a natural area anyway....so if the day is to stay neutral they will bring it back to the center but the key for me was that we had that big volume as an attractor too.....a double whammy as an attractor!!!

Here is a rough chart showing the volkume spike at the 1307 area; We know somebody was using that area because the volume couldn't hide from us

if you look at the right side of my chart just under the lower horizontal line you will see a gap in the data...about 4 - 5 bars back.....these are my least favorite targets as over the years I have seen those fail more than I care to remember...perhaps due to data discrepencies and IB data....

can anyone confrim that gap near 05.75...?

If I had runners I would have been trying for that gap and would have been stopped out on this mini move back up..

I'd like to see them take one more peak above 1310 and then hunt for one last short...gotta watch the internals though as we are getting even later than before...

can anyone confrim that gap near 05.75...?

If I had runners I would have been trying for that gap and would have been stopped out on this mini move back up..

I'd like to see them take one more peak above 1310 and then hunt for one last short...gotta watch the internals though as we are getting even later than before...

"breaking 1308.50 leads me to believe 1212-13 is next , beyond that 1321 is possible. "...1312.75-1313.25 specifically,imho

I'm gonna have to differ with ya on that one Kool but you may end up being right...LOL...yesterday was a classic trend day so I think it is wise to expect consolidation after that...the buy the breaks, sell the rallies mentality...and so far that seems to be the market theme....

Not the best time of day for me but I wish you luck if you are holding longs for 1321 today...that's a bit agressive but you know that anyway

My best guess is that we will drift back to 1307.50 and lower but I'm sitting out now

Not the best time of day for me but I wish you luck if you are holding longs for 1321 today...that's a bit agressive but you know that anyway

My best guess is that we will drift back to 1307.50 and lower but I'm sitting out now

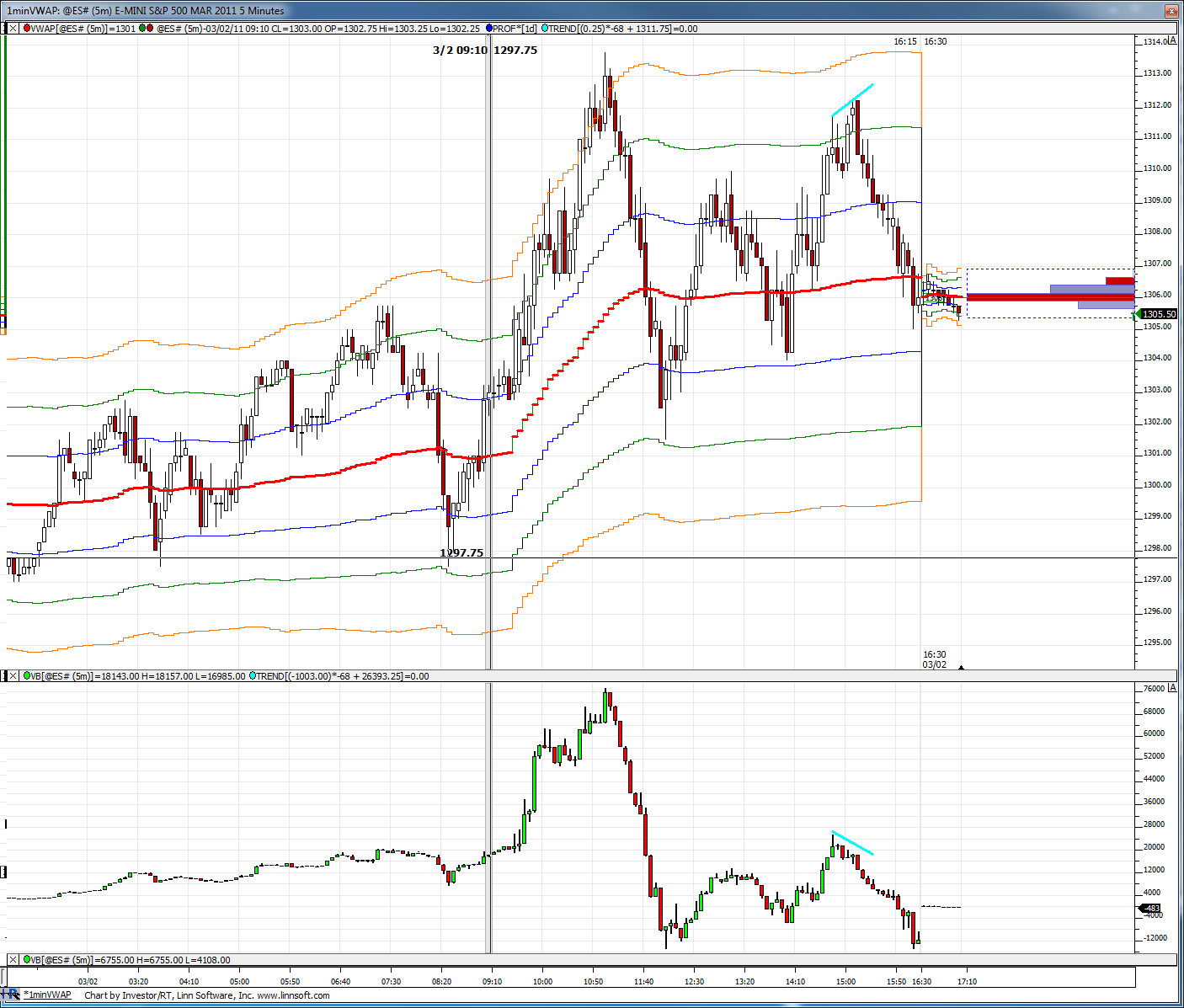

look how the last 40 minutes can't get $ticks under minus 300.....that's why I side stepped the last 1310 sell but will watch to see what happens when we start getting below the minus 600 levels and break that $tick trend...

odds are not good for me actually taking a trade this late....I'll leave that fade for the more agressive among us..

odds are not good for me actually taking a trade this late....I'll leave that fade for the more agressive among us..

There you go Bruce. I've marked the area you are referring to with corresponding blue trend lines. Certainly not an overwhelming divergence but it was one for sure.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.