ES weekend preview 2-20-11

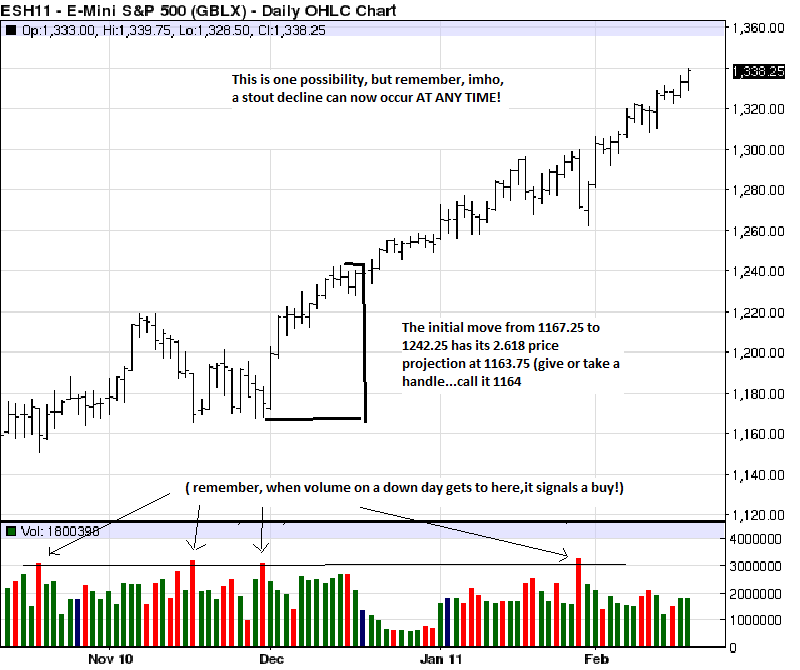

Just a brief review this weekend. Long term, the market signalled it wants 1426 this year,at a minimum. This projection was given off of the bear low of 665.75 and initial move up to 956.50.(long ago the move above 1136.25,the 1.618 is what turned me longer term bullish(for now) ,untill the 2.618 at 1426-7.)On the intermediate term, i was looking for a decent pullback at 1302.50. Then again at 1333-1336.50. Both areas gave small pullbacks only as the rally extended against increasingly negative technicals. This forced me to look again at intermediate charts. I showed last weekend how this leg of the advance should attain at least 1357.25 or higher before a meaningful decline.Im thinking that 1364 might be the area...

Originally posted by koolblue...

taking 1342.50 (the secondary high as the primary high proj was already fullfilled) to 1387.50 gives a 2.618 down projection of 1329.50...which is a buy zone imho!

sorry!

wonder if the slide in the ES had anything to do with oil up 6 bucks?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.