A Kools Tools primer for newer traders

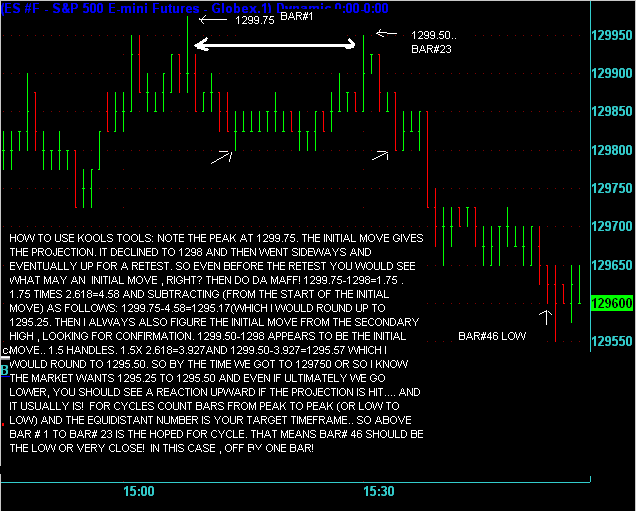

Tired of getting your ass kicked by the markets? Tried all the 'systems' and technical indicators but still losing? Mypivots has a wealth of information here by real traders who have completely differing methods but enjoy some success.My personal favorites include Bruce, who can be found in various threads, most recently on the es short term trading thread under Trading Strategies and setups.Charter Joe who uses a good opening range type method . Youll have to do a search here to call up his old threads. Do a search here for Mini ib thread (ib is fancy ass market profile talk for initial balance... basically the first bar of the trading period).Be sure to read the whole thing. Bruces fine work can be found several places here. He is a very good interpeter of market profile concepts(a method of interpeting price action,not a trading system per se)and of pit bull type concepts.Do a search here for pitbull three strategy and youll find it. Also i would highly recommend reading a market profile book or googling market profile concepts so you have a rough understanding of the terms and hopefully the concepts. Most of us pay close attention to Bruces 'air' on the es short term trading thread , which is really the markets tendancy to always come back to what market profile would call single prints.With these concepts you dont need indicators (which are lagging after the fact, by their very nature) , but simply price action as a determining factor in entering and exiting trades. There are many others. These are just a few of my personal fav's. This is so you will understand more about what some of us do on the es trading thread. For my own self, i use a unique, maybe even bizzare, method using fibonacci extensions (not retracements! which i have never found to be very useful for exact entries and exits!). Here is a quick primer so you will at least understand what i mean (whether you agree or not) when i post charts or make comments....

There are lots of addendums, like i watch the 1.618 and a move one or 2 ticks beyond indicates to me a likelyhood the market wants to achieve the 2.618 and so on. Note these are not projections of where a particular rally or decline has to end, but where a reversal bounce of some sort usually occurs. So if you want success you have to be willing to spend the time and effort required studying and doing research and mypivots can be an excellant tool for that! This thread is dedicated to the 2 great passions in my life: trading and family!...

Great looking kids Kool

.. btw I am 99% focused on 6e now and apply the same trading concept to ES when I focus on it...

.. btw I am 99% focused on 6e now and apply the same trading concept to ES when I focus on it...

Originally posted by redsixspeedThx pal,im American, but mom is 50% Vietnamese (we've been divorced for over 5 years, but still live together. lol GO figure!) and they're natural father is 100%. They are without a doubt, the best trade i ever made in my life! lol

Great looking kids Kool

.. btw I am 99% focused on 6e now and apply the same trading concept to ES when I focus on it...

Fantastic Kool....thanks for sharing not only your technical work but also allowing us a peak at part of your personal world !!

Big thanks and appreciation, as always Koolio! Great, in-depth analysis as usual. Nice pic of the kiddos buddy!

Your passion comes through wonderfully Kool and doing what you love is something so few people in this world get to do.

Cheers!

Cheers!

Yea Red,

6E has been a mover and shaker recently with awesome tradeable moves.

6E has been a mover and shaker recently with awesome tradeable moves.

Originally posted by redsixspeed

Great looking kids Kool

.. btw I am 99% focused on 6e now and apply the same trading concept to ES when I focus on it...

KoolBlue, here is the daily chart of USD/JPY. Can you please have a look and tell us how to count the cycle candles. Weekly low occurs on 13th Jan and then again on 18th Jan. The markets are closed on Saturdays and on Sundays we get only 6 hrs of trading (6.00PM TO 1159PM EST) before the date changes and a new candle starts. Should we ignore counting Saturdays on our cycle count??? Do we ignore or count Sunday candles??

My rule of thumb is ,just go by what your eyes tell you! So i would ignore sat where their are no bars formed ,but count sun where you have the little dash bars(knowing the cycle might be a tiny bit off as a result... for example...

Thanks Kool.... for the insight

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.