Is the pitbull Crazy?

The purpose of this post is twofold. One is to explain a trade I took on 1-12-11 in the day trading threads and the other is that I am looking for feedback on peoples ability to comprehend what I am trying to explain. I donot think I am a great communicator and at times in the day trading threads it gets frustrating at the lack of questions on things I've typed in. I don't want to assume that what I write about is crystal clear to everyone reading them.

So I'd like you to vote this thread up if you understand the reasoning for the trade and the concepts and vote it down if you don't. You may not agree with the trade and it may not even be a trade you would take but that should not stop you from understanding the reasons for taking it.

For those who can't or don't vote then please leave a comment in this thread of send me a private message with your feedback. This will help me to know that my effort at posting my trades and ideas is coming through or let me know that I'm not doing a good job explaining and need to step up my efforts at getting the ideas across.

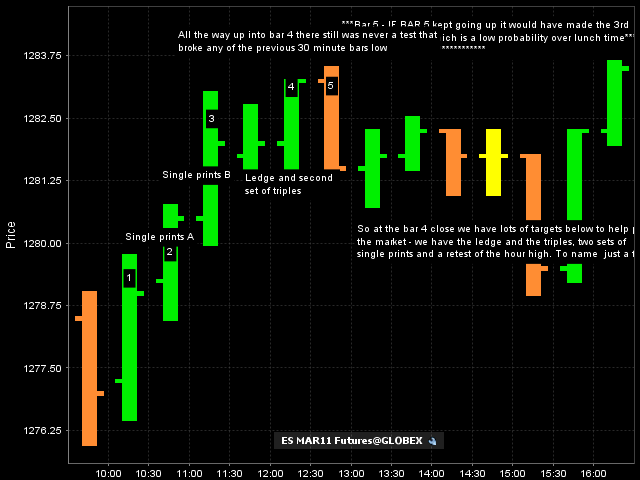

On Tueday 01-12-11 we gapped higher and started trading above the R2 level of the day. We then started making higher highs combined with higher lows on the 30 minute time frame. Up until 12:30 we never had any bar take out ( trade below) the previous 30 minute bars low. I can almost say that we ALWAYS will make a test of a previous bars low at some point during the trading day when we trend! I can't recall from memory a day in the market that we haven't in recent years.

So at the close of bar 4 we have multiple sets of single prints , and a ledge which is also an area of triples below the market. Also an air pocket on the 5 minute bars ( not shown). It's also 12:30 so it is not a great TRENDING time frame. Here is the context chart.

I took the entry ( for the record this was my second short attempt up here) at bar 4's close BECAUSE I knew that there was a high probability that even if the next bar went higher that it would probably come back down because you donot normally see THREE sets of single prints before a reaction test DOWN. So if bar 5 kept going up then a third set of single prints would have formed. This and all those targets below helped me take the trade.

here is what happened after: Note how we filled in the ledge, the air pockets and all single prints. These charts and post take too much time, probably too much time..so I'd like to know if you can understand them.

Thanks

Bruce

So I'd like you to vote this thread up if you understand the reasoning for the trade and the concepts and vote it down if you don't. You may not agree with the trade and it may not even be a trade you would take but that should not stop you from understanding the reasons for taking it.

For those who can't or don't vote then please leave a comment in this thread of send me a private message with your feedback. This will help me to know that my effort at posting my trades and ideas is coming through or let me know that I'm not doing a good job explaining and need to step up my efforts at getting the ideas across.

On Tueday 01-12-11 we gapped higher and started trading above the R2 level of the day. We then started making higher highs combined with higher lows on the 30 minute time frame. Up until 12:30 we never had any bar take out ( trade below) the previous 30 minute bars low. I can almost say that we ALWAYS will make a test of a previous bars low at some point during the trading day when we trend! I can't recall from memory a day in the market that we haven't in recent years.

So at the close of bar 4 we have multiple sets of single prints , and a ledge which is also an area of triples below the market. Also an air pocket on the 5 minute bars ( not shown). It's also 12:30 so it is not a great TRENDING time frame. Here is the context chart.

I took the entry ( for the record this was my second short attempt up here) at bar 4's close BECAUSE I knew that there was a high probability that even if the next bar went higher that it would probably come back down because you donot normally see THREE sets of single prints before a reaction test DOWN. So if bar 5 kept going up then a third set of single prints would have formed. This and all those targets below helped me take the trade.

here is what happened after: Note how we filled in the ledge, the air pockets and all single prints. These charts and post take too much time, probably too much time..so I'd like to know if you can understand them.

Thanks

Bruce

Originally posted by BruceM

Like I said before, 90% of my trades are fades and usually happen near previous highs and lows of the RTH session, the overnight session and other key chart points. Again a very visual thing. Agreed, snap a couple of lines at S/R and let 'er rip!

With that said I also understand how you might think it is complicated. This particular trade had many different ideas which lead me to believe that some selling might come in. I'm just pointing out the things I see that accumulated as we went higher. Some might just want to trade for triples or even better the air pockets. If you study today's chart ( Friday, January 14th ) and the chart above you will see many cool differences and perhaps you will see why my fades in the later part of today didn't go anywhere.

My view was there was no target (support) sufficiently far enough away to take those later fades.

My advice to anyone would be to stick with the things that come easy. If you have a proven method that you enjoy then just stick with that.

I think it is real difficult to incorporate new ideas while day trading and let me give a personal example. Two things that I used many years ago were the weekly open and the 50% mark on ranges. About four moths ago I started to "remember" them again. So I try to think about the ideas while I'm trading and here is the key point:

Some days I will remember to be aware of those areas in the morning before trading and by the time the afternoon has come I have forgotten about them. I get caught up in the movement of the market and ideas that I'm currently more familiar with. So I basically have trouble remembering my own stuff...all within a few hours..

Sounds WAY too familiar!

Thanks so much for the reply..I appreciate your comments.Originally posted by Big Mike

Bruce,

I find your ideas very interesting although way too detailed and complicated for me.

To keep all the things that you use coordinated is amazing. I prefer simple but will keep reading and enjoying.

Thanks!

Always interesting, thanks Bruce.

Bruce, upon reviewing your trade and explanation, i dont see anything i dont understand. It appears to be simple breakout concepts, with a dabbling of MP theory thrown in. As i recall, you were quite good at pointing out the air, triples ,etc on the way up,so i for one, knew you were looking for a short. The entry , however, was a bit 'after the fact' in that you could have been a little more specific after bar #4 lets say, to identify exactly what would prompt your order placement. I do think your being a bit 'sensitive' about the lack of questions at the time. Look, some of my most brilliant calls ( which i define as an exact strike of a price and turn, from a long distance away, when most others had completely different views) have not even garnered a single vote! LOL, The fact is, most readers at this, or any forum, are likely, looking for that defined entry and exit, well in advance, with simple to understand reasons so they can see if it is something that 'fits; with their own work, or view. Unfortunately, this ignores the fact that some of what you do is ,as one termed it discretionary. In my opinion, that is the essense of market profile, a collection of ideas and concepts,that need interpetation, ... not a well defined system for exact entries and exits! For my own part, i have enjoyed your explanations and views ,over the years,and more important, i have LEARNED a great number of concepts, particularly with regard to mp . I even have incorporated some of what you do in my own work.. air (single prints) for instance. So please, brother, keep up the good work, and those posts coming! There are a number of us here who greatly enjoy, and more importantly, Learn, a lot from what you do!

Great Rburns...you guys are giving me lots of great feedback...perfect....

I use three main charts ...the 30 minute , the 5 minute and the one minute......if you look at your 5 minute chart from that day you will see the triples on the 5 minute. At the same point and time on the 30 minute chart a ledge forms....In general a ledge is on the 30 minute and doesn't have to be consecutive where the triples do need to be consecutive..to sum that up we had triples on the 5 minute time frame and a ledge on the 30 minute...at the same time

I just don't have the time to post as many charts as i would like...but I hope that clears up the confusion from this specific chart example. It is a busy chart and should have been split up. I appreciate the honest input I'm getting and pleasse keep asking questions about anything.

This thread isn't meant to be a "please stroke my ego" thread but I do appreciate the positive vibes. I really just want to make sure the ideas are getting thorugh and can be understood. So far I'm encouraged but realize I may need to be a bit more specific but it also tells me that the concepts have come through.

Thank you Rburns!!

I use three main charts ...the 30 minute , the 5 minute and the one minute......if you look at your 5 minute chart from that day you will see the triples on the 5 minute. At the same point and time on the 30 minute chart a ledge forms....In general a ledge is on the 30 minute and doesn't have to be consecutive where the triples do need to be consecutive..to sum that up we had triples on the 5 minute time frame and a ledge on the 30 minute...at the same time

I just don't have the time to post as many charts as i would like...but I hope that clears up the confusion from this specific chart example. It is a busy chart and should have been split up. I appreciate the honest input I'm getting and pleasse keep asking questions about anything.

This thread isn't meant to be a "please stroke my ego" thread but I do appreciate the positive vibes. I really just want to make sure the ideas are getting thorugh and can be understood. So far I'm encouraged but realize I may need to be a bit more specific but it also tells me that the concepts have come through.

Thank you Rburns!!

Originally posted by rburns

Bruce

I find you to be one of the two finest live posters of trades anyone will ever have the pleasure of reading on the internet. Mr Kool being the other. With that said, it is really the responsibility of any trader to do his own thing. I only read this site as I find too much info a detrimental to my trading. I look to see what areas you and Kool are interested in trading at. Kools reasons I can always understand as his formula is simple and well documented. You do confuse me at times as to why the area is important. I will give you one example and leave it at that. In your first chart you call the ledge trips. I only see two. In the second chart I do see a third ledge there. Irregardless I am responsible for my own trades and appreciate seeing what levels you are trading at.

Best regards and good trading to all David

Bruce one of your other concepts I have read in the past has delt with your expectations of 30 min HL and running out as I believe you have called it. I have guessed that you use it as a reversal signal but it doesnt fit my plan so I dont consider it in my trading.

Not to hijack your thread I will put as simply as possibly my signals. I used a 5 min for air lines. A 13 and 30 min for both air and Kools lines. Addition areas of interest are drawn from the MP previous day VAH and VAL along with the MP initial balance. This then gives me areas of confluence both above and below the market to trade at when an overbot and oversold osc I concocted on a 1.25 range chart tells me to hit the button. As you can see both yours and Kools teachings are used. If I have confused any one or a futher explanation is asked for i will gladly respond. David

Not to hijack your thread I will put as simply as possibly my signals. I used a 5 min for air lines. A 13 and 30 min for both air and Kools lines. Addition areas of interest are drawn from the MP previous day VAH and VAL along with the MP initial balance. This then gives me areas of confluence both above and below the market to trade at when an overbot and oversold osc I concocted on a 1.25 range chart tells me to hit the button. As you can see both yours and Kools teachings are used. If I have confused any one or a futher explanation is asked for i will gladly respond. David

This is an interesting post Bruce and some equally inportant feedbacks. However what I could never understand is what triggered your entry!!!!!!. So lets start with this.... We have a 1/15/30 min. chart.On these chart you apply lines at Pr. RTH High/Low, Pr. H/L, Overnight H/L, VAL/POC/VAH,Pivot points and Ratchets. Now when the RTH open we start looking for gap up/down, air/triples on 5 min chart, ledge (what is a ledge???) on a 30 min chart to form.So say one of the above pattern forms.... Now what do we start looking for as the market starts to approach any one of our support resistance lines we have applied. Any specific pattern? How do we trigger the entry???????

Glad this is understandable Koolio. I agree with you completely that most people are looking for some form of exact entry and exit and many times they look for some kind of price action to do so. Over time I have found that I don't see enough price action exits or entries so I basically just take the trade in a specific "zone". I just got tired of waiting for inside or outside bars, doji bars or whatever to pull the trigger. Sometimes they just never come.

I'm not specifically sure what you mean by "after the fact" on that particular trade ? It was posted slightly after my entry which is almost 99% market orders on entries. Exits are handled a bit differnt sometimes and I keep things a bit more "loose" than most traders. What I am basically doing is analyzing all the evidence, forming a bias and then taking the trade. One could almost take random entries as long as they can manage when they are wrong but adding in a bias and having "evidence" increaes the odds of having a potentially profitable trade.

With all that said, I agree with you in that I could have been more specific on the entry but I'm not really looking for anyone to take the trade with me. This gets back to the risk tolerance and account size issues I mentioned before. I really wouldn't want to tell anyone to "sell here and risk 3 points" for example.I'm trading market development and I think you summed up the drawbacks to that. It just isn't specific !

Recently I added the 30 minute closes as a guideline to monitor. I donot rely on them completely as I am still testing the concepts but it shows promise. Echoing the thoughts of Rburns, I would really like folks to make the ideas their own. I try to post when and where I will be wrong but it is not always so easy...especially when I add into trades. You may have noticed that I am not doing that as often this year so far. On friday I had two fades late in the day that went nowhere. I used the close concept to exit and will post a chart later as I feel it is a good example.

Sometimes I babble on so much that my thoughts and posts are not as clear as they probably could be. Hence the title of this thread. In the past I have been "sensitive" but this particular thread was trying to be about clarity. I'm not planning to stop posting but I am looking at ways that I can be a better trader and also get some ideas across....I've always wondered if it would be better to avoid posting while trading.....still not sure if it's good or bad....posting on a forum also lets me give my trades room to breathe and acts as a temporary distraction.

So I'm processing all this great feedback and getting a good feel on things that need improvement too. Thanks so much for taking the time and effort in writing out your thoughts to me on this. I appreciate them and realize it takes time to put our personal lives on hold to type things into the computer....

This trader is glad he has a fine group of folks to tell it like it is.

Bruce [p]

I'm not specifically sure what you mean by "after the fact" on that particular trade ? It was posted slightly after my entry which is almost 99% market orders on entries. Exits are handled a bit differnt sometimes and I keep things a bit more "loose" than most traders. What I am basically doing is analyzing all the evidence, forming a bias and then taking the trade. One could almost take random entries as long as they can manage when they are wrong but adding in a bias and having "evidence" increaes the odds of having a potentially profitable trade.

With all that said, I agree with you in that I could have been more specific on the entry but I'm not really looking for anyone to take the trade with me. This gets back to the risk tolerance and account size issues I mentioned before. I really wouldn't want to tell anyone to "sell here and risk 3 points" for example.I'm trading market development and I think you summed up the drawbacks to that. It just isn't specific !

Recently I added the 30 minute closes as a guideline to monitor. I donot rely on them completely as I am still testing the concepts but it shows promise. Echoing the thoughts of Rburns, I would really like folks to make the ideas their own. I try to post when and where I will be wrong but it is not always so easy...especially when I add into trades. You may have noticed that I am not doing that as often this year so far. On friday I had two fades late in the day that went nowhere. I used the close concept to exit and will post a chart later as I feel it is a good example.

Sometimes I babble on so much that my thoughts and posts are not as clear as they probably could be. Hence the title of this thread. In the past I have been "sensitive" but this particular thread was trying to be about clarity. I'm not planning to stop posting but I am looking at ways that I can be a better trader and also get some ideas across....I've always wondered if it would be better to avoid posting while trading.....still not sure if it's good or bad....posting on a forum also lets me give my trades room to breathe and acts as a temporary distraction.

So I'm processing all this great feedback and getting a good feel on things that need improvement too. Thanks so much for taking the time and effort in writing out your thoughts to me on this. I appreciate them and realize it takes time to put our personal lives on hold to type things into the computer....

This trader is glad he has a fine group of folks to tell it like it is.

Bruce [p]

Originally posted by koolblue

Bruce, upon reviewing your trade and explanation, i dont see anything i dont understand. It appears to be simple breakout concepts, with a dabbling of MP theory thrown in. As i recall, you were quite good at pointing out the air, triples ,etc on the way up,so i for one, knew you were looking for a short. The entry , however, was a bit 'after the fact' in that you could have been a little more specific after bar #4 lets say, to identify exactly what would prompt your order placement. I do think your being a bit 'sensitive' about the lack of questions at the time. Look, some of my most brilliant calls ( which i define as an exact strike of a price and turn, from a long distance away, when most others had completely different views) have not even garnered a single vote! LOL, The fact is, most readers at this, or any forum, are likely, looking for that defined entry and exit, well in advance, with simple to understand reasons so they can see if it is something that 'fits; with their own work, or view. Unfortunately, this ignores the fact that some of what you do is ,as one termed it discretionary. In my opinion, that is the essense of market profile, a collection of ideas and concepts,that need interpetation, ... not a well defined system for exact entries and exits! For my own part, i have enjoyed your explanations and views ,over the years,and more important, i have LEARNED a great number of concepts, particularly with regard to mp . I even have incorporated some of what you do in my own work.. air (single prints) for instance. So please, brother, keep up the good work, and those posts coming! There are a number of us here who greatly enjoy, and more importantly, Learn, a lot from what you do!

That's what it's all about....taking out the ideas that show promise and fine tunning them to your own account and risk. Great!!

Originally posted by rburns

Bruce one of your other concepts I have read in the past has delt with your expectations of 30 min HL and running out as I believe you have called it. I have guessed that you use it as a reversal signal but it doesnt fit my plan so I dont consider it in my trading.

Not to hijack your thread I will put as simply as possibly my signals. I used a 5 min for air lines. A 13 and 30 min for both air and Kools lines. Addition areas of interest are drawn from the MP previous day VAH and VAL along with the MP initial balance. This then gives me areas of confluence both above and below the market to trade at when an overbot and oversold osc I concocted on a 1.25 range chart tells me to hit the button. As you can see both yours and Kools teachings are used. If I have confused any one or a futher explanation is asked for i will gladly respond. David

One of the basic things to look for is a volume and $tick divergence. It usually takes strong $tick, volume and broad participation from other markets to drive price outside of key ranges. Many you have mentioned above. Some like to use Market Delta and cumulative delta to help refine this.

I also feel that I have a strong instinctive feel for a failed break but I still get caught in those sometimes. How and where we open in relation to previous days is very important and how we travel to range extremes can be a clue.

As a quick example: On thursday I believe we tried to break down the Overnight low but we had only one 30 minute close below that low and couldn't go further....so sometimes just realizing which way the market isn't able to push is enough for me. It isn't often that they just blow though highs and lows without a retest....so it becomes a probability thing. Quite often we stall at these points...enough to tighten the stop or take a profit....and when they trend then we lose.

I know this doesn't specifically answer your question but you need to think about what it takes to TREND the S&P market...that is my continued study...I'm obsessed with that, it is my passion, it drives me....it only happens 18 - 20% of the time or less but that small portion of time can drain you financially and mentaly. The biggest thing I look at is the volume...quite often you will see volume come in ahead of a significant price point so when it gets to the exact breakout point it doesn't have volume left for the breakout. so you get a stall affect...and often that stall leads to a move in the opposite direction. Sometimes it's only a pause before the trend continues

I hope that helps....I really can't explain the instinctive side of it but will need to give it more thought

I also feel that I have a strong instinctive feel for a failed break but I still get caught in those sometimes. How and where we open in relation to previous days is very important and how we travel to range extremes can be a clue.

As a quick example: On thursday I believe we tried to break down the Overnight low but we had only one 30 minute close below that low and couldn't go further....so sometimes just realizing which way the market isn't able to push is enough for me. It isn't often that they just blow though highs and lows without a retest....so it becomes a probability thing. Quite often we stall at these points...enough to tighten the stop or take a profit....and when they trend then we lose.

I know this doesn't specifically answer your question but you need to think about what it takes to TREND the S&P market...that is my continued study...I'm obsessed with that, it is my passion, it drives me....it only happens 18 - 20% of the time or less but that small portion of time can drain you financially and mentaly. The biggest thing I look at is the volume...quite often you will see volume come in ahead of a significant price point so when it gets to the exact breakout point it doesn't have volume left for the breakout. so you get a stall affect...and often that stall leads to a move in the opposite direction. Sometimes it's only a pause before the trend continues

I hope that helps....I really can't explain the instinctive side of it but will need to give it more thought

Originally posted by ak1

This is an interesting post Bruce and some equally inportant feedbacks. However what I could never understand is what triggered your entry!!!!!!. So lets start with this.... We have a 1/15/30 min. chart.On these chart you apply lines at Pr. RTH High/Low, Pr. H/L, Overnight H/L, VAL/POC/VAH,Pivot points and Ratchets. Now when the RTH open we start looking for gap up/down, air/triples on 5 min chart, ledge (what is a ledge???) on a 30 min chart to form.So say one of the above pattern forms.... Now what do we start looking for as the market starts to approach any one of our support resistance lines we have applied. Any specific pattern? How do we trigger the entry???????

Thanks Bruce, to me the bottom line is that each morning post thoughts about the overnight session explaing if any thing catches the eye or sticks out, in which time frame and why it sticks out. Lot of work..... though. Then go from there as RTH rolls out.

BruceM wrote

"I really wouldn't want to tell anyone to "sell here and risk 3 points" for example. I’m trading market development and I think you summed up the drawbacks to that. It just isn't specific!”

These simple words have a lot of value in them. Stop loss has different meanings depending upon a number of factors like volatility, volume, overnight range, type of economic data etc, etc. It isn't perfect and never will be. Defining a perfect S/L for a given market is another quest for the Holy Grail... will one be successful... Often one may hear Oh!!! I exited and the market reversed!!!!!

One can stop loss in many different ways....... A few e.gs are.....Exit a position completely when a tolerance limit is reached or exceeded. Another is to add to a loosing position when the criteria that were met at the initial entry point are met again e.g. you sold the market when the stochastic were in the overbought condition and we had a bearish cross in the MACD. Let this condition occur again in order to add to the loosing position. Another way could be to exit partially i.e. if you are in with say 10 contracts close 1 or more contracts.

Another way is don’t trade if you don’t understand what’s going on....... Money not traded is money saved. It is said even madness has a logic..... So go looking for it before getting on the rollercoaster..................

There may be more ways....to stop loss.......

One technique that can be useful in order to augment the way one lets a trade breath is to enter the market 2-4 seconds before the close of a one minute candle and at that point "Join Bid/Offer” instead of a market order. This gives an extra 1-2 tick advantage and prevents slippage that may occur while placing market orders.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.