ES short term trading 1-11-11

Things I'm watching in the Rth session:

1274 - 75 - this is last weeks high, the R2 level today and a key Rat.

We are on target to open outside of yesterdays range so I'll be watching for the following:

1/2 a gap fill within the first 30 - 60 minute

a retest of the R1 level in the first 30 minutes - if we open above

Watching to see if we trade on both sides of the Opening range

These will be the clues that mean reversion trading is working and odds DO NOT favor a gap and go type of day.

Report at 10 so initial shorts will be lighter..

Other key area is 68 - 70 as that is yesterdays high and the midpoint of this big range we seem to be in ( 1275 - 1258.50)also that key R1 level sits there

1274 - 75 - this is last weeks high, the R2 level today and a key Rat.

We are on target to open outside of yesterdays range so I'll be watching for the following:

1/2 a gap fill within the first 30 - 60 minute

a retest of the R1 level in the first 30 minutes - if we open above

Watching to see if we trade on both sides of the Opening range

These will be the clues that mean reversion trading is working and odds DO NOT favor a gap and go type of day.

Report at 10 so initial shorts will be lighter..

Other key area is 68 - 70 as that is yesterdays high and the midpoint of this big range we seem to be in ( 1275 - 1258.50)also that key R1 level sits there

That 1274 area is also the .618 extension of Monday's RTH session ... with the 1.0 extension at 1278 ... a heads-up as per Paul's research that if it hits and moves beyond the .618 then odds favor it reaching the 1.0

Either way ... important price area.

Either way ... important price area.

Some of my numbers are congruent with yours, I also have a bit higher objective at 1280.00 .

From my perspective, the outside objective at 1280.00 will be void if the ES moves below 1264.00 (It did hit 1264.00 O/N but bounced back up)

Right now ES is near the prev. day H. possible test here- I'm currently waiting for a signal to get in.

Will see, in due time the market will show us the way .

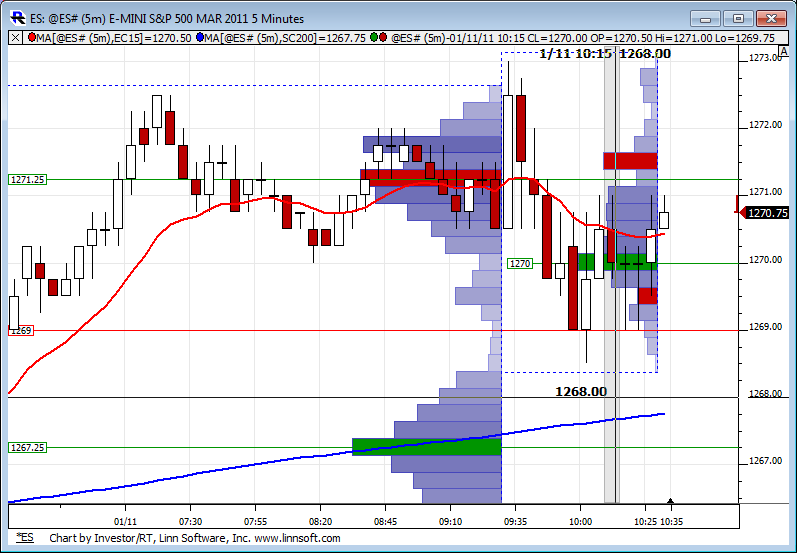

ES trading 1270.25 @ 10:14

From my perspective, the outside objective at 1280.00 will be void if the ES moves below 1264.00 (It did hit 1264.00 O/N but bounced back up)

Right now ES is near the prev. day H. possible test here- I'm currently waiting for a signal to get in.

Will see, in due time the market will show us the way .

ES trading 1270.25 @ 10:14

Originally posted by MonkeyMeat

That 1274 area is also the .618 extension of Monday's RTH session ... with the 1.0 extension at 1278 ... a heads-up as per Paul's research that if it hits and moves beyond the .618 then odds favor it reaching the 1.0

Either way ... important price area.

so far Ticks and volume tappered off from yesterday...I think we will see the 50% and gap fill so still leaning short

Nice calls and work Bruce!

Originally posted by BruceM

Things I'm watching in the Rth session:

1274 - 75 - this is last weeks high, the R2 level today and a key Rat.

We are on target to open outside of yesterdays range so I'll be watching for the following:

1/2 a gap fill within the first 30 - 60 minute

a retest of the R1 level in the first 30 minutes - if we open above

Watching to see if we trade on both sides of the Opening range

These will be the clues that mean reversion trading is working and odds DO NOT favor a gap and go type of day.

Report at 10 so initial shorts will be lighter..

Other key area is 68 - 70 as that is yesterdays high and the midpoint of this big range we seem to be in ( 1275 - 1258.50)also that key R1 level sits there

those triples below have me holding a new short from 71.25..all that is really left is the hour range...which one will they break.....? Volume is sucking...for some reason I'm drawn to the NQ today as a measure...like to see the 11pm close below yesterdays highs in NQ

its AM Bruce:}

we didn't hit the 50% back so that is something in the back of my mind on this second campaign..so we have some conflicts between the things that DID happen and the things that are SUPPOSED to happen by now..

added at 73.25...to short..cautious though

added at 73.25...to short..cautious though

we didn't hit the 50% back so that is something in the back of my mind on this second campaign..so we have some conflicts between the things that DID happen and the things that are SUPPOSED to happen by now..

added at 73.25...to short..cautious though

added at 73.25...to short..cautious though

thanks for the good words.....I think the biggest problem with trading is trying to figure which are THEE best numbers to look at....this is just me babbling and not directed at you...so that's why I set up zones of confluence.....It's very hard to get exact tops and bottoms but we can come up with areas that many folks are looking at.......that's why I can't use fibs and other projection methos..it's not that they don't work, they certainly do as we have seen Kool blue use them for years,,,,,,It's just that my simple brain can only process so much...it is already overloaded enough...

ah, chasing girls...I still do that but only two girls...my wife and my "almost" two year old..Good luck( ;q

ah, chasing girls...I still do that but only two girls...my wife and my "almost" two year old..Good luck( ;q

Originally posted by i1hunter

Great work Bruce! Two things I missed today that should have me trading with you in the down side. 1) R2 resistance at 1273.75, Es spent some time in that area. You had it right.

2) This afternoon I was short and overlooked yesterday's close at 1265.50. The ES hit that 1265.50 and bounced right back, I missed reversing my position, short term oscillators where oversold too! ....... Looking forward to tomorrow, God willing,

Done chasing the market, now time to go chase the girls, YeeeHaaa!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.