ES short term trading 01/06/11

In order to overcome the 1273.50 resistance barrier from this afternoon, I think the ES will need to open gap up and above it.

So for tonight and tomorrows trading: If ES moves above 1272,50, will target 1276.75 as first objective, above 1276.75, 1281.25 as second obj. above 1281.25, 1285.75 as third Obj.

The voiding point for that possible scenario is at 1269.25.

Below 1269.25, 1265.00 is next support.

ES trading 1272.00 @ 22:22

Will see, and as always, the market has the last word and in due time will show us the way.

So for tonight and tomorrows trading: If ES moves above 1272,50, will target 1276.75 as first objective, above 1276.75, 1281.25 as second obj. above 1281.25, 1285.75 as third Obj.

The voiding point for that possible scenario is at 1269.25.

Below 1269.25, 1265.00 is next support.

ES trading 1272.00 @ 22:22

Will see, and as always, the market has the last word and in due time will show us the way.

as long as we don't close on 30 minute back above the O/N low and 60 minute low then that ledge in 67.25 area is a reasonable goal

Back from lunch. Moving stop to B.E. 1267.25

ES trading 1271.25 @ 14:01

ES trading 1271.25 @ 14:01

Originally posted by i1hunter

I did, actually 1267.25 with stp at 1266.00. I'm looking for a retest of O/N highs possibly 1280/81.

Moving below 1266.00 will void my objective and have me reversing towards 262.50 and possibly 1257 area.

ES trading 1269.00 @ 11:55Originally posted by koolblue

so did every body buy that 66 area?

yeah, i much prefer longs here...but i did just sell (one only) at 1271.75

Failing to move above previous day close 1271.75. testing as SR, lots of resistance here. Taking partial profit on three and let 2 go with sto at 1269.25

ES trading 1271.25 14:09

ES trading 1271.25 14:09

Originally posted by i1hunter

Back from lunch. Moving stop to B.E. 1267.25

ES trading 1271.25 @ 14:10

Originally posted by i1hunter

I did, actually 1267.25 with stp at 1266.00. I'm looking for a retest of O/N highs possibly 1280/81.

Moving below 1266.00 will void my objective and have me reversing towards 262.50 and possibly 1257 area.

ES trading 1269.00 @ 11:55Originally posted by koolblue

so did every body buy that 66 area?

, if i had two es instead of one ,id let the runner go ,but i wasnt that smart!...

i only have 2.5 handles in the bank today so i've lowered my stop to 1272.50 from 73 originally...

just took 1272.25... there seems to be more support here than i would have suspected,..plus 1.5 (only had one es)

1272.25 is the red avg on my 5 min chart.. normal support in an uptrend...

Runners stp out. Will see if will give me an other set-up or I'm closing shop.

ES trading 1269.25 @ 14:44

ES trading 1269.25 @ 14:44

Originally posted by i1hunter

Failing to move above previous day close 1271.75. testing as SR, lots of resistance here. Taking partial profit on three and let 2 go with sto at 1269.25

ES trading 1271.25 14:09Originally posted by i1hunter

Back from lunch. Moving stop to B.E. 1267.25

ES trading 1271.25 @ 14:10

Originally posted by i1hunter

I did, actually 1267.25 with stp at 1266.00. I'm looking for a retest of O/N highs possibly 1280/81.

Moving below 1266.00 will void my objective and have me reversing towards 262.50 and possibly 1257 area.

ES trading 1269.00 @ 11:55Originally posted by koolblue

so did every body buy that 66 area?

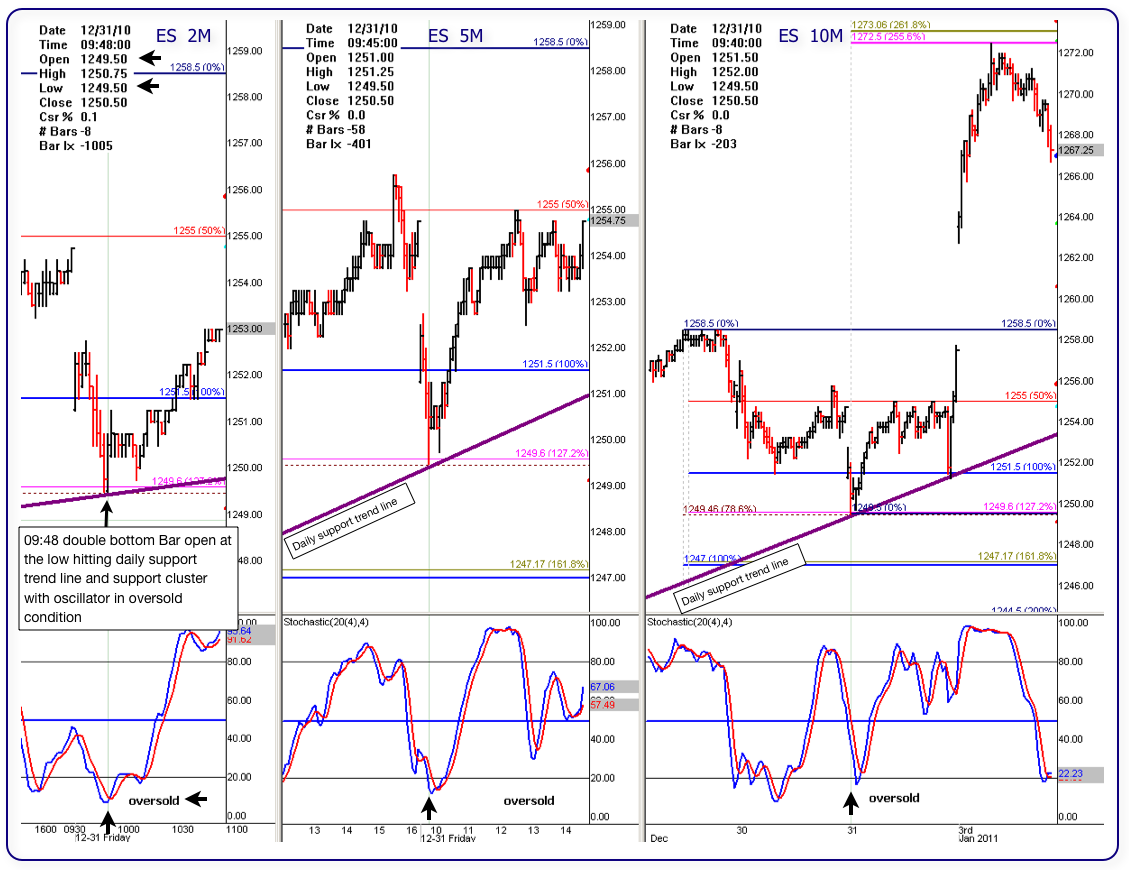

Here is one example of double bottom, "BUT" it is in a 2M chart.

Below is a pic of 3 intraday charts from the same day session 12/31/10. A 2M chart (left), a 5M and a 10M.

In the 2M chart, notice that at 09:46, the price hits the daily support trend line and percentage support cluster (78.6% and 127.2%) then bounces off. The second 2m bar, at 09:48 opens right at support and also bounces off creating a double bottom with the opening right at the low on support.

Notice that the other time frame isolators where working their way down to oversold.

This set-up does not happen often but when it does it is fun to trade it.

Below is a pic of 3 intraday charts from the same day session 12/31/10. A 2M chart (left), a 5M and a 10M.

In the 2M chart, notice that at 09:46, the price hits the daily support trend line and percentage support cluster (78.6% and 127.2%) then bounces off. The second 2m bar, at 09:48 opens right at support and also bounces off creating a double bottom with the opening right at the low on support.

Notice that the other time frame isolators where working their way down to oversold.

This set-up does not happen often but when it does it is fun to trade it.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.