ES Short Term Trading 01-05-2011

small shorts going on at 63.75......odds favor another test of opening print still...ideal shorts will be above gap fill if it happens

On last weekends preview, while stressing that a decent correction could start at any time, i tried to hint that my bias was for a favored time frame would be mid to late this month. The calendar showed Mon as a Kools turn point day and i showed 2 different reasons why on the daily chart. Monday was the 1272.50 high ! And we have a decent little 16 handle decline since then. This is exactly what i suspected although i really thought we'd get to the 1251.50 area or even 1248 as a max decline. I suppose we still could, but i'm inclined to believe that may be it and new rally highs lay ahead (likely toward the 1304 or 1312 areas i mentioned.LATER THIS MONTH and at these zones is where i really suspect a much larger decline (80+ handles ) could materialize. Anyway, whether or not any of this unfolds, this is why today ,for instance, i am trying longs!(bought 1253.50 just before 10 am and sold at 1266.00 so far). Currently, im trying to buy at 1264.00 (still doing homework!)... Time will tell!

still expecting trade back to open range..context...is open inside range and we didn't have two 30 minute bars go through open the last two days....obvious support is the weekly open at 63.25 to getthrough...all air is filled

Attention, Charter Joe... kudos to your call of 1.34 resistance on the euro! Brilliant!.. Do you ever watch gold?...

Out finally at 1265.75,plus 1.75 on 2 es.. im such a wimp tho, i really should have sold one and held the runner for the 1269 area...oh well...

starting new short campaign at 66.75...

I was waiting for YD triples to get run out to start new campaign...longs will want air fill from YD if my short has pressure

and nice buy koolio!!

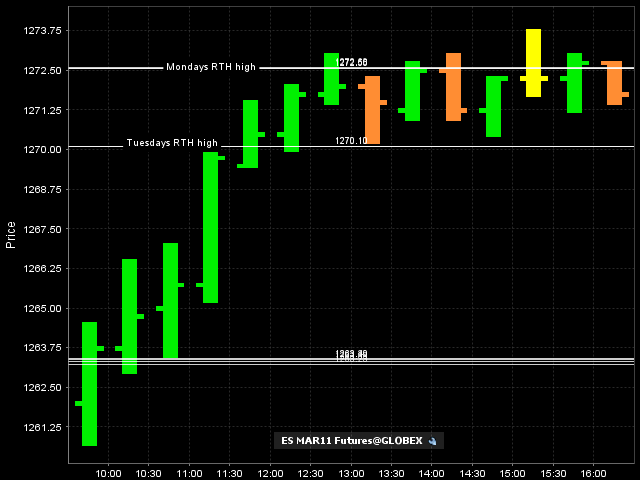

here is a look at the 30 minute closes from today. a few quick things to note:

1: The close above the hour highs

2: The close above the high from Tuesday

3: The failure ( except for the 4 pm close) to get a close above the high from Monday

4: The ping pong match of price not being able to close back below Tuesdays high and inability to sustain the close above Mondays highs

I used the concept to take a good loss. I sold the 69.50 and the 70.75 but exited when we closed above Tuesdays high on the 5th bar of the day.

I also went short the first time we went above Mondays based on a few market profile reasons.. I won't mention here. Email me if you really need to know. Here is the chart. I'm not gonna ram this concept down anyones throat. You will either see the value to it or it will be useless to you. Nuff said!

1: The close above the hour highs

2: The close above the high from Tuesday

3: The failure ( except for the 4 pm close) to get a close above the high from Monday

4: The ping pong match of price not being able to close back below Tuesdays high and inability to sustain the close above Mondays highs

I used the concept to take a good loss. I sold the 69.50 and the 70.75 but exited when we closed above Tuesdays high on the 5th bar of the day.

I also went short the first time we went above Mondays based on a few market profile reasons.. I won't mention here. Email me if you really need to know. Here is the chart. I'm not gonna ram this concept down anyones throat. You will either see the value to it or it will be useless to you. Nuff said!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.