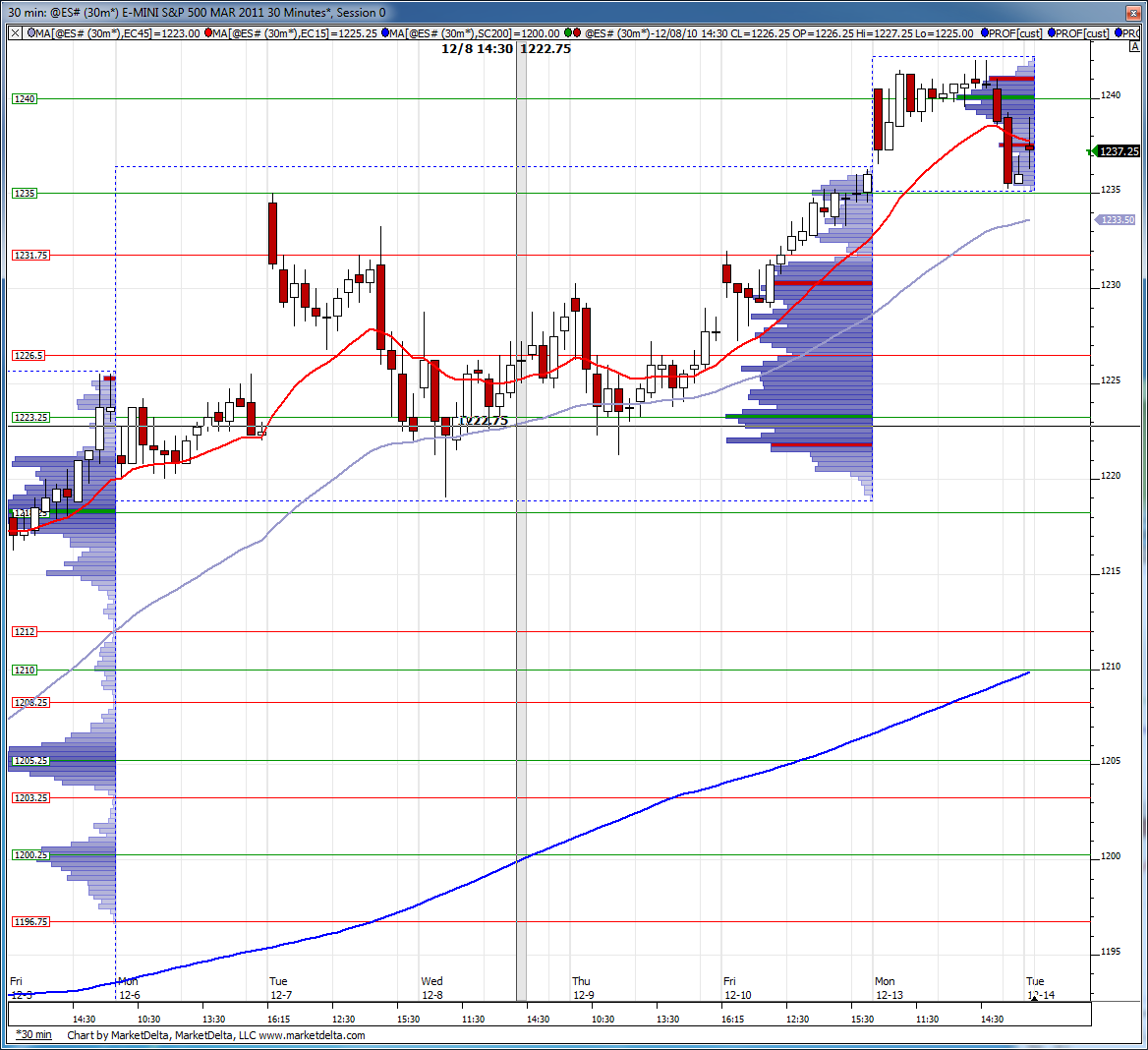

selling 1240 and 1242...

In O/N session.......1242 hasn't hit yet........betting they don't want to spend much time trading near the 1250 RAT on this opt. Exp Monday....

will hold for gap fill...

will hold for gap fill...

Game of chicken going on here at this 38.50 level.

Originally posted by pt_emini

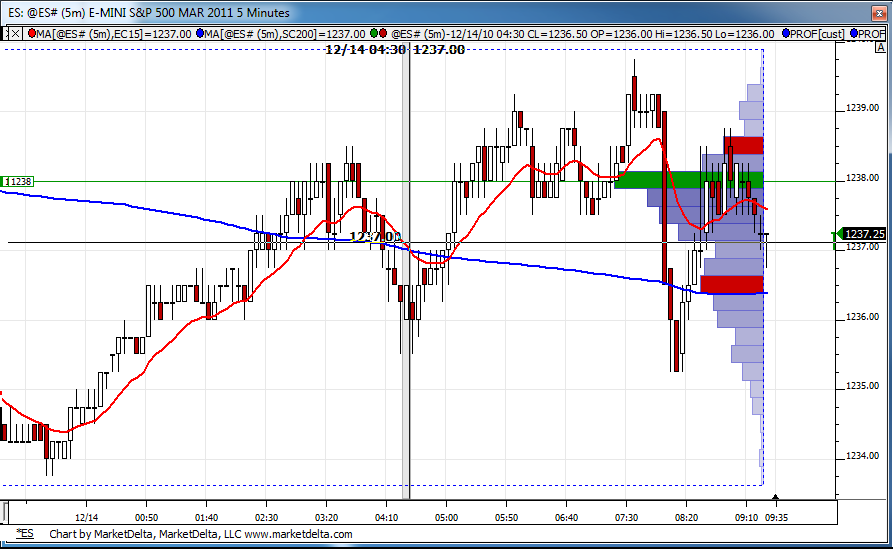

Just entered short at 1239.25 at the low volume break point on Lorn's chart.

Closed the short attempt at 1240.00 with a 3 tick loss.

trading for 38.50 run out...so short again

symetric volume should bring market back to midpoint of range and run outthe 38.50

39 is midpoint so buyers may protect a bit before that 38.50 ledge runs

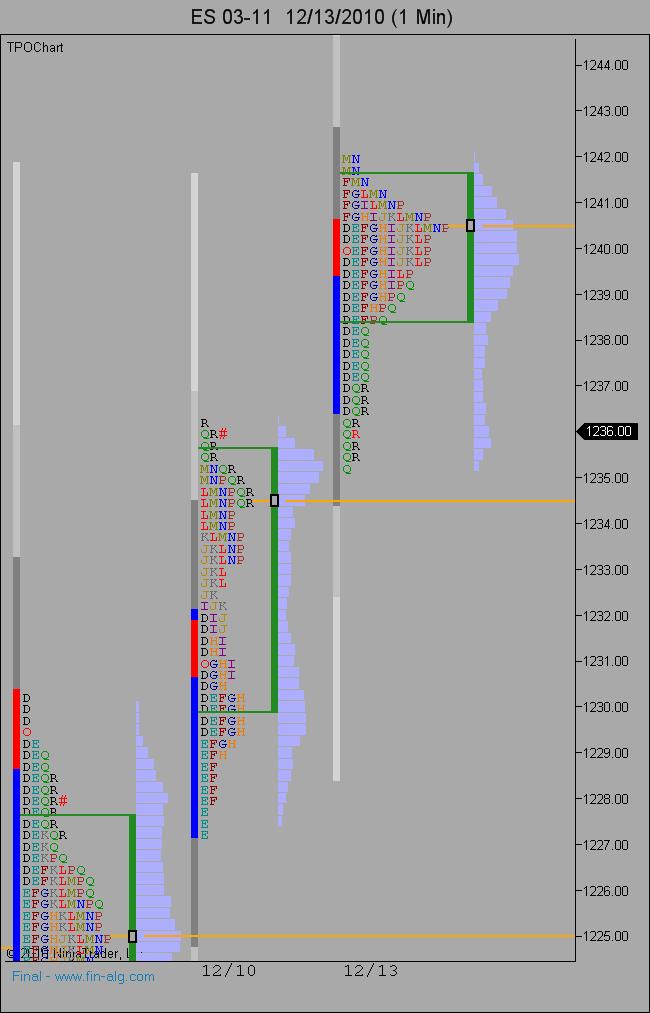

My resistance this morning , pre- open , is 1239.75 - 1240.50.... (high vol + POC). Above that level is 1241.50 - 1242.00 (VAH + yest High).

Support clearly delineated at 1235.25. Below that is a low volume zone at 1232.00 - 1232.50 (in the middle of Friday's Value Area).

Got off a couple short trades yesterday late as market finally broke down through the 1238.50 support level.

This morning starting with a short at 1239.25

FOMC this afternoon, so expect things to slow down a bit through the late morning into lunchtime hours.

Support clearly delineated at 1235.25. Below that is a low volume zone at 1232.00 - 1232.50 (in the middle of Friday's Value Area).

Got off a couple short trades yesterday late as market finally broke down through the 1238.50 support level.

This morning starting with a short at 1239.25

FOMC this afternoon, so expect things to slow down a bit through the late morning into lunchtime hours.

this is untradeable to me......watching pushes up away from Pivot and rat at 1237.50 to sell into..so basically using the 36 - 37.50 as a magnet...but haven't traded yet....

Last month on Tuesday and wednesday of Opt. expiration they kept it away from 1175 and 1200 Rats.......so lets see if they can keep it away from 1250 and 1225 over the next two days.....obvious Fed day and tax news may give the market some extra volatility but still watching those two areas as main keys

Last month on Tuesday and wednesday of Opt. expiration they kept it away from 1175 and 1200 Rats.......so lets see if they can keep it away from 1250 and 1225 over the next two days.....obvious Fed day and tax news may give the market some extra volatility but still watching those two areas as main keys

Great job from everyone! BruceM, Lorn, Monkey M, & Pt-mini.

Thanks for sharing the way you see.

Thanks for sharing the way you see.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.