ES Short Term Trading 11-30-2010

I have support at 1172.25 (Yesterday's low) 1170 or 2.618% ext from O/N. Also 1168 MdP Lots of support in this area. If below then 1154 will be my objective.

for the outside? Looking at 1184 PP and a possible test of O/N high. Will see what the market gives us today.

I see for you the same I see for my self: Having the very best of luck and most profitable trading adventure!

for the outside? Looking at 1184 PP and a possible test of O/N high. Will see what the market gives us today.

I see for you the same I see for my self: Having the very best of luck and most profitable trading adventure!

watching the spike low of 77.50.....critical as we opened BELOW it....will be resistance the first test up only...so if we get above a second time then shorts need to be aware and not try fades so agressive....

odds favor two sided trade inside spike which runs from 77.50 ALL the way up to 90 !!

odds favor two sided trade inside spike which runs from 77.50 ALL the way up to 90 !!

and lets not forget our weekly open...should print today

Here is a chart to take in. 1 minute timeframe with delta on the bottom. I've marked O/N H/L's and YD H/L's from the perspective of delta. You can see how the O/N low was quickly bought turning prices around. Interestingly delta is now back to its high from yesterday.

Let me try to "clean up" my last two posts.

A market that opens below it's spike low ( see daltons book) should initially find ressistance at the spike low....so yesterday afternoon the spike began at 77.50. An obvious key point. If we begin to trade inside the spike then we can expect back and forth trade over time as they are trying to accept the spike away from value from yesterday.

So expecting a quick and clean gap fill would not be expected to happen today. You can expect back and forth trade. Naturally the gap could fill and anything can happen. It's just that the context implies a non trending environment so holding trades for longer targets is tougher. Now we add in that we traded on both sides of the open within yesterdays range and we can further assume some consolidating type action

A market that opens below it's spike low ( see daltons book) should initially find ressistance at the spike low....so yesterday afternoon the spike began at 77.50. An obvious key point. If we begin to trade inside the spike then we can expect back and forth trade over time as they are trying to accept the spike away from value from yesterday.

So expecting a quick and clean gap fill would not be expected to happen today. You can expect back and forth trade. Naturally the gap could fill and anything can happen. It's just that the context implies a non trending environment so holding trades for longer targets is tougher. Now we add in that we traded on both sides of the open within yesterdays range and we can further assume some consolidating type action

and one last thing while I'm babbling...go to Yesterdays thread and look at Lorns last chart...then look at his Volume profile and see where the LOWEST volume is from yesterday........1183.50......!!!

Todays current high is 1183.75!! So since everyone in the world is now wired into FT71 we can call that an LVN from yesterdays trade...I like air pockets but I'm not gonna do a beat down on anyone today...LOL. As long as we can "see" the areas...

Todays current high is 1183.75!! So since everyone in the world is now wired into FT71 we can call that an LVN from yesterdays trade...I like air pockets but I'm not gonna do a beat down on anyone today...LOL. As long as we can "see" the areas...

so anyone who is trying to buy this market doesn't want to see market getting below 77.50 now,,,,and naturally they can't have market spending time and volume below the spike low...

as an aside...all air pockets filled quickly today......that's what happens when we are inside the previous days range.....CONTEXT!!

I won't be fading a new high above the hour high if it happens....that would imply that we tested the 77.50 and the weekly open and HELD.....under those circumstances it would be logical to expect a gap fill and trade back up above 1188 and new highs for the week...

as an aside...all air pockets filled quickly today......that's what happens when we are inside the previous days range.....CONTEXT!!

I won't be fading a new high above the hour high if it happens....that would imply that we tested the 77.50 and the weekly open and HELD.....under those circumstances it would be logical to expect a gap fill and trade back up above 1188 and new highs for the week...

and back to weekly open...too funny....just one giant range bound market,,,,,,bigger picture should be rounding out soon so it will be symetric and break coming this week I think....but which way..? sure seems like down...perhaps wishful thinking for my SDS proshares...

A little wishful thinking never hurt as long as you recognize that's what it is.

Originally posted by BruceM

and back to weekly open...too funny....just one giant range bound market,,,,,,bigger picture should be rounding out soon so it will be symetric and break coming this week I think....but which way..? sure seems like down...perhaps wishful thinking for my SDS proshares...

Thanks for the clarification Bruce, much appreciated

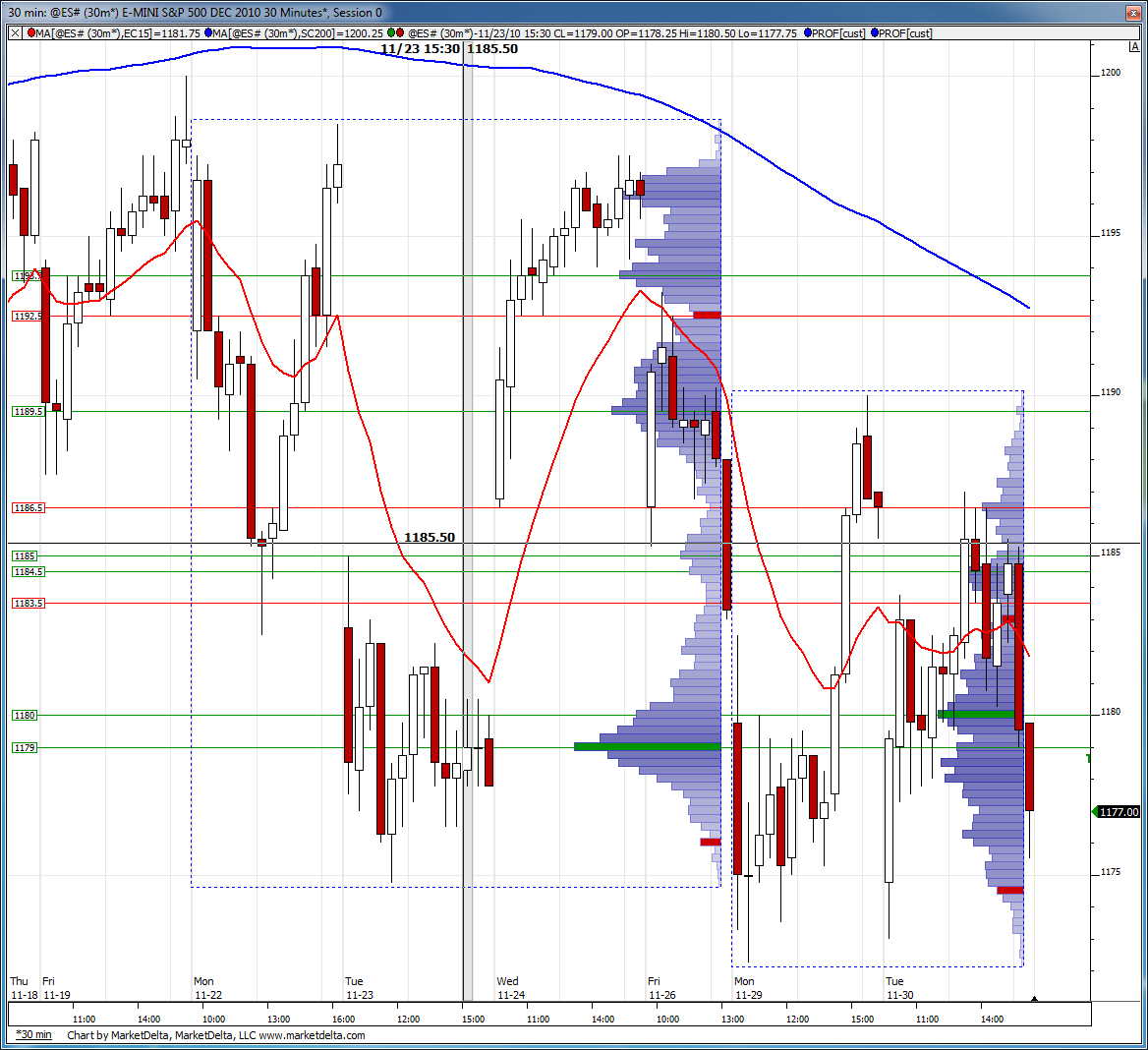

Here is this weeks developing profile and last weeks profile with HVN and LVN labeled with green and red lines respectively.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.