ES short-term Trading 10-25-10

I've taken the time to initiate a thread for this day only because at least there is something here for people to read and possibly make a reply.

I don't usually trade RTH on Mondays, I want to let the market give me some price bounds for the week, but I wanted to take the time to present an observation that might or might not be worth something.

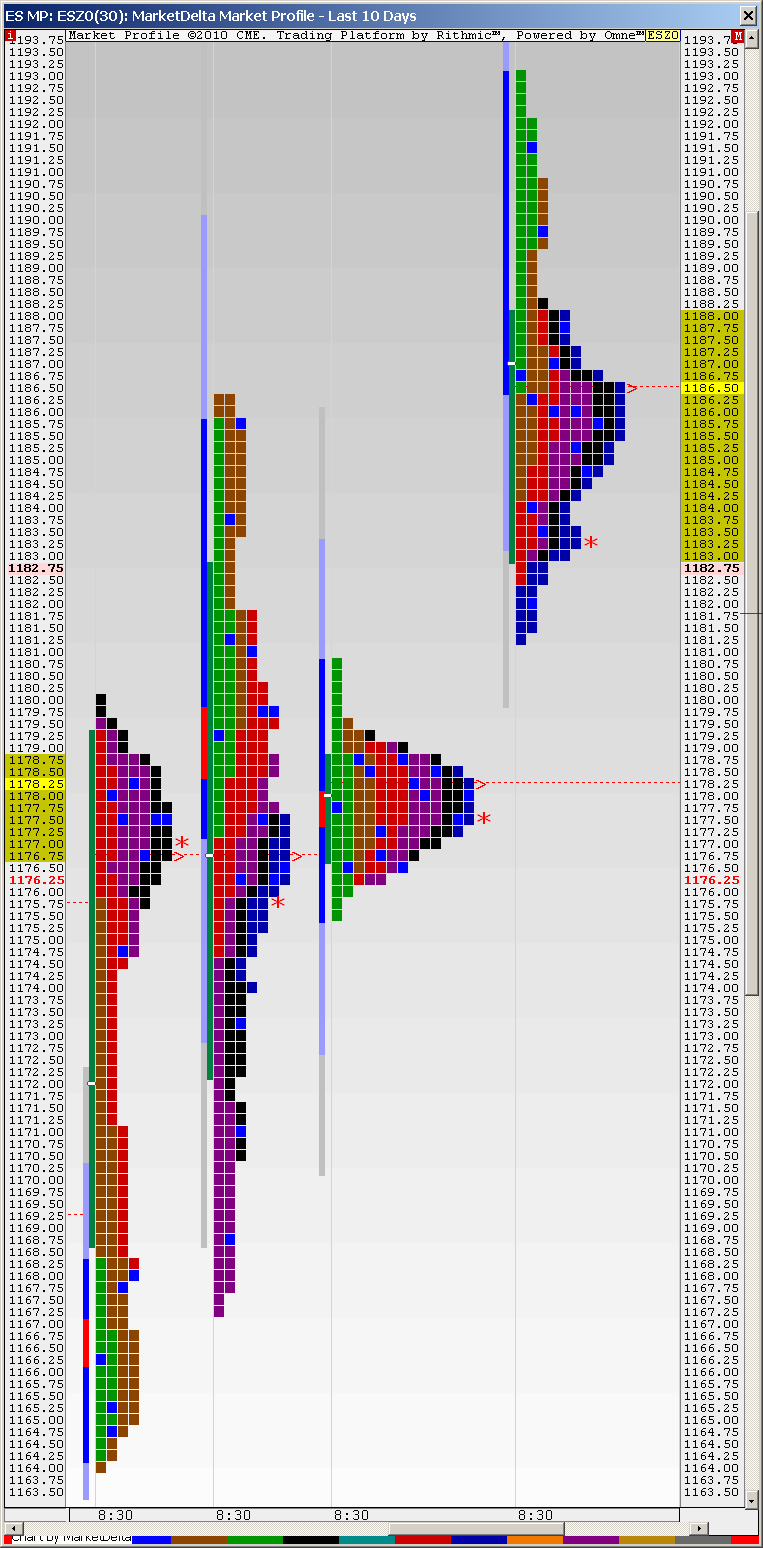

ES had an inside day on Friday (RTH). I am bogged with research for former clients, but I wanted to bring this to the attention of readers... I have noticed (have not quantitavely studied) that on the trade day following an inside (RTH) day, there is often a test of BOTH, the H of the inside day and the Low of the inside day. Both in the same RTH session.

As I write this, ES is printing 1188 which is well above the High on Friday of 1181.50.

These are bullish conditions right now, I don't know whether price can make a break and run higher, and neither do you. But I am curious to see how price evolves today and whether or not Friday's intraday RTH Low is tested.

The RTH low for Friday was 1175.50,

Currently, price is above the Highest H of the past 40 trade days (1186.25), Gapguy did a study (published it weeks ago) that 82% of the gaps up that OPEN at a new 40 trade day new H fill. (BTW 82% filled means that 18% do NOT fill)

Friday's close (needed to print for a fill) was 1180.75.

I have to say, I understand BruseM's reluctance to bother to post anymore because it seems like readers just read, don't really do any additional research of their own to present to the readers. That's too bad; I was hoping the site could offer me additional observations about technical conditions I describe, but it seems more likely that comments are just read and who-cares?...

I am considering becoming just a reader.

Good luck trading to all.

I don't usually trade RTH on Mondays, I want to let the market give me some price bounds for the week, but I wanted to take the time to present an observation that might or might not be worth something.

ES had an inside day on Friday (RTH). I am bogged with research for former clients, but I wanted to bring this to the attention of readers... I have noticed (have not quantitavely studied) that on the trade day following an inside (RTH) day, there is often a test of BOTH, the H of the inside day and the Low of the inside day. Both in the same RTH session.

As I write this, ES is printing 1188 which is well above the High on Friday of 1181.50.

These are bullish conditions right now, I don't know whether price can make a break and run higher, and neither do you. But I am curious to see how price evolves today and whether or not Friday's intraday RTH Low is tested.

The RTH low for Friday was 1175.50,

Currently, price is above the Highest H of the past 40 trade days (1186.25), Gapguy did a study (published it weeks ago) that 82% of the gaps up that OPEN at a new 40 trade day new H fill. (BTW 82% filled means that 18% do NOT fill)

Friday's close (needed to print for a fill) was 1180.75.

I have to say, I understand BruseM's reluctance to bother to post anymore because it seems like readers just read, don't really do any additional research of their own to present to the readers. That's too bad; I was hoping the site could offer me additional observations about technical conditions I describe, but it seems more likely that comments are just read and who-cares?...

I am considering becoming just a reader.

Good luck trading to all.

thanks for the good info Paul ... for any faders out there, my software's showing trips at 89.50 and a tick of air at 88.75

I missed selling at 1192.50 out of respect for the news! Damn! I did take 1188.50 down to 1185.25.

Only looking for a buy @1181 or done for now.

Good luck to all.

Only looking for a buy @1181 or done for now.

Good luck to all.

Now that is rewarding to read MM as you nailed it and spotted that concept perfectly.....Nice to see that and hope others did too...it makes all the babbling on those two concepts worth it..( the air and triple combo).!

Originally posted by MonkeyMeat

thanks for the good info Paul ... for any faders out there, my software's showing trips at 89.50 and a tick of air at 88.75

So Paul u r basically looking for some kind of OUTSIDE day to form after an inside day.....That should be able to get some statistical testing done by the stats wizards out here on the forum

Originally posted by PAUL9

I've taken the time to initiate a thread for this day only because at least there is something here for people to read and possibly make a reply.

I don't usually trade RTH on Mondays, I want to let the market give me some price bounds for the week, but I wanted to take the time to present an observation that might or might not be worth something.

ES had an inside day on Friday (RTH). I am bogged with research for former clients, but I wanted to bring this to the attention of readers... I have noticed (have not quantitavely studied) that on the trade day following an inside (RTH) day, there is often a test of BOTH, the H of the inside day and the Low of the inside day. Both in the same RTH session.

As I write this, ES is printing 1188 which is well above the High on Friday of 1181.50.

These are bullish conditions right now, I don't know whether price can make a break and run higher, and neither do you. But I am curious to see how price evolves today and whether or not Friday's intraday RTH Low is tested.

The RTH low for Friday was 1175.50,

Currently, price is above the Highest H of the past 40 trade days (1186.25), Gapguy did a study (published it weeks ago) that 82% of the gaps up that OPEN at a new 40 trade day new H fill. (BTW 82% filled means that 18% do NOT fill)

Friday's close (needed to print for a fill) was 1180.75.

I have to say, I understand BruseM's reluctance to bother to post anymore because it seems like readers just read, don't really do any additional research of their own to present to the readers. That's too bad; I was hoping the site could offer me additional observations about technical conditions I describe, but it seems more likely that comments are just read and who-cares?...

I am considering becoming just a reader.

Good luck trading to all.

outside day... Yeah,

It got me thinking.

happens quite often, but as I was stacking firewood in the garage before expected showers tonight, I got to wondering.

How often really is an inside day followed by an outside day? I will have to check on that, it should be simple enough to write the code, But what could be more important is...

In it's simplest psychological definition, an inside day is a day where bulls and bears are evenly matched, neither able to shove price past the extremes of the previous day.

after an inside day, is a test of both the H and the Low more likely if price opens inside the range of the inside day?

and... if there is an open outside the range of the previous day, say above the H of the inside day, how likely is price to test the H of the inside day, how likely is price to test 50% of the inside day's range... the L of the inside day...

After an inside day, an open inside the range of that inside day would suggest that bulls and bears were still in a stalemete, and a test of the inside's day H & L could actually be a search for stops/and unleash of volume.

I still have half a cord to stack, who knows what I'll come up with to test.

It got me thinking.

happens quite often, but as I was stacking firewood in the garage before expected showers tonight, I got to wondering.

How often really is an inside day followed by an outside day? I will have to check on that, it should be simple enough to write the code, But what could be more important is...

In it's simplest psychological definition, an inside day is a day where bulls and bears are evenly matched, neither able to shove price past the extremes of the previous day.

after an inside day, is a test of both the H and the Low more likely if price opens inside the range of the inside day?

and... if there is an open outside the range of the previous day, say above the H of the inside day, how likely is price to test the H of the inside day, how likely is price to test 50% of the inside day's range... the L of the inside day...

After an inside day, an open inside the range of that inside day would suggest that bulls and bears were still in a stalemete, and a test of the inside's day H & L could actually be a search for stops/and unleash of volume.

I still have half a cord to stack, who knows what I'll come up with to test.

Interesting post. One thing worth mentioning here is that after an inside day look how they open at 9:30 est the next day. If they open above the RTH high of the previous day we will be in an uptrend till the next inside day. So trading longs is the way to go. Viceversa if we open below the RTH of an inside day.

17 Nov was an inside day. RTH high is 1182. 18 Nov rth open is at 1189.50. If you have the money, time and patience we will trade back to 1182.(Gap fill)

15th Nov. was inside day. Next moring we opened below the RTH low. Retail traders going short, wholesale traders going long.17 nov another inside day. Market back to 15th Nov low. Everbody wins....

Today we got down to the 1182 level FWIW....

Y

Y

Originally posted by ak1

17 Nov was an inside day. RTH high is 1182. 18 Nov rth open is at 1189.50. If you have the money, time and patience we will trade back to 1182.(Gap fill)

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.