ES short-term trading 10-6-10

Here is an historical study that (IMHO) is worth tracking and its "set-up" might be realized today.

I've related that I get the gap-guys free videos (I don't subscribe and I don't necessarilly trade opening gaps) but I do like to see what he has to say about the daily bars and he does provide technical historical studies that are pure data.

Last week he published a study that looked at Gap Up openings where the Open was a new 40 trading day H. Incredibly, historically, 82% of these gaps fill on the same day.

This happened on Thursday, 9-30-10 and that gap filled.

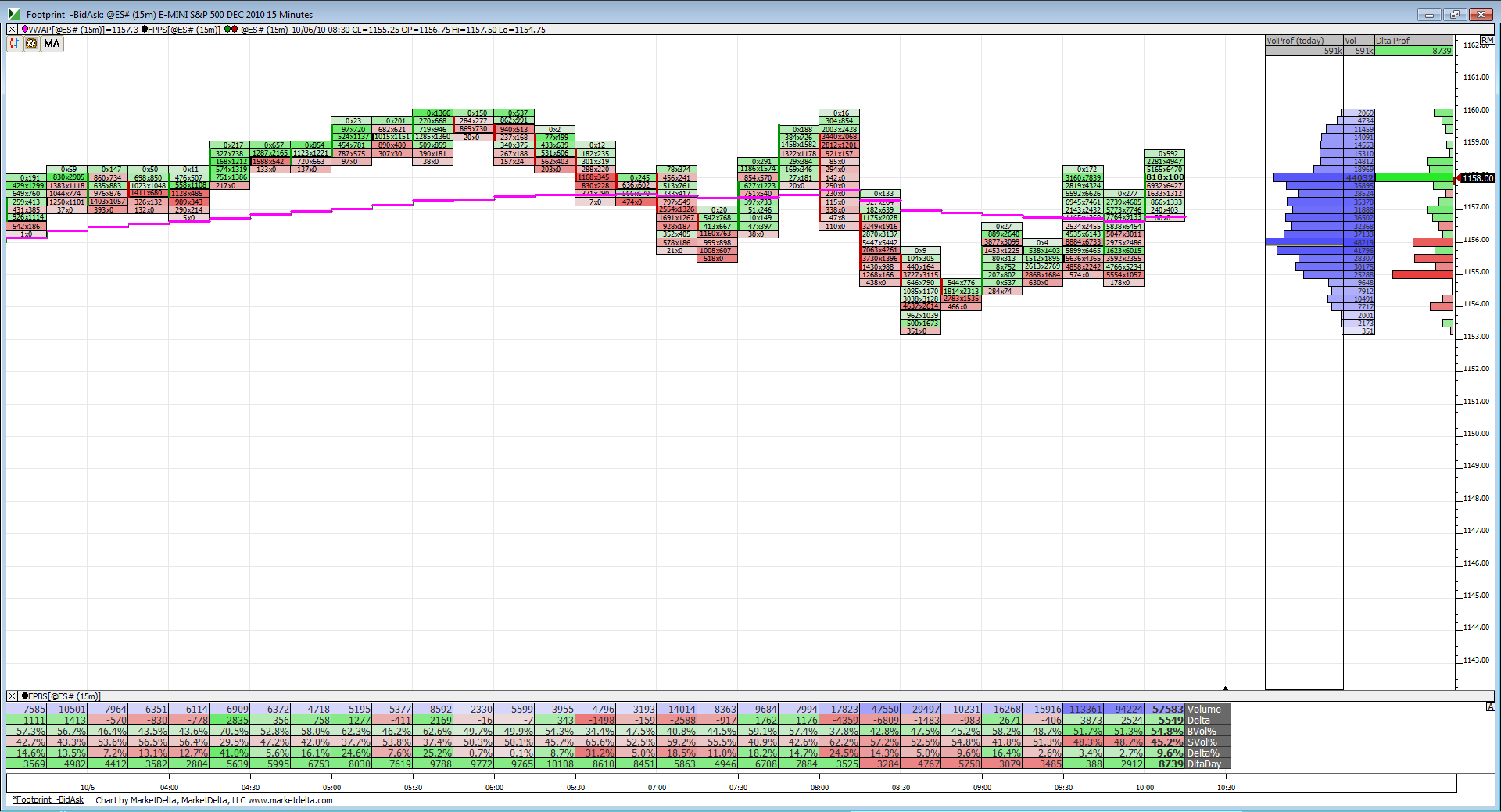

If today, Wed, 10-06-10 opens above 1158.75, that would be a gap open at a new 40 trade day High.

I've related that I get the gap-guys free videos (I don't subscribe and I don't necessarilly trade opening gaps) but I do like to see what he has to say about the daily bars and he does provide technical historical studies that are pure data.

Last week he published a study that looked at Gap Up openings where the Open was a new 40 trading day H. Incredibly, historically, 82% of these gaps fill on the same day.

This happened on Thursday, 9-30-10 and that gap filled.

If today, Wed, 10-06-10 opens above 1158.75, that would be a gap open at a new 40 trade day High.

selling 58 now...hope they run O/N high for adds....this is last campaign for early session

no reports..I c no reason to not come back to 56 area again...rockin em !!

the nerve of the YM being above it's RTH of yesterday while the es and NQ weren't...LOL...no better fade concept !!

What's the span Bruce if trips fail? At least 10 pts in the other direction?

usually 8- 10 Lorn or next key number...LOL....in this case the air pocket from yesterday...

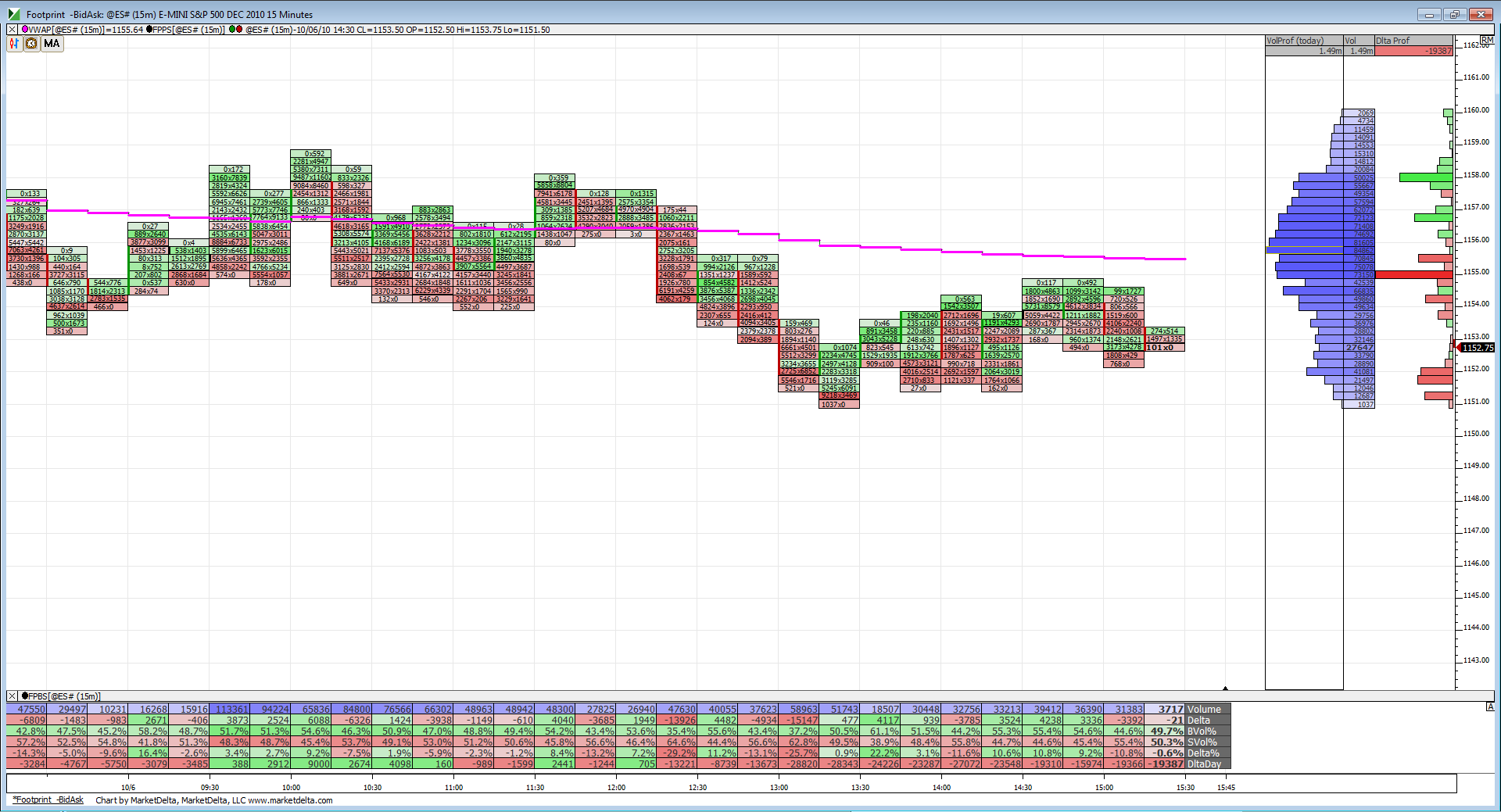

Here is todays POP quiz : It's 12 noon EST and this is how the cash indexes looked...

DOW : +23

Compx -12

S%P : + .56

Do you favor Buys,sells ? Now no peeking ....HA...we all know what did happen but can u see why it might have happened given those numbers?

Here is todays POP quiz : It's 12 noon EST and this is how the cash indexes looked...

DOW : +23

Compx -12

S%P : + .56

Do you favor Buys,sells ? Now no peeking ....HA...we all know what did happen but can u see why it might have happened given those numbers?

Like anything Lorn the trips need to be in context and I don't like them at the highs and lows....in this particular case we would need to become break out traders to get them.....

Now if they were on the lows it would have been much better as we have a sell rallies mentality today....not a "buy the breakout" mentality"

Still a good reference point and the day is still young..perhaps if NQ canget above Mondays high we can think of long possibility...till then it's a hard fade to be buyers down here..at least for me..

Now if they were on the lows it would have been much better as we have a sell rallies mentality today....not a "buy the breakout" mentality"

Still a good reference point and the day is still young..perhaps if NQ canget above Mondays high we can think of long possibility...till then it's a hard fade to be buyers down here..at least for me..

Bruce could you pls talk about what you are thinking when you have lets say 3 air pockets below, or above. What are thinking about how many will fill, and will you buy or sell the 1 st air with others below or above. If I am not clear pls say so.

Coming into 3:30 you can see by the volume profile on the right most of the volume for the day is still above where prices are now. The O/N low of 1053.25 seems to be a sticking point as prices tried to let go but keep coming back to it.

Originally posted by MRamzan

where i can read more about technical indicators and what about the analysis that brokers provide ?

You can read about the indicators almost everywhere on the net.

Just place in Google terms like "technical indicators" "technical analysis indicators" "price action indicators", etc.

Brokers today (guilty as charged )have become sales people for software trading platforms. If you are a beginner maybe could you enjoy the benefit of working with a full service broker: http://www.optimusfutures.com/commodity-futures-phone-execution.htm

our chief broker is Chad, and he will provide you advice and research before the execution of any trade.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.